Avoid a lose-lose situation in the marketplace

Many retirement planners suggest you’ll need 75 percent to 85 percent of your pre-retirement income to live comfortably in retirement. So whether you’re looking simply for money to pay your monthly bills or finance your way through a long-deferred bucket list, you’re going to need income — regardless of the market’s performance.

Unfortunately, taking money from an equity-based retirement account (such as a 401(k) or IRA) during an economic downturn can have a big impact on the future value of your account and the income from it. You’ll compound your losses by reducing the amount of income you have available during retirement, as well as the amount of money you can leave as a legacy to your family.

Find alternate sources of retirement income

Of course, the easiest way to avoid compounding your losses is to avoid withdrawing income from your retirement account when the stock market is in decline. And yet you have to find another source of retirement income from somewhere — ideally one that isn’t impacted by market volatility.

Your options include certificates of deposit (CDs), fixed annuities, and other conservative savings vehicles. Compared to equities, these assets may offer lower overall returns over the long run. But, they represent a stable source of financial growth — and that stability is key to your financial future.

There’s another option to consider: a whole life insurance policy.

Draw income from a whole life policy — tax-free

A whole life insurance policy gives you the pre-retirement protection you need now and guaranteed policy cash values for potential supplemental income later if needed. In addition, a participating policy has potential to earn dividends, which would increase both the protection and cash value. Dividends, however, are not guaranteed.

Plus, the cash value of a whole life policy is unaffected by short-term market volatility. That means it could provide an alternative source of income during years when markets are down and taking money from your equity-based retirement accounts isn’t a wise idea.

It’s important to remember there are implications to borrowing cash value or taking partial surrenders. These actions will reduce the policy’s cash value and death benefit. This could also increase the chance the policy will lapse, and it may result in a tax liability if the policy terminates before the death of the insured.

The wisdom of tapping into a whole life insurance policy for income in retirement will vary depending on individual circumstances. Many people seek out a financial professional for advice before making such a move.

Protect your family finances now and later

Of course, there are considerations to take into account for life insurance beyond retirement funds.

Purchasing life insurance is one of the most important decisions you can make. So make sure to consider an option that provides both flexibility and stability. Choosing a term policy may be an affordable option, but it is also important to think about how long you may actually need the coverage and the additional value a whole life policy provides. One thing that separates a whole life insurance policy from a term policy is how it protects your family both today and for your lifetime.

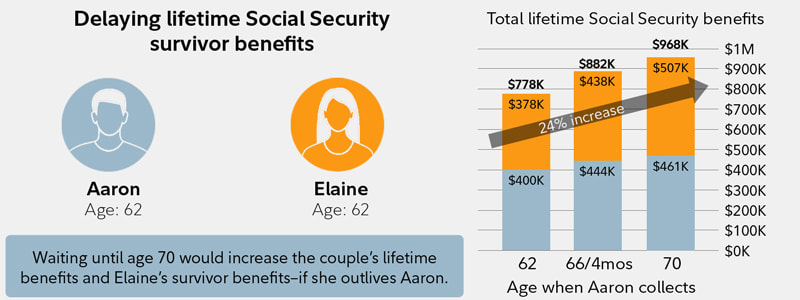

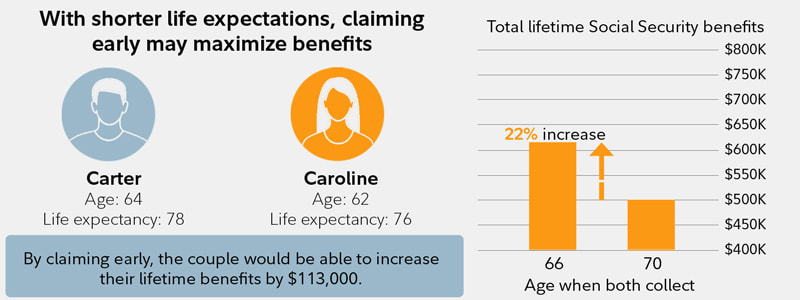

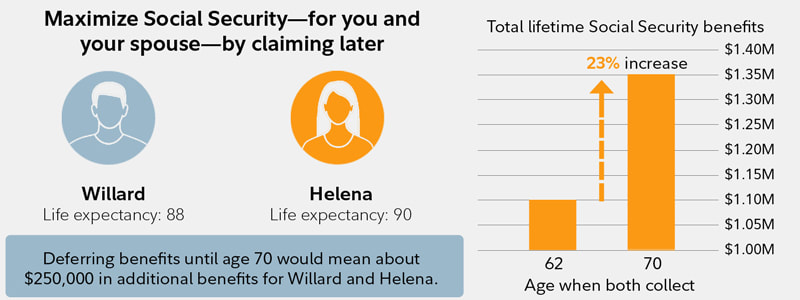

Even when you retire and stop receiving a traditional paycheck, you may still have income to protect. The benefits you receive from Social Security and income from many pensions may stop or be reduced when you pass away. This can significantly decrease the amount of money your spouse has to live on. The death benefit from a whole life policy can help him or her supplement some of that lost money and income, pay off the mortgage or reduce some other major expense.

Retire the old way of thinking about retirement

Today, many people are realizing the traditional ways of funding their retirement aren’t as reliable as they used to be. Between the volatility of the stock markets, the insecurities around Social Security, and the dwindling number of employer-provided pension plans, it’s clear that you may need stable options, such as whole life insurance, to supplement your retirement income.

RSS Feed

RSS Feed