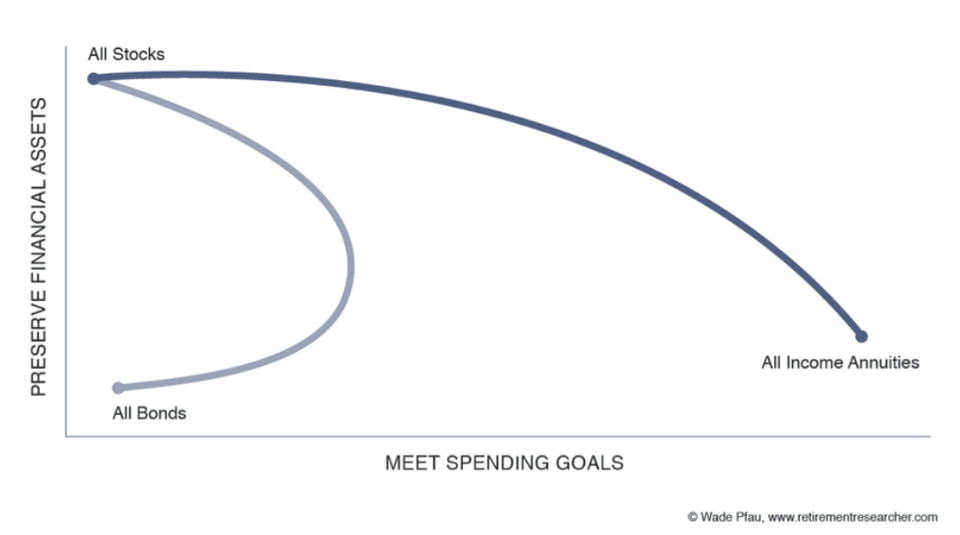

In “Why Bond Funds Don’t Belong in Retirement Portfolios,” Professor Wade Pfau presents a concept called the Retirement Income Efficient Frontier. He performs a Monte Carlo analysis to see how a number of different portfolios will perform in unknown financial market conditions against the two main goals in retirement: (a) not running out of money and (b) leaving a legacy. The portfolios he tests consist of stocks and/or bonds and/or annuities.

His results show that the most efficient portfolios are those with stocks and income annuities, but without bonds. These are the portfolios that offer the smallest chance of running out of money and the greatest chance of leaving a legacy behind. As he explains, “Income annuities outperform bond funds as a retirement income tool because they offer mortality credits.”

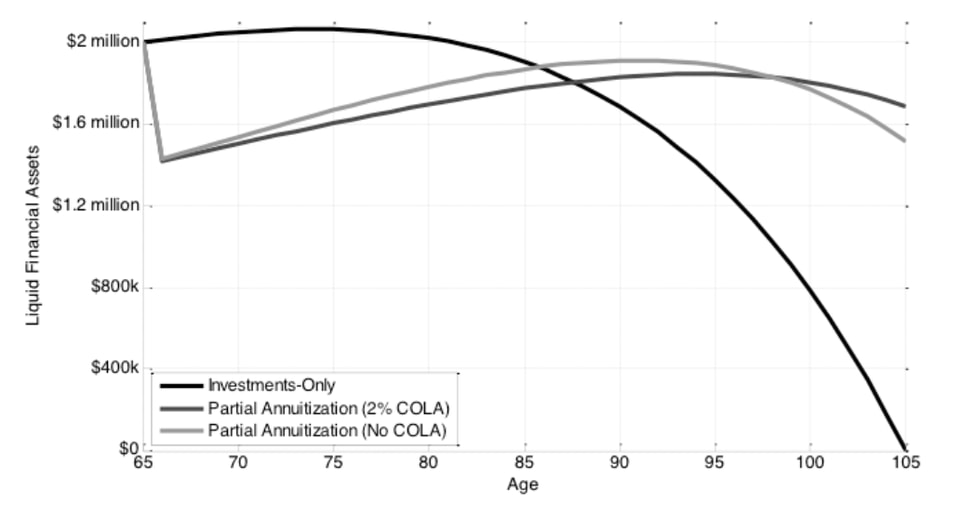

In the same paper, Professor Pfau also shows that liquid financial assets can be larger later in retirement if you have some of your portfolio in annuities. Shown below are 3 options for someone’s portfolio: (1) only invested in a mix of stocks and bonds, (2) bonds reduced in favor of an income annuity with a 2% annual inflation adjustment, and (3) bonds reduced in favor of an income annuity without an inflation adjustment.

In next blogpost, we will show that It Costs Less to Fund Retirement with Annuities Vs. Bond Ladders.

RSS Feed

RSS Feed