Now, the Payment Options and Features of a fixed lifetime income annuity.

Fixed lifetime income annuities offer various options that pay different amounts of income, based on the types of guarantees they provide and the date you plan to begin receiving income. The three most common payment options include:

1. Life Only. You’ll receive income payments over either your lifetime alone or the joint lifetimes of you and your spouse (which would decrease the amount of the payment because it would be based on two lifetimes). The “life only” option offers the highest possible income payment because it’s only for as long as you or you and your spouse live; no money goes to your heirs. This option typically works well for those in good health and who anticipate a long life.

2. Life with a Guaranteed Period. You’ll receive income payments for the rest of your life. However, if you pass away before the guarantee period ends, any remaining income payments will continue to your beneficiary(ies) until the end of the guarantee period. Here, you get a somewhat lower payment than life only, because the insurance company is guaranteeing to make payments for a minimum number of years.

3. Life with a Cash Refund. With this option, the priority is ensuring that you never get back less in payments than your original investment. As with many income annuities, you get a lifetime income payment (but typically lower than a life-only option). If you pass away before receiving payments that total your original investment, the remaining value will be paid to your beneficiary(ies). This means, for example, that if you are paid only $10,000 of a $100,000 policy during your lifetime, the remaining $90,000 is paid to your heirs.

Annual Increase Feature

In addition to different payment options, annuities can include different features. One of the more popular features is an annual increase option. This feature provides for annual increases in the payment amount beginning on the anniversary following your initial payment. The annual increase can be based on a fixed percentage or linked to changes in the Consumer Price Index (CPI). Note that the initial payment amount for an annuity with this option may be lower than an identical annuity without the option.

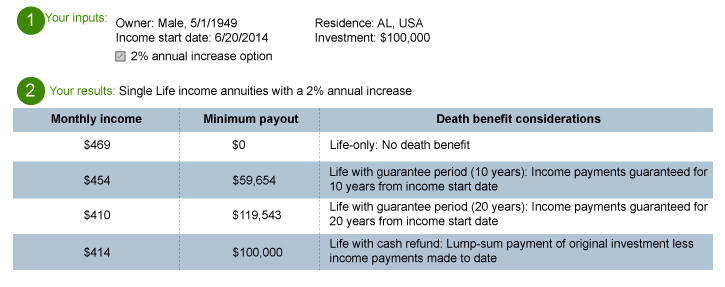

Let’s take a look at how these payment options might differ. Shown below are the actual results for a hypothetical 65-year-old man who invests $100,000 in a lifetime income annuity starting today. We assume he was born on May 1, 1949, and started receiving income on June 20, 2014, with a 2% annual increase.

Compare Four Fixed Lifetime Income Annuity Options

RSS Feed

RSS Feed