Living benefits on a policy may be triggered when the insured experiences a qualifying chronic, critical or terminal illness. Exact requirements for living benefits depend on life expectancy and the terms of the life insurance contract. However, since the income tax free receipt of life insurance proceeds is usually described as dependent on the death of the insured, the taxation of these living benefits has raised questions.

Below we will examine some of the potential tax implications with regard to qualifying health events and policy ownership. In general:

- Terminal illness or chronic illness/long term care benefits should be income tax-free if the death benefit would have been income tax-free upon the death of the insured. These benefits would be taxable to the business for business-owned policies.

- Critical illness benefits should generally be income-tax free when premiums are paid by the individual insured rather than by an employer.

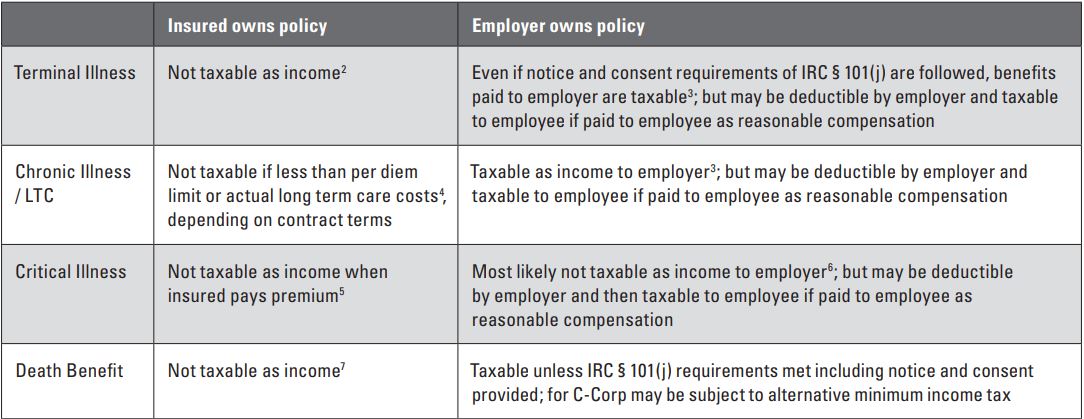

The table below compares some of the differences in taxation based on ownership of the life insurance policy:

RSS Feed

RSS Feed