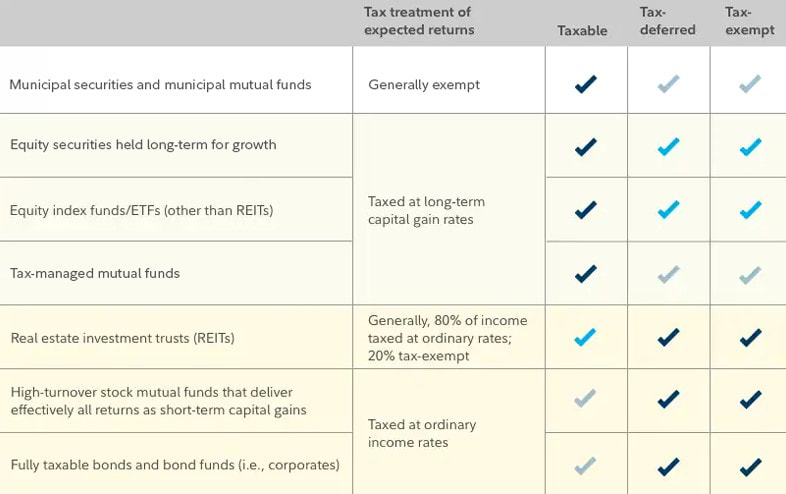

Each person will have to find the right approach for their particular situation. But generally, depending on your overall asset allocation, you may want to consider putting the most tax-advantaged investments in taxable accounts and the least in tax-deferred accounts like a traditional IRA, 401(k), or a deferred annuity, or a tax-exempt account such as a Roth IRA.

RSS Feed

RSS Feed