|

In our last blogpost, we discussed the more complicated 1-35 exchanges. Now we will discuss when an 1035 exchange is appropriate.

When Is 1035 Exchange Appropriate? There are a number of reasons why an 1035 exchange makes sense. Some life insurance products offer features and benefits like guarantees against lapse or new policy riders providing chronic illness coverage that were not available just a few years ago. Or, as the family, business, and financial status change, the insurance purchased to meet objectives may need to be changed. In some other cases, a new type of policy can meet the needs for insurance in a more cost-effective way. Non-tax Factors to Consider However, there are a number of NON-tax factors that should be considered before an 1035 exchange. The non-tax factors that should be considered include:

In our last blogpost, we discussed some of the common guidelines for 1035 exchanges. Now we will discuss some of the more complicated 1-35 exchanges.

1. Exchange of Life Insurance Policies with Loans

In our next blogpost, we will discuss when an 1035 exchange should be considered. In our last blogpost, we introduced the concept of life insurance and annuity 1035 exchange. Now we will discuss the IRS guidelines for 1035 exchanges:

If Contract Owner is the Same Before and After the Exchange

Types of Contracts that Can Be Exchanged

In our next blogpost, we will discuss some 1035 exchange complications. 1. What is 1035 Exchange?

1035 Exchange is an IRS allowed transaction for non-taxable or “tax-free” exchanges between certain types of life insurance and annuity contracts under the concept of like-kind exchanges. An 1035 Exchange often happens because after a review of an existing life insurance and annuity contract, it was found that a more cost efficient contract with better guarantees and/or rate of return is available, therefore the desire of a transfer of the existing cash value to a new contract via a 1035 exchange. Normally, when a life insurance policy or an annuity contract is surrendered, if the gross cash value of the contract exceeds the owner’s basis in the contract, gain is immediately taxed as ordinary income. However, when properly structured, an 1035 exchange provides that in some instances where the surrender proceeds from the original contract are transferred into a new contract, there will be no tax on gain at the time of the exchange. Taxation of the gain is not forgiven but rather delayed through the use of “carryover” basis since the income tax basis of the old contract carries over to the new contract. In our next blogpost, we will discuss the guidelines IRS allows for the 1035 exchanges. In our last blog post, we discussed some of the third party research firm's evaluation of mutual funds. Now we will discuss several other topics an investor should look into before investing in a fund.

Part 5. Other Factors to Consider

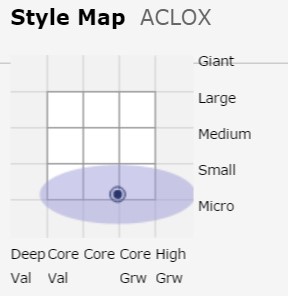

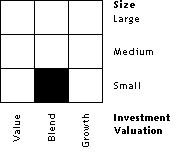

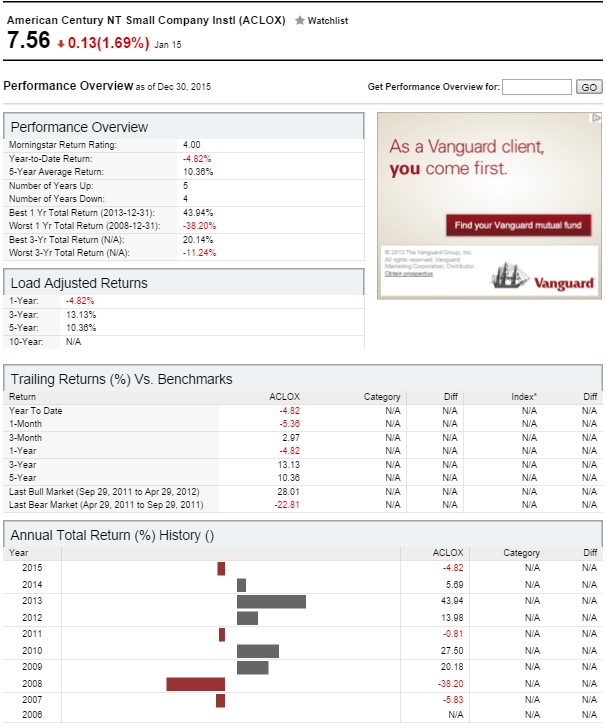

In our last blog post, we discussed some of the key metrics that measure a fund's risks. But researching a fund is out of question for most of small investors. Why not utilizing some 3rd party experts' evaluation and rating of the funds? Part 4. 3rd Party Fund Evaluations Morningstar is a well-known 3rd party rating agency specialized in mutual fund/ETF research. Its rating system may suffer from controversy, but it does no harm for investors to get more information, especially when an investor has no capability to do the research on his or her own. A 3rd party’s rating could work as a piece of puzzle that constitutes your overall understanding of mutual funds. There are two well known Morningstar fund appraisals 1. Morningstar rating The Morningstar rating system sorts every fund by its Morningstar score which is calculated based on the fund's past return and risk information. Then the top 10% of the funds are assigned a “5-star”. The following 22.5% of funds are “4-star” as shown in the picture below. 2. Morningstar style box This is a more prevailing method that being cited by lots of major financial websites as part of a fund’s basic profile. The following picture is an example of ACLOX. As showing in the picture, the vertical axis is the relative market cap from “micro to giant”. lower the risk. The horizontal axis evaluates the mutual fund’s investing attributes ranking from “Deep value to high growth”. A simple interpretation of the style box is that, the larger the market cap and the closer the fund to the “value” position, the lower the fund's risk. In yahoo finance, a simpler version is provided as below. No matter what kind of investing style box is used, an investor can easily understand a fund’s risk and strategy by finding the fund's position in the style box.

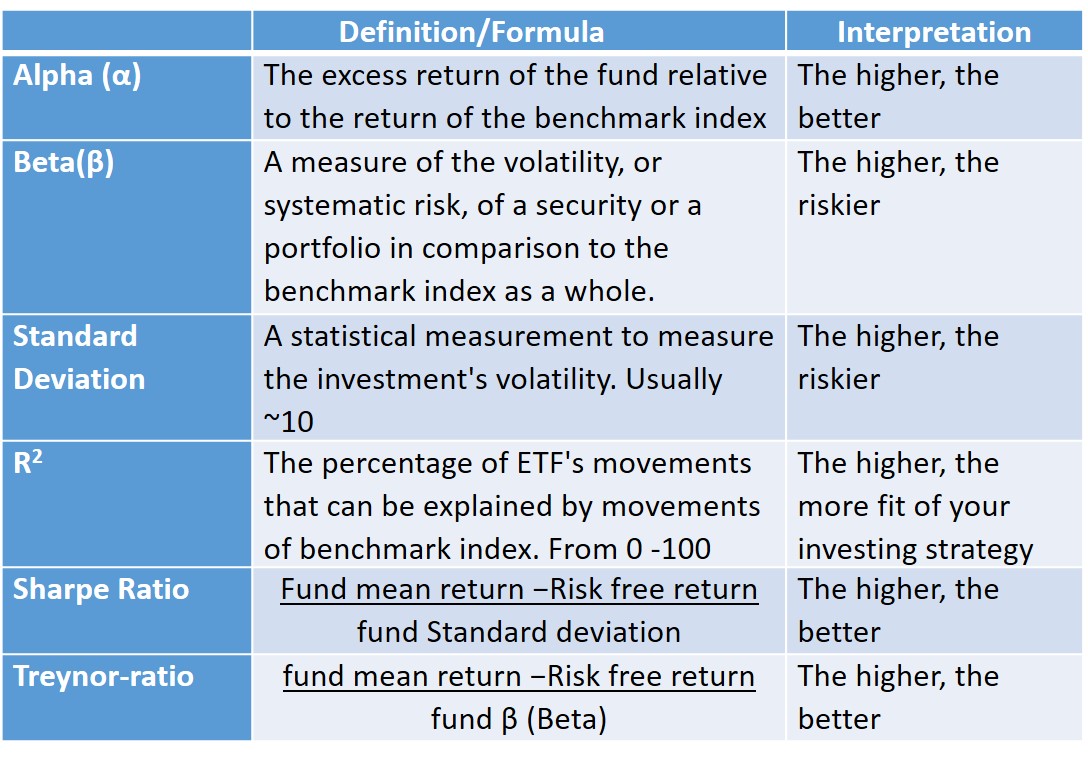

In the last part of our blog series on mutual fund 101, we will discuss several other things you should investigate before investing in a fund. In our last blog post, we looked at how to examine a fund's past returns. In the investment world, returns and risks go together. In today's blog post, we will discuss how to evaluate a fund's risks. Part 3. Risk Measures of a Fund For fund investors, the good news is that you can easily quantify a fund's risks and compare them with those of other funds or benchmarks and make the appropriate investment decisions. The most commonly used measurements of a fund's risk are as bellows: Some financial institutions (e.g. Vanguard) have their own simple, visual, and comprehensive ways of displaying a fund's risks. However, if you are seriously considering investing in a fund, it pays to look at all of its risk indicators as shown in the table above.

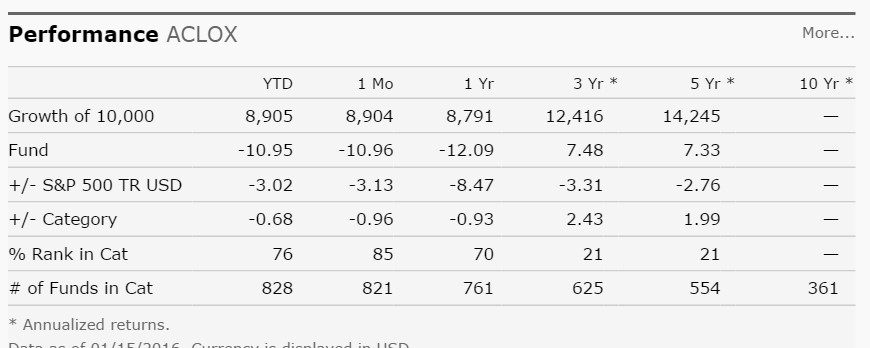

In our next blogpost, we will look at how to leverage some 3rd party agencies' ratings of a fund. In our last blog post, we discussed the basic profiles of a fund, now let's take a look at how to find a fund's past performance. Part 2. Past Performances of a Fund You can find a fund's past performances - 1-year, 3-year, 5-year, or even 10-year returns at most financial websites. You can also find a table or a chart comparing the return of the mutual fund with that of its benchmark index, like the table and chart below. From the information above, you can calculate a fund's true annual return - add the cash dividend yield (if there is any) and minus the expense ratio. You may also want to take your income tax rate into consideration to calculate your after-tax return.

A common investment goal is to choose a fund whose return at least doesn’t underperform your investing goal. However, every investor needs to remember - past performance may not repeat in the future. In part 3 of our fund analysis, we will look at how to evaluate a fund's risks. Q. What's the best way to learn about mutual funds?

A. For mutual fund investors, there is no shortage of information available, but what's the key information to learn about a mutual fund? We will discuss this topic in a 5-part mini blog series. Part 1.The fund’s basic profile The first thing to learn about a fund is to get its basic profile, which includes: fund name, NAV (net asset value), price change, year-to-end return, yield, and a few other key facts. Fund name & company: A fund's name sometimes reveals the fund's investing strategy. For example, AMG TimesSquare Small Cap Growth Instl (TSCIX) clearly states its focus is on Small Cap growth. In addition to the fund name, the company behind the fund may also give you an idea about the fund’s investing style. For example, Vanguard funds have a reputation of low cost. Investing asset class/category: Most mutual funds fit into the following categories: equity, bond, money market, or a mix of above. Net Assets: You may want to know a fund's Net Assets information if you want to invest in funds with certain size limitations. For example, you might be looking for a mega fund which typically has net asset over 1 billion dollars. NAV & Price: NAV is the fund’s net asset value per share. While a fund's price mirrors its NAV, they are not always the same. A fund's price may have a premium or discount over its NAV. Also, while NAV fluctuates during the trading hours, an investor could only buy a fund at one price - usually after the market closes. Price, price change, yield, YTD return: The best way to use information reported by these metrics is not to look at these numbers themselves, rather it's best to compare them with those of benchmark index/category so you could have a better .understanding of the fund's performance. Cost: This includes expense ratio and other management fees that might occur. Cost is an important factor since it will eat into a fund's performance, even a fund is losing money. Index funds are usually cheaper than actively managed funds. Inception date: The longer a fund has existed, the more data you could collect, therefore giving you more information about a fund's historical performance, especially how it performs when the market is at different cycles. In our next blog post, we will discuss how to check a fund's past performance. Q. My ALT used to be moderately high, but now is within normal after taking . Will this ALT history affect my life insurance application?

A. If your ALT was only mildly elevated (high norm typically around 45), but now is resolved and within normal, this should not be an issue, of course depending on if there’s any diagnosis or history of a more serious liver issue ... For people entering retirement stage, move or stay-put is a major decision. Fortunately there is a free online calculator where you plug in your numbers and it will create a clear picture for you.

Note that the benefits come from two sides: a. lowered mortgage or rent expenses; b. increased income due to a portion of your large house now becomes cash for you to invest. Q. How to use leftover funds in 529 account for my child?

A. You have several options: 1. If due to Scholarship If the leftover fund is due to your child received scholarship, you can withdraw the fund by only paying income tax on the earnings, but not the 10% penalty. 2. Use for other people You can repurpose the 529 funds for other people, including yourself, for eligible education purpose by naming that person as the beneficiary. 3. Close the account You can close the account by taking the money out, but you will have to pay income tax on earnings, plus the 10% penalty. Q. Is it true that there is absolutely no tax for any holdings in my Roth IRA account?

A. Unfortunately, the answer is NO. While IRA and Roth IRA have great tax benefits, they do have limits. For example, there is tax due for MLPs held within a Roth IRA account. What is MLP? As we have introduced here before, MLPs typically transport, store, produce and refine energy and pass most of earnings back to shareholders. As a consequence, MLPs tend to have high yields and many investors hold MLPs within IRA or Roth IRAs for tax reasons. MLP's Tax Trap If an investor uses IRA funds to invest in MLP, because MLP is a partnership (not a stock, bond or fund), there is tax due on certain annual income from the partnership exceeding $1,000, thanks to an antiabuse provision from IRS. This levy is known as Unrelated Business Income Tax (UBIT). Furthermore, when this tax is due, the IRA custodian or trustee is responsible for obtaining a special tax ID number and then filing and signing an IRS form 990-T reporting the income, while the IRA owner is responsible for paying the tax bill. So you could very likely receive a tax bill from IRS already signed on your behalf! The Conclusion If you want to avoid the tax complexity, better avoid owning MLPs in your IRA accounts. Or you can invest in some ETF/ETN products that track the same space, such as AMJ or MLPI or MLPN or MLPY (all are ETNs), AMLP (an ETF). Q. Do I pay income tax rate or capital gain tax rate for interest earnings from CDs?

A. Interest on a certificate of deposit (CD) is always taxed as income. So even you have held your CD for more than 1 year, you don't pay long term capital gain tax rate on the interest earned, instead, you will have to report the CD's interest earnings as ordinary income and pay ordinary income tax rate. In our last blogpost, we showed that target date funds have learned from the 2008 financial crisis and increased exposure to bonds. While this was supposed to be a prudent move, but as more of the bond holdings happen to be bonds with longer maturities (because they tend to have better yields), such a portfolio weight shift will turn out to be a risky move when the Fed raises rates.

The reason is simple, when the Fed increases interest rates, investors will flock to new bonds with higher yields, therefore the older bonds' prices will fall. Bonds with longer maturities will fall even harder because you will be stuck with its lower rates for longer time. What are the target date funds doing to minimize such risks? Many target date funds are seeing this risk coming and shifting longer maturity bonds to shorter ones. But this means lower yields which is a different risk to people, especially the ones who already retired, holding target date funds. To compensate the lower yields, some measures target-date funds turned to higher yield junk bonds, which this will increase default risk for the investment. The silver lining of this risk is, when the Fed raises interest rates, it typically means the economy is healthy, which means high yield junk bonds' default risks will be subdued. In short, there is no easy solution, which could be a reason for investors to reevaulate their target-date fund investment decision. Q. All of my 401k investment is in a target date fund. Should I reconsider this decision if the Fed will start raising the interest rates steadily in the future?

A. It is wise to reevaluate your target fund decisions in a rising interest rate environment. First, what is a target fund? A target date fund is an all-in-one fund so an investor doesn't have to worry about portfolio allocation. The target date fund will automatically adjust its stocks/bonds allocation as time goes by so it always fits your risks tolerance levels. However, that is in theory. In practice, a target fund could increase your investment portfolio's risk even though you might think it is safe. Here is why. Since the financial crisis, all of the target date funds have shifted more weights to bonds and reduced exposures to stocks, hoping to avoid repeating the same portfolio meltdown experienced in the 2008 financial crisis. For example, based on a Wall Street Journal report, in 2007, the average stock exposure for target funds with planned retirement years between 2000 and 2010 was 50.4%, this percentage dropped to 42.4% in 2015 for target funds with similar retirement time horizons. Unfortunately, such reduction of exposure to stocks will be be a bad move when the Fed starts raising interest rates. We will explain in our next blogpost. For people live in the north, snow is hardly a problem.

They have the tools to get rid of snow when it happens and the ways to deal with the trouble comes with the snow. Most problems are like that. If you prepare for a problem and get used to it, the problem is not a problem anymore. Mint and Mint Bills: These are two separate free apps. Mint came first, offering budgeting advice and categories, along with a convenient dashboard for seeing where all your money is - and where it went! It's free because it allows advertisers to ping you with offers of lower rate cards and so forth. But the app also sends you immediate notification when you are about to overspend your own budgeted limits for entertainment or dining out!

The one thing that Mint doesn't do -- pay your bills -- has been remedied by the Mint Bills app. It's simple, allowing you to view all your bills, schedule payments and make sure you have enough money to cover them! Acorns: Everyone agrees that there is never "enough" money to set aside for investments. So this free app makes it easy to find the cash, automatically rounding up all your checking and credit card purchases for accounts you enroll, then sweeping those extra pennies into a stock fund every time you accumulate $5 in extra pennies! You can always add more cash -- and you can get your money back if you need it. But the whole idea is that this almost imperceptible process will help you build a long-term, growing investment account. It's the modern-day version of a penny jar! BUDGT and Wally: Throw out the old budget book, paper receipts and pencil sharpener. Two apps, BUDGT (not a misspelling!) and Wally, will help you track expenses so at least you know where the money went -- and in what categories. This easy technology is especially helpful if you file an expense report, want to track deductible expenses or simply want to gain control over your spending habits. Q. What are good free or deeply discounted e-book sites?

A. You can sign up the following major e-book distribution sites. They will send you daily emails about free or discounted e-book deals, including some of the top hotsellers. In our last blogpost, we have shown two tactics a family could do when the rate rises. Now two more tactics a wealthy family could do.

3. Qualified Personal Residence Trusts (QPRT) A QPRT is a trust that passes a primary residence or vacation home to heirs, while the grantor retains the right to live in the house for a number of years. This freezes the value of the property for gift and estate-tax purposes at the time of creation. The potential taxable gift is the present value of the asset in a certain number of years. When the rates keep rising, the present value of the asset becomes lower, which means the gift value becomes lower. 4. Charitable Reminder Annuity Trusts (CRAT) You could put assets into CRATs and name one or more charities as the ultimate beneficiary while continuing to draw income during your lifetime. The grantor is allowed a tax deduction at the time the CRAT is created. When the interest rates become higher, the present value of the income stream the donor receives becomes lower, making the value of the gift to the charity higher for tax purposes. Q. What could an affluent family do differently for estate planning with the interest rates rising?

A. Interest rates can affect strategies for minimizing estate taxes and taking advantage of income tax breaks in several different ways. Here are 4 tactics recommended by a recent WSJ article for wealthy families: 1. Intrafamily Loans You can lend money to your adult children to invest, you will take back a promissory note on which the children pay interest. Tax rules require the minimum interest rate the parents must charge to avoid having a below-market rate loan which will be treated as a taxable gift. Such a market rate varies, right now ranges between 0.56% to 2.61%, depending on the term of the loan. When the rate increases, the rate of return the borrowers will need to pay will be higher which makes this tactic less attractive. 2. Grantor Retained Annuity Trusts GRATs are used by wealthy individuals to pass down appreciating assets to heirs without taking a big gift-tax hit and to lower the overall estate-tax burden. GRATs are set with 2 or more years' terms, and often funded with assets with high growth potential. The parent who creates GRAT usually receives annuity payments from the trust that add up to the asset's original value plus a market-based interest rate set by tax rules. When the assets in GRAT generate a total pretax return that exceeds the hurdle rate, the excess return passes to heirs free of gift and estate taxes. With the rate increases, you might want to set up a new GRAT to lock in today's low rate. In our next blogpost, we will share two more tactics a wealthy family could do when the rates start rising. Do you want to improve your productivity?

Nowadays you can find an app for almost anything. But now you can do it better - with Zapier, you can find a menu of thousands of apps, pick two, zap them together, and you just created a new app that integrates the two picked one seamlessly. Every entrepreneur needs to give Zapier a try to improve productivity! |

AuthorPFwise's goal is to help ordinary people make wise personal finance decisions. Archives

September 2022

Categories

All

|

RSS Feed

RSS Feed