|

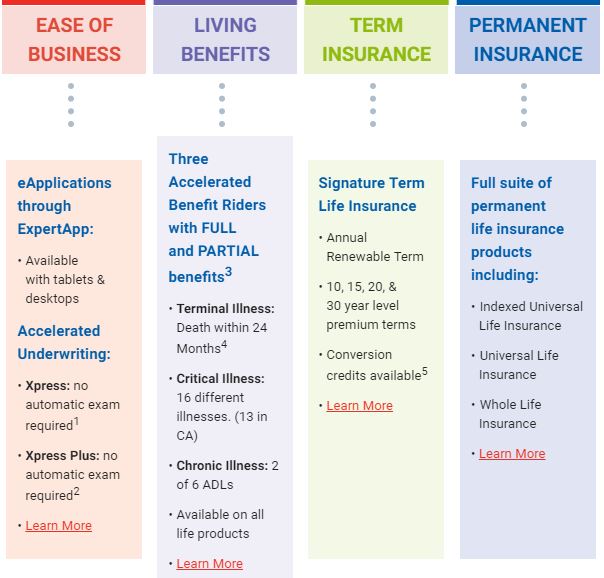

Below is a marketing flyer from American National that introduces many benefits of choosing American National for your life insurance needs - accelerated underwriting and 3 free living benefits riders are very attractive and unique among all life insurance carriers:

0 Comments

Investment decisions are personal decisions. Depending on your beliefs, your investment strategies could be different. Below are some popular investment strategies based on your beliefs -

Q. How to get into the financial planning industry on a part time basis?

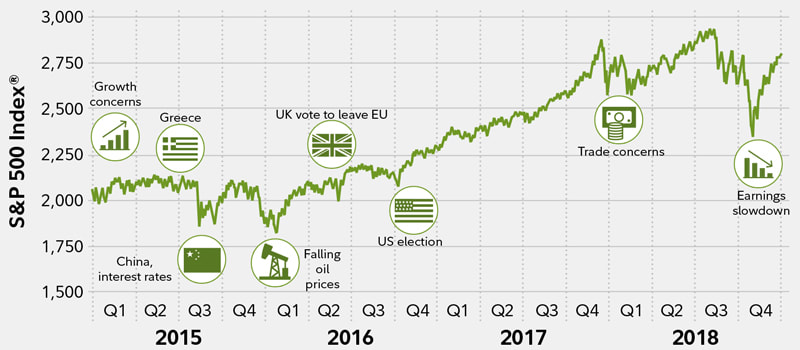

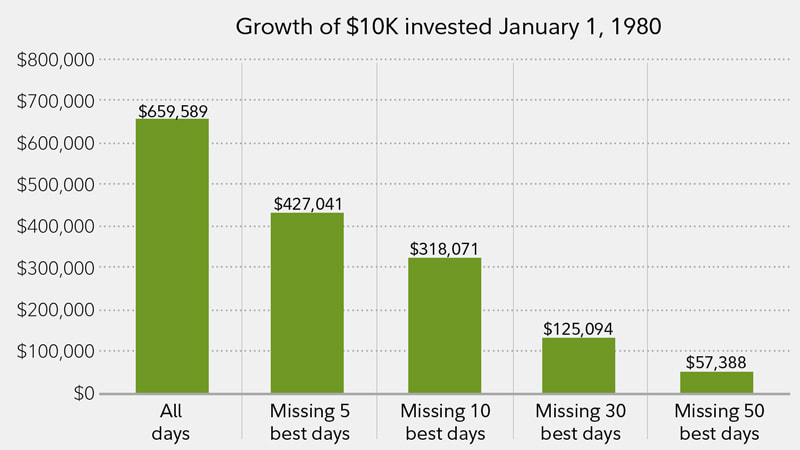

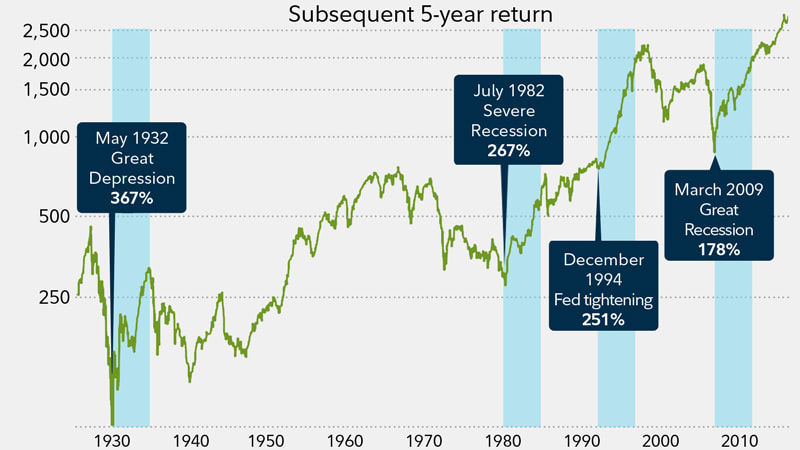

A. You can start as a financial planner on a part time basis, but don't expect to make anything big at all for some years. Her is a typical path that might work - 1. Study for a CFP board certification If you do this on a part time basis, you probably need 18 months and spend non-trivial amount of money to get your CFP certification. This is a must to start with. 2. Pass the Series 65 exam Most states will accept the CFP marks in lieu of the Series 65 exam, but if you just start out, you won't have your CFP mark because you couldn't meet the 3-year experience requirement, so just spend a few weeks or months to study and pass the Series 65 exam. 3. Search for a full time position, or start your own part time firm You can start your own firm by registering it with the state and start from scratch your own RIA firm. The first year cost should be less than $10,000, but don't expect any income yet, because while the cost barrier is low, advising people about their life savings is a sacred duty and education and experience are important to gain people's trust and do it well. So a more realistic way is to start full time at another firm, most likely start from an entry level job, and prepare for a pay cut if you current work. If you are worried about the volatility of stock market, the following 3 charts will help you keep perspective - 1. Volatility is a normal part of investing life 2. Trying to time market can cost you 3. It pays to stay in the market during volatile times Q. Does Medicare plan cover foreign travel?

A. For retirees with Medicare plan and travel overseas, it should be noted that the Original Medicare and Medicare Advantage plans do not cover if you are outside the US. If you want coverage, you need to consider a Medigap policy. It's a supplemental insurance plan that's designed to cover gaps in coverage left by Medicare. Unlike Medicare, Medigap is not a government-sponsored insurance program. It’s sold through private insurance companies and you're responsible for purchasing the policy on your own. What Medigap generally covers outside the US? If you have Medigap Plan C, D, E, F, G, H, I, J, M, or N, your plan:

6 questions to ask your health insurance company about foreign travel:

80 percent of people pay for college with cash flow or drawing down an asset, however, there is an alternative to college savings that could make more sense. Here are the 4 steps process:

Step 1: Collateralize assets by leverage compounding interest You still have to save the money, but instead of giving all that money to the college, you can collateralize the assets. When you collateralize the assets, you can take advantage of the power of compounding interest. Step 2: Calculate the Expected Family Contribution (EFC) This is the amount of money the government says each family should be able to pay per year to educate one child (Assess 25 percent of family income and 6 percent of visible assets). Step 3: Identify how much you have to pay This is where the EFC from the parents is added with any other source of income (student loans from need-based financial aid, grants, scholarships, etc.) to meet the expected tuition payments. Step 4: Find the best and most efficient strategy for college expenses and retirement You can combine your savings goals into one - use retirement dollars to help pay for college, and use college dollars to help with our retirement. The preferred tool? Use a whole life insurance policy where loans can be collateralized from the policy to help pay for college, you can see how the numbers work with the policy’s loan summary. Quick Take: whole life benefits as a college planning tool

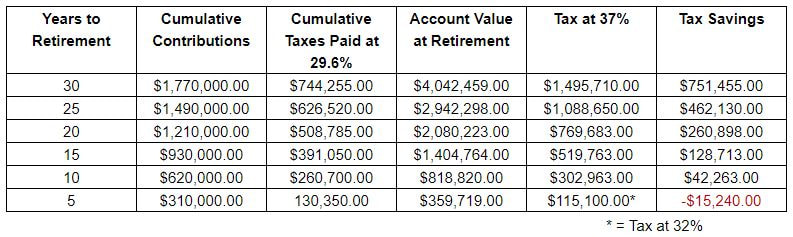

If you are interested in using whole life as a 529 alternative, please contact us so we can run illustrations for you, and you can then decide if the numbers make sense for you or not. The article below is from an insurance carrier's pension department, it should be very interesting for people who runs his or her own single person business. What is a Single-Participant 401(k) Plan? A single-participant 401(k) plan is a 401(k) plan that is sponsored by an employer and has no other employees except the business owner. Under such plans, the business owner wears two hats: his employee hat and his employer hat. A single participant 401(k) plan is typically funded by a combination of employee salary deferral contributions (the “employee” part) and employer profit sharing contributions (the “employer” part). Taxes, Taxes, Taxes For years, the conventional wisdom has been that contributions to the plan should be made on a pre-tax basis to defer taxes to the participant’s retirement years when he is expected to be in a lower tax bracket. Employee deferrals have usually been of the pre-tax variety and employer profit sharing contributions have usually been made on a tax-deductible basis. Does conventional wisdom still hold true today? For some single-participant 401(k) plan sponsors the answer very well may be no. The reason for this is the effect that §199A of the Tax Cuts & Jobs Act of 2017 had on the taxation of small businesses such as sole proprietorships, partnerships, S-Corporations and LLCs. For qualifying employers §199A reduces the top marginal tax rate on business income from 37% to 29.6%. The top personal income tax rate remains at 37%. Therefore, a business owner might ask himself the question, “Does it make sense for me to contribute to a plan and take a deduction at 29.6% when I might pay 37% on the money when I take it out of the plan down the road?” The business owner has a point. Fortunately, there is a way to provide him with tax-free income at retirement if he chooses to pay taxes on his current contributions instead of waiting to pay tax when he retires. To do so we would follow a three-step process. Three-Step Process to Maximize Tax Free Income In Retirement Step One: Switch from making his salary deferrals on a traditional pre-tax basis to an after-tax Roth basis instead. Everybody can make Roth salary deferral contributions if their 401(k) plan permits it. For 2019, a participant may make up to $19,000 in Roth salary deferrals. Participants age 50 or more may add on an extra $6,000 in Roth catch up contributions. Roth contributions plus the investment earnings they generate can be withdrawn from the plan tax-free if the Roth deferrals are kept in the plan for the requisite minimum holding period. In general, the required holding period is the later of: • The fifth year following the year that the first Roth deferral contribution was made, or • Attainment of age 59 ½ Step Two: Stop making profit sharing contributions to the plan and instead allow the business owner to make additional voluntary after-tax contributions to the plan. For 2019, this can be as much as $37,000 if the maximum Roth salary deferral has been made. Voluntary after-tax contributions have been around for a long time but have fallen out of use ever since they became subject to discrimination testing under Code §401(m). As very few, if any, non-highly compensated employees will ever make voluntary after-tax contributions plans that allow them are quite likely to fail discrimination testing and require that voluntary after-tax contributions made by highly compensated employees be refunded. Discrimination testing is not a concern in a single-participant plan because there are no non-highly paid employees to discriminate against. Such plans can accept voluntary after-tax contributions without any worries. Discrimination testing also does not apply to plans where the only participants are the owner and his spouse, his children or his parents. It also does not apply if the only participants are co-owners of the business, such as a partnership, as long as each participant owns more than 5% of the business. Testing also does not apply to plans where every participant is a highly compensated employee, i.e. everyone has earnings in excess of $125,000 for 2019. Add non-highly compensated employees into the mix, even one, and voluntary after-tax contributions will probably be disallowed because of discrimination testing. Step Three: Have the business owner elect to make an in-plan Roth conversion of his voluntary after-tax contributions right after they have been made. Since the contributions were made on an after-tax basis there will be no tax consequences from making the Roth conversion election. The Results The results can be very interesting. Here is a chart of potential tax savings assuming that the maximum contribution rate remains unchanged at 2019 levels and the contributions generate an investment return of 5% compounded annually: For most participants except those nearing retirement Roth salary deferral contributions and Roth conversions of voluntary after-tax contributions can be an attractive option.

If you found the above piece interesting, we can help you set up retirement plans for you, please contact us here. Q. If I used marijuana in the past, will it affect my life insurance application?

A. Below is a view shared by insurance companies' underwriters, it should give people who have the same question above a clear answer - Marijuana is consumed in a variety of ways. Most commonly, it is smoked; however, it can also be consumed orally through foods, capsules, and teas. THC (tetrahydrocannabinol) is the primary psychoactive chemical found in marijuana (in other words, this is the component within cannabis that causes changes in brain function, mood, and perception). In recent years, the levels of THC have increased considerably when compared to marijuana smoked just 20 years ago. Thus, today’s marijuana is much more potent than in the past. THC is accumulated in the fatty tissues and eventually eliminated over a period of days (and sometimes weeks or longer). Therefore, a positive marijuana test on an insurance lab does not necessarily mean that the proposed insured had recently used pot. It is very possible that the proposed insured used marijuana days or weeks prior. As the legal environment and cultural norms have changed, the use of marijuana has increased in recent years. It is estimated that almost 15% of U.S. adults have used marijuana in the past year. One recent comprehensive national survey found that 38% of college students have used marijuana at least one time in the last year and 21% report using in the last month. These numbers are even higher in people of the same age group not attending college. Increased use of cannabis isn’t isolated to young people. A 2017 review found a significant recent increase in cannabis use among U.S. adults age 50 and over. The Good News For adults using marijuana on a recreational/occasional basis, there is evidence that there is not much overall impact on health, except with poorer periodontal health. For those using marijuana for control of pain, there are indications that this may reduce the use of more dangerous prescription narcotic medication. Some research has concluded that there is reduced opioid-related accidental deaths when marijuana is legalized. The Bad News As Dr. Cliff Titcomb ( Medical Director at Hannover Re) has stated, “…it is important to remember that the mortality risk is not from the drug {marijuana} itself, but rather the company it keeps.”

The Bottom Line As with so many other underwriting issues, context is key. The underwriter will be looking at things such as frequency of use, medicinal vs. recreational, past or current abuse of other substances, and other medical issues. For occasional/recreational use only with no other concerns, standard rates are common. More frequent use can result in a substandard rating. Preferred rates, while not as common as standard, is the best-case scenario. A typical preferred risk will have these characteristics:

We discussed tax on gold investments here, now final part of tax-wise about investment.

Part 7, Tax on MUNIs, MLPs, and REITs

We discussed taxes on futures and options here. Now we will discuss tax on gold investment.

Part 6. Tax on Gold Investments The IRS treats gold bullion (and silver, platinum and palladium) as a collectible - the same as baseball cards - rather than as an investment, such as stocks or bonds. Long term capital gains are taxed at 28%. If you invest in an ETF that buys and sells precious metals, your gains will also be taxed at the 28% rate. Funds and ETFs that invest in gold mining stocks, however, are treated the same as any stock funds. In our last part, we will discuss tax on MUNIs, MLPs, and REITs. In last blogpost, we discussed which method you could consider: LIFO or FIFO, now part 5.

Part 5. Tax on Futures and Options Profits from Futures trading are generally taxed as 60% long term capital gains and 40% short term capital gains, no matter how long you have held the contract. Tax rules on Options trading are the same as on stocks. Profits on Options held less than 1 year are typically taxed as short term capital gains (the same as ordinary income) and losses are short term capital losses. Income you gained from selling an option to another investor is taxed as short term gain. Next, we will discuss tax on gold investment. In last blogpost, we discuss cost basis, now will discuss which method do you use when you sell a security - LIFO vs FIFO.

Part 4. Use LIFO or FIFO? You can sell shares in the order you bought them - first in first out (FIFO), this increases the odds you will pay the lower long term capital gain rate, but you may have reasons to sell shares you bought most recently - last in first out (LIFO), for example, after you bought the stock, it tanked, allowing you to take a capital loss. You can also specify certain shares to sell, or just assume you will use the average cost per share when figuring your basis. If you use the average cost per share to account for part of a position that you have sold, you need to use the same method when you sell the rest. IRS usually assumes you use FIFO method, if you use a different method, you must let your broker know in writing and keep a record of that order in case the IRS asks about it. Next, part 5 - tax on futures and options. In part 2 we discussed tax on stock dividends. Now part 3.

Part 3. Calculation of Cost Basis You might think it's easy to figure out cost basis - your purchase price. However, it is important to adjust your cost basis for reinvested dividends, because you will pay tax on dividends that you reinvest as though you have pocketed the cash. But you won't be taxed twice - once when the dividend is paid to you and again when you sell - because your cost basis is adjusted upward by the amount of the dividend. Investment expenses such as commissions will also increase your cost basis and reduce your taxes. Brokerage firms usually keep records of all purchases and sales of securities for at least 6 years. Next, we will discuss LIFO vs FIFO. We discussed long term vs short term capital gains here. Now part 2 of tax-wise in investment.

Part 2. Tax on Stock Dividends First, domestic qualified stock dividends are taxed at capital gain rates. How to determine if a dividend is qualified or not? If you have held your stock for more than 60 days within the window that extends from 60 days prior to 60 days after the ex-dividend date (the date the company declares a dividend payment). Non-qualified dividends are taxed at your ordinary income rate. Foreign stock dividends: many countries withhold taxes on dividends paid to foreigners. If you invest in an international fund, an international stocks, or an ADR, you will see box 7 of your 1099-DIV form will include an amount indicating the foreign taxes paid. The Foreign Tax Credit lets you recoup some or all of these taxes. Each year, you will have the choice of taking a deduction for foreign taxes, which reduces your taxable income, or a credit, which reduces your taxes dollar for dollar. It is generally better to take the credit. You can use Form 1116 to figure the tax or credit, and enter it on Schedule 3 of Form 1040. Next, we will discuss cost basis. We will use several blogposts to discuss tax in investment.

Part 1. Long Term Gain vs. Short Term Gain When you realize a gain on investment (not a tax-favored retirement account), you will have to pay tax on the gain, how much will depend on your income and how long you held the investment. If you bought and sold within 12 months, you have a short term capital gain, which will be taxed at your maximum income tax rate. If you are in top 40.8% tax bracket, which incomes a 3.8% Medicare surtax, that will be the tax rate on your gain! If you wait more than a full year between your purchase and sale, now you qualify for a more favorable long term capital tain rate, which is determined by your taxable income. If you are a high earner with modified adjusted gross income that puts you in the top 23.8% capital gain bracket (includes a 3.8% Medical surtax), that will be the rate you will pay! At tax time, you match up all of your long term gains against your long term losses, and your short term gains against your short term losses. Then you match any remaining gains against remaining losses to figure your capital gain tax. If you have a net loss, you can deduct up to $3,000 worth from your income. Losses greater than $3,000 can be carried over into the next tax year and future years, until they are used up. In part 2, we will discuss qualified stock dividends and dividends from foreign stocks. We have discussed the previous 7 strategies here, now the last 3 strategies.

8. Roll money over to a Roth There is no RMD requirement for Roth IRA, so any money you have rolled over from a traditional IRA to a Roth avoids future RMDs. However, you will have to pay taxes on the rollover, and if you do it after age 70.5, you will have to take that year's RMD before rolling over the money. 9. Consider a QLAC Money you invest in a deferred-income annuity known as a qualified longevity annuity contract and is removed from your RMD calculation. You can invest up to $130K from your IRA in a QLAC (or up to 25% of the balance in all of your traditional IRAs, whichever is less) at any age (most people do this in their fifties or sixties). You pick the age when you would like to start receiving annual lifetime income, usually in your seventies or later (no later than age 85). 10. Don't pay more in taxes than you have to If all of your IRA contributions were made with pretax or tax-deductible money, your RMDs will be fully taxable. But if you made any non-deductible contributions, a portion of each withdrawal will be tax-free. Keep track of your tax basis on Form 8606 so you don't pay more in taxes than you owe. We introduced the first 3 strategies here, now the next 4 strategies below.

4. Understand how 401(k) rules are different If you have several 401(k) accounts, you have to calculate and withdraw RMDs separately for each 401(k). You even have to take RMDs from Roth 401(k), although those withdrawals are not taxable. You can't take 401(k) account RMDs from your IRAs and vice versa. If you are still working at 70.5, you may be able to delay taking your RMD from your current employer's 401(k) until April 1 of the year after you stop working (unless you own more than 5% of the company). But you still have to take RMDs from traditional IRAs and former employer's 401(k)s. If your current employer allows it, you may want to roll funds from other 401(k)s into your current plan and avoid taking RMDs on that money while you are still working. 5. Choose the right investments to withdraw Some IRA or 401(k) administrators automatically withdraw RMDs proportionately from each of your investments, and they could sell stocks or funds at a loss to make your payment. If you want to avoid that, you can usually elect to take a fixed percentage from each of your investments or have 100% taken from cash. 6. Automate your RMDs If you want to simplify the process and not worrying about missing deadlines, most IRA administrators will let you automate your RMDs, you can sign up to have the money withdrawn every month or quarter, or by a certain date each year. 7. Donate to charity and get a tax break After you turn 70.5, you can transfer up to $100K directly from your IRA to charity each year which counts toward your RMD but isn't included in your adjusted gross income. This strategy could be helpful if you itemize your deductions and otherwise won't get a tax break for your charitable gifts. Keep reading the next 3 strategies here. Q. I know it's required to take money out of retirement accounts once reaching 70.5, how to minimize the tax bite?

A. The prospect of taking Required Minimum Distributions (RMD) and facing the tax bill can be daunting, here are 10 strategies you can use to minimize taxes, make the most of your investment and avoid costly mistakes. 1. Calculate the amount of your withdrawals RMD is based on the balance of your accounts as of December 31 of the previous year, divided by a life expectancy factor based on your age. Most people use the Uniform Lifetime Table (Table III) in Appendix B of IRS Publication 590-B. Your IRA or 401(k) administrator can usually help with the calculations. 2. Time it right You usually have to take your annual RMD by December 31, but you have until April 1 of the year after you turn 70.5 to take your first required withdrawal. However, delaying that first withdrawal means you will have to take 2 RMDs in the second year which could push you into a higher tax bracket, making you subject to the Medicare high-income surcharge or cause more of your Social Security benefits to be taxable. 3. Pick the best accounts for RMD You have to calculate the RMD from each of your traditional IRAs (not Roths), including rollover IRAs and any SEP or SIMPLE IRAs. But you can add the total required withdrawals from all of those IRAs and take the money from any one or more of the IRAs. IRAs are owned individually, even if you are married and file a joint tax return, you and your spouse have to take your RMDs from your own accounts. Please keep reading the next 4 strategies. Q. Why should I consider indexing in investment?

A. I can think of 5 reasons that show the power of indexing - 1. Proven Performance Standard & Poor found that in the 15-year period through June 30, 2018, S&P 500 Index beats 92% of large-cap funds. Morningstar found that Vanguard 500 Index has done better than the majority of funds in its category - large cap blend. 2. Tax Efficiency Only a handful of companies in the S&P 500 change each year, so trading expenses and tax consequences are minimum. 3. Low Cost Fidelity has a no-fee Zero Large Cap Index (FNILX) which is linked to Fidelity's own index of 504 stocks that are nearly the same as those in the S&P 500. Vanguard charges just 0.04% for Vanguard S&P 500 (VOO) ETF. 4. Hard to Find Better Performing Funds If you want to find a better performing actively managed fund, the odds are against you - A study by S&P found that "out of 500 domestic equity funds that were in the top quartile as of Sept 2016, only 7.1% managed to stay in the top quartile at the end of Sept 2018". 5. More Market Exposure In addition to S&P 500, you can also buy Vanguard Total Stock Market Index (VTSAX) which reflects the performance of every exchange-listed U.S. stocks and charges 0.04%. Fidelity Zero Total Market Index (FZROX) does the same and charges no expenses. We have discussed step 3 of family wealth transfer here, now final step.

Step 4. Follow Up On Your Plan Once you have your plan in place, you should continue the vital discussions you've already started with your family members regarding the details of your plan. Sharing the particulars of your plan is a highly personal decision. But helping your loved ones better understand your intentions before any incapacitation or death is something to carefully consider. Finally, review your plan as circumstances change. As a general rule, you should have the estate planning documents reviewed every 3 to 5 years. In addition, you should review your plan when major life events occur, such as marriage, the birth of a child, divorce, the receipt of an inheritance, or a death. We discussed step 2 here, now step 3 of family wealth transfer.

Step 3. Focus on Your Legal DocumentationsBefore you meet with an estate planning attorney, you will need to pull together key documents.

Once you have chosen an attorney, the process usually has 3 phases:

Read step 4 here. We discussed step 1 of family wealth transfer here, now step 2.

Step 2. Identify Your Assets and Liabilities When planning for your family's financial future, be comprehensive. Start out by creating a personal balance sheet.

We will discuss step 3 here. We will use 4 blogposts to discuss a 4-step family wealth transfer plan.

Step 1. Develop A Family Vision

We will discuss step 2 next. Q. Is it still safe to use 4% withdrawal rate to take money out of my retirement portfolio?

A. We will share a few reasons for people who think why the 4% rate is outdated, you can determine if they make sense or not by yourself. What is 4% rule? This rule states that a 65-year-old could withdraw 4% of their assets from their portfolio during the first year of retirement, grow those assets by the inflation rate in subsequent years, and have minimal probability of running out of money over the next 30 years. The 4% rule may seem safe at a glance, but the complexities of retirement challenge the validity of this strategy. Why 4% is outdated? When the 4% rule was first introduced in the early 90s, the probability of running out of money was calculated using historical returns. When updated with new capital markets data, using a moderate risk portfolio, the 4% rule today is actually closer to 3.5% for current retirees and a 3.5% withdrawal rate yields only an 85% probability of success. In other words, this withdrawal rate would fail 15 times out of 100. In addition, the 4% rule fails to address the following uncertainties imbedded in every retirement plan:

Q. How to choose the right Medicare Supplement plan/

A. We have introduced Medicare plan here. Now we will discuss how to choose the right Medicare Supplement plan. Medicare Supplement plans (Medigap plans) pay out-of-pocket costs not covered by Medicare, it has 10 letter designations (A through D, F, G, and K through N). All plans with the same letter have the same coverage, but prices can vary by company.

Most state insurance departments describe the types of medigap policies and list the premiums for plans in their area. You can find your state's insurance department at www.NAIC.org. |

AuthorPFwise's goal is to help ordinary people make wise personal finance decisions. Archives

September 2022

Categories

All

|

RSS Feed

RSS Feed