|

The document below is from American National which naturally shows that its accelerated death benefit riders are the best among its competitors! If you are interested in any life insurance products with accelerated death benefit riders, please contact us.

0 Comments

Q. I am planning my retirement, how do I ensure my portfolio could sustain market volatility?

A. It's important to understand that volatility is a fact of life, and there will be market events and recessions - sometimes at inconvenient times. What should you do? Try the following 4 steps: 1. Develop a Solid Foundation For baby boomers nearing retirement - and for most investors, it’s important to start by understanding your basic financial needs during retirement. Based on a recent MassMutual Retirement Savings Risk Study, while 80% of pre-retirees think they’ll have lower retirement costs, only 50% of those in retirement now actually spend less than they did before.Once you’ve developed that understanding, look at the different aspects of your retirement income and figure out how much of what you need for necessities can be covered by your monthly Social Security benefits and pension if you have it. 2. Create a 5-year Bond Ladder Once the necessities are planned for, you could create a bond ladder to last five years. A bond ladder will arrange for investments that mature at different times while providing you with interest income. You should be able to create a situation where you can receive regular income and then, as bonds mature, you can use the principal to cover current-year expenses. A five-year bond ladder can help with discretionary income that goes beyond the bare necessities. After the bond ladder is in place, you can keep a portion of your retirement portfolio in the stock market, and pursue growth for later. 3. Convert Part of Portfolio to Roth IRA In general, you don’t want to sell off a lot when the market is down, however, a downturn might be a good time to consider converting part of your portfolio using a Roth conversion. You have to pay taxes when you convert to a Roth IRA, but if you do so when the value of your portfolio is lower, depending on your tax bracket now versus later, you may reduce the tax impact. Once you’ve converted to a Roth account, you won’t have to worry about paying taxes on your distributions in retirement (once the conversion has aged five years). If or when the market recovers after a period of volatility, you can take advantage of the gains - without paying the higher taxes. Plus, your Roth IRA doesn’t come with required minimum distributions (RMDs) at age 70 1/2 (as opposed to traditional IRAs), and Roth tax-free distributions won’t increase your Medicare premiums. 4. Conduct a Stress Test Before you move forward with any retirement portfolio changes ahead of expected market volatility, you should conduct a stress test to test different scenarios to better understand the potential impact of losses in the first few years of retirement. When you know what you’re up against, you might be able to make a few tweaks to your portfolio or prepare ahead of time by doing a little rebalancing. Q. What is the difference between estate tax and inheritance tax?

A. Unless your family counts among the wealthiest 2% of Americans, the estate tax probably won’t affect you. The federal estate tax is essentially a transfer tax on property including cash, real estate, and stock paid by the heirs. Basically, you’ll need to file an estate tax return with combined gross assets exceeding the exemption limit of $11.4 million per individual in 2019, up from $11.18 million in 2018. According to the Internal Revenue Service (IRS), you may elect to pass on any of your unused exemption to a surviving spouse. But don’t confuse the federal estate tax with inheritance taxes on property or money, which are state taxes that require the beneficiary—not the estate—to pay the tax. The main difference between an estate tax for the ultra-wealthy and an inheritance tax on property or money imposed by some states is who is required to pay it.

What about inherited retirement accounts? We will discuss it in next blogpost. Q. Is volatility an asset class that I could invest in?

A. There’s an inverse correlation between the market volatility (VIX) and the stock market - when the market drops, fear and uncertainty tend to rise. However, you can’t directly buy the VIX because it’s a reference rate - an index made up of the implied volatilities of a basket of short-term options on the S&P 500 ($SPX), normalized to a 30-day constant maturity. But there are ways to sell and buy volatility exposure, as discussed below: 1. VIX Futures VIX futures (/VX) are simply the market’s anticipation of where the VIX will be at monthly points in the future. VIX futures are cash settled, with a final settlement value equal to $1,000 times the settlement price. So, if you buy a VIX futures contract for 15 and it drops to 14, you’ll be down $1,000. The minimum tick size is 0.05, which represents $50. VIX futures settle to a settlement reference index under the ticker symbol VRO. But futures aren’t for everyone. They involve leverage, and not all accounts allow the trading of futures. Plus, if you’re looking to buy and hold volatility, the value of your investment might erode over time. 2. Volatility ETFs/ETNs If you’re looking for a buy-and-hold strategy and you either can’t trade futures or don’t wish to trade futures, there are a number of exchange-traded products such as volatility ETFs and ETNs that attempt to mirror the performance of the VIX. These products trade like stocks insofar as they can be bought and sold on exchanges and are generally available for most account types. They don’t hold securities, but rather use derivatives to attempt to track VIX performance. And although their aim is to mirror the VIX, they don’t always hit the mark. Because most of them use VIX futures, they’re subject to the same contango loss as VIX futures, plus a number of administrative and transaction costs. 3. VIX Options VIX options are much like standard equity options, with a few key differences. First, they’re European-style options, which means they can be exercised only at expiration (as opposed to standard equity options, which may be exercised on any business day up to and including expiration day). Plus, unlike standard options that are physically settled into shares of the underlying stock, VIX options are cash settled (at $100 times the intrinsic value at expiration), with in-the-money options settling to the same settlement reference (ticker symbol VRO) as VIX futures. Finally, perhaps the most important aspect of VIX options is that they’re based not on the VIX itself, but rather on VIX futures. By 2035, 58.7 million retirees could be taking RMDs. The document below showcases some RMD case studies and strategies: Q. How can I create a will free or with low cost?

A. Try the following resources:

Bank and Brokerage Accounts

Once you haven't touched your account for 3 to 5 years, banks usually transfer your money to the state of your last known address. Visit unclaimed.org and follow links to the website of each state where you have lived. You can also recover money in a deceased relative's account if you have proper documentation. Life Insurance Policies If it is not listed on unclaimed.org, use the Life Insurance Policy Locator at naic.org, a service run by state insurance regulators. Retirement and Pension Accounts Visit freeERISA.com to find your old employer's latest form 5500, which has contact information for the administrator. If your 401(k) was terminated, check askebsa.dol.gov/abandonedplansearch for contact information. If your pension plan failed or was shut down, you may still qualify for a payment from the Pension Benefit Guaranty Corp, look for your plan at pbgc.gov/search-unclaimed-pensions. If all this is fruitless, the nonprofit Pension Rights Center (pensionrights.org) may be able to help. For conservative customers, the 4.5% illustration rate test for IUL products is a good one, and AIG's product stands out from the pack, see the document below. Life Comes With Risks Take control of the future today a national study found that 62.1% of bankruptcies were attributable to major medical expenses. Whether it is a critical illness, a chronic illness or even the terminal illness of a loved one, these tragedies can drain the entire family emotionally and financially. What is a Living Benefit? American National’s Living Benefits are Accelerated Benefit Riders (ABRs) which provide the potential to receive a partial or full accelerated life insurance benefit if the insured experiences a qualifying medical condition.

Protection with No Additional Premium The riders are offered at no additional premium. However, the accelerated payment will be less than the requested death benefit because it will be reduced by an actuarial discount and an administrative fee of up to $500. The amount of the reduction is primarily dependent on American National’s determination of the insured’s life expectancy at the time of election. The accelerated payment is limited to $2,000,000 for ages up to 65 and $1,000,000 for ages 66+. The Accelerated Benefit Riders Cover Three Types of Illnesses

Available On the Following Products:

Q. I am self-employed. What tax-deferred retirement plan options I could consider?

A. There are three main options you as a self-employed person could explore -

In our last blogpost, we discussed method 1 - spread the conversion tax cost. Now we will discuss method 2 below.

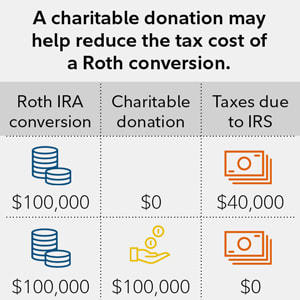

Method 2. Consider a Charitable Contribution For high-income earners, a charitable contribution is a method worth considering. The tax deduction for a contribution to a public charity can be up to 60% of adjusted gross income (AGI) for cash donations and up to 30% for donations of securities (generally deductible at fair market value when long-term appreciated securities are gifted) in a given year. And if a contribution exceeds these limits, the excess can generally be carried forward for up to 5 years. The amount of the charitable deduction available to claim can generally be estimated by adding the taxable portions of a conversion amount to AGI. For example, for those planning to convert $200,000 to a Roth IRA, with a $150,000 AGI before the conversion, the estimated AGI would be $350,000 after the conversion. Up to $210,000 (60% of $350,000) of a charitable cash contribution or $105,000 (30% of AGI) of a charitable donation of securities with long-term appreciation, could potentially be deducted. This could significantly reduce the tax impact of a conversion. See illustration below. Q. How to minimize Roth IRA conversion's tax impact?

A. The benefits of a Roth IRA are clear: tax-free growth and tax-free withdrawals. But not everyone may be able to contribute to a Roth IRA because of IRS-imposed income restrictions on contributions. But anyone can convert existing money in a traditional IRA or other tax-deferred retirement savings account to a Roth IRA. A Roth IRA conversion does have a cost - income taxes need to be paid on the converted amount. Taxes are "front-loaded," which allows the money in the Roth IRA to grow tax-free. We will discuss 2 ways to help manage taxes. Method 1. Spread the Cost This method involves converting the Roth IRA over a few years. This spreads the taxes too, and it may also prevent the income from the conversion causing a bump into a higher tax bracket. An example Imagine a married couple who expect to file jointly with $100,000 in taxable income. They could convert up to $50,000 to a Roth IRA and stay within their current tax bracket, which applies to taxable income between $90,000 and $150,000. As long as their tax rate and income generally stay the same, they could convert this amount yearly until they reach the total amount they want to convert. The potential benefit is that they maintain a consistent tax rate when converting (provided their situation and the tax rates don’t change in the ensuing years.) If they converted more than $50,000, any amount over the current marginal rate income range would be taxed at the next higher marginal rate. Two considerations First, a conversion must be completed by December 31. Estimating taxable income can be tricky without all tax reporting documents, which aren't typically available until late January of the following year, at the earliest. So, your estimated taxable income may end up being higher or lower than expected. Second, for those near the top of their bracket, it may take a long time to convert the total amount wanted without moving into a higher bracket. For example, for joint filers with $100,000 in taxable income, the next bracket begins at $150,000. Converting only $10,000 would keep the filers within the same bracket. In our next blogpost, we will discuss method two to minimize tax when convert to Roth IRA. An inherited IRA could create a lifetime legacy for your heirs, but unless you are careful, you could end up leaving a large part of your savings to Uncle Sam.

Spouse vs Non-spousal Heirs The tax code treats IRAs inherited by children and other heirs differently from IRAs inherited by spouses. Spouses can simply roll inherited IRAs into their own accounts, postponing required minimum distributions - and taxes - until they turn 70.5. Non-spousal heirs don't have that option. To continue to benefit from tax-deferred growth, each heir must roll his or her portion of the IRA into a separate account known as an inherited IRA. Rules to Take Distributions Once heirs transfer the money into an inherited IRA, they can take annual distributions based on their own life expectancies. But to give your heirs this option, you must name them as beneficiaries of the IRA. If you name the estate as the beneficiary, your children will still inherit the money, but they will be required to clean out the IRA by the end of the fifth year after your death if you die before you turn 70.5, if you die after age 70.5, your heirs can take payouts based on your life expectancy, as set by IRS tables. Roth Inheritance A Roth inheritance is usually tax-free, but your heirs can't leave the money in the account forever. The rules for withdrawals are the same as they are for traditional IRAs. If your heirs transfer the money to accounts for inherited Roth IRAs, they can usually stretch withdrawals over their life expectancies. Q. How to avoid probate?

A. Probate is the court-supervised process of passing assets through a will (or through state law if there is no will) after you die. Money in a trust generally does not have to go through probate. Life insurance death benefits and money in IRAs, 401(k)s and other retirement plans with beneficiary designations pass directly to the beneficiaries without having to go through probate (and the beneficiary designations supersede your will). Bank accounts and brokerage accounts held as joint tenants with rights of survivorship pass directly to the joint owner after you die. Many states now permit people to own bank accounts and other financial accounts with a transfer-on-death designation. The accounts can pass on assets outside of probate when you die, and you don't have to give up any control over your accounts while you are alive. Q. Why transfer RMD to charity could help save money?

A. Taxpayers who are 70.5 or older can transfer up to $100,000 from a traditional IRA tax-free to charity each year, as long as you transfer the money to the charity directly. The "qualified charitable distribution" will count as your required minimum distribution without being added to your adjusted gross income, which can be a boon if you were going to take the new, higher standard deduction instead of itemizing (you can't deduct charitable transfers). The transfer could also help keep your income below the threshold at which you are subject to the Medicare high-income surcharges as well as hold down the percentage of your Social Security benefits subject to tax. Make a QCD well in advance of New Year's eve because the money has to be out of the account and the check needs to be cashed by the charity by December 31. For people who enter retirement stage, you give up the security of a steady paycheck, and exposed to a host of uncertainties - interest rate moves, stock market corrections, and tax changes, to name a few. It is hard to adjust from a saving mode to spending mode.

Here are a few practical tips to help the transition smoother - 1. Create a guaranteed income stream You can convert a lump-sum payout from a former employer into a simple fixed annuity, or convert a whole life insurance policy into a fixed annuity. Such guaranteed income stream will make you feel better when spend the rest of savings. 2. Protect against future higher tax rates Withdraw more than your required minimum distributions to take advantage of today's relatively low rates, or make charitable contributions from your pretax accounts to reduce the amount you will be required to take in RMD when you turn age 70.5 which will cut your tax bill. 3. Protect against stock market corrections Save enough money in safer accounts such as CD or money market accounts so you don't have to touch the money invested in stock markets when it is low in value. 4. Lower withdrawal rates The traditional withdrawal rate of 4% is still valid, but you could lower it a little bit if it makes you feel safer. However, there is a lot of evidence that retirees may be worrying too much about preserving their money. 5. Create a financial plan that gives you permission to spend For example, maintain separate accounts for things such as basic bills, travel, and investment. Practice spending money and reward yourself for the experience, you can start small, for example, put some slips of paper with writings that note things that will bring joy to your life, and every a few weeks take out a slip and buy what's written on it.. Q. What factors do I need to consider before investing in ETFs?

A. Exchange-traded funds (ETFs) can be powerful investing vehicles. They trade intraday like stocks. Yet, like mutual funds, they are baskets of investments (e.g., stock ETFs hold a basket of stocks) representing the entire market or specific segments of it. With more than 2,000 ETFs available to trade representing stocks, bonds, and commodities, including passive and actively managed strategies, ETFs offer a wide variety of options allowing investors to implement a short- or long-term strategy. Once you've determined your investment strategy, which may be implemented in whole or in part through the use of ETFs, you still need to do your homework before investing in an ETF. Below are five key factors to consider:

While estate planning and passing on wealth to the next generation (in a tax-efficient manner) is a standard conversation for affluent clients, a recent book by Tom McCullough and Keith Whitaker entitled “Wealth of Wisdom: The Top 50 Questions Wealthy Families Ask” highlights that for many families, figuring out how to pass on their family values is equally or more important than “just” passing on their wealth alone.

Accordingly, five key lessons for “values transmission” within the family include: 1) Values are caught, not taught (meaning that actions speak louder than words, and the best way for families to communicate values to their children is by living and doing them, not just saying them… although establishing a family mission statement or family values statement may still help the family to at least crystallize its thinking of the values to express in the first place); 2) Values are different from beliefs, preferences, and choices (in essence, “values are the compass that each of us uses to direct our behavior, often unconsciously” and serve as the organizing principles of our lives, such that Christianity or Judaism are preferences or choices while “spirituality” would be the unifying value, or environmental conservation or the arts are preferences while “generosity” is a value); 3) Leading a life that is consistent with your values is the greatest predictor of happiness (as it’s the congruence between life and values that drive happiness and satisfaction, while misalignment between the two leads to frustration and stress, though the demands of growing and maintaining wealth can often challenge affluent families to stay in congruence, and teenagers will have a natural tendency to challenge their parents’ values are part of their own development); 4) Storytelling is a powerful means of sharing values (as telling stories is a way to express your own life’s work, in the context of what’s most important to you, and what your values are); and 5) If the family is to flourish for multiple generations, the attention to human capital should be as serious as that to financial capital (which means focusing on both maintaining healthy family relationships, and using financial resources to enhance the life experiences and opportunities of each member of the family). Q. How can I correct the excessive contribution I made to my retirement account?

A. If you put a little too much in your retirement account, by accident or not, you will face the 6% penalty. But the good news is you can correct an excess contribution without facing tax penalties. Here is how. Contact your IRA custodian with the amount of the excess contribution you made. Filers have until the extension filing date to correct an IRA excess - usually October 15. However, you also need to take out the earnings on that excess contribution. Custodians can usually calculate that for you. You’ll owe a 10% premature distribution penalty on the earnings if you are under age 59 1/2. If you don’t correct the excess, the 6% penalty applies each year you miss the deadline until it’s fixed. April 15 is the deadline to correct a 401(k) excess. The 401(k) limit for 2019 is $19,000 for those under age 50. It’s possible to contribute to multiple 401(k)s if you switch jobs or work two jobs; if you contribute more than $19,000 in a year, it’s called an excess deferral. Contact your 401(k) service provider or your HR department to let them know and get assistance correcting the excess deferral. Any earnings will be taxed but not subject to the 10% premature penalty. Note that all deferral plans are included in the $19,000 limit, including the SIMPLE IRA, individual or solo 401(k), and SARSEP (a specific SEP IRA). If you don’t correct your 401(k) excess deferral by April 15, the excess deferral will be subject to double taxation, both in the year contributed and the year it’s finally withdrawn. It will also be subject to the 10% premature penalty if you’re under age 59 1/2. The earnings on the excess deferral are taxable in the year withdrawn. Q. Is it possible to delay required minimum distribution from my retirement accounts?

A. Given the tax advantages of IRAs and 401(k)s, it’s no surprise that you might want to delay making withdrawals from your accounts for as long as possible. You can wait until you’re 70 1/2 to start taking your required minimum distributions, and you can even wait until April 1 of the following year. If you were still working at age 70 1/2 and have an employer-sponsored work plan like a 401(k), you can delay RMDs until you actually stop working. (That exception doesn’t apply to business owners.) Penalties for not taking RMDs are stiff, at 50% of the missed withdrawal amount. Traditional IRA owners need to take their RMDs at age 70 1/2 regardless of work status to avoid an IRA withdrawal penalty. You can put off taking your initial RMD until the following April, but you still need to take funds for the current year. For example, if you turn 70 1/2 in 2018, you could delay the first RMD until April 1, 2019, but you need to take a second RMD by December 31, 2019 to avoid paying a penalty. By waiting, you end up doubling up. So that could double up your tax bite as well and put you into a higher tax bracket. The year you turn 70 1/2, you might want to seriously consider not waiting until April. In our last blogpost, we discussed what information do you need to get ready in order to receive life insurance quotes. Now we will discuss the actual application process.

After you’ve found your best quote, you’ll need to apply for the life insurance policy - this process can take from several weeks to several months. The process of applying for life insurance can involve even more extremely personal questions, paperwork, and a medical exam. Here’s what will happen - Verify your application First, you’ll need to speak with an agent on the phone who will verify some of the information you provided online and confirm that the quote you selected is the best policy for you. The agent will then provide some paperwork for you to sign and submit your application to the insurer. Schedule your medical exam If the insurance company requires a medical exam (and most do), a contractor known as a paramedical professional will contact you to schedule the exam. The paramedical professional is trained like a nurse in performing a physical exam. Life insurance medical exams sound like a pain, but the reality is they try to make them as easy as possible for you. They’ll come to your workplace during the day or your home very early in the morning. Complete your exam, then wait! The examiner will take a thorough medical history to confirm the info in your application. He or she will take your blood pressure and draw a blood sample that will be sent to a lab to test for cholesterol and glucose levels, tobacco and drug use, and diseases. These results could be shared with you by mail. In life insurance applications, honesty is paramount: don’t be surprised if you must answer the same question about your medical history or tobacco use five times, but always answer honestly. Insurance companies share information, so misrepresenting information might not just get you denied from one carrier, but banned from many. Worse, it could give the insurer legal grounds to deny your family’s claim if you die. The insurance underwriter’s job is to take all the information from your application and medical exam and decide whether to insure you and how much to charge. This takes many weeks. You’ll want to ask your agent whether the carrier binds any life insurance upon receipt of the application. For example, when you submit your application and a check for your first premium, many carriers will insure you for something, although not the full amount you’re requesting, pending completion of the underwriting process. What to expect after you apply When your policy is approved, it is placed in force and you will be notified, and receive a full copy of the policy. If you didn’t already provide your agent with a deposit, you’ll be asked to make the first premium payment. Some insurers may allow you to make your first payment to bind your policy upon submission of your application (prior to your medical exam). The insurer reserves the right to cancel the policy or increase your premium if your exam reveals previously undisclosed medical conditions, however. Either way, be sure to ask when your policy will be effective—especially if you’re replacing an existing policy. Don’t cancel the old life insurance before you’re sure the new policy is in effect! The agent will send you a hard copy of the policy. You should make a copy of this policy, place the original and the copy in different spots for safekeeping, and tell your spouse where they are. Finally, you can relax knowing that one of the most important pieces a solid financial plan is in place for you and your family. That’s it! Although it seems like a lot, the process of buying life insurance can be easier than you think. Scheduling the medical exam and waiting on the results are the only real hassle. In our last blogpost, we discussed 3 ways to buy life insurance. Now we will discuss what information you need to get ready in order to receive life insurance quotes -

You will need to provide the following information in order for an independent insurance broker to generate premium quotes for you -

You may be surprised to see a wide range of prices from different insurers But without a more detailed application, most of these numbers are just guesses. Insurance companies employ actuaries who do nothing but crunch numbers to determine how to price insurance. The more information you provide upfront, the more accurate your quotes will be. Learn your class: preferred, super-preferred, standard, or substandard The insurance industry uses these broad groups to classify customers by risk. For example, if you are perfectly healthy, have a low body mass index (BMI), and do not have other risk factors (like smoking, dangerous activities, or a lousy driving record), you may meet the super-preferred class. By contrast, somebody who is overweight and has high blood pressure may only classify for the standard class and will pay more for the same insurance. Although life insurance classes can provide broad guidelines of what you can expect to pay, every insurer works differently. For example, let’s say you have a hobby that insurance companies consider high risk – like flying a plane or rock climbing. Some insurance companies may place you in a lower class and charge you more for these “high-risk” activities. Another insurance company may insure you in a higher class, but place exclusions on your policy meaning you won’t receive a benefit if you die as a result of those activities. In our next blogpost, we will discuss life insurance application process. |

AuthorPFwise's goal is to help ordinary people make wise personal finance decisions. Archives

September 2022

Categories

All

|

RSS Feed

RSS Feed