According to Arapakis’ research (using data from the Health and Retirement Study, the Medical Expenditure Panel Survey, and administrative Medicare and Medicaid data, a 65-year-old can expect to incur an average of $310,000 of health care costs during the remainder of their life. However, almost 80% of these costs are covered by insurance, leaving them to pay a mean total of $67,000 during their retirement (not including insurance premiums). Even an individual at the 90th percentile of medical expenses would ‘only’ have to pay a total of $138,000 out of pocket (out of a total of $642,000 of costs incurred) from age 65 until their death.

|

One of the key concerns among retirees is health care costs, including potential long-term care costs. Given the uncertain nature of these costs for a given individual, retirees will often save excessive amounts to cover these expenses, leaving behind dollars that they might have used for other spending needs. Amid this background, a recent analysis suggests that thanks to insurance coverage, retirees might face fewer out-of-pocket health care costs than they think.

According to Arapakis’ research (using data from the Health and Retirement Study, the Medical Expenditure Panel Survey, and administrative Medicare and Medicaid data, a 65-year-old can expect to incur an average of $310,000 of health care costs during the remainder of their life. However, almost 80% of these costs are covered by insurance, leaving them to pay a mean total of $67,000 during their retirement (not including insurance premiums). Even an individual at the 90th percentile of medical expenses would ‘only’ have to pay a total of $138,000 out of pocket (out of a total of $642,000 of costs incurred) from age 65 until their death.

0 Comments

Fidelity.com has a great article that discusses how to build a bond ladder by utilizing the Bond Ladder Tool from Fidelity:

"Here’s an example of how you can build a ladder using Fidelity's Bond Ladder tool. Mike wants to invest $400,000 to produce income for about 10 years. He starts with his investment amount—though he could also have chosen a level of income. He sets his timeline and asks for a ladder with 21 rungs (that is, 21 different bonds with different maturities) with approximately $20,000 in each rung. Then he chooses bond types. In order to be broadly diversified, each rung contains a range of bonds and FDIC-insured CDs with various investment grade credit ratings." Keep reading here and see how this bond ladder tool in action! What Is the Rule of 55?

The IRS rule of 55 recognizes that you might leave or lose your job before you reach age 59 1/2. If that happens, you might need to begin taking distributions from your 401(k). Unfortunately, there’s usually a 10% penalty—on top of the taxes you owe—when you withdraw money early. This is where the rule of 55 comes in. If you turn 55 during the calendar year that you lose or leave your job, you can actually begin taking distributions from your 401(k) without paying the early withdrawal penalty. You still have to pay taxes on your withdrawals, but you won’t have to pay the extra penalty. Not only does the rule of 55 work with a 401(k), but it also applies to 403(a) and 403(b) plans. If you have a qualified plan, you might be able to take advantage of this rule. You can verify the status of your plan by checking with the Summary Plan Description you received (or can access electronically) for your workplace retirement plan. 5 Things to Know About the Rule of 55 Before you start withdrawing money from your 401(k), though, it’s important to understand five things about the IRS rule of 55. 1. Public safety employees get an extra five years. Police officers, firefighters, EMTs, and air traffic controllers are considered public safety employees, and they get a little extra time to access their qualified retirement plans. For them, the rule applies in the calendar year in which they turn 50. Double-check to ensure that your plan meets the requirements, and consider consulting a professional before withdrawing money. 2. You can withdraw only from the plan specific to the employer. Before you start taking distributions from multiple retirement plans, it’s important to note that the 401(k) withdrawal rules for those age 55 and older apply only to your employer at the time you leave your job. So you can only take those penalty-free early 401(k) withdrawals from the plan you were contributing to at the time you left (or were fired from) your job. The money in other retirement plans must remain in place until you reach age 59 1/2 if you want to avoid the penalty. 3. You must leave your job the calendar year you turn 55 or later. The rule of 55 doesn’t apply if you left your job at, say, age 53. You can’t start taking distributions from your 401(k) and avoid the early withdrawal penalty once you reach 55. However, you can apply the IRS rule of 55 if you’re older and leave your job. If you get laid off or quit your job at age 57, you can start taking withdrawals from the 401(k) you were contributing to at the time you left employment 4. The balance must stay in the employer’s 401(k) while you’re taking early withdrawals. The rule of 55 doesn’t apply to individual retirement accounts (IRAs). If you leave your job for any reason and you want access to the 401(k) withdrawal rules for age 55, you need to leave your money in the employer’s plan—at least until you reach age 59 1/2. You can take withdrawals from the designated 401(k), but once you roll that money into an IRA, you can no longer avoid the penalty. And if you’ve been contributing to an IRA as well as your 401(k), you can’t take penalty-free distributions from your IRA without meeting certain requirements. 5. You can withdraw from your 401(k) even if you get another job. Finally, you can keep withdrawing from your 401(k), even if you get another job later. Let’s say you turn 55 and retire from your work. You decide you need to take penalty-free withdrawals under the rule of 55 and begin to take distributions from the employer’s plan. Later, at age 57, you decide you want to get a part-time job. You can still keep taking distributions from your old plan, as long as it was the 401(k) you were contributing to when you quit at age 55—and you haven’t rolled it over into another plan or IRA. From the introduction of the index mutual fund several decades ago (which greatly reduced the cost of buying a diversified portfolio) to the more recent dramatic reduction in the costs of trading (now free on most platforms), investors have benefited from the trend of lower investment fees. Nevertheless, simply because one product has a lower fee than another does not necessarily mean it is the better choice, because in some cases higher costs bring with them certain benefits that can outweigh paying a higher fee.

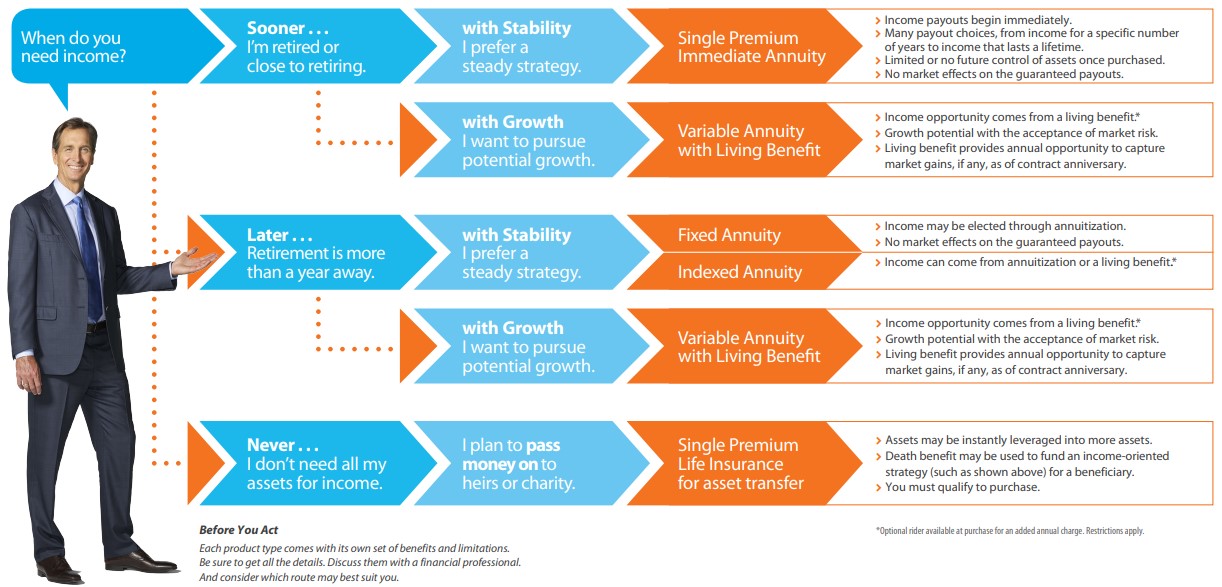

One area where fees and benefits can vary significantly is in the annuity space. For example, annuities with a Guaranteed Lifetime Withdrawal Benefit (GLWB) feature – which allows access to the annuity contract value (i.e., are revocable) and guarantees a minimum level of lifetime income (which in some cases could even increase) even if the underlying account value goes to zero – can come with a range of features that add additional costs. And while GLWBs have traditionally offered an annual ‘step-up’ provision (that can increase the income/benefit base used to determine the income level), more recent products only offer a step-up only once, at retirement. These ‘GLWB-Lite’ products with fewer step-ups come with reduced fees compared to ‘regular’ GLWBs, but advisors might wonder whether the reduced costs are outweighed by the more limited benefits. According to an analysis conducted by Blanchett, while the expected aggregate value of the products (lifetime payments plus any residual balance available for heirs) is similar, the ‘regular’ GLWB dominates based on lifetime income (while there is a larger residual balance leftover with the ‘GLWB-Lite’). And so, because individuals typically buy annuities for the income benefits as a form of longevity insurance (rather than as a tool to maximize the size of legacy gifts), it likely makes more sense for these individuals to purchase the ‘regular’ higher-cost GLWB if they’re going to pursue such income guarantees at all (and perhaps earmark some of the non-annuitized portions of their portfolio for a legacy benefit). Ultimately, the key point is that it is important for advisors to look beyond fees and understand client goals when analyzing potential investment products. And this is especially true in the case of annuities with GLWB features, where ironically seeking the lowest-cost option could negate much of the benefit of buying an annuity in the first place! ThinkAdvisor has a great article discussing the new contingent deferred annuity, here is the link and key parts of the article.

Longevity risk is one of the hot topics on the minds of advisors and clients considering expanding life expectancies. The poor performance of equities and bonds so far in 2022 compounds these concerns given the prospect of sequence of return risk for retirees. And while sources of guaranteed income, such as annuities, might be attractive to many clients, some balk at the loss of optionality that comes from taking funds out of their portfolio and putting them into the annuity. With this in mind, Aria Retirement Solution’s RetireOne introduced a fee-based Contingent Deferred Annuity (CDA) product (also known as a Stand-Alone Living Benefit or SALB) that allows clients to keep their funds invested in their current investment account (with eligible RIA custodians) while gaining the protection of guaranteed income if their account is depleted. With the CDA, the issuing insurance company guarantees a certain annual income for the purchaser, such as $40,000/year on a $1,000,000 investment account. This income initially comes from portfolio withdrawals from the account itself. If returns are favorable, the distributions simply sustain. However, if market returns are less favorable, and the portfolio is depleted to a specified level, at that point, the insurance company takes over the income payments. In return for this protection, the insurance takes an annual fee from the portfolio (varying from 1.1% to 2.3% per year in the case of the new Aria/Midland product, with fees driven in part by the amount of risk taken in the portfolio). Notably, the total cost of a CDA arrangement will also include the advisor’s own AUM fees for managing the portfolio, and any underlying fund fees. In a new whitepaper, retirement researcher Michael Finke compares the CDA to sharing a birthday cake at a party. If the slices are made too big (i.e., too much annual income is withdrawn from an investment portfolio), the cake (portfolio) could run out. On the other hand, if the slices are too small, there could be some left over (or in the case of a retiree, they spent less during their lifetimes than what their portfolio would have supported). The CDA ensures that the retiree will be able to have a certain annual income each year without having to make the annual ‘slices’ small enough to make sure the portfolio lasts throughout retirement (because the CDA guarantee backstops the arrangement if the ‘cake’ is running out). In the end, it is important for advisors to recognize their clients’ retirement income styles and choose a retirement income strategy accordingly. For those with full confidence in long-term market returns, underlying guarantees may not be necessary, and those who don’t want to take any market risk may not want to invest at all. However, for a segment in particular, the CDA structure is aiming to find a balance of serving clients who are willing to stay invested in markets, but are willing to give up some long-term upside (as a result of the annuity costs) in exchange for having some income floor in place in the event of an unfavorable sequence of market returns that is otherwise beyond their control. The brochure from Prudential below is a perfect piece about estate planning and taxes. It breaks down information into “Highlights” and “Examples” to ease understanding. Below is an article from AIG that shows how a fixed index annuity (FIA) can provide a unique combination of growth potential, asset protection and lifetime income that a traditional 60/40 stock and bond portfolio may not offer. In last blogpost, we discussed how rising interest rates affect bonds. Now let's see how rising rates affect stocks.

Short Term Impact When interest rates are rising or if investors anticipate a rise, many will sell bonds or some of their bonds to avoid the fall in prices and buy stocks. This commonly results in stocks rising while bonds are falling. Like bonds, not all stocks react the same way to rate hikes. In fact, some sectors historically perform well during periods of rising interest rates. For example, banks typically have stronger earnings because they can charge more for their services. Rising interest rates also tend to favor value stocks over growth stocks because of the way many investors calculate a stock’s intrinsic value. Rising interest rates makes these investors demand more for their investment dollars, so they’ll commonly turn to stocks that have a history of earnings growth. Of course, past performance is not an indicator of future results. Long Term Impact However, over time, rising interest rates can have a negative effect on stock prices. Higher interest rates make it more expensive to borrow money. A business that doesn’t want to pay the higher cost for a loan may delay or scale back projects. This, in turn, may slow the company’s growth and affect its earnings. A company’s stock price generally drops when its earnings decline. Also, rising rates increase margin rates or the rate in which traders borrow money to trade stocks. The higher rates make trading on margin less profitable, and many traders often cut back the amount of margin they use, which means there’s less demand for stock shares. Finally, rising rates typically lead to a stronger dollar, which may put additional pressure on the stock prices of multinational companies because it becomes more expensive to do business in some countries. Generally, bond prices and interest rates move in opposite directions - when interest rates rise, bond prices tend to decline. Think of it this way: Say, you have a choice of a $1,000 bond that pays 2% interest or one that pays 3%. All other things being equal, which would you choose? The higher interest rate can make the lower-yielding bond less appealing to investors, which causes the price to drop.

Not all bonds react the same way to interest rate changes. Some are more sensitive depending on the type of bond or its quality. For example, corporate bonds typically have higher coupon (interest) rates, which generally make them less sensitive than U.S. Treasuries. This is because higher-quality bonds tend to be more sensitive to changes in interest rates. So, if you have a AAA-rated corporate bond, you may see a larger change in the price compared to a AA-rated bond. Bonds with shorter durations (maturities) are usually less affected by rate changes as well. An 1% rise in rates could lead to a 1% drop in the one-year Treasury bill’s price. The longer the maturity, the greater the effect a rise in interest rates will have on bond prices. The same 1% rise in rates could mean a 5% decline in the price of a five-year bond or a 16% drop in the price of a 20-year bond. One way to potentially help minimize the risks of rising interest rates is to create a bond ladder, which involves having multiple bonds with different maturity dates. This diversified approach allows investors to own a variety of bonds with a variety of maturities so when interest rates change, each bond will be affected differently. Additionally, as each “rung” on the ladder matures, you can purchase new ones with higher yields, assuming rates are still rising. You may also want to consider diversified bond mutual funds or exchange-traded funds (ETFs). In next blogpost, we will discuss how rising interest rates affecting stocks. Below is an article from the Barron's:

Moving to a state that has little or no income tax may not be a savings panacea. That’s what financial professionals are telling clients who are fed up with high income tax rates in their home state and weighing an out-of-state move. They’re counseling clients to take an in-depth look at the possible financial and lifestyle ramifications before packing their bags. Your money-saving move could end up being a costly one if you run afoul of state residency requirements. That’s because clients trying to escape a state with high income taxes could experience higher property taxes, sales tax, insurance rates, and other cost-of-living expenses that minimize or negate the financial benefit they’re seeking. “States with low or zero income tax are funding their government somehow,” says Rob Burnette, chief executive of Outlook Financial Center, an Ohio-based company that provides insurance services and asset protection solutions. Here are several factors financial professionals say clients need to consider. The overall tax picture. When helping clients make a relocation decision, financial advisors try to provide a full overview of how things could look in terms of income taxes, property taxes, sales taxes, and estate or inheritance taxes—major budgetary items people tend not to think about when making decisions on where to move. Property tax rates, in particular, tend to catch people unaware, says Morgan Stone, a certified financial planner and president of Stone Wealth Management in Austin, Texas. He has had several clients move to his town to escape high income tax states, such as California, only to be shocked by high property tax rates. In Austin, a person could pay $18,200 in property taxes for a $1 million home, compared with $6,400 for the same value home in San Francisco, according to Smartasset.com’s property tax calculator. Certified financial planner James Bogart recently ran an analysis to illustrate how much a relocating client who was buying an $800,000 home could expect in property taxes, effective income tax, sales tax, and estate or inheritance tax in six different areas of the country. The analysis also showed the estimated size of the client’s investment portfolio at age 90 based on these factors. The upshot: the state with zero income tax wasn’t the best move for the client’s portfolio. Rather, the client could amass roughly $1.4 million more by opting for the lowest property tax location instead. This type of analysis is important, he says, because it shows that income tax can’t be considered in a vacuum. Other taxes can still have a “material impact” on overall financial well-being, even if a client maintains the exact same lifestyle, says Bogart, who is president and chief executive of Bogart Wealth, which has offices in Virginia and Texas. Sources of income. While the common misconception is that if you move to a state with low or zero income tax, this rate will apply to all of your income, the analysis is more complicated if you earn income from multiple states, says Or Pikary, a certified public accountant and senior tax advisor with the Los Angeles office of Mazars, the global accounting and consultancy firm. Say, for instance, you have a business that sells to customers in multiple states. Even if you move to Florida, which has no state income tax, you’re still required to pay taxes to the other states to the extent the income is sourced from there, he says. Rental property owners, regardless of where they live, also generally need to pay income tax to the state where the property is located. As a result, “your perceived income tax savings may be less than you think,” Pikary says. Additionally, he suggests being cautious about state residency requirements if you’re moving to a lower tax state and maintaining ties to your old community. States have gotten more aggressive about doing residency audits—even more so since Covid began, he says. Your money-saving move could end up being a costly one if you run afoul of state residency requirements, he says. Cost of living differences. Burnette of Outlook Financial offers the example of a recently retired client who planned to move from Ohio to Florida. His calculations showed that by moving to Florida she would need to work part time to maintain her lifestyle. This was true despite the income tax savings she’d achieve by moving. Special deliberations for retirees. Some states, depending on your adjusted gross income, may not tax your income at all. So you may be in the same position—or worse—by moving to a zero income tax state once you factor in other taxes and a higher cost of living, Pikary says. “It has always puzzled me when someone retires from a high income tax state and moves to a no state income tax state, such as Texas, when they have no earned income and then make a large real estate. “In reality, it should be the reverse—live and work in Texas and enjoy no state income taxes, then retire and move to a high income tax state when you have no earned income. Buy a big house there, and pay half the property taxes you paid in Texas,” he says. Other considerations. Financial professionals say it’s important for clients to think through lifestyle implications and the potential associated costs. Those with school-age children should investigate the strength of the public school system and whether private school could be warranted and what the cost could be. Another consideration is whether your current state offers vouchers to attend private school and whether that’s a perk you’ll be giving up or gaining through a move, Pikary says. People should also scope out the medical system in the new location and whether they will have to pay more for car insurance or home insurance generally, or wrack up additional costs due to provisions such as flood protection they didn’t previously need, says Bogart. It’s also important for clients to determine whether they will still have access to activities they enjoy, such as skiing or sailing, and whether there may be extra costs involved. People also need to take into account their proximity to family and whether travel costs will increase. “Many decisions in life are part financial, but also part emotional,” says Bogart. “We need to properly assess as many implications as possible.” For archived newsletters, please visit here.

How do people manage their income and spending in retirement? How do they adjust their asset allocation as they transition into retirement? Certainly, there is survey data on the subject and much informed speculation. Yet the full picture—based on empirical evidence that shows how people actually behave—has remained elusive.

No longer. Drawing on an Employee Benefit Research Institute (EBRI) database of more than 23 million 401(k) and IRA accounts, and JPMorgan Chase data for around 62 million households, this article studied 31,000 people as they approached and entered retirement between 2013 and 2018.

If you want to know more details about these 6 pitfalls, Fidelity.com has a more detailed article explaining them. We discussed the first 2 reasons here, now the next 2 reasons.

3. Lower tax rates Now is an opportune time to plan while the federal estate exemptions are still high and income tax brackets are lower. As planned today, the Tax Cuts and Jobs Act will “sunset” in 2026, changing: • The top marginal income tax rate reverts to 39.6% • The estate and gift tax exemption amount reverts to $5 million, indexed for inflation This could happen sooner than 2026, should legislation be passed. 4. Uncertain legislative environment The Build Back Better Act that was heavily debated in 2021 has not passed; the Tax Cuts and Jobs Act (TCJA) is sunsetting; and other proposed changes could be in the works. Past proposals give us insight into potential changes lawmakers could consider and propose again in another bill. What could happen in the future? What could be taken away? How can you prepare now? 1. Rising inflation

Given the current environment, it’s likely inflation is also on the mind of everyone. Inflation: In 2021, inflation was a staggering 7%— the highest the country has seen in 40 years! Inflation creates a “hidden tax” effect and the purchasing power will suffer. Purchasing power effect: With inflation at 3.5%, purchasing power will be reduced by 51% in 20 years (in other words, your dollar today will be worth 49 cents in 2042). Retirees, widows, and widowers will suffer most. Health care: Health care costs have been rising at a rate of nearly 5% for the past 40 years. Longevity: The longer one lives, the more damaging inflation will be. The death of a spouse may cause the surviving spouse to experience the “widow(er)’s penalty”— the likelihood that the surviving spouse will experience higher taxes, higher health care costs, and a reduction in purchasing power caused by inflation. 2. Historically low interest rates Changing interest rates affect estate planning. Some strategies are more effective in environments with higher interest rates, while others are more effective with lower interest rates. • Lower IRC Section 7520 and applicable federal rates provide opportunities for tax-efficient wealth transfer • For certain strategies to succeed, investments need higher returns than interest rates, and that’s easier with lower rates • Lending strategies can be more advantageous in a lower interest rate environment Coupled with high federal estate tax exemption amounts, people who use certain strategies in the lower interest rate environment have the ability to transfer wealth while incurring minimal or possibly no gift taxes. We will discuss the next 2 reasons in the next blogpost. Why Diversification

Diversification across asset classes is one of the core investment principles. By spreading out assets across a range of asset classes with varying degrees of correlation, one can reduce the overall risk to the portfolio (because a downturn in one asset class is likely to be ameliorated by the returns of the other less-correlated investments). And while many people diversify assets by investing in both U.S. and international equities, a combination of increasing correlations between U.S. and international stocks and relative underperformance by international stocks might have some wondering about whether they are actually adding value to the portfolios through international diversification. The Problem with Diversification A problem for investors looking to use international stocks to diversify their equity holdings has been high correlations between U.S. and international stocks in recent years. For example, between 2019 and 2021, the correlation between U.S. and developed market (ex-U.S.) stock returns was 0.93 and the correlation between U.S. and emerging markets was 0.82. Both of these figures are significantly higher than they have been in the past, reducing the international stocks’ diversification benefits in case of a market downturn. Should You Diversify? However, historical correlations suggest that international stocks could provide increased diversification benefits in the future. For example, as recently as 2019, the correlation between U.S. and developed market stocks was below 0.8 and the correlation between U.S. and emerging market stocks was less than 0.6. And looking back further, correlations between U.S. and non-U.S. stocks were as low as 0.12 during the 1970s, 0.29 in the 1980s, and 0.54 in the 1990s, making them significantly more valuable as a portfolio diversifier (of course, there is no guarantee that these historical conditions will return). Also, those looking for equity diversification could also look to emerging markets, which are typically less correlated with the U.S. than are developed markets. In the end, having a diversified portfolio of assets with low correlations means that some portions of a portfolio will necessarily underperform others. And so, while some people might be frustrated by the recent underperformance (and higher correlations) of international markets compared to the U.S. in recent years, a return to lower correlations between the asset classes could increase the value of international stocks as a portfolio diversifier! Which investments do you put where to help enhance after-tax returns?

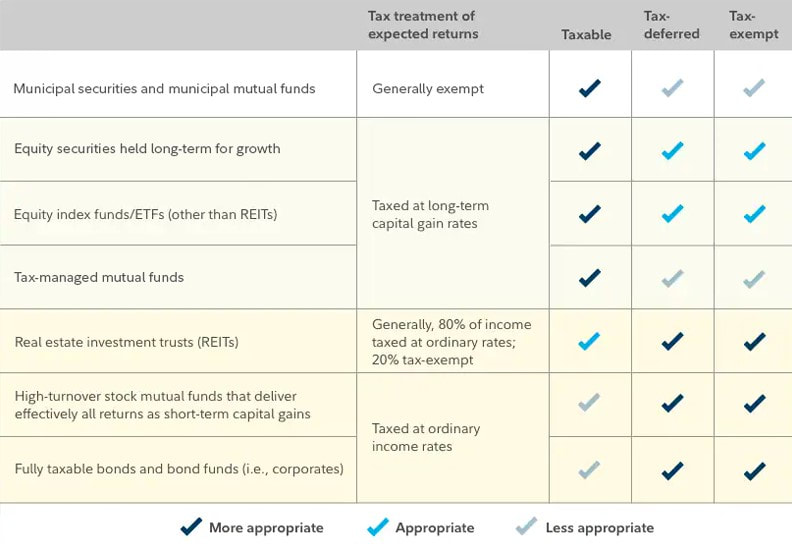

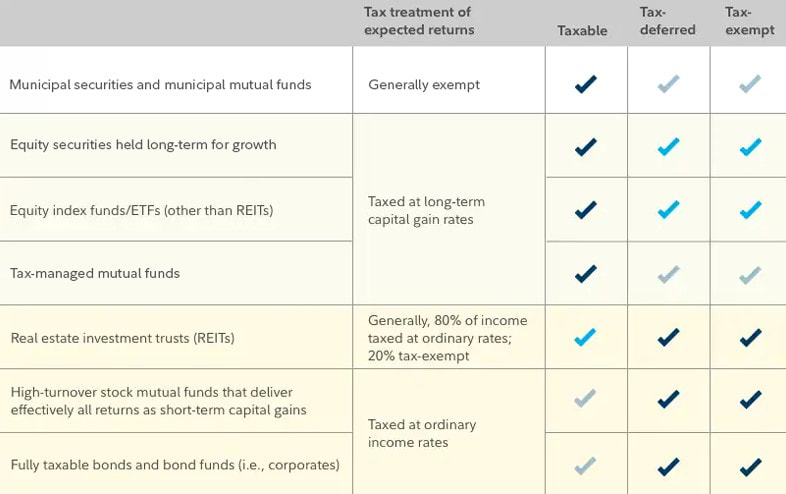

Each person will have to find the right approach for their particular situation. But generally, depending on your overall asset allocation, you may want to consider putting the most tax-advantaged investments in taxable accounts and the least in tax-deferred accounts like a traditional IRA, 401(k), or a deferred annuity, or a tax-exempt account such as a Roth IRA (see chart below). In last blogpost, we discussed how to rank investment on tax-advantaged scale. So, which investments do you put where to help enhance after-tax returns?

Each person will have to find the right approach for their particular situation. But generally, depending on your overall asset allocation, you may want to consider putting the most tax-advantaged investments in taxable accounts and the least in tax-deferred accounts like a traditional IRA, 401(k), or a deferred annuity, or a tax-exempt account such as a Roth IRA. We discussed if you can benefit from active asset location strategy here. Now we will continue the discussion.

If you are in a position to benefit from an asset location strategy, you have to choose which assets to assign to your tax-advantaged accounts and which to leave in your taxable accounts. In general, the following are higher on the tax-advantaged scale:

So, which investments do you put where to help enhance after-tax returns? See next blogpost for the answer. In last blogpost, we discussed what is active asset location strategy. Now we will discuss if you can benefit from it.

There are 4 main criteria that tend to indicate whether an asset location strategy may be a smart move for you. The more of these criteria that apply to your situation, the greater the potential advantage in seeking enhanced after-tax returns.

If you are in a position to benefit from an asset location strategy, you have to choose which assets to assign to your tax-advantaged accounts and which to leave in your taxable accounts, see next blogpost here. There are 3 main investment account categories:

Asset location in action Let's look at a hypothetical example. Say Adrian, age 40, is thinking about diversifying his portfolio by investing $250,000 in a taxable bond fund. For this example, we will assume Adrian pays a 35.8% marginal income tax rate on net investment income and the bond fund is assumed to earn a 6% rate of return each year—before taxes. In what account should he hold the investment? The answer matters, and can mean the difference between paying taxes annually and deferring them until withdrawal. Suppose Adrian has 2 accounts with sufficient assets to choose between, to hold the investment. One is his taxable brokerage account where interest earned on the investment will be taxed annually; the other is a traditional IRA he has been making after-tax contributions to for many years. Since Adrian began contributing to the IRA midway through his career, he never made any tax-deductible contributions. If Adrian chooses to hold the investment in the tax-deferred IRA, the return on his investment, after-taxes, could be nearly $72,000 greater than it would be in the taxable account when he begins withdrawals 20 years later at age 60, assuming his tax rate remains the same. Tax deferral has the potential to make a big difference for investors—especially when matched with investments that may be subject to high tax rates, as interest on taxable bonds can be. In next blogpost, we will discuss if you can benefit from active asset location strategy. 1. Get Clear On Your Fixed Expenses

One of the first steps for getting a handle on your budget is understanding how much money you must spend each month. Fixed expenses are expenses that generally remain the same every month or expenses that you are required to pay or there will be consequences. This can include things like:

2. Identify Which Expenses Can Be Cut Obviously, there are some expenses that we can’t put on hold or cut entirely. Things like rent, utilities, and food are pretty essential. However, in times of crisis, we often are required to make some sacrifices and cut some things out. Get clear on which fixed expenses you would be safe and capable cutting or reducing if you were to lose your income or have some other financial emergency. That way, if crisis strikes, you’ll know exactly which expenses to cut, reduce, or pause. This will take some of the stress out of the situation if the time comes. Debt and student loan payments can’t just be turned off, but there might be an opportunity for flexibility. If you have federal student loans, you can put your loans into forbearance if you’re in a moment of financial hardship. Alternatively, even if you have private debt, you may be able to reach out to the lender or bank to see if they’re willing to help you. In the beginning of the pandemic, many banks were helping customers who were struggling to make payments. Understanding what your options are ahead of time will help you when crisis hits. 3. Review Your Typical Flexible Spending Flexible spending is spending that you generally have more control over, but it doesn’t mean it’s all spending that can be completely cut out. These categories can include:

Many items that fall under flexible spending are important and even imperative. But it’s still necessary to have an understanding of how much you spend outside of your fixed costs. If you don’t know how much you’re spending, it’s impossible to make changes, if necessary. This exercise will help you identify if you’re overspending in certain areas. It can also help you understand what can get reduced or cut completely if you fall into financial hardship. 4. Identify How Much Money You Can Live Off Of Once you’ve gotten clear on what can be cut and what absolutely can’t, you’ll have clarity about how much money is the least that you could possibly live off of. You want to make sure that you’re prioritizing things like food, transportation, healthcare, and anything else that is important for your overall wellbeing and that of your family. If you were to lose your job, and you drastically reduce your household spending, this will help reduce the amount of debt you might accrue, or reduce the amount you have to withdraw from savings. Remember, hopefully this restriction will be temporary, until you get back on your feet. 5. Prioritize Your Emergency Fund Prioritizing funding your emergency savings account should always be top of mind. That should be even more apparent after what we’ve gone through over the past two years. Anything can happen at any time, and it’s so important to have money set aside to protect us and our families during a crisis. If you haven’t already started saving for emergencies, get started today. Even if you need to start with $5 a month, do it. You can increase that over time. If you already have an emergency fund, check back in with it to make sure you’re comfortable with the balance. How long could you live on your worst-case scenario budget if you only had your savings to use? If that amount of time scares you, it’s time to start increasing your savings. 6. Keep A Record Of Your Worst Case Scenario Budget Once you’ve done all this work to create a worst-case scenario budget, make sure you actually save the information! Create a spreadsheet or a list of your expenses that will stay and the expenses that will be cut. That way, you’ll know exactly what steps you need to take in the moment of crisis. Don’t give yourself more stress by requiring yourself to go through this process again when it’s unavoidable. We discussed the first 4 strategies here, now the last 2 strategies.

5. Dynamic income strategy With a dynamic strategy, retirees adjust their spending based on the performance of their portfolio and its resulting effect on a Monte Carlo simulation. For example, a retiree targeting an 85% chance of success in a Monte Carlo simulation might increase their income if this figure rises to 95% but decrease income if it falls below 75%. This ‘guardrails’ approach can also be improved by introducing risk-based measures as well. While retirees will appreciate the opportunity to increase their incomes, they will also have to be prepared for reduced incomes when their probability of success hits the lower guardrail. 6. Insurance strategy Finally, retirees can use an insuring strategy, in which they use their assets to purchase a guaranteed income stream, typically through an immediate fixed annuity. This has the advantage of guaranteeing a certain income for the life of the retiree (or both members of a couple) regardless of market conditions, and unlike the asset-liability management approach, it also covers the uncertainty of longevity (as annuity payments can be ‘for life’). However, purchasing such an annuity is an irrevocable commitment of capital, and includes costs associated with the product. We discussed the first two of six strategies here. Now the next two strategies.

3. A "bucket" strategy For retirees who are nervous about having to sell investments in a down market, a ‘bucket’ strategy can be useful. With this method, the retiree sets aside a cash-like ‘bucket’ of money to cover their expenses in the short term (perhaps two to three years) and allows the rest of their assets to be invested. In this way, the retiree will not have to sell invested assets to fund their lifestyle (until the short-term ‘bucket’ runs out) or be tempted to move their assets to cash in a downturn. However, a simple rebalancing has been shown to be a potentially superior strategy (in part by ensuring that liquidations come from asset classes that are up the most in value, similar to what bucket strategies are intended to accomplish). 4. Variable income strategy With a variable retirement income strategy, retirees plan to spend different amounts of income in the various stages of retirement. For example, research from David Blanchett demonstrated a ‘spending smile’, with inflation-adjusted spending among retirees declining throughout most of retirement, only increasing in their final years. Using a variable strategy could allow retirees to spend more in their early years, while saving for potential healthcare costs in their later years. However, some retirees might resist declines in real spending throughout the middle part of their retirement. We will discuss the last 2 strategies here. |

AuthorPFwise's goal is to help ordinary people make wise personal finance decisions. Archives

September 2022

Categories

All

|

RSS Feed

RSS Feed