Solution: Select a refund payout option that guarantees Greg or his beneficiary will receive all premium.

|

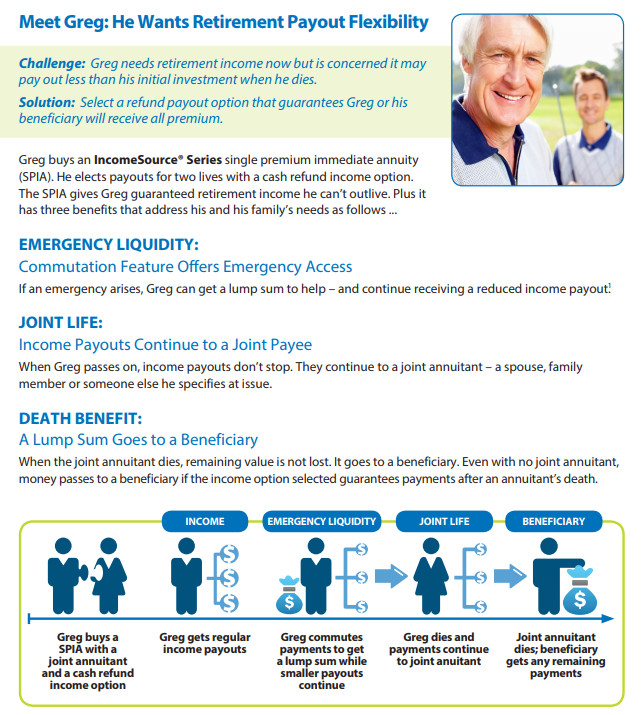

Challenge: Greg needs retirement income now but is concerned it may pay out less than his initial investment when he dies. Solution: Select a refund payout option that guarantees Greg or his beneficiary will receive all premium.

0 Comments

For people who purchase annuities but want retirement payout flexibility, below is an interesting case study.

IRS recently issued Notice 2018-58 to provide important clarifications regarding the new 529 rules.

Specifically, the following are worth noticing: 1. It clarifies that the Tax Cuts and Jobs Act (TCJA) provisions allowing up to $10,000/year to be paid for a beneficiary for K-12 expenses as Qualified Higher Education Expenses (QHEEs) includes any elementary or secondary school, public or private or religious. 2. It re-affirms that 529 college savings plans can now be rolled over to a 529A ABLE account for a special needs beneficiary, and clarifies that the rollover can occur either to a 529A plan for the same beneficiary or for a special needs beneficiary who is a member of the same family (given that the 529 plan itself could have been rolled to another family member and then moved to a 529A plan anyway), though the maximum dollar amount to be transferred in any particular year is still capped at the annual gift tax exclusion amount (currently $15,000/year, and aggregated with any other 529A contributions that year) and the rollover must occur within 60 days of the prior distribution. 3. It clarifies, as part of the PATH Act of 2015, that students who receive a tuition refund from a school may re-contribute those dollars back to a 529 plan and treat the entire amount as a recontribution of principal (as it’s not administratively feasible to track how much of a partial tuition refund should be allocated to principal versus growth anyway). In last blogpost, we discussed kiddie tax. Now we will introduce some children's income tax planning strategies.

Strategy 1. For children with earned income, self-employed parents should hire their children (which provides a deduction for the business at the parents’ rates and taxes the income at the kids’ rates); Strategy 2. For children with unearned income, pay careful attention to which brackets it will or won’t fall into, and consider whether it may be better to more aggressively try to shelter that income under the new kiddie tax rules (from buying municipal bonds, to zero-dividend stocks or tax-managed mutual funds, or leveraging a 529 plan). Strategy 3. Notably, though, because (for children age 18 or older) the kiddie tax rules only apply if the child is claimed as a dependent, parents may increasingly want to simply let young-adult children file for themselves (if the child can provide more than half of his/her own support), especially since the dependent exemption is gone anyway. This article - understanding taxation of dependent children's income after tax reform is a good read. Q. Is there still kiddie tax in the new tax law?

A. First of all, what is kiddie tax? The tax law has long applied special rules to the income of children, recognizing that on the one hand, as with any income, it should be taxed, but on the other hand, the fact that tax brackets start out lower may create incentives for families to shift and split income, especially from passive assets, in order to use (and potentially abuse) those lower tax brackets. Earned vs. Unearned Income As a consequence, the tax law has different treatment for earned income of dependent children – from tips and wages, to babysitting and dog-walking and lawn mowing – versus the treatment of unearned income (i.e., interest, dividends, and capital gains). Kiddie Tax Generally, earned income of children is taxed at their own (typically low) tax brackets, but unearned income is taxed at the parents’ income (after allowing a $1,050 standard deduction, and another $1,050 to be taxed at the child’s tax rates). However, under the Tax Cuts and Jobs Act, this “kiddie tax” of subjecting a child’s unearned income to his/her parents’ top tax rates has changed, and children’s unearned income is now taxed at the trust tax brackets instead (which can reach the top tax bracket far more quickly due to compressed trust tax brackets!). Next, we will discuss some tax planning strategies. Q. What type of life insurance products I should consider at different stages of my life?

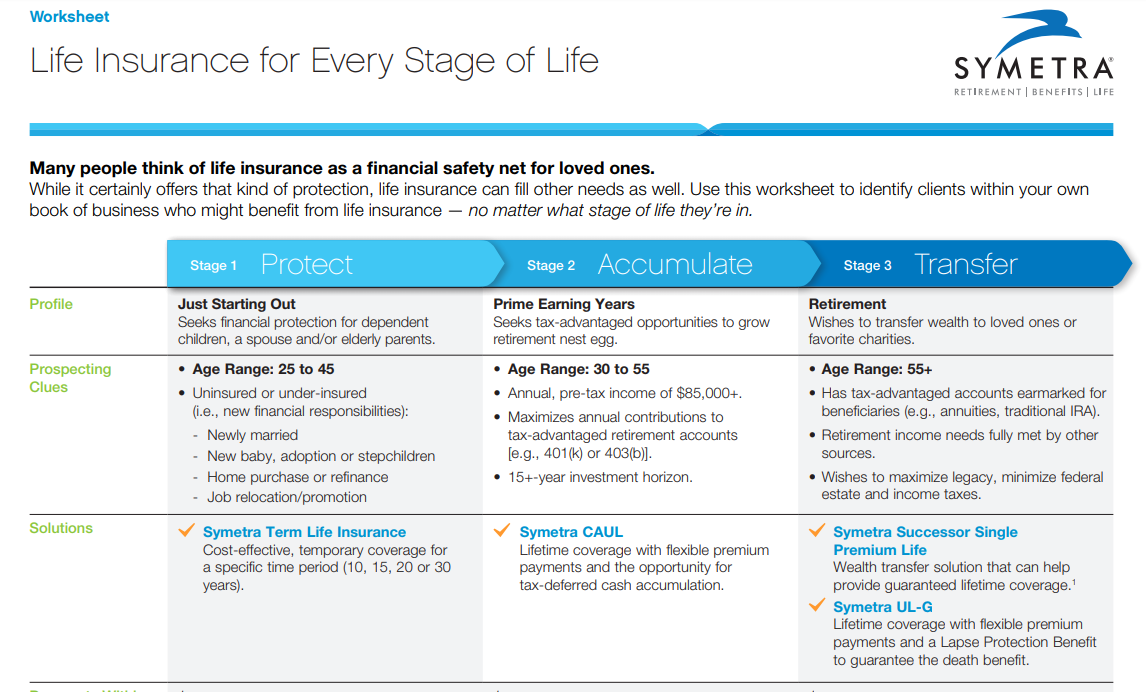

A. Below is a worksheet from Symetra for life insuance agents to help their clients figure out what types of life insurance products are best fit for different stages of life, please contact us if you want to know more about any of these products. Q. How do my family's spending compare with other families' spending?

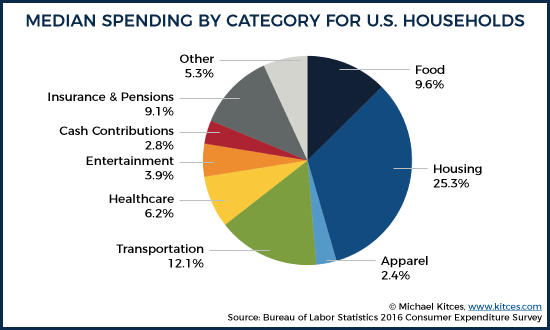

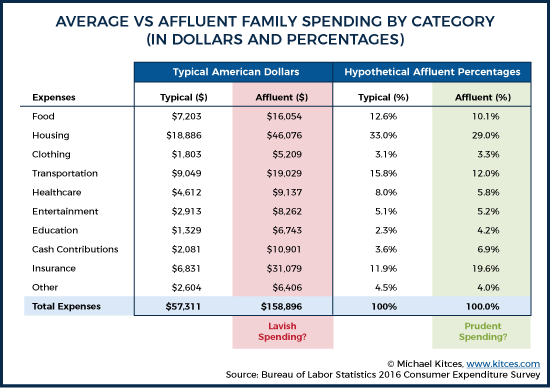

A. If you want to cut down your household expense, one way to start is by comparing your family's spending on different categories with that of national average figures. The Consumer Expenditure Survey from the Bureau of Labor Statistics (BLS) tracks consumer household spending across a wide range of categories, providing insight into what, exactly is (and is not) material to the household budget. Q. What's the risk of co-signing a loan, especially college loan?

A. When you co-sign a loan or credit card account, you are liable for any debt incurred. According to Federal Trade Commission, 75% of all co-signed loans in default are ultimately repaid by the co-signer, not the original borrower. Lenders will act quickly to contact co-signers when payments are late. Delinquencies are also reported on the co-signer's credit report, this put your own financial wellbeing at risk when you co-sign a loan. Co-signing a college loan has probably the highest risk because government could debit the social security benefits of recipients who co-signed loans. In 2015 alone, $171 million was taken from about 114,000 recipients age 50 or older who had co-signed loans that had been in default for at least one year. Q. Many index universal life products offer several different index crediting options, how to select the best one for my situation? A. It could seem like a daunting task to select the best strategy from an IUL product that best fit your needs. In order to do it, you have to fully understand the details behind each option. We can use AIG's Max Accumulator+ as an example to illustrate. Fortunately, AIG has created a nice summary that compares all of its 4 index crediting options side by side. You can pick the one that best fits your needs. Please contact us if you have any questions, or would like to run some illustrations. Q. Do I have to pay tax on social security benefits?

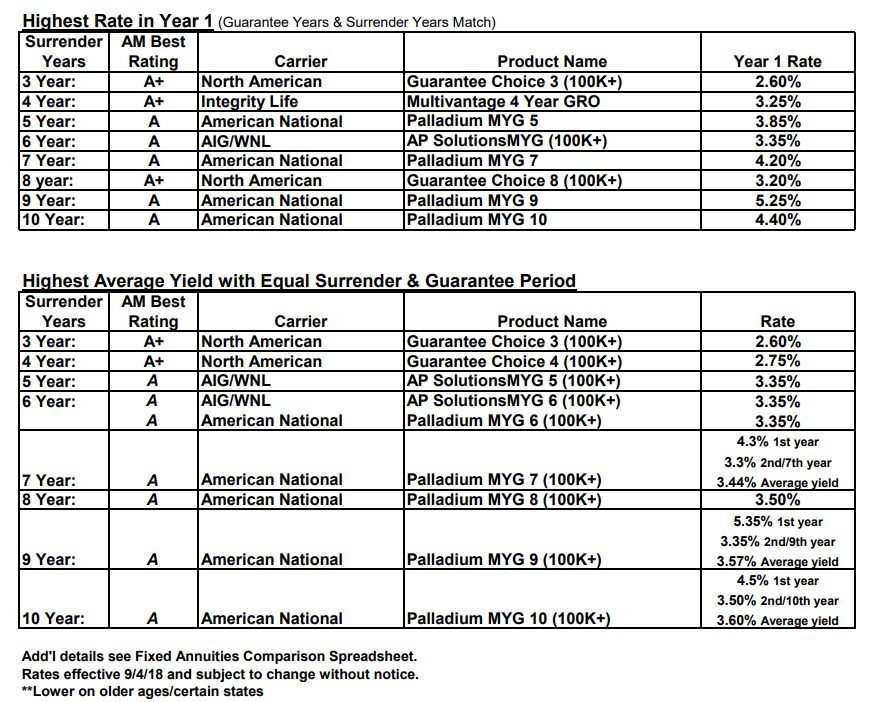

A. To determine how much of your social security benefits will be taxable, you need to tally your adjusted gross income plus nontaxable interest and half of your Social Security benefits. That figure is your combined income. Individual Tax Filer If you are an individual filer and your combined income is between $25,000 and $34,000, you may owe tax on up to 50% of your benefits. If your combined income is more than $34,000, up to 85% of benefits may be taxable. Married Couples Who File Jointly Married couples who file jointly have slightly higher income thresholds. If you and your spouse have a combined income between $32,000 and $44,000, you may owe tax on up to half of your benefits. If combined income is more than $44,000, up to 85% of benefits may be taxable. Read more about figuring the tax in Publication 915 at IRS.gov. Social Security Tax Withholding If you expect to owe Uncle Sam tax on your benefits, you can choose to have federal taxes withheld from Social Security by filing Form W-4V. You may also owe state tax if you live in one of the 13 states that currently tax Social Security benefits. North American just announced new living benefits on its ADDvantage term, which include critical and chronic illness riders with no extra premium! The chart below shows the best of fixed annuities snapshot, if you want to know more details, please contact us!

The video from AIG below illustrations how IUL compares to traditional retirement plans. In our last blogpost, we introduced the idea of 3-bucket retirement income system. Now an example how to fill your buckets.

An Example of 3-Bucket Retirement Income System Assume you have a $500K portfolio and an annual need for $20K (in addition to social security and pension payments). While the specific allocation will depend on your special circumstances and your risk tolerance level, below is an example for you to consider - Bucket 1. Cash Amount: $20K or 1-year's income gap needs Allocation: money market, jumbo bank CD Average yield: around 1-2% Bucket 2. Conservative Income Amount: $230K Allocation:

Bucket 3. Long Term Growth Amount: $250K Allocation:

In last blogpost, we discussed a big problem every retiree faces. Now the solution.

What is the 3-Bucket Retirement System You divide your retirement money into 3 buckets: Bucket 1 Cash that you will need in the next year or two (in addition to your social security payment and pension payment) that covers major expenses, such as a vacation, a car or a new roof. Bucket 2 Money you will need in the next 10 years. You will invest conservatively in this bucket, as its purpose is more like a hedge again a market crash. Bucket 3. Money you will need in the more distant future, either for you or your heirs. You could invest very aggressively here because you have a long time horizon for funds in this bucket. How to Use the 3-bucket System? This 3-bucket system will give you peace of mind - knowing that you are well covered for your retirement needs, even there is a stock market crash tomorrow! If the stock market does well, allocate some of the funds from either bucket 2 to bucket 1 or from bucket 3 to bucket 1 or 2. In next blogpost we will give an example how a $500K retirement fund could be allocated across the 3 buckets and what kind of investments each bucket could have. The Problem It Addresses

For most families, it doesn't matter how much you have saved for retirement, you probably always feel you don't have enough. It's understandable, because while during the asset accumulation phase, you could use dollar cost averaging (DCA) to guide your investment - the lower the market goes, the more shares you will collect, in retirement (or fund distribution phase), you will encounter the DCA's evil twin - the lower the market, the more shares you will have to sell (to generate the same amount of income as in higher market). Howe to address this problem? The 3-bucket retirement income system. Q. What's the catch with Fidelity's no-fee funds?

A. Fidelity recently announced two index mutual funds that come with non investment minimums and a 0% expense ratio -

What's the catch? There are two:

Q. Are managed payout funds right for me?

A. Managed payout funds guarantee a set monthly payout which is very attractive to retirees. However, the amount you will receive usually fluctuate at regular intervals, usually annually. Typically, if a managed payout fund doesn't earn enough to make the monthly payout, part of the check it sends out will be a return of your capital. How Does It Work? Some managed payout funds aim to distribute all of your investment within a certain period, while others touch principal only when absolutely necessary, so it's important to choose the one that fits your needs. Who Offers It? Most brokerage houses offer managed payout funds - Vanguard, Fidelity, T.Rowe Price, Charles Schwab, the American Funds, etc. Difference With Immediate Annuities In the end, a managed payout fund is similar to immediate annuities, however, while you can sell shares of a managed payout fund at anytime, it can't guarantee fixed lifetime income. Fidelity recently introduced zero expense mutual funds, many people ask: Fidelity zero vs Vanguard, which company has better index funds?

Please see this article to see some comparisons. Introducing Protective® Guaranteed Income Indexed Annuity

In our last blogpost, we discussed the causes and risk factors of kidney disease. Now we will discuss life insurance underwriting for applicants with kidney disease.

The primary questions to be asked of the proposed insured who presents with a history of kidney disease:

Underwriting Class For Kidney Disease Applicants Underwriting for kidney disease will vary. It depends on the severity of the case, the doctor's notes, and lab work pertaining to the history. Acute renal issues can often still get "Preferred" offers. Chronic kidney issues will often receive "Standard" at best or a decline for someone on dialysis (through table ratings and based on severity). Please contact us if you have any question, we have in-house underwriting expert to help you in your life insurance application if you have kidney disease or any other diseases. Q. I have kidney disease, what insurance class will I get?

A. First, let's talk about what are the causes and risk factors of kidney disease. When the kidneys become damaged, waste products and fluids can build up in your body. This can cause swelling in your extremities, vomiting, weakness, shortness of breath, and may cause sleep disturbances. If left untreated, diseased kidneys may eventually stop working completely. Loss of kidney function is a serious and potentially fatal condition. Chronic Kidney Disease and Causes Kidney damage - or reduced kidney function that lasts longer than three months - is referred to as chronic kidney disease (CKD). CKD is particularly dangerous because there are often no apparent symptoms until after considerable (and often irreparable) renal damage has occurred. Common causes of CKD include high blood pressure, diabetes, cardiovascular disease, obesity, frequent urinary tract infections, exposure to drugs and toxins, and family history of chronic renal disease. Renal problems are common and associated with increased mortality risk. As a result, insurance underwriting will screen applicants for renal function through a series of kidney function tests (KFT’s) done within the insurance exam. There are two common blood tests performed, both of which are closely reviewed. First, the eGFR (glomerular filtration rate). This measures how well the kidney filters and removes undesirable substances from your blood. These substances include creatinine (a waste product resulting from normal wear and tear on your muscles) and BUN (blood urea nitrogen, resulting from the breakdown of proteins in the food you eat). Several urine (HOS) tests are monitored as well, including urine protein, microalbuminuria, and urine creatinine or creatinine clearance. In next blogpost, we will discuss life insurance underwriting for kidney disease. Q. Is an ex-spouse entitled to an IRA after divorce?

A. Please read this financial-planning.com article that answers this question in great details, it addresses both life insurance assets and similar assets such as IRA. |

AuthorPFwise's goal is to help ordinary people make wise personal finance decisions. Archives

September 2022

Categories

All

|

RSS Feed

RSS Feed