|

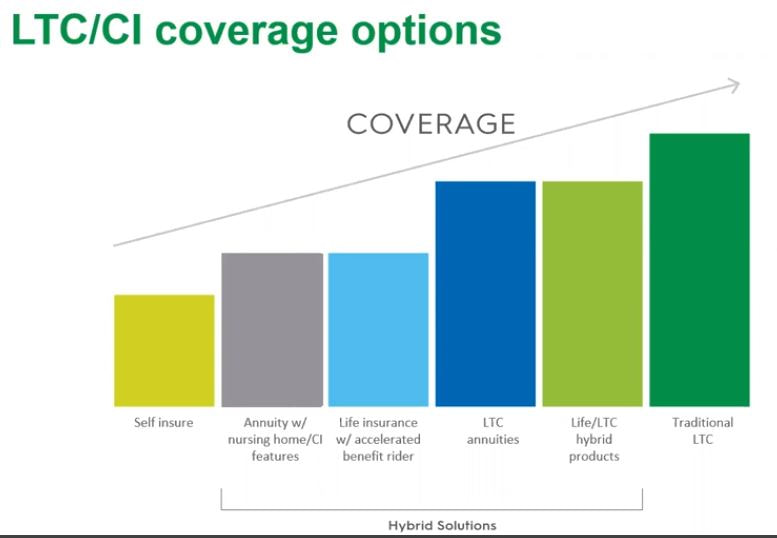

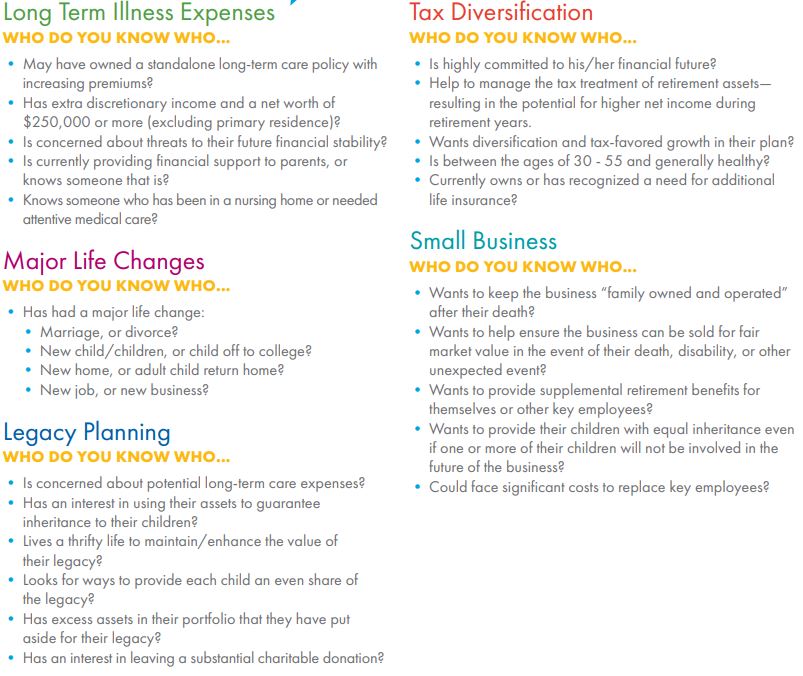

November is Long-Term Care (LTC) Awareness Month! Below is a good summary of all the LTC options: This online presentation from Securian below has a good discussion of various products that best fit for people at different stages of life.

0 Comments

Taxable municipal bonds are the fastest growing sector in U.S. fixed income right now, they offer an attractive alternative to corporate bonds, with higher yields and lower historical default rates.

In 2020, issuance has exploded mainly because a 2017 change in the tax law that prevents state and local governments from refinancing older high-rate muni debt in advance of their maturities with new tax-exempt bonds. Such refundings must now be done in the taxable market. For regular investors, 3 major options are available to play in this sector. Below are some good candidates: Closed-end Funds:

Open-end Funds:

Exchange-Traded Funds

Taxable munis are well suited to retirement accounts as an exposure to fixed income. Withdrawals of IRA converted balances are subject to the IRS rule that requires a waiting period of 5 years, or you may pay a 10% penalty. The clock starts on January 1 of the year you do the conversion—no matter when during the year it actually happened.

Withdrawals of earnings are subject to a different 5-year rule. It must have been 5 years since your first Roth contribution or conversion, plus you must be age 59½ or otherwise eligible to make penalty-free withdrawals. Q. If I want to keep a specific stock or asset in my IRA in my portfolio for the long-term, can I keep that asset and convert it to a Roth IRA?

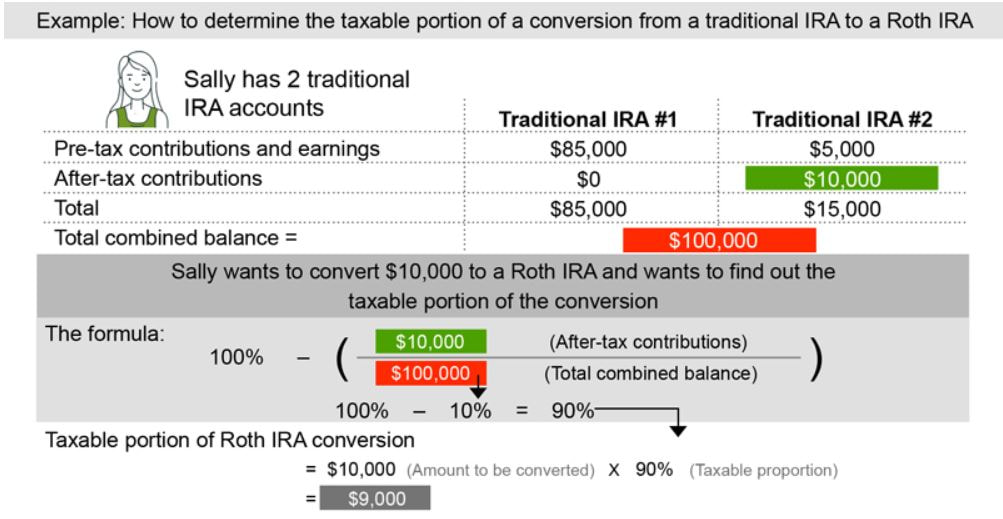

A. Yes. If you are holding investments in a traditional IRA—ones you want to keep for a number of years— and you think you may be in a lower tax bracket this year than you might be in the future, then a "focused conversion" may be a strategy to consider. With this strategy you move specific assets from a traditional IRA to a Roth IRA, rather than selling the assets first and then moving the resulting cash. In terms of the taxes, there is no difference between the two techniques. When you convert an IRA to Roth IRA, you need to note that all the IRAs you own are considered 1 IRA, no matter how many accounts you have. Your tax liability is based on 2 things: the taxable income generated by the conversion and your applicable tax rate.

To figure out how much of a conversion from a traditional IRA to a Roth IRA may be taxable, you need to note there are 2 types of contributions.

Estimating the taxable income from a conversion is straightforward if you've never made nondeductible contributions to any traditional IRA. If that is the case, whatever amount you convert will all be taxable income. Note that earnings are always taxable when converted, whether they come from deductible or nondeductible contributions, so for purposes of figuring out taxes on a conversion, you can think of your balances as falling into just 2 categories: (1) nondeductible contributions, and (2) everything else. According to IRS rules, you cannot cherry-pick and convert just nondeductible contributions, leaving deductible contributions and earnings in the account, in order to avoid taxes. Instead, you must figure out the proportion of your total traditional IRA balances that is composed of nondeductible contributions, then use that percentage to find out how much of your conversion will not be taxable. Note that inherited IRAs are excluded in this calculation. Keep state taxes in mind too. A Roth IRA conversion is a taxable event. If your state has an income tax, the conversion will generally be treated as taxable income by your state as well as by the federal government. Below is an example that helps you understand how to estimate the taxable portion of the conversion. There is a little-known rule buried deep on the IRS website presents a once-in-a-lifetime opportunity for people with a health savings account — the ability to make a contribution directly from an IRA.

Who would benefit from this move? People who suffer from large medical expenses in a single year without enough cash on hand or funds in their HSA to cover such costs typically benefit most from this transfer because it saves them incurring penalties or income tax. If you are interested in knowing more details, here is a link to an article at Financial-Planning magazine that explains it well. A mutual life insurer is a life insurance company that’s owned by some or all of its policyholders. A mutual may use dividends to pay part of its profits to the policyholder owners.

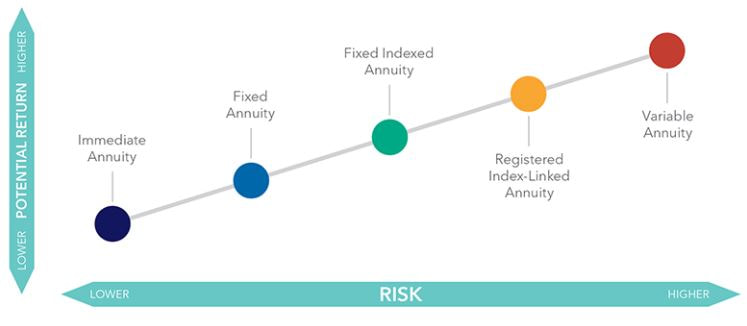

Mass Mutual Mass Mutual is cutting its 2021 dividend rate slightly, to 6%, from 6.2% for this year The company says it expects to pay a total of $1.7 billion in dividends in 2021. A year ago, MassMutual said it expected to pay $1.7 billion in dividends for 2020. Northwest Mutual Northwest Mutual says the interest rate it uses to calculate the 2021 dividend payments will hold steady at 5%. Ohio National Ohio National says the interest rate it uses to calculate the dividend payments will fall to 4.7% for open block policies, from 5.2% for this year, and to 4% for closed block policies, from 4.5% for this year. While all annuities are designed to provide income, there are different kinds to align with your accumulation goals and how much risk you’re comfortable taking.

If you are looking for permanent life insurance protection, make sure to look for products that meet the following 5 criteria.

What is the traditional 60/40 portfolio?

It refers to a portfolio with 60% in stocks and 40% in bonds. It has been popular for many years, especially buy and hold investors. Why 60/40 portfolio no longer works? Because the yields on the bonds are heading lower and lower, so the insurance value offered by bonds are disappearing. Plus, the government are boosting economy which will bring up inflation, and as interest rates start rising, bond prices will fall, talking about triple hits to bonds holders. What's a better portfolio? It depends on what type of investor you are. If you are young and can tolerate volatility, stocks should carry more weight in your portfolio. If you need fixed income, you can find other types of fixed incomes, such as dividend paying stocks or convertible bonds which could offer the best of both worlds. 1. Start by contacting the local Area Agency on Aging.

There are over 600 “Triple As” that form a national network, connecting older people and their families throughout the country with local programs and services. Created under a Federal law, the Older Americans Act, they support services such as meals on wheels, transportation, adult day care, and senior centers, all available at no or low cost. They also sponsor an information telephone line for family caregivers and can provide general guidance on home care, assisted living, respite care and other public and private services. To find the Area Agency on Aging in your community, visit their website or call 1-800-677-1116. 2. Explore eldercare benefits offered through your employer. Many employees of large or medium-sized companies are surprised to find that their employer makes resources available to assist working caregivers with eldercare issues. Employees at these companies are likely to have access to an internal website with a wealth of caregiving information, and the option to speak with a designated eldercare coordinator who ca answer questions, provide lists of local resources and help them think through what might be needed. Though not as common, some employers offer more robust services such as in-person consultations or paid leave. Check with the human resources department to see if these benefits are available. 3. Retain a care manager. It may be a smart move for caregivers to hire a private geriatric care manager--usually a social worker or nurse--to help families with eldercare needs. They generally start with an in-home assessment, then meet with the family and put a car plan in place. Depending on the agreement, families may want them to implement the plan and take on more responsibility. As the onsite experts, coordinators and advocates, they provide services such as monitoring care, solving problems, dealing with health insurance issues, and handling crises as they occur. To locate a care manager, contact the Aging Life Care Association (ALCA). All 2,000+ members must meet strict criteria and sign a code of ethics. 4. Visit websites for caregivers. There are a number of websites that focus on caregiving and it’s worth taking time to look into them. Their subject matte is extensive, and ranges from information on benefits and legal documents to tips for hiring private caregivers to caring f someone with Alzheimer’s Disease and suggestions for coping with the ups and downs of being a caregiver. Some have chat rooms that function as virtual support groups so caregivers can share their experiences. Others help you locate independent caregivers, home care agencies or assisted living facilities (although caregivers should note that they may b listed because they are advertisers). AARP has a robust section on its website for caregivers. Another helpful website Is sponsored by the Family Caregiver Alliance. You can google “caregiving” to find other good websites. 5. Understand more about financing care and protecting against financial abuse. While caregivers begin their journey mainly concerned about parents’ health and safety, they soon find out that the financial and legal aspects of caregiving need to be dealt with too. They discover that home care, assisted living and nursing home care is very expensive and they may end up being the ones who will pay for Mom or Dad’s care. In the best of all worlds, their parents planned ahead, have all their legal and financial papers in order and purchased long-term car protection. No matter what the situation, a financial professional can play a valuable role by reviewing care options and the cost implications and by providing some strategies to help stretch caregiving dollars. Since elders are often victims o financial abuse, losing their financial nest e impacts their ability to pay for care. It’s a good idea to become familiar wit ways to prevent and report scams and fraud. Google “financial elder abuse” for descriptions of the causes, types of abuse and whom to contact if necessary, or go to the National Adult Protective Services Association website. The client

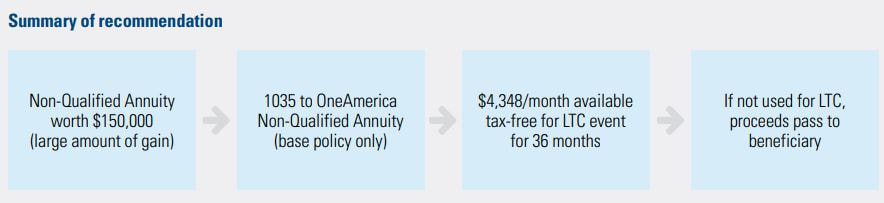

Age 75 to 85; has $150,000 from a large build up in a Non-Qualified Annuity not subject to surrender charges or money from a CD; views proceeds as lazy or emergency money. The situation Client is concerned about efficiently funding an extended health care or Long-Term Care (LTC) event. Has already identified assets to use but wants preservation of their capital, a reasonable rate of return and access and control over their money if they need it. The agent’s current BD doesn’t allow sale of Indexed Annuities. A solution To address the specific concerns of the client, a 1035 transfer to Annuity Care, base policy only, may be a possible solution. This solution offers the client on $150,000: • The ability to access gains tax-free for extended care or LTC events • A 34.8% tax-free income stream for 36 months ($4,348 a month) for qualifying LTC expenses • Can add a spouse or other insured giving both access to the full monthly benefit • Retain access and control over the assets just like in their current annuity • No medical underwriting or cognitive phone interview for base policy only • Ability to add a rider doubling pool of assets or lifetime coverage (requires cognitive phone interview) The 5 ways mentioned below are based on an article from Money.CNN.com -

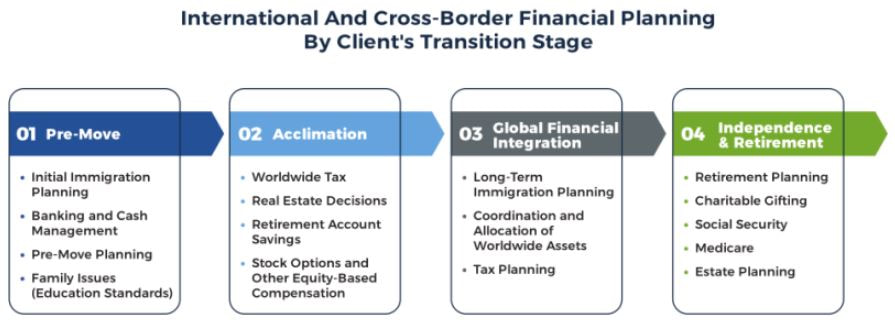

1. Take advantage of Medicare's free preventive services Medicare eligibility kicks in at age 65, and once you're enrolled, you get access to a host of no-cost benefits designed to help you stay on top of your health. But many seniors don't take advantage of these services, and therefore lose out on an opportunity to get ahead of health issues. As a Medicare enrollee, you're entitled to a free wellness visit with your doctor every year, and scheduling that could help you avoid a separate bill later on. Similarly, many critical health screenings are free under Medicare, including mammograms and certain cancer screenings, diabetes testing, and depression screenings. Capitalizing on these free services is a good way to keep your health in the best possible shape, thus lowering your health care costs on a whole. 2. Address health issues before they escalate Minor health problems can easily become major ones when they're left to fester. One of the easiest ways to save money on health care in retirement is to address medical issues before they get worse. Imagine, for example, that you come down with a bad cough but opt to wait it out rather than go to the doctor. If that cough turns into pneumonia and you wind up hospitalized, you'll face a much larger bill than your typical copay under Medicare, all while putting your health at risk. If you have mobility issues that make it difficult to get to a doctor, utilize Medicare's telehealth system, which gives you access to health care professionals virtually. This way, you avoid the hassle of having to physically get to a doctor's office while benefiting from legitimate medical advice. 3. Consider a Medicare Advantage plan Part of what makes healthcare so expensive in retirement is the fact that many essential services aren't covered under traditional Medicare. Dental care, vision services, and hearing aids, for example, are just a few of the things Medicare won't pay for. But if you opt for a Medicare Advantage plan, you might save money on these and other critical services. Medicare Advantage plans are designed to mimic the coverage offered by traditional Medicare, only they typically provide a wider range of benefits. And in some cases, you could end up paying less for Medicare Advantage than traditional Medicare, even with that improved coverage. Medicare Advantage might also save you money by limiting your out-of-pocket spending — most plans put a cap on that figure, whereas with traditional Medicare, your yearly costs are virtually limitless. And that's reason enough to look into an Advantage plan. 4. Shop around for the best prescription drug plan If you take prescription drugs, it's crucial to find a cost-effective plan in retirement. If you're enrolled in traditional Medicare, you'll need a separate Part D plan to cover your drug costs, but not all plans are created equal. That's why you'll need to do some comparison shopping to see which plans offer the best deals based on the medications you're taking. But don't just settle on a single Part D plan and stick with it year after year. Because plan formulas can change, it could be that a certain drug that's affordable one year doubles or triples in cost the following year. Furthermore, as your prescription needs change over time, you may come to find that a certain Part D plan saves you more money than another. Along these lines, it pays to see what your drug coverage looks like under Medicare Advantage. Some Advantage plans include prescriptions, which means you might not only save money, but eliminate the need to deal with a separate drug plan. 5. Buy long-term care insurance If you think the cost of doctor visits and prescriptions in retirement is astronomical, just wait until you face the prospect of long-term care. And it's likely you will. An estimated 70% of seniors 65 and over wind up needing some type of long-term care in their lifetime, and the figures are downright astonishing. A year's stay in a nursing home, for example, will run you about $82,000, and that assumes you're bunking with a roommate. An assisted living facility, meanwhile, will set you back over $43,000 per year, on average. If you want to save money on long-term care costs, invest in insurance when you're in your 50s or 60s. The younger you are when you apply, the more likely you are to not only get approved but snag a health-based discount on your premiums. And while you will pay for coverage year after year, those premiums could save you considerably more than what you would spend on them in the long run. Advisors must be prepared to address specific concerns at each stage and work with clients as they transition through these phases. Expatriate clients may consult with an advisor at any stage of their transition, whether it be before their international move, as they first arrive, or well after moving.

Good news for non-spouse beneficiaries of tax-deferred retirement accounts: thanks to the 10-year rule in the Secure Act passed into law in 2019, most will avoid annual required minimum distributions for deaths occurring after 2019.

But there’s a hitch: This RMD hall pass for surviving beneficiaries requires these inherited accounts to be emptied by Dec. 31 of the 10th year following the year of death. Failure to comply could trigger a 50% penalty; a full withdrawal after 10 years of compounding could produce a huge lump-sum of taxable income. Financial Planning magazine has an article discusses various deft maneuvering to deal with such long term concerns, worth a read for someone face such a situation. The Internal Revenue Service announced income range increases in 2021 for determining eligibility to make deductible contributions to traditional Individual Retirement Arrangements, to contribute to Roth IRAs and to claim the Saver’s Credit. However, 401(k) contribution limits for 2021 are unchanged at $19,500.

As the IRS explains in Notice 2020-79, taxpayers can deduct contributions to a traditional IRA if they meet certain conditions. If during the year either the taxpayer or his or her spouse was covered by a retirement plan at work, the deduction may be reduced, or phased out, until it is eliminated, depending on filing status and income. (If neither the taxpayer nor his or her spouse is covered by a retirement plan at work, the phase-outs of the deduction do not apply.) Here are the phase-out ranges for 2021:

AIG's IUL products, QoL Max Accumulator+ and QoL Value+ Protector are designed for people who are looking for permanent life insurance protection.

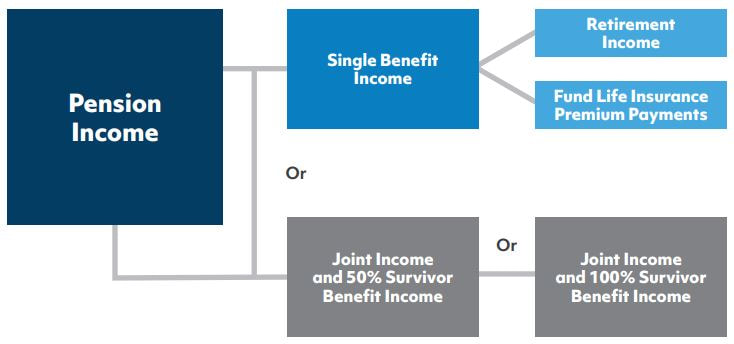

1 Volatility Protection – Offers protection against market volatility, through global and domestic index interest crediting strategies. Learn more about Volatility Control in Volatile Market Conditions. 2 Cash Value Access & Riders – Allows clients to take distributions as needed because life doesn’t always go as planned. 3 Tax Diversification – Helps fuel supplemental retirement income that is generally tax-free. 4 Low Cost Structure – Its affordable and transparent cost structure is designed to help generate optimal, stable income in good years and bad years. 5 Non-Medical Underwriting – It’s faster and easier to acquire for policies that qualify. Although fewer individuals are participating in Defined Benefit Pension Plans, many individuals who participate in these plans for several years are starting to retire. The choices at retirement are limited to how the participant wants to take the income stream. The decision on how to take the income can have a dramatic impact on how much income the participant can receive. . Married couples have a much longer life expectancy than single individuals so pension administrators must provide a much smaller benefit to cover two lives. How much less depends on ages and whether a 50% survivor benefit, 75% survivor benefit, or a 100% survivor benefit is chosen. The higher the survivorship benefit, the lower the primary benefit will be. At retirement, pension plan participants who are married must make a decision: Choose the maximum monthly income for the life of the retiring employee or choose a substantially reduced pension that will cover the lives of the employee and spouse whether Joint and 50% benefit, Joint and 75% benefit or Joint and 100% benefit. For married individuals, the single life option is not viable, since the death of an employee will leave the surviving spouse with nothing. Any joint option will leave both spouses with less to live on. If the employee spouse dies soon after beginning benefits, the survivor will receive a lifetime of reduced benefits. If they both live long and die a year apart, they will have wasted the sacrifice of taking less. Whichever payout option they choose, there will be nothing left to pass onto children. Pension Maximization may provide a solution that allows for higher income for both and a legacy left for loved ones. If the retiring employee lives for a long time, there will be money from the life insurance policy to pass on to children. If the employee does not live to their life expectancy leaving a surviving spouse, the spouse will have income from the death benefit to help fund their remaining retirement and may have some money left over to pass to children. If both live a long life they will have cash value available to borrow to further fund lifestyle needs when they are older.

The cash value of the policy is available for emergencies while living. If the employee’s spouse predeceases the retiring employee, the policy can be surrendered for the cash value. If the policy is surrendered, sold, or exchanged for an immediate income annuity, the money can be put to work generating additional retirement income. The death benefit payout is income tax-free and the death benefit is available for unforeseen debts and medical bills. The death benefit can be annuitized and/or invested to provide income for the surviving spouse. This provides principal that can be passed on to loved ones. Conclusions Purchasing life insurance on the retiring employee and possibly purchasing a single life immediate annuity may result in more money available during retirement. Life insurance creates a fund which, if not fully utilized, provides a legacy to loved ones after they are gone. People planning retirement should consider obtaining life insurance prior to deciding on how to take pension benefits. This will ensure that a sufficient amount of insurance is purchased to cover the need. If when evaluating a permanent policy, you find it does not generate a large enough death benefit to cover the surviving spouse, consider combining term insurance with a permanent policy to reach the needed death benefit. Pension Maximization provides an opportunity in the right situation to improve a retiree's retirement and in some cases allows more assets to pass to children and grandchildren. Each state has its own estate and income tax laws, and it is important to plan appropriately. Furthermore, some states are common law property states and others are community property states. There are significant differences between them when it comes to transferring assets, and a document drafted in a common law property state might not be appropriate in a community property state.

Are You Subject to State Estate Taxes? As of 2020, 17 states and the District of Columbia* also impose some form of estate or inheritance tax. Additionally, each state has different exemption amounts, so it is vital to evaluate your current wealth and estate planning needs with your attorney, keeping both the federal and your state's exemption amounts in mind. In addition, for many married couples in a state that imposes a state estate tax, this may have the effect of requiring payment of state estate tax after the first death, when none had been anticipated. Prior to 2001, because the "pick-up tax" was imposed only on estates that had to pay federal estate tax, estates below a certain threshold did not have to worry about such a tax. The threshold was the amount of the federal applicable exclusion amount. That is no longer the case. The practical effect of the difference between a state's exemption amount and the federal applicable exclusion amount is that certain estates will now be subject to a state estate tax, despite the fact that the estate is exempt from federal estate tax. In some situations, establishing a trust as part of an estate plan can help counter state estate tax implications. Review your estate plan with your attorney and tax professional, with an eye toward reducing federal and state estate taxes, and make sure to reevaluate and potentially update your plan to establish residency in another state. Do you still need a guardian?

When a child is young, a key estate planning decision parents often make is to determine a guardian. If your child is now an adult, however, a guardian may no longer be relevant, but new considerations arise: Is your child married? Is your child financially responsible? Are you leaving assets to your children in a trust? Have your children had children of their own? How does your trust distribute assets? Many trusts are designed to distribute assets to children at certain ages, e.g., one-third at age 25, one-half of the remaining assets at age 30, and the remaining balance at age 35. If a child is now above one or more of these ages, they will receive distribution of part or all of the trust assets outright and free of trust upon the last to die between you and your spouse. Now that your child is older, you may feel differently about their ability to handle a large inheritance; for example, you may feel that large sums might not be spent in the most prudent manner if they are free of restrictions. Further, if the child is married, an inheritance can easily be commingled with the spouse's assets, possibly subjecting the distributed trust assets to equitable distribution upon a divorce. An inheritance free of trust will also be subject to any existing or future creditor claims. These are some of the factors you may wish to consider when reviewing your estate plan to determine if it still meets your needs. What're your current wishes? Furthermore, in many cases, outdated estate plans are simply not consistent with current wishes or circumstances. For example, it is possible that one child within a family has been financially successful while another has not. When an estate plan is initially created, an equal amount of inheritance among children may have been the goal, but that may have changed over time. Also, in some cases, beneficiaries named on retirement accounts and life insurance policies may not be in line with the trusts created for children under a will or revocable trust. It is vital to revisit all the ways assets are being left to children, given their current age and maturity, to make sure the plan still matches the current intent. What do your adult children need on their own? Lastly, when children are minors, they do not typically need health care powers of attorney, living wills, or advance health care directives, since their parents or guardians are legally responsible for them. But once they become adults, they should consider having these important documents in their own right. Periodically review the ways that assets will be left to your children, and encourage them to have the appropriate estate planning documents in place as they get older and their circumstances change. Fiduciaries

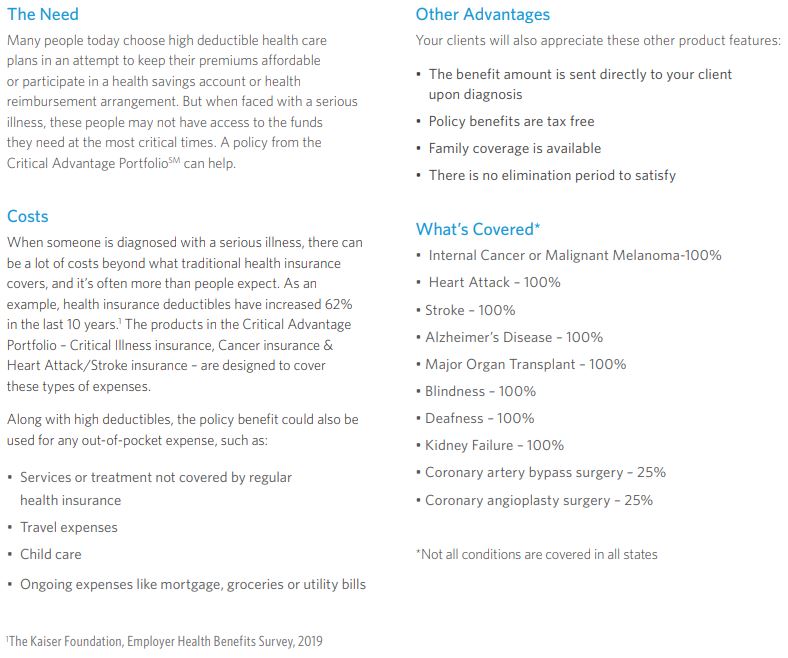

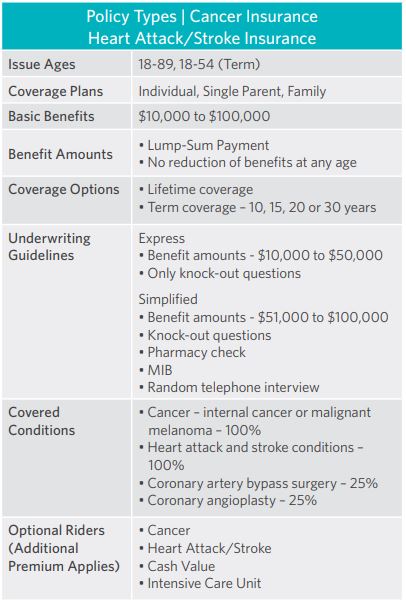

Do you know who your fiduciaries are? A fiduciary is someone who is appointed to take legal control over assets for the benefit of another person (the beneficiary). It is a fiduciary's legal responsibility to act in the beneficiary's best interest. Two types of fiduciaries often seen in estate plans are executors and trustees. Executors Executors are typically appointed in a will and are given control of assets during the probate process, until the assets are ultimately distributed to the named beneficiaries. Executors are responsible for collecting all the assets of the deceased, paying final debts, paying expenses, and filing any estate tax returns. Trustees Trustees control the assets held within trusts, which may have been set up during a person's life, or at death under the terms of a will. While an executor's role is typically for a finite period, a trustee's role may continue either in perpetuity or until the trust is terminated. A key role of the trustee is to make distributions to a beneficiary while following the terms of the trust agreement. Executors and trustees generally bear responsibility for investments, accountings, and tax filings during their tenure. What Could Go Wrong? Outdated estate plans often name fiduciaries or successor fiduciaries that may no longer be suited for the position. A fiduciary named years earlier may be too elderly, or even deceased. If a professional (e.g., attorney, CPA) is named, it is possible that they may no longer be practicing, or their professional relationship with the beneficiary may have since ended. Even named corporations, which we generally assume to exist in perpetuity, may have merged with or been acquired by another entity. And children who may have been too young to serve when the documents were created could now be capable of taking on the role of fiduciary. Although fiduciaries are bound by certain standards of law, it is most important to name individuals you trust. Other important considerations are the age, maturity, and level of financial knowledge of the fiduciary. It is quite possible that the individuals who had fit most of these qualifications may have changed over the years and now no longer do. Check to see who you have named as fiduciaries in your estate planning documents to determine whether you need to revisit these designations. Critical Advantage Portfolio Insurance Fills the Gap of High Out of Pocket Health Expenses11/7/2020 With health care premiums rising and increases in treatment costs, many people are looking to fill the gap between coverage and out-of-pocket expenses. Cancer Insurance & Heart Attack/Stroke Insurance pays the policy holders a lump-sum payment upon diagnosis, providing them with some security in their time of need.

The fixed index annuity products usually offer a powerful combination of benefits that help protect against many of today's common retirement concerns, as summarized in the chart below.

|

AuthorPFwise's goal is to help ordinary people make wise personal finance decisions. Archives

September 2022

Categories

All

|

RSS Feed

RSS Feed