- Flexible guaranteed death benefit coverage and premiums from ages 80–121.

- Innovative cash accumulation potential, with three carefully selected index options.

- Secure protection for life’s unexpected events with Accelerated Benefit Riders.

|

The American National Signature IUL is a good insurance product with multiple benefits:

0 Comments

Momentum has been building for several years, driven in large part by increasing demand for EVs like Tesla's (TSLA) Model 3 (the top-selling EV worldwide in 2021) and Model Y, Wuling Motors' (WLMTF) Mini EV, Volkswagen's (VLKAF) ID.4, BYD's (BYDDY) Qin Plus DM, Ford's (F) Mustang Mach-E, General Motors' (GM) Bolt, and Nissan's (NSANF) Leaf.

Here are the 10 largest automakers by market cap who produce only electric vehicles:

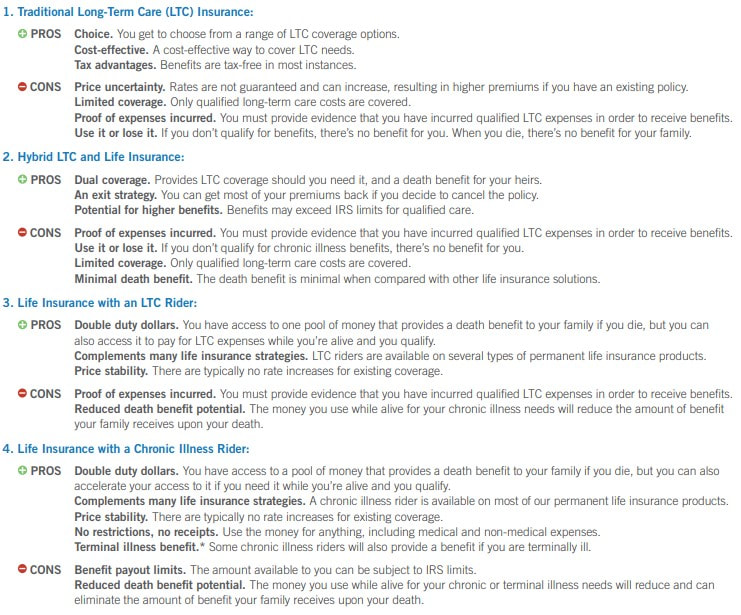

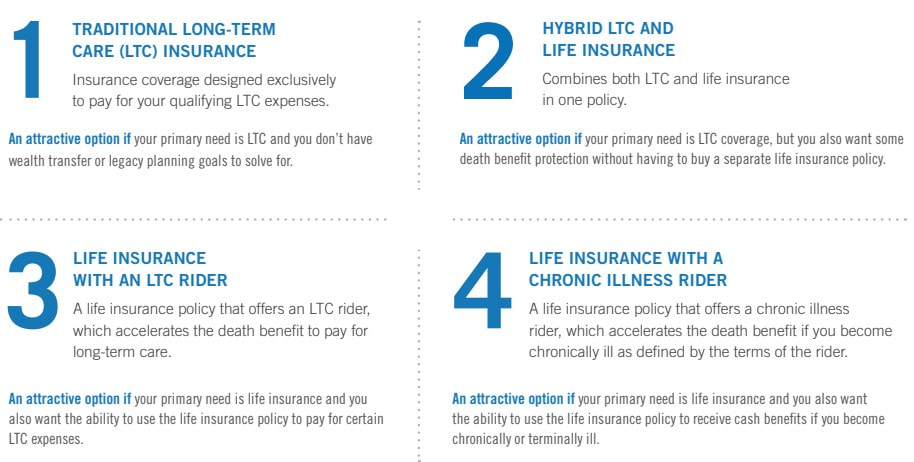

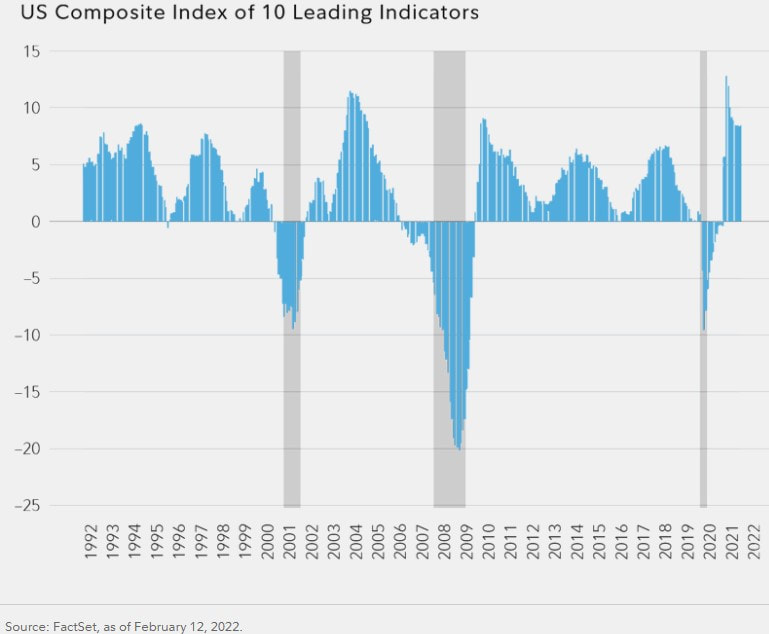

Being chronically ill means you’re unable to perform at least two of the Activities of Daily Living (eating, bathing, etc.) for at least 90 days; or you suffer from a severe cognitive impairment. Here’s a quick snapshot of four common insurance options that people may consider for financial protection in the event of a chronic illness. In next blogpost, we will compare the pros and cons of each option. The following AIG flyer shows a scenario where one could use a combination of Term and GUL to protect from both pre- and post-retirement risks! The US Index of Leading Indicators is a composite of 10 indicators ranging from measuring unemployment to stock market performance.

Proponents of this index believe that it captures a wide dispersion of information and can help forecast shifts in the economy. After rapidly plunging into negative territory in the wake of the spread of COVID-19 around the globe, this index took roughly a year to rebound to a positive reading—and actually surged to a multidecade high in 2021, reflecting the economic reopening. Over the past several months, it has begun to recede from those peak levels, but has been strongly positive and near historically high levels. In The 2022 Policygenius Life Insurance Trend Report, 3 trends are noted.

Growth in no-medical-exam life insurance The COVID-19 pandemic has accelerated changes in consumer shopping habits, with shoppers demanding convenience and more no-medical-exam policies that allow consumers to apply for term life insurance using digital health information. According to Kartik Sakthivel, vice president and chief information officer at LIMRA, nine in 10 insurance executives surveyed in 2020 reported that their customers “have an increased appetite for the digital shopping experience,” a trend that continued into 2021. Internal Policygenius data corroborates this trend. From October to December 2021, roughly 56% of life insurance applications submitted through Policygenius were for no-medical-exam policies, compared to 26% in January to March 2021. In addition to providing convenience, accelerated underwriting policies can be more affordable options for shoppers. Policygenius Life Insurance Price Index data from the last year shows that no-medical-exam term insurance policies are competitively priced compared to term policies requiring a full medical exam — and some applicants even paid less for no-medical-exam term coverage. For example, 25-year-old females buying $250,000 in coverage paid 1.6% less in 2021 for no-medical-exam term policies than they did for traditional policies. Strong demand from younger age groups According to Mark Friedlander, director of corporate communications at the Insurance Information Institute, 2020 life insurance sales “were largely driven by younger age groups” and there was a year-over-year increase of 7.9% in life insurance sales for policyholders 44 and under from 2019 to 2020, the last year for which he has complete data. In terms of the amount of coverage purchased through Policygenius in 2021, people 18-44 bought the vast majority (84%) of policies exceeding $1 million in coverage, and 81% of policies from $750,001 to $1 million. Older Gen Xers and Baby Boomers — people age 45 to 64 — bought only 16% of policies over $1 million in coverage, and those 65 and up didn’t buy any of these policies. Compared to other demographics, Gen Xers and Baby Boomers also bought less coverage overall through Policygenius in 2021: 85% of policies bought by people over 65 and 87% of the policies bought by people age 45 to 64 were for under $250,000. Stability in life insurance pricing The life insurance industry saw a significant increase in death claims due to COVID-19 in 2020. “Death benefits paid in 2020 jumped to $87.5 billion, up 15% from $76 billion in 2019, the largest increase in nearly 25 years,” according to Friedlander. One carrier on the Policygenius platform saw a similar rise in death claims in 2020 — and an even bigger increase in 2021. Legal & General America, the parent organization of the Banner Life and William Penn life insurance companies, saw a 12% increase in death claims, measured by dollars paid, from 2019 to 2020. Death claims rose again last year, increasing 17% from 2020 to 2021. Despite this increase, as well as inflation, life insurance prices stayed consistent throughout 2021, with only nominal changes. Based on Policygenius data from April 2020 to April 2021, older smokers saw a surge in life insurance pricing, but pricing adjustments in May 2021 and the following months brought prices back to April 2020 levels. Consumers will likely continue to see price stability as insurers gather long-term data on COVID-19’s impact on mortality rates. If you had a withdrawal from your Virginia529 account(s) during 2021, a 1099-Q form was issued for tax purposes.

If a withdrawal was made payable to an account owner, a 1099-Q will be mailed to the account owner and is available online at Virginia529.com. Simply log in to your account, locate the “View My Account” tab, and select “Tax Information (1099-Q Form)” from the dropdown menu. If a withdrawal was made directly to the student beneficiary, to a K-12 school or eligible educational institution, the student will receive the Form 1099-Q in the mail. Students can log in to their Virginia529 account to review a digital copy or create a login ID if they do not already have account access. It's important to note that the account owner will not be able to view this document. Reporting 1099-Q Amounts on Your Tax Return Virginia529 is required to report withdrawals to the IRS with Form 1099-Q. Qualified education expenses include tuition, fees, books, computers and related technology, and some room and board costs for students attending an eligible college or university. Families can also take a tax-free withdrawal to pay for tuition expenses at private, public and religious elementary and high schools. This amount is limited to $10,000 per year, per student. The SECURE Act of 2019 expanded the definition of qualified 529 plan expenses to include costs of apprenticeship programs and qualified student loan repayments. Qualified distributions for student loan repayments have a lifetime limit of $10,000 per beneficiary and each of their siblings. 529 withdrawals spent on other purchases, such as transportation costs or health insurance coverage are generally considered non-qualified. If the withdrawal(s) taken on your account did not exceed the total amount of 2021 qualified higher education expenses incurred, you should not need to report the withdrawal(s) on your tax return. If, however, the withdrawal(s) exceeded your total qualified higher education expenses, consult a tax professional for more information as you may have income tax consequences. Reporting Contributions on Your Tax Return If you’ve simply been contributing to an existing 529 account you may not have to report anything on your federal income tax return. Contributions to a 529 plan are not deductible and therefore do not have to be reported on federal income tax returns. What’s more, the investment earnings in your account are not reportable until the year they are withdrawn. As for state income tax filings, Virginia529 account owners who are Virginia taxpayers may deduct contributions up to $4,000 per account per year with an unlimited carryforward to future tax years, subject to certain restrictions. Those account owners who are Virginia taxpayers age 70 and above may deduct the entire amount contributed to their Virginia529 account in one year. In addition, contributions to Virginia529 accounts are treated as a completed gift by the account owner to the student beneficiary. This means contributions up to $16,000 a year, or up to $32,000 if married, may be gift tax free. You should consult your tax advisor regarding the specific tax consequences of contributions. If you’re expecting a tax refund check this year, consider transforming it into a contribution toward your Vigrinia529 account. Tax season is upon us, but before you file, take the time to help make sure you’re not paying more than you owe. If you’re among the Americans who typically only take the standard IRS deductions instead of itemizing on your 1040, you may be missing out on some money-saving tax deductions or credits that you’re eligible for. Keep these three factors in mind that may help you save.

Charitable contributions You already know that you can deduct donations of money or goods, but most taxpayers often don't deduct enough. That's because many of us fail to keep detailed records tracking our donations throughout the year. Whether you dropped off a bag of clothing at a local charity or donated $5 at the register of your grocery store, you should be tracking all of these contributions to ensure that you get the highest tax benefit. If you didn't track this last year, sit down now and do your best to account for as much as possible. And don't forget, you may be able to include transportation costs in service to a charitable organization (like dropping off those donations or getting to and from a charity event or volunteer day). Then pay closer attention to donations this year. Reinvested dividends Reinvested dividends in a taxable investment account are treated as current income, the same as though you received them in cash. Qualified dividends, which are those held for a specific time, are taxed at a lower capital-gains tax rate (visit irs.gov to find out what qualifies as a dividend). This isn't exactly a deduction, but you may be able to cut down on your tax bill through good record keeping. When reinvesting dividends, add this amount to your basis in the security. By tracking the basis, you can reduce your capital-gains tax if you sell the security at a higher price. Earned income tax credit The Earned Income Tax Credit (EITC), designed to supplement wages for low-to-moderate income workers, may or may not be on your radar. Although tens of millions of people previously classified as “middle class” — including traditional white-collar workers — now fall into the “low income” bracket because they lost a job, took a pay cut, or worked fewer hours during the year. Given the interruptions and changes in employment affecting millions of workers from the widespread efforts to help control the pandemic, it may be worth talking to your tax advisor to see if you’re eligible this year. Tax-advantaged product solutions can help clients save more for retirement and potentially grow their savings faster. Most clients may be familiar with 401(k)s and IRAs, but there's another tax-advantaged vehicle to consider for retirement planning: fixed indexed annuities (FIAs).

FIAs are insurance products that offer growth potential and guaranteed income for retirement. Funds in an FIA earn interest credits based in part on the upward movement, if any, of a reference stock market index, such as the S&P 500®. Since money in an FIA is not directly exposed to stock market risk, FIAs also provide protection from loss due to market downturns. What's more, this combination of growth potential and protection comes with tax advantages that can complement other savings and investment vehicles in your clients' retirement portfolios. Here is a look at three key tax benefits of FIAs and how they can contribute to a tax-smart approach to retirement planning.

The big picture With their tax benefits and ability to provide growth potential and protection, FIAs can play an important role managing taxes within a retirement savings plan. They may complement other sources of growth potential and retirement income, including stocks, bonds and mutual funds held in taxable brokerage accounts; savings in tax-deferred accounts like 401(k)s; and other tax-advantaged vehicles such as Roth IRAs. Using a mix of these tools can be vital to helping clients minimize the effect of taxes, manage risk and provide growth potential before and after retirement. Here is an updated version of 2022 tab tables from Athene. Taxes are constantly changing. And, this could lead to unanticipated tax risk for your clients and their heirs. That’s why many individuals are not waiting until retirement to prepare. Here’s an example of what someone could do now to protect their assets and their loved ones who will inherit them.

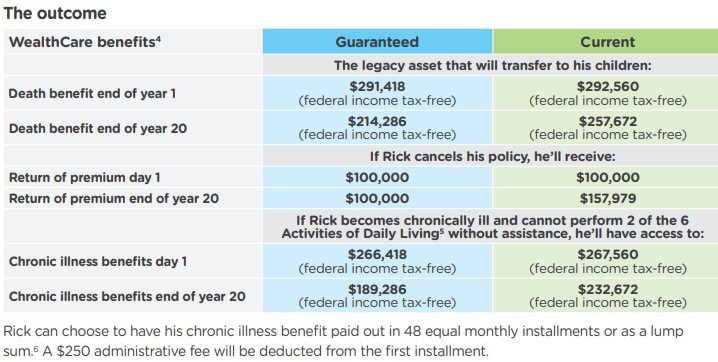

Case Study: An asset for tax diversification Rick is age 55. He and his wife, Tina have two adult children. This couple recently sold their home and moved to a condo in town. They made a nice profit on the sale, and Rick is ready to use part of the money in a tax-efficient way. Rick’s goals • Finding an asset that offers tax-advantaged growth • Creating a legacy for his children without creating tax risk for them • Establishing his plan for care Rick’s concerns • Facing market risk and losing the profit he made on his home sale • Not knowing what income and capital gains taxes will be in the future The solution In conjunction with recommendation from Rick’s tax and estate planning team, Rick purchase a $100,000 Indexed Single Premium Universal Life Insurance policy as a differentiated asset within his portfolio. This will provide the liquidity of a full return of principal, tax advantaged growth, guarantees, an income tax-free legacy for his children, and income tax-free chronic illness benefits if he would ever need care. At the time of purchase, Rick chooses the Global Multi-Index Bonus HIGH PAR Strategy which can help his death benefit grow tax-deferred over time. He’ll have principal protection and will never face losses due to market performance. The outcome Although having a retirement savings number is important, it’s also a moving target and fixating on one number runs the risk that you won’t adjust your savings goals to new circumstances, such as higher health care costs, inflation or the vagaries of the economy. Life isn’t stationary and your retirement plan, including any target savings number, shouldn’t be either.

Instead of focusing exclusively on the size of your nest egg, create a comprehensive retirement plan that you’ll refine and change over time. It should include your financial goals, a net worth statement, a working budget, debt management strategy, emergency funds and any insurance. Any retirement plan also should reflect your expected retirement lifestyle, investing horizon, risk tolerance, savings goals and estate planning. You’ll want to consider how your retirement savings would hold up under different scenarios, simulating extreme market conditions or unexpected life events, to be sure your bases are covered. A financial professional can help you do it or use Microsoft’s free online Retirement Financial Planner template. Revisit the plan every few years while you’re accumulating assets and whenever you have a life change, such as switching jobs, losing a family member or moving. As retirement nears, the plan should factor in your required minimum distributions to minimize your tax burden. You want an appropriate mix of taxable and nontaxable investments, such as a Roth IRA combined with a taxable brokerage account, as well as a balance of stocks, bonds, real estate and other assets. Many retirement spending models use the 4% rule in which retirees withdraw 4% from their retirement portfolio in the first year of retirement. Each year thereafter, they adjust the dollar amount of their withdrawals by the previous year’s rate of inflation. The rule is designed to prevent retirees from running out of money during a 30-year-retirement. Your current spending also may be nothing like your retirement expenses because when we have more leisure, we often spend more. In retirement, health care costs escalate dramatically. Working households spend about 6% of their annual budget on health expenses, versus 14% for retirees, according to the Kaiser Family Foundation. You need to allow for flexibility because your life is going to change over time. Although you may be perfectly healthy now, things could happen, and there could be additional costs associated with your care. Q. How can an annuity be used by an individual as an estate planning tool?

A. In order to avoid the potential tax and financial repercussions that a lump sum transfer can create, many individuals wish to protect their heirs by providing structure to the way assets are inherited. For these taxpayers, annuities, though commonly used as retirement income planning tools, can provide the solution. The reasons for using an annuity as a wealth transfer vehicle often mirror those that apply when a taxpayer is planning for retirement—the annuity creates a stream of consistent income over time, guaranteeing that the taxpayer’s beneficiary is provided for far into the future. This strategy can protect heirs who might be otherwise unable to manage a large one-sum payment, or who might have financial problems that could cause them to spend a large sum too quickly. Q. If an annuitant dies before a deferred annuity matures or is annuitized, is the amount payable at the annuitant’s death subject to income tax?

A. Yes, to the extent there are any gains. An annuity contract generally provides that if the annuitant dies before the annuity starting date, the beneficiary will be paid, as a death benefit, the greater of the amount of premiums paid or the accumulated value of the contract (although some contracts may provide additional “enhanced” death benefits as well). The gain, if any, is taxable as ordinary income to the beneficiary, and is measured by subtracting (1) investment in the contract (reduced by aggregate dividends and any other amounts that have been received under the contract that were excludable from gross income) from (2) the death benefit, including any enhancements. Below is part of a recent WSJ article that discusses 4 major questions that investors are wrestling with, and any one of which could hit stocks hard.

Will inflation hammer profit margins? Companies are faced with soaring input costs, with producer prices rising even faster than consumer inflation, itself the highest year-over-year rate since 1982. Investors are closely focused on which businesses have the power to raise prices to offset higher costs. On Friday Clorox stock plunged 14%, the worst in the S&P 500, in large part because it warned about rising costs. Amazon was up 14% in part because its planned increase in the price of a Prime subscription reassured investors that it can offset soaring delivery and labor costs. Will Covid-era gains fade? Lockdowns accelerated the switch to many online services, but some will prove temporary. No one wants to be like Peloton Interactive, whose home cycling workout has proved tougher to sell when customers have the choice of outdoor exercise, and whose stock has lost three-quarters of its value since its peak a year ago. Some of the reason for Netflix’s big fall after its earnings was because it turns out people prefer real life to home movies; similarly, Clorox disinfectant sales have fallen back, and PayPal growth has slowed. Will Big Tech eat itself? One of the most attractive features of the leading online platform companies is the defensive benefit they get from being big, what are known as “network effects.” People use Facebook because other people use Facebook, so everyone has to use Facebook. Except, not so much. Meta stock tumbled 26% on Thursday primarily because TikTok is beating it in the competition for young eyeballs. Amazon and Apple made Meta’s situation worse, Amazon because it is snaffling advertising dollars at a rapid rate, Apple by changing privacy settings, something Facebook has struggled with. Competition has already hit several other tech themes. Netflix has to spend heavily to maintain its position because of the streaming wars with services from Amazon, Disney, Comcast and others. Uber Technologies got an early lead in online taxi services, but it turned out to be an easy model to copy and many other services sprang up around the world, competing both for customers and drivers. The pattern is a standard one in tech: Microsoft has long since lost its virtual monopoly in operating systems and word-processing software, while IBM’s dominance of PC hardware is ancient history. The battlegrounds of the future are cloud computing and self-driving cars, and the competition is keen. So far there’s no sign of a slowdown in the cash milked from the cloud by Amazon, Microsoft and to a lesser extent Alphabet, but all are investing heavily, and it might become competitive in time. True self-driving cars aren’t for sale yet, but Alphabet, Apple and Tesla are all spending heavily on development and, in the case of Alphabet’s Waymo, some limited services. Amazon and Intel have bought in to the area, and a bunch of traditional carmakers have made progress, too. Whoever cracks it first might get a big lead, and would deserve a big valuation, but competition, as well as regulation, would surely follow. Will bond yields carry on up? Growth companies are highly sensitive to bond yields, because so much of their lifetime profits lie further in the future than cheaper businesses. Bond yields jumped again on Friday on the back of a strong jobs report, taking the 10-year Treasury yield up to where it started 2020 for the first time since then. If the economy stays strong and yields keep rising, it will be a headwind for the big growth stocks. Should annuity buyers time the market? That is the question this thinkadvisor.com article tries to answer. Its conclusion? See below:

The Fed is expected to raise rates at least three times in 2022 and end its asset purchases in Q1. The trajectory of the coronavirus pandemic and fate of President Biden's economic plan could upend those expectations. Strategists recommend that investors stay in the short end of the yield curve and stick with high-quality securities.

The above is the summary of the bond strategies recommended by thinkadvisor.com for 2022, if you want to read for more details, follow this link. Thinkadvisor.com has an article that introduces the new state birthday rules, and calling it one of the least known opportunities for seniors.

Medigap Basics The Medicare Part A hospitalization program pays hospital bills, and the Medicare Part B program pays outpatient and physician services bills. Medigap policies can help consumers pay their Medicare Part A deductible and meet the traditional Medicare copayment and coinsurance requirements. Consumers can also buy Medicare Advantage plans. Those policies tend to offer enrollees broader coverage than the traditional Medicare program, in exchange for giving the enrollees financial incentives to use in-network providers and requiring the enrollees to get preauthorization for some medical procedures. Many producers strongly prefer selling consumers Medigap policies, because they see both the rules for producers and the coverage rules for the patients as being more flexible. For producers, one obstacle to selling Medigap policies has been higher monthly premium costs for Medigap coverage. Another obstacles has been the difficulties unhappy Medigap users have with switching policies. Medigap Enrollment Period Rules Health insurers, and some voluntary public health benefits programs, use “open enrollment period” systems, or limits on when people can buy coverage without going through much, or any, medical underwriting, to encourage healthy people to pay premiums even when they feel fine. The idea is to keep healthy people in the risk pool, by raising the possibility that they could break legs or suffer heart attacks, and have no way to get health coverage, outside the open enrollment period. Federal law creates a one-time, six-month Medigap policy open enrollment period period after a consumer’s 65th birthday. After that, Medigap users must show they qualify for a special enrollment period to switch Medigap policies. Users can get special enrollment periods easily when they move to new markets. Otherwise, they may have to show that their Medigap plan issuer has broken federal government rules or shut down. Idaho, Illinois and Nevada The new Idaho birthday rule is set to take effect March 1 2022. It will create a 63-day plan switching period beginning on the policyholder’s birthday. The new policy must offer the same level of benefits as the existing coverage or a lower level of benefits. The Medigap policy user can either switch insurers or change to a new Medigap policy from the same issuer. Idaho will switch to a community rating system for Medigap enrollees, meaning that premium rates will no longer be based on the age of the applicant. In Illinois, a new birthday rule will take effect Jan. 1, 2022. The Illinois rule will let Medigap users ages 65 through 75 have annual Medigap open enrollment periods lasting 45 days after their birthday anniversaries. The new policy must offer the same level of benefits as the existing coverage or a lower level of benefits. In Nevada, a new birthday rule will take effect Jan. 1, 2022, and provide 60-day plan switching periods starting on the first day of a Medigap user’s birthday month. Eligible consumers can buy new coverage, with the same or lesser benefits, from either their existing carriers or new carriers, without medical underwriting. A consumer cannot use the new rules to get policies with extra, innovative benefits, such as dental insurance, vision insurance, hearing benefits or gym memberships, officials say. Why the Quirks? One reason the new birthday rules are complicated is that insurers and government officials have been trying to give consumers ways to switch coverage without increasing the odds that some especially generous or well-run Medigap issuers will attract large numbers of new enrollees with very high health care costs. Another reason is that Congress created the Medigap program before the Medicare Advantage plan, and it left much more responsibility for regulating Medigap policies in the hands of the states. States have more ability to tailor Medigap rules to suit local needs, but that means producers who do business in two or more states may have to use different strategies for clients in different locations. Financial-planning.com has an article analyzes if Roth IRA conversion is still a risk worth taking this year, see below -

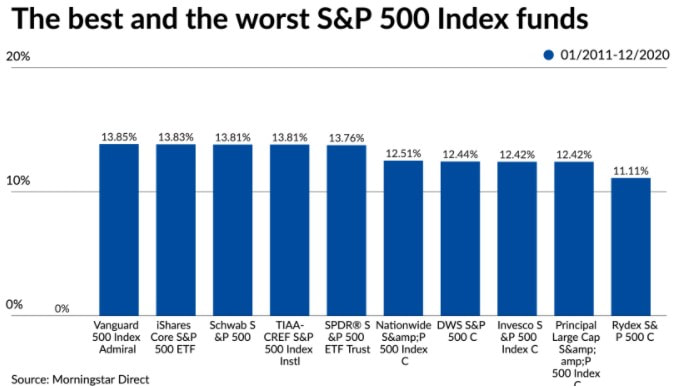

Go all out on contributions to retirement plans Didn’t max out your contribution limits last year? The IRS allows contributions for 2021 to be made through April 15, 2022. That’s three days before this year’s April 18 filing deadline, which was extended due to the Emancipation Day holiday in Washington, D.C. Some contributions are deductible, so they’ll lower the total amount of income on which taxes fall, a savings to the taxpayer. For 2021 returns being filed now, Americans could contribute a maximum $6,000, plus an extra $1,000 if aged 50 or older, to a traditional individual retirement plan (IRA) or Roth IRA. So an older married couple can put in a maximum $14,000. Traditional IRAs are generally funded with money on which taxes haven’t yet been paid, while Roth plans are fueled by after-tax dollars. Pretax contributions grow tax-deferred, with the owner paying ordinary rates on future withdrawals. While investors can also contribute money on which they’ve already paid taxes, they pay ordinary tax on withdrawals, making after-tax contributions to a traditional IRA a double tax hit. In contrast, Roth plans grow tax-free, with no levies on withdrawals. Deductions get complicated, depending on how much a taxpayer makes and whether she or a spouse has a workplace retirement plan. A traditional IRA owner who doesn’t have a workplace retirement plan (or whose spouse lacks one) or whose income is below $76,000 gets a whole or partial deduction. If a married couple filing jointly has one spouse with an employer-sponsored retirement plan, typically a 401(k), then an IRA contribution by the other spouse is no longer deductible once their joint income hits $214,000. Straightforward Roth IRA plans are a little different. The contribution limits are the same. But while there are no income limits on who can contribute to a traditional IRA, contributions to Roth plans now are limited to people who made under $140,000 last year (under $208,000 for couples). Because their assets grow tax-free and don’t bear future taxes, Roth contributions aren’t deductible. The Roth conundrum It’s still not clear what might happen to so-called backdoor Roth conversions, a mainstay of large retirement accounts and estate planning for the wealthy, under stalled legislation in Congress. While emerging versions of the Build Back Better tax-and-spending bill aim to limit or ban the ability of high earners to own Roths through indirect methods, the legislation is mired in infighting by Democrats. But some tax and retirement experts think that it’s probably safe to take advantage of their current tax benefits, even as legislators work to curb them. January 31, 2022 8:36 PMBackdoor conversions involve an investor converting a traditional IRA into a Roth. They’re a way for wealthy people to sidestep the income limits for direct contributions to a Roth. An early version of the House bill banned conversions of after-tax dollars in IRAs and 401(k)s. The House passed a somewhat softened version of that proposal last November. The legislation, which has to be passed by the Senate, would outlaw so-called mega-backdoor Roth conversions starting Jan. 1, 2022. The strategy came under a spotlight when ProPublica showed how PayPal co-founder Peter Thiel used it to transmute less than $2,000 worth of pre-IPO shares into a $5 billion account. The bill would still allow regular Roth conversions but would ban people with higher incomes from doing them starting in 2032. Last December, the Senate offered its own version of Build Back Better that proposes those same limitations. The backdoor strategy involves using hefty after-tax contributions to a 401(k) plan that permits them. Under IRS rules, a taxpayer could put as much as $58,000 last year into a workplace retirement plan ($64,500 for those 50 or older). One chunk of the money reflects the maximum pre-tax amount of $19,500 ($26,000 if 50 or older), while the remainder, up to $38,500, reflects after-tax dollars. The limits include any company matches. The taxpayer then converts her 401(k) to a tax-free Roth. The higher amounts can swell a retirement portfolio far beyond what direct contributions to an ordinary Roth can. Christine Benz, Morningstar’s director of personal finance, wrote in a Jan. 21 research note that it’s “unlikely” that when a final bill makes it to President Joe Biden’s desk for signature, if indeed one does, the proposed curbs would be retroactive to the start of this year. “Given that these contributions and conversions are currently allowable,” she wrote, financial advisors have “been urging their clients to go ahead with them until the law officially changes." Benz quoted Aron Szapiro, the head of retirement studies and public policy for Morningstar, as saying that the likelihood of a retroactive ban on after-tax contributions is "close to zero.” Of course, nothing’s final on Capitol Hill until it’s final. Nonetheless, Benz wrote, “given that backdoor Roths are one of the few mechanisms that higher-income heavy savers can use to achieve tax-free withdrawals and avoid RMDs in retirement, many such savers are apt to conclude that it’s a risk worth taking." Morningstar Direct said that the 10-year annualized return through last December for index funds in all forms ranges from 14.61% (for the Rydex S&P 500 H) to 16.49% (for the iShares S&P 500 Index K). The nearly 2% difference means that $50,000 invested in the Ryder fund would hand an investor just over $195,500 after a decade, while the same amount in the iShare fund would yield more than $230,000 — a roughly $34,500 difference.

The fees charged by mutual funds range widely, so it’s not surprising that returns for those funds vary, even if they’re passively following a benchmark. What about returns by the four low-cost ETFs? They also vary in their performance, even though they’re roughly charging the same low costs and following the same benchmark. Blame benchmark-tracking glitches and their lucrative practice of lending stock to big banks, a move that can paradoxically cause a fund that passively mirrors an index to, in fact, beat that index. There may be a silver lining for crypto investors selling at huge losses during the recent market turmoil: a quirk in the Tax Code that lets people minimize what they’ll owe the government down the road.

Unlike stocks and bonds, cryptocurrencies aren’t subject to federal rules that bar people from claiming deductions if they sell an asset at a loss and then buy an identical or similar asset within 30 days before or after the sale. That provides a unique opportunity for people suffering steep losses to sell and reap future tax savings, then buy more virtual tokens at cheaper prices, according to crypto tax filing software firms. This is a great time to store your capital losses, because when you exit the market at a future date at a huge gain, you can use these losses After surging 60% in 2021 — and touching an all time high of nearly $69,000 in November — Bitcoin has fallen 20% to under $37,000 this year. The impact of crypto’s January turmoil won’t show up on investor’s 2021 tax returns. However, thousands of crypto investors who piled into the asset class last year must account for those investments as they file their returns during the next few months. Investors who sold crypto at a loss and then purchased similar assets at a lower price — a move that some refer to as wash sales — are free to take advantage of the tax strategy, according to TaxBit, a crypto tax software company. Some Democrats tried to close the loophole in a roughly $2 trillion spending bill that failed late last year. “Tax-loss harvesting” Strategy Under the strategy, investors can use their losses to offset any gains in a given year. If they don’t have gain to offset, they can deduct up to $3,000 in losses from ordinary income. Any excess capital losses above that amount can be used to lower tax bills in subsequent years. With all the tax legislation oxygen taken up by BBB, many have forgotten about Secure 2.0, but it’s still waiting to see the light of day.

Keep an eye on this bill. Of all the the bills that could be enacted in 2022, this one has the best chance, having passed out of committee unanimously, with full bipartisan support. See if you may be affected by these proposals in 2022: ‘Rothification’ Secure 2.0 includes provisions allowing both SIMPLE and SEP Roth IRAs. In addition, plan catch-up contributions would be required to be made to Roth plan accounts, and plans could allow participants to have employer matching contributions made as Roth contributions. Other Proposed Changes

Thinkadvisor.com recently had an article that highlights the flaws of target date funds, it's worth a reading if you have or plan to invest in target date funds.

Highlights of the article include:

Mutual funds generate capital gains taxes each time they sell an underlying holding that has appreciated, even if an individual investor holds on to her fund. So that cost is passed on to her. By contrast, ETFs use an obscure tax loophole to cash in on appreciated holdings by swapping assets with a buyer — in this case, major banks.

For example, a fund sells an appreciated stock in its “basket” of shares to a bank and immediately buys back “substantially similar” shares. Because no cash has traded hands, there’s no capital gains tax on those profits. Or an ETF can sell a losing stock, deduct the loss, then buy back similar stock. The deduction boosts the returns of the fund. Of course, when an investor sells her ETF, she owes capital gains tax on the profits. But until she does, the capital gains taxes on internal trades made to keep the fund in line with its benchmark are “washed away.” With active trading strategies, the tax perk for the new semi-transparent and opaque ETFs is even more significant. As well as potentially more prone to scrutiny. Sen. Ron Wyden, who heads the Senate Finance Committee, called in Sept. 2020 for an end to ETFs’ use of “in-kind” transactions to avoid triggering capital-gains taxes. |

AuthorPFwise's goal is to help ordinary people make wise personal finance decisions. Archives

September 2022

Categories

All

|

RSS Feed

RSS Feed