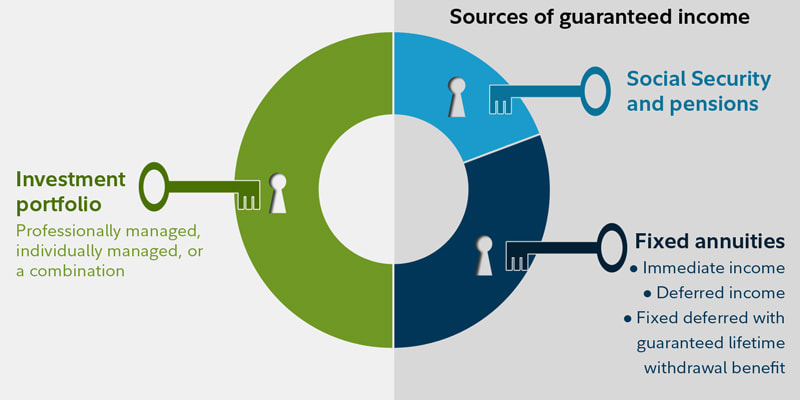

A. SPIA should be considered by every retiree for two reasons:

1. Eliminate Longevity Risk

A SPIA is an excellent way to reduce the fear of running out of money. It can allow an individual to spend the growth in their portfolio on travel, new cars, hobbies and other activities of daily living that occur in retirement. Retirement has become a new Life Stage and people want to enjoy retirement but it takes income to do so and a SPIA provides that income and they will receive it as long as they are alive.

2. Avoid Unnecessary Losses in a Down Market

By covering fixed and necessary living expenses with a SPIA, an individual has reduced the risk of loss in retirement portfolio. They no longer need to sell off assets in a downmarket in order to fund everyday living expenses. Their social security and Immediate annuity income cover all those necessary expenses.

RSS Feed

RSS Feed