|

In deciding where to put your cash, you need to consider your goals, time frame, attitude, and needs. Once you are clear on them, you have four places to hold cash and we will analyze them one by one below.

Savings accounts

Money market mutual funds

Certificates of deposit

Individual short-duration bonds

The classic view of retirement is that it is the third and “final” phase of life - after we go through the first phase of youth and learning (from birth to adulthood), and the second phase of our ‘productive’ working years (from adulthood until we can no longer work anymore), allowing us to reach a final stage of rest, relaxation, and leisure.

However, in practice, retirement itself is really a multi-phased experience – given both the substantive nature of the transition itself from what precedes it and the sheer duration of retirement that encompasses many years and decades (throughout which our lives continue to change). Accordingly, Andy Millard highlights a series of 6 key phases of retirement, including:

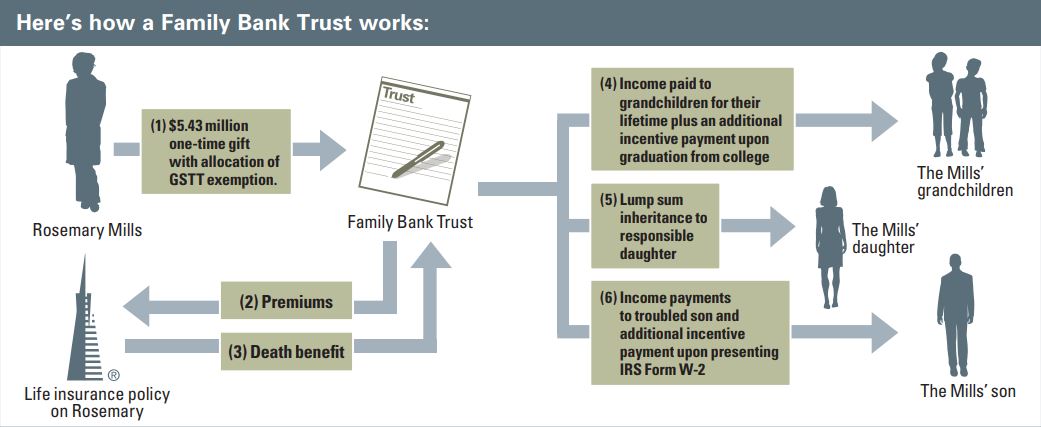

In last blogpost, we discussed why including life insurance in family bank trust. Now we will introduce a case study.

Example

Goals and Objectives:

In last blogpost, we discussed what is a family bank trust and why one needs it.

Why Include Life Insurance in Planning with a Family Bank Trust? There are 2 major benefits: 1. Instant Liquidity With a life insurance policy, one can rest assured that instant cash will be available to their loved ones upon their passing. 2. Tax-Efficient Life insurance proceeds owned by a Family Bank Trust will ultimately pass income tax-free to beneficiaries. In addition, the money that one gifts to the trust to pay premiums may be sheltered from gift tax and will reduce one's estate for estate tax purposes. Furthermore, life insurance policy cash values grow on a tax-deferred basis and the death benefit of a Family Bank Trust-owned policy will be sheltered from estate tax. What are the Profiles of One Who Needs a Family Bank Trust?

In next blogpost, we will introduce a case study - how a family bank trust works for someone. What is a Family Bank Trust?

A Family Bank Trust is a form of irrevocable life insurance trust; also known as a Generation Skipping Transfer Trust or Legacy Trust. The trust allows its creator to minimize transfer taxes and maximize the legacy left behind to children, grandchildren and future generations. The Generation Skipping Transfer Tax (GSTT) applies to both outright gifts and transfers in trust to either related persons who are more than one generation below the donor or to an unrelated individual who is more than 37½ years younger than the donor. Now that the estate, gift and GSTT exemption amounts are unified at $5.43 million for 2015, with proper planning significant amounts of wealth can be transferred without transfer taxes being imposed. Why a Family Bank Trust? A Family Bank Trust can help accomplish multiple goals:

In next blogpost, we will discuss how life insurance play a role in a family bank trust. People who can most benefit from legacy building are those usually within retirement age that have dormant assets. These are typically assets they plan on leaving for heirs, a church, charity, or possibly to help pay educational costs for grandchildren.

These assets are often held in low interest-earning accounts or vehicles, which may not be an efficient method of wealth transfer for the purpose of legacy building. These “legacy assets” may be leveraged into a greater benefit and a more efficient method of wealth transfer using life insurance. Let’s take a look at a typical profile:

Usually, there are two types of people - those fully committed to the strategy and those who are committed now but may want to change their strategy down the road.

Why life insurance?

First, having a will in place is crucial. A will allows one to control how and to whom assets are distributed, and it can be used to suggest a guardian for the care of children or other dependents. Without a will in place, state inheritance laws could determine how one's property is distributed, and even who should care for your children. Having a will helps to ensure your wishes are met. However, even with a will, assets may not always transfer immediately to beneficiaries. There are many circumstances that can impede the process - the most common being probate court. Debt, funeral expenses, and the care of dependents could all be hanging in the balance during a potentially lengthy court process. At the time of death life insurance can provide generally tax-free access to the death benefit proceeds - helping to give beneficiaries the financial support they may need during a difficult time. Life insurance may help create a solid estate plan that allows one to not only preserve what they have now, but also build their estate throughout their lifetime. Good estate planning works to help protect assets while also considering other factors, like outpacing inflation and growing the estate value. How does it work? Estate planning is a complex process and should be done in collaboration with other professionals you may work with (e.g. attorneys, accountants, trust officers, etc.). An in-depth analysis of personal and professional assets can help determine what will best benefit the estate. Plans for the allocation of different types of property can be constructed, as well as a life insurance policy to provide a liquid asset in the form of the death benefit proceeds. A popular method is to use a joint survivorship life insurance policy. This type of insurance policy can insure two lives under one policy for a low cost and provides death benefit proceeds when both insureds have died, providing financial support to those who need it. The beneficiaries are typically children, a charity , an organization or a trust. The death benefit can also be used to help pay taxes on sizeable estates upon death. In last blogpost, we divided the retirement life into 3 phases, now we will introduce a blend and customize strategy for asset distribution in retirement time.

The blended approach of strategies, customized to suit each person's situation, when combined with insurance strategies, provides a better outcome. It is essential to:

The portfolio created for a retiree factoring in the above methods should be designed to generate about 6% income for the go-go phase and provide about 4% income for the slow-go stage. In last blogpost, we showed 5 typical distribution strategies.

None of the distribution approaches provides optimized outcomes for the majority of retirees. Instead, an enhanced strategy that recognizes the three phases of retirement should be adopted: 1.The go-go phase: Early years in retirement are when people are very active. It includes much travel and acquisition — buying a new toy such as a boat, etc. 2.The slow-go phase: Typically, in the middle years, people are settled and mellow out. 3. The no-go phase: In this phase, the retirees could require much caregiver help, long-term nursing home care, and includes the final act of passing away. For different reasons, phases one and three are each more expensive than phase two. Therefore, using the 4%, fixed-percentage, fixed-dollar amount, systematic withdrawal, or bucket plan methods mentioned before do not work as they do not alleviate all the risks optimally. Based on the above design of retirement phases, a blend and customize strategy will work the best, as explained in the next blogpost. The distribution strategies retirees use typically falls into one of the following five approaches:

4% rule: Withdraw 4% of your account balance initially and adjust that dollar amount for inflation annually. (Given low-interest rates these days, it is questionable if this rate is even sustainable.) Fixed percentage: Withdraw the same rate annually based on prior year-end values. Fixed-dollar amount: Withdraw a set dollar amount every month or year. Systematic withdrawals: Withdraw only interest and dividend income leaving principal intact. Bucket plan: Hold some assets in cash equivalents, some in fixed-income, and some in equities filling the cash bucket when low from the fixed-income bucket or the equities bucket, depending on which is appropriate. These methods are vulnerable to factors including market volatility, low-interest rates, inadequate savings and investments in place. Then there’s the possibility of retiring too early, living too long, risk-tolerance mismatch, inflation risks, unknown tax consequences and out-of-pocket health care costs. So, how to develop an optimized distribution strategy in retirement? Focus on the amount of income needed in golden years is the way to go. See next blogpost for more details. New presidents typically make their mark on the tax code, and the estate tax is a likely target for Biden. The effect of taxes on estate planning stretches beyond the estate tax. Wealthy and Affluent families have different goals and may need different strategies.

If you believe the above statements, this article at ThinkAdvisor.com has a good discussion about various strategies the wealthy and affluent families could consider, now, in order to deal with the potential tax code changes. Only about 4% of retirees make the optimal Social Security claiming decision. This results in a loss of wealth of roughly $2.1 trillion for current retirees that made a suboptimal claiming decision.

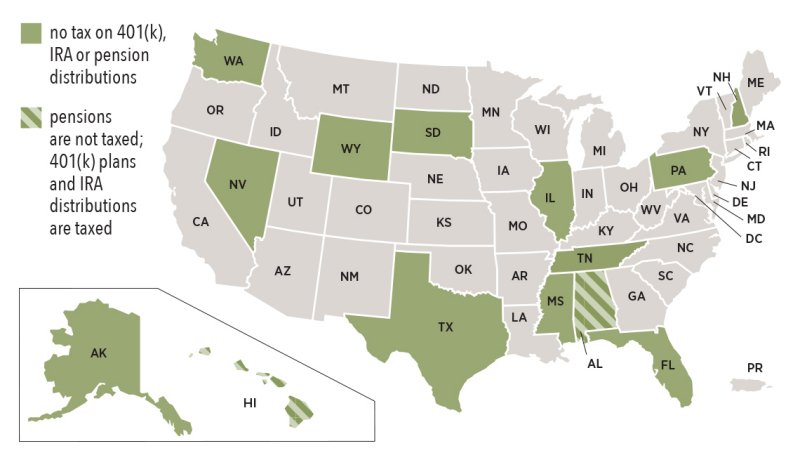

The above is quoted from an article at ThinkAdvisors.com, it thoroughly discusses how to evaluate the social security claiming decision. Below is an example in the article that clearly explains how to approach such an evaluation: ======================= By delaying claiming from age 69 to age 70, the healthy client may forego $30,000 in income for one year in order to receive an additional $2,400 in annual income for life starting at age 70. What is the value of this income? Simply multiply the survival probability by the present value of the payment. The value of a monthly payment during the 75th year of age for a man is about $2,250. It’s about $1,500 for his 85th year and $470 for his 95th year. In total, the present value is $44,700, or nearly 50% higher than the income he gave up. For a woman, the present value is $48,500, or 62% higher. Put another way, the healthy female client can gain $18,500 in expected retirement wealth by simply waiting a year to claim. ======================== Some states with low or no income taxes have higher property or sales taxes. For example, while Illinois does not tax retirement income, it has one of the highest sales and property taxes in the U.S.

Other low-tax states may have fewer programs that you might find helpful, such as senior centers and public transportation. By using substantially equal periodic payments from a retirement account–more formally known as a rule 72(t) distribution–savers under 59½ can avoid paying the 10% penalty on early withdrawals. These can be taken from traditional or Roth IRAs.

With this type of distribution, account holders must take at least five substantially equal periodic payments, and these distributions must occur for either five years, or until the owner reaches 59½, whichever is longer. That means someone who starts a 72(t) distribution at age 52 must take withdrawals for seven years, while someone who is 57 would have to make withdrawals until age 62. Rule 72(t) distributions are viable options for people who need access to their money, but they are complex calculations with rigid distribution rules. There are three ways the Internal Revenue Service allows individuals to calculate these distributions. The first is the required minimum distribution method, which takes a person's balance, current interest rates and divides it by his or her life expectancy. Each year it is recalculated based on life expectancy and current balance. The other two methods are a fixed amortization method, which annually distributes by amortizing the account balance over life expectancy, and a more-complex fixed annuitization method, which uses a person's account balance, age and life expectancy and an annuity factor. Distributions are bound by the prevailing interest rate, so a lower rate means lower payments. For example, if the IRA is $1 million and the retiree needs $750,000, rather than drawing down the total amount, she recommends opening a second account to represent the 72(t) distribution, in this case $750,000, and leave the $250,000 in the original IRA. Although the retiree will avoid a penalty, he or she will still need to pay taxes on the distribution amount. Once rule 72(t) distributions are put in motion, they can't be undone. Workplaces that offer 401(k) and similar accounts allow employees under age 50 to save up $19,500 tax-deferred in 2021, while those over 50 can contribute $26,000. However, some employers have a provision in their 401(k) plans that allows workers to contribute after-tax money to their qualified plans.

For plans that allow voluntary after-tax contributions, the combination of employee and employer contributions can total up to $58,000 for people under 50 and $64,500 for those over 50. This is a way to really turbo-charge your savings! Although the employees need to confirm with their workplace if this is allowed. Here's how it works.

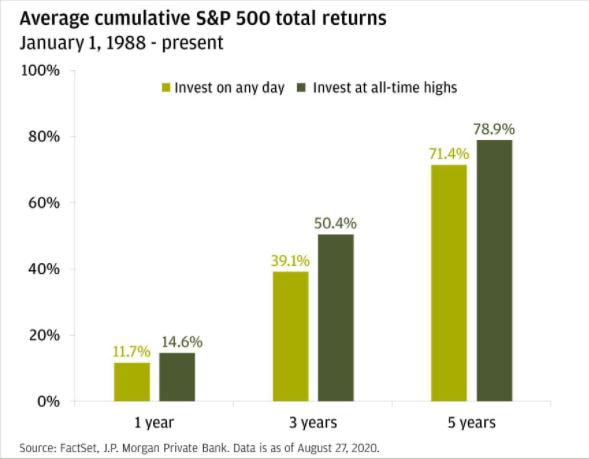

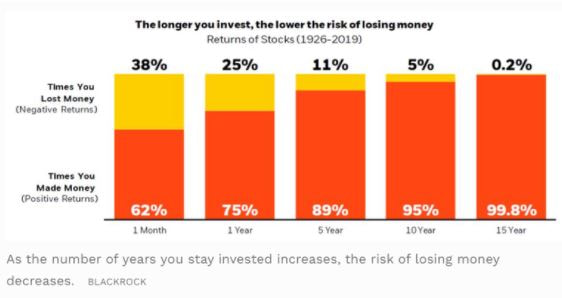

There are three benefits to putting after-tax money in a 401(k) if allowed. 1) After-tax contributions can be withdrawn if needed without facing any tax penalty 2) They get the same retirement plan protection as pretax money 3) The money can be rolled into a Roth IRA without further taxes Some plans allow those after-tax contributions to be immediately rolled over to a Roth conversion, commonly referred to as a "mega Roth," but these in-service withdrawals aren't common. However, employees who leave their firm can roll those after-tax contributions into a Roth IRA at any time. Most people realize trying to time the market by always buying low and selling high isn't a realistic endeavor. Yet even with that knowledge, if you have a substantial amount of cash to invest, the thought of investing when the stock market is hovering near all-time highs may give you pause. Similarly, when facing the opportunity to 'buy the dip' (remember March 2020?), few investors have the stomach to do so. However, historical data shows that investing cash when the market is high is likely to produce even higher future returns. Don't believe it? See the chart from J.P. Morgan below - investing on days where the S&P 500 closed at a new all-time high can actually produce better returns than investing on a day where the market didn't set a new record. Furthermore, history shows as the number of years you stay invested increases, the risk of losing money decreases. This is why we call it long-term investing. Don't believe it? See the chart from BlackRock below. Finally, in the last 20 years, 70% of the best days in the market happened within 14 days of the worst ones. You can't get one without the other. But if you try to time it, it can cost you dearly. So if you're afraid to invest because the market is up or down, consider the cost of missing the best days. Deciding whether or not it's a good time to invest shouldn't have much to do with recent market conditions. See the chart from JP Morgan below as a proof.

The meaning of the letters from A to Z are shown here:

A narrow but far-reaching federal tax law change tucked inside the 2020 year-end omnibus spending and coronavirus relief bill applies some new math to the interest rates used to define certain life insurance policies. The updates—enacted as part of the Consolidated Appropriations Act, 2021 (H.R. 133)—could usher in a healthier sales environment for life insurers and a higher savings opportunity for consumers, experts say.

The reduction in the interest rate in 2021 to 2 percent and then a floating rate after 2021 will allow a higher cash value increase and a better internal rate of return on cash value policies. Below are two articles that discuss this profound change that would impact cash value life insurance policies. lifeproductreview.com/2021/01/05/257-the-section-7702-christmas-miracle/ https://www.investopedia.com/small-tax-law-change-may-have-big-impact-on-life-insurance-sales-and-values-5097046 For people who seek a retirement income stream now from a selection of payout options, SPIA (single premium immediate annuity) is a good choice.

There are many benefits: Multigenerational income strategies. Non-spousal joint life payouts. Corporate and trust ownership. That’s just three benefits, there are more as the flyer shows below. HSAs offer rare triple-tax advantage status. Rather than using HSA funds to pay for medical bills today or in future retirement, they can be used some other creative ways.

Medicare and COBRA Premiums HSA funds can pay for Medicare Parts A, B, and D as well as copays for Part D. Medicare HMO, Medicare Advantage and MAPD plan premiums are also eligible for reimbursement. However, HSAs cannot help with Medicare Supplement Plan or Medigap premiums. Married couples may run into trouble when they go to reimburse for such premium expenses in the account owner isn't also the spouse who is going onto Medicare or they are not yet yet 65 because while HSAs can normally be used to pay expenses incurred by the acount owern's spouse or dependent, Medicare premiums aren't considered an eligible expense unless the account holder is 65. Long Term Care Premiums HSA funds can be used to cover premiums for long term care insurance. To qualify, a policy must provide coverage for only long term care service and kick in if assistance is needed with at least two daily living activities or if they suffer cognitive impairment. If you plan to self-fund long term care, you can tap HSA funds to pay for such expenses as they occur. Non-medical Expenses If you need funds to cover living expenses after a job loss, can you use HSA? Yes, you can if you have unreimbursed past health care expenses. As long as you have an open HSA when you incurred the medical expenses and haven't yet tapped it to cover the cost, an amount equal to that bill can be withdrawn at any time and used for any purpose. You can claim back to 2004 when HSAs were first introduced. Without a will or estate plan, state law dictates how your assets are distributed after you die. Not only can this be a costly process in many cases, but it can also be a giant burden on the heirs during a time of grieving and sadness.

With a will, the court-supervised process will pass your assets through a will (if without a will, through state law), and it can still be time consuming and expensive. With a trust (the most common is a revocable living trust), you can not only avoiding probate but ensuring your assets go to the people you choose. In Short With a will, the executor is just kind of an administrator who transfers assets from one person to another. With a trust, a trustee is more of a decision maker, they stand in your shoes and make decisions you would want to make if you were still around to make them. In last blogpost, we discussed loans could avoid paying taxes. But why you have to take a loan from your own money?

First, because of the tax advantages we just discussed in last blogpost. Second, it is actually not a loan from your own money, it is a loan from the insurance company. It will use your policy's cash value as a collateral, therefore even with a loan, you will not see your cash value decrease, it will continue to grow tax-free. The only values that are reduced on the ledger when loans are taken are the surrender value and the death benefit, because the "lien" assessed against those two values. Third, insurance carriers would charge an interest rate for the loan, but all the gains the insurance companies get from all the loans will be distributed back to the shareholders, this is very important because for whole life participating policies, the policy owners are also the shareholders of the insurance company! Let's say you pay premium of $1,000 per year into a permanent life insurance policy. In year 20, and after paying $20,000 in premiums, the cash value has grown to $30,000. How can you gain access to the $30,000?

One way is to cash it out. You can simply ask the insurance company for your money back and the insurance company will send you the check. However, that is not the only thing that will be sent to you. A 1099 will also come that will lead to income taxation on the $10,000 you took out above and beyond what you put in. If you don't want the 1099 to come, what can you do? Take a loan against the policy. Note a loan is not a "withdrawal", because loans are not taxable and withdrawals above basis are. When was the last time you went to get an auto loan and received a 1099 on the amount you got from that bank? Never. Based on the IRS section 7702A, it says loans are not treated as distributions under Section 72, therefore policy loans are not taxed assuming the policy is not what they call a MEC. Next blogpost, we will discuss why you have to take a loan from your own money. |

AuthorPFwise's goal is to help ordinary people make wise personal finance decisions. Archives

September 2022

Categories

All

|

RSS Feed

RSS Feed