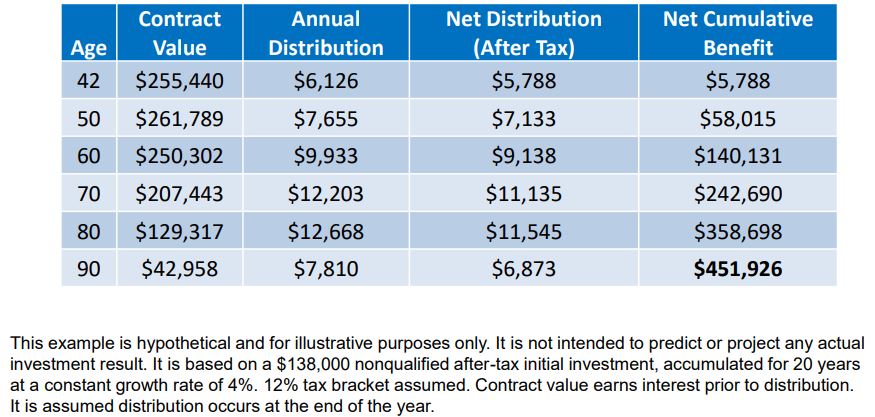

An index universal life insurance (IUL) policy can help provide tax-free income over time allowing you to withdraw cash value or borrow against the policy for any reason.

Watch the “Road to Retirement” video below to understand how the modern day life insurance can be an important destination on your retirement journey – providing an extra source of cash while you are living.

RSS Feed

RSS Feed