|

Q. Which term life product includes free living benefits riders?

A. Most of term life products do not include free living benefits riders. AIG's recently introduced QoL Flex term product is an exception - it includes 3 free living benefits riders (terminal illness rider, chronic illness rider, and critical illness rider), and its premium is still very competitive when compared with the regular term life products. You can click here to visit the QoL Flex term life product page from AIG Direct, it provides a lot details about this product, after reading it, you will have a pretty good idea whether this is the product you need or not. Here is its quoting tool, you can play around with different coverage amount, term length, and health conditions. Q. Which passive funds had the best 10-year return record?

A. Financial Planning magazine has an article that puts together a list of 20 of the best-performing passive funds over 10 years. The average annual return for these 20 passive funds was 12.6%, while the S&P 500 posted a 7.6% annual gain during the same period, as measured by SPY, the biggest S&P 500 ETF. Over three years, the average return of these 20 funds was 13.1%; for SPY, it was 11.6%. Q. Is it possible to use my 401K savings to pay for life insurance premiums?

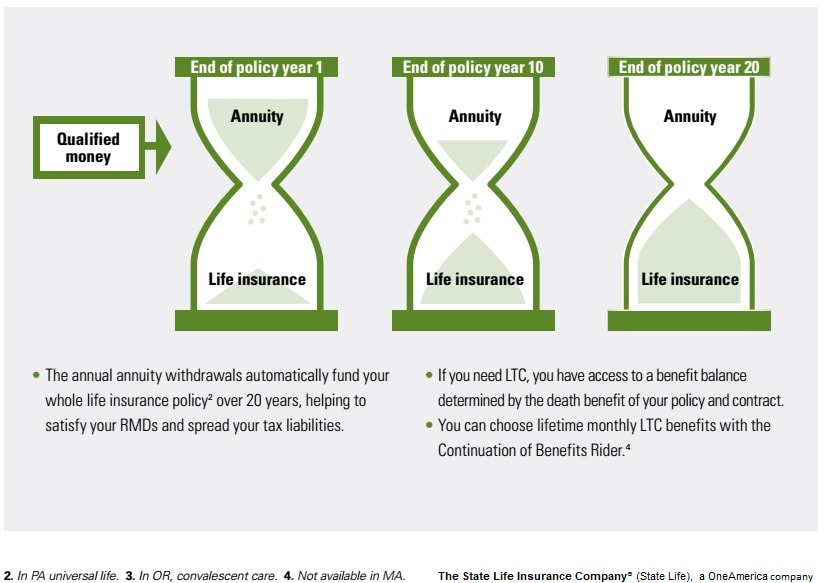

A. Yes, you can. For many savers, their largest asset is their retirement account. Some life insurance policies allow you to rollover a portion of your retirement account, such as an IRA or 401(k), to an IRA deferred annuity. Then, from that IRA annuity a withdrawal is taken annually to fund the life insurance policy. These annual withdrawals defer taxes and still meet your Required Minimum Distributions (RMDs). If your life insurance has living benefits riders, you also effectively have a long term care protection which many seniors likely will need. Q. Is Bitcoin a scam or a legit investment tool? A. How about hear from experts talk about cryptocurrency, from why it’s impossible to value to why people choose Bitcoin over gold? See a Youtube video by Scott and Aswath Damodaran discussing these topics below. You can use the Fidelity personal finance checkup tool to do a finance checkup - in 10 minutes or less, you can get your score (1-100), find out how you're doing, and leave with a plan.

Are you investing your 401k money the right way? See the common mistakes below -

The vast majority of Americans with access to 401(K) plans use them, but nearly as many don’t use them correctly.

Q. How do I know if a robo-advisor is right for me? A. If you can understand Chinese, below is a great video that analyzes all the aspects of robo-advisor trends and helps you determine whether a robo-advisor is right for you or not. If you don't understand Chinese, that is fine too, because the content is entirely in English. Q. What are the best ways to limit my tax burden in retirement time? A. Morningstar shared these 5 strategies to minimize tax in retirement, they include: have a flexible withdrawal strategy, diversify across account types, and develop a targeted Roth conversion schedule, ... Q. I am done with collecting judgement, what do I need to do now?

A. Within 14 days of the judgment being fully paid, the judgment creditor must file an Acknowledgment of Satisfaction of Judgment (EJ-100) with the clerk. The judgment creditor may be liable for $50 plus actual damages for failing to file the Acknowledgment of Satisfaction within 14 days of receiving a written demand to do so from the judgment debtor. Q. How do I recover the cost associated with collecting a court judgement?

A. A judgment creditor is entitled to recover certain costs incurred in enforcing a judgment. The judgment creditor is also entitled to claim 10% simple interest on the principal amount of the judgment. Costs must be added to the judgment within two years of incurring them. Interest may be added at any time. Accumulated costs and interest are added to the judgment by filing a Memorandum of Costs After Judgment, Acknowledgment of Credit, and Declaration of Accrued Interest (MC-012) with the clerk. Complete the form and have it sent by first class mail or served personally on the judgment debtor by a non-party to the action who is at least 18 years of age. After serving the judgment debtor, file the original with the clerk. Q. How to garnish a debtor's rental income after winning a court judgement?

A. If the judgment debtor owns rental property, you may garnish the rents paid by the current tenants. The procedure is the same as wage garnishment, except you instruct the Sheriff's Department to do a rent garnishment instead of a wage garnishment. There is a fee for the Writ of Execution and for the Sheriff's Department to serve the rent garnishment. Q. How to place a judgement lien on a debtor's real property?

A. If you have won a court judgement, you can place a lien on the debtor's real property:

Q. How to do Till Tap or a Keeper's Levy after winning a court judgement?

A. If the judgment debtor owns a business that has a cash register, you may arrange for a Deputy Sheriff to go to the business and do either a Till Tap or a Keeper's Levy.

Certain money is exempt from levy, such as child support payments. If the judgment debtor files a Claim of Exemption from the levy, you will be notified and will have an opportunity to oppose any claim of exemption. Q. How do I levy bank funds after winning a court judgement?

A. If you know the bank and branch where the judgment debtor (or spouse) has a deposit account, you may levy the funds in the account. To begin this procedure, you must file a Writ of Execution (EJ-130) and pay the fee with the clerk. Once the clerk has processed the writ, take the original writ to the Sheriff's office and request a bank levy. After the Sheriff's Department serves the levy, the bank account is frozen and the account holder is notified. The Sheriff's Department charges a fee for this service. Q. How to garnish wage?

A. If the judgment debtor is employed, his/her wages may be garnished to pay off the judgment. To begin the wage garnishment process, you should do the following:

Q. I won a court case, but I don't know where a debtor's assets are, what can I do?

A. If you do not have any information about the judgment debtor's assets, you may file an Application and Order to Produce Statement of Assets and to Appear for Examination (SC-134) with the clerk.

Q. I am a landlord, I won an eviction case, now how can I collect the money from the tenant who has moved out?

A. The court will not collect the judgment for you. The key to enforcing a judgment is knowing where the judgment debtor's assets are located. Common sources of assets are bank accounts, employment income, rental income, and business receipts. We will answer a few common questions you might face after winning in the court.

If you are interested in One Policy that can help with life insurance, chronic illness coverage & retirement income, please see the innovative product from AIG below - Q. I heard tax diversification, what is it and why should I consider it?

A. There are two main reasons for a tax diversification - First, we don't know what future tax rates might look like (uncle Sam could change the tax rates at any time, for example, as recently as 1980, the top federal marginal income tax rate (TFMITR) was 70%. In 2017, the TFMITR is 39.6%. Second, there are three investment accounts with different tax exposures you could choose from - a) taxable, b) tax free and c) tax deferred. So you need to make a decision about how to allocate your funds in these 3 accounts to maximize your after-tax gains, hence a tax diversification strategy. Investments in taxable accounts that generate interest and/or short-term capital gains are taxed at your income tax rate (top rate is 39.6%), while investments that generate long-term capital gains may be subject to the more attractive top federal capital gains rate of 20%. Investments in taxable accounts that generate dividends are generally taxed at the same tax rate as long term capital gains. For those filing single with an income of $200,000 or more ($250,00 or more if married and filing jointly), your investment gains and dividends may also be subject to 3.8% investment surtax — resulting in a cumulative 23.8% tax. Investments in tax free accounts do not generate taxes. Investments in tax deferred accounts could reduce your taxable income today and may subject your investments to lower tax rates in the future (e.g.: during retirement). Q. Will the income I earn during retirement time affect my social security benefits?

A. The answer is Yes, if you are receiving social security benefits and haven't reached full retirement age (66 for now and 67 later), your social security benefits could be impacted by your earnings. In 2017, if you make more than $16,920, you will lose $1 in social security benefits for every $2 you earn over that amount. In the year you reach full retirement age, you will lose $1 for every $3 you earn over $44,880 before your birthday. Starting from the month you reach full retirement age, your social security benefits will not be impacted by your earnings. However, your social security benefits were not lost forever. Once you reach full retirement age, your social security benefits will be adjusted to recover what was withheld. Nevertheless, it makes sense when you plan your working during retirement time to keep your earnings below the limit or delay claiming social security benefits until you reach full retirement age. Q. What are the state level estate tax rates?

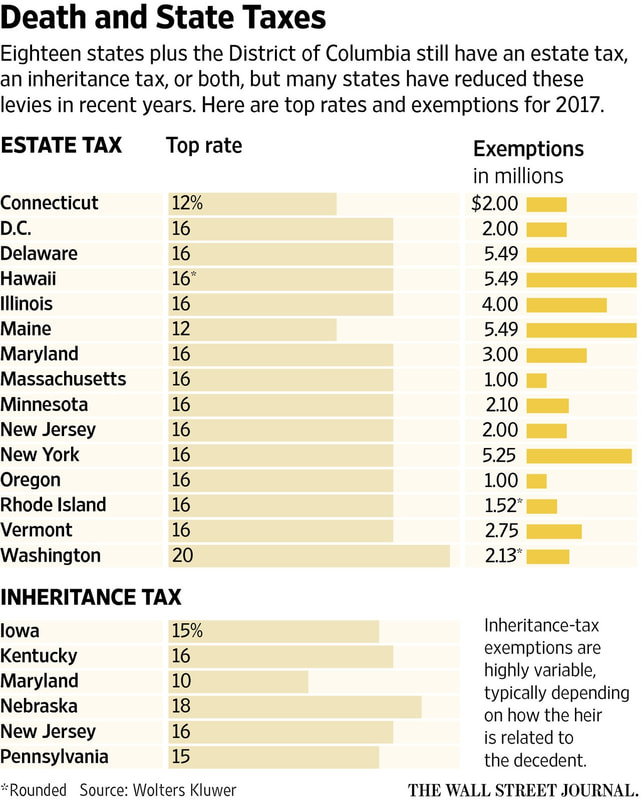

A. Eighteen states plus the District of Columbia still have an estate tax, an inheritance tax, or both, but many states have reduced these levies in recent years. Here are the top rates and exemptions for 2017 - How to deal with the following 3 non-financial retirement risks - excessive giving to adult children, long-term care expenses, and cognitive decline? See the video below. Q. Does social security benefits increase each month after I pass full retirement age? Is the 8% prorated for each month that I delay?

A. Delayed retirement credits are calculated each month you delay taking benefits beyond your full retirement age, which is 66 for people born from 1945 to 1954 and rises by 2 months each year until it reaches age 67 for people born after 1960. You will get an extra 2/3 of 1% of your full retirement benefit for each month you delay after your birthday month, adding up to an extra 8% for each full year you wait till age 70! The clock starts from the month you reach full retirement age. Q. Does 529 plan cover off-campus living expenses?

A. Yes, as long as the student is a half time student, you can withdraw the amount he or she spends on off-campus rent, up to the room-and-board allowance the college includes in the cost of attendance for federal financial aid purposes. You can find the amount from the college's website, or ask the financial aid office, and make sure keep the records of the rent paid. |

AuthorPFwise's goal is to help ordinary people make wise personal finance decisions. Archives

September 2022

Categories

All

|

RSS Feed

RSS Feed