|

The power of life insurance with living benefits!

0 Comments

In our last blogpost, we introduced the concept of Fixed Annuity, now we will specifically discuss the Lincoln MYGA -

In our last blogpost, we introduced Lincoln Finance Group's MyGuarantee fixed annuity, now we will discuss a few general points of a Fixed Annuity:

In next blog post, we will show you more details of the Lincoln MYGA annuity. Q. How can I rebalance my portfolio by adding more bonds but don't get hurt when Fed raise rates?

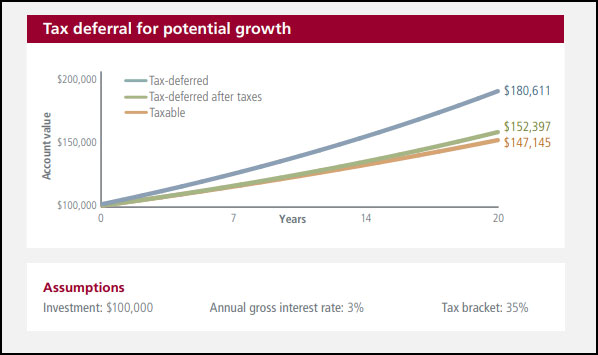

A. With stocks look like to take a downturn, it is natural to move some gains into bonds. However, with interest rates are rising, bond prices will go down which will hurt bond investors' returns. There are 3 options to consider if you want to add bonds to your portfolio - 1. Short-duration treasuries Shorter-dated treasuries may yield less interest than longer-term ones, but they will be safer when inflation rises. Vanguard Short-Term Treasury (VFISX) is a low-cost fund in this category. 2. Emerging market bonds They tend to have higher yields which could help make up for the volatility of their prices. Goldman Sachs Emerging Markets Debt Fund (GSDIX) is a popular option. 3. Municipal bonds If you live in a high tax state, municipal bonds are good considerations because they are less sensitive to fluctuations in interest rates, and their interests are partly tax-exempt. For people who have a sizable amount of money sitting on their CD accounts, this annuity from Lincoln Financial Group - MyGuarantee Puls Annuity (MYGA) - is very simple, and the interest rate is way above the competition for the same surrender period, and certainly way more than any interest rate you could get at any bank. For example, the 5-year MYGA offers a 3.5% interest rate. If you compare that to the big national banks on Bankrate.com, and this annuity beats every one of their five-year guarantees, PLUS you can take out 10% every year penalty-free, let your money grow tax-deferred (unlike CDs), AND there’s no “re-lock” provision on the back end like many other CDs or annuities, you are truly free to do with the money what you want. You can leave it be at the new rates five years from now without locking it back in, or you can take their ball and go home… free and clear… no games. The product brochure is below and in next blogpost we will explain what is Fixed Annuity and why it's better than CD. Q. What is the difference between a longevity annuity and a deferred annuity?

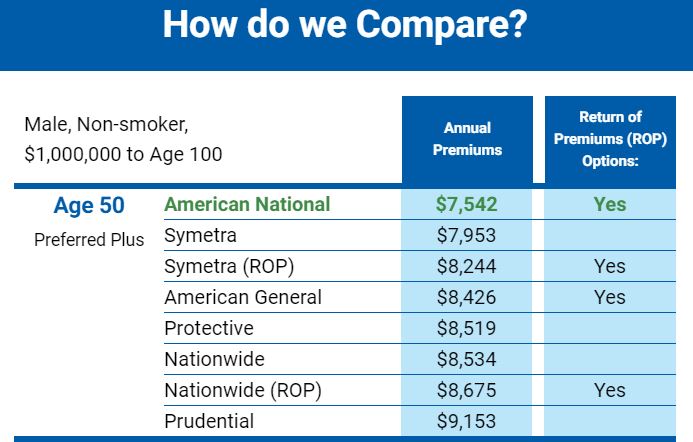

A. A deferred annuity provides for an initial waiting period before the contract can be annuitized (usually between one and five years), and during that period the contract’s cash value generally remains liquid and available. Beyond the initial waiting period the contract may be annuitized, though the choice remains in the hands of the annuity policy owner, at least until the contract’s maximum maturity age at which it must be annuitized. By contrast, a longevity annuity generally provides no access to the funds during the deferral period, and does not allow the contract to be annuitized until the owner reaches a certain age (usually around 85). In other words, many taxpayers purchase traditional deferred annuity products with a view toward waiting until old age to begin annuity payouts, but they always have the option of beginning payouts at an earlier date. With a longevity annuity, there is generally no choice, but this also allows for larger payments for those who do survive to the starting period; as a result, for those who survive, longevity annuities typically provide for a larger payout (often, much larger) than traditional deferred annuity products. Most taxpayers who purchase longevity annuities do so in order to insure against the risk of outliving their traditional retirement assets. The longevity annuity, therefore, functions as a type of safety net for expenses incurred during advanced age. Where a deferred annuity contract may be more appropriately categorized as an investment product, the primary benefit of a longevity annuity is its insurance value. Q. Which insurance company has the best Guaranteed Universal Life product? A. Based on American National's recent study, it appears American National's GUL is the most competitive among the top carriers. See its comparison table below. If you are interested in GUL comparisons, please contact us and we will help you find the best GUL product.

Retirement is an exciting chapter in your life—and maybe you just can't wait to enjoy all your big plans. But can you afford to leave the workforce early? Perhaps. Here are four things you can do to determine if you're in a position to clock out before you turn 65. Plus, what steps you might still need to take to get you there.

The flyer from AIG below shows the Power Series of Index Annuities from AIG that could act as long-term retirement solutions and potentially provide people who prepare for retirement with growth opportunities and protection from market downturns. In our last blogpost, we showed two steps for people who are not qualified for tax-deduction to IRA but still want to have a Roth IRA. Now we will discuss some of the details.

If you don't have a traditional IRA you're still not out of luck. It's possible to open a traditional IRA and make nondeductible contributions, which aren't restricted by income, then convert those assets to a Roth IRA. The only potential issue you may have is tax. If you have no other traditional IRA assets, the only tax you'll owe is on the account earnings—if any—between the time of the contribution and the conversion. However, if you do have any other IRAs, you'll need to pay close attention to the tax consequences. That's because of an IRS rule that calculates your tax liability based on all your traditional IRA assets, not just the after-tax contributions in a nondeductible IRA that you set up specifically to convert to a Roth. For simplicity, just think of all IRAs in your name (other than inherited IRAs) as being a single account. Check out one of our previous blogposts about more details related to Roth IRA conversion. Q. I don't qualify for tax-deductible contributions to IRA, can I still contribute to a Roth IRA?

A. Yes, you can do this in two steps: First, even if you don't qualify for tax-deductible contributions, you can still have an IRA. If you're covered by a retirement savings plan at work—like a 401(k) or 403(b)—and your 2018 or 2019 modified adjusted gross income (MAGI) exceeds applicable income limits, your contribution to a traditional IRA might not be tax-deductible. However, getting a current-year tax deduction isn't the only benefit of having an IRA. Nondeductible IRA contributions still offer the potential for your money and earnings to grow tax-free until the time of withdrawal. Second, you can convert those nondeductible contributions to a Roth IRA.Roth IRAs can be a great way to achieve tax diversification in retirement. Distributions of contributions are available any time without tax or penalty, all qualified withdrawals are tax-free, and you don't have to start taking required minimum distributions at age 70½.5 But some taxpayers make the mistake of thinking that a Roth IRA isn't available to them if they exceed the income limits.6 In reality, you can still establish a Roth IRA by converting a traditional IRA, regardless of your income level. Our next blogpost will discuss the conversion of a traditional IRA to Roth IRA Take this checklist to meetings with your agent or your realtor and don’t settle until all of their answers are to your satisfaction.

1. Can I See Your Real Estate License? No brainer, right? Always ensure you’re working with a trained, accredited professional. Every listing agent should be prepared to deliver proof of their license to sell in your area. If they can’t deliver, move on because something shady is going on. 2. Can You Pass Along a List of Referrals? Like a license, every listing agent—and home buyers’ agent for that matter—should arrive at a first meeting with referrals. If they do not, ask for them. Be wary if an agent can’t offer a handful of client names to call. 3. What Is Your Listings’ Average Days on Market? Always ask to see how long their listings sit on the market. Compare it to other agents interviewed, and if theirs is oddly high, ask for an explanation. If they can’t attest to why, find another agent. 4. What Is Your List-to-Price Ratio? An agent can show the prices at which they list a home, but more important is to see how that compares to the price the homes actually sell—up to date, of course. A good list-to-price ratio will depend on the market and location, but be wary of percentages too far below 90%. Also, if an agents’ ratio is skyrocketing over 100%, be careful of their strategy of underpricing homes to pad the ratio. Request specific details about their motivation for the listing price. 5. Have You Sold Homes in This Neighborhood? Communities differ greatly in terms of what types of homes sell, what buyers want, and more. Plus, to sell a home, agents are also selling the neighborhood and its perks. If an agent has experience in your specific neighborhood, it’s a major advantage. 6. Have You Sold Homes in This Price Range? Price range can dramatically alter decisions for marketing and selling a house.Agents should understand the market, period. 7. How Long Have You Been a Real Estate Agent? Be cautious of new agents, but it’s not a deal-breaker if they have stellar referrals. 8. Are You a Part-Time or Full-Time Agent? Be far more cautious if an agent is part-time. Selling your home needs to be a full-time job, and they should be focused. 9. How Many Sellers Are You Currently Representing? Focus is also a concern for agents who are juggling several listings. You don’t want to get lost in the shuffle. 10. What’s the Ratio Between Buyers and Sellers You Represent? Listing agents need to be experienced in, of course, listing. If history shows far more experience on the buying side than the selling, it’s not a deal-breaker, but be comfortable with an agents’ answers for all of the other questions. It could benefit to have a network of eager buyers at the disposal. 11. Will I Be Working With You Directly or a Team? There’s nothing more frustrating than getting incredibly comfortable with an agent and then seeing someone new at every meeting. A small team is OK—it means more resources and assistance—but get introduced to everyone. Don’t allow your home to be another nameless, faceless listing. 12. How Do You Plan to Market the Home? Every realtor should enter this partnership with a plan—period. 13. Do You Have XYZ in Your Network? Experienced listing agents should, at a minimum, be able to recommend the following: a lawyer specializing in real estate, mortgage advisor, handyman, home stager, house cleaners, and moving companies. Part of the benefit of working with a real estate agent is access to their vast network, Fleishman, explains. 14. How Do Your Realtor Fees Work? No surprises, understand ahead of time how to pay the realtor. Typically listing agents work under split commission. When the seller pays a listing agent, for example, 6% commission, that agent will split it with the agent who brought the buyer to the home. However, fees should always be negotiable. 15. Can You Explain the Home Selling Process from Start to Finish? For home-selling novices, the process can seem long and complicated. Feel comfortable understanding the key points along the way—preparing the home, showings, how to manage offers, home inspections, what happens post-accepting an offer, timelines, etc. A realtor should make you comfortable along the way, though always expect the unexpected. 16. What’s the Best Way to Contact You? A realtor should never be out of touch, within reason. 17. Can I See a Written Comparative Market Analysis? A CMA is step one of determining a price for the house. It examines the neighborhood, showing prices at which similar properties sold. 18. What Price Will Sell This House? The worst thing you could do is overprice a home. No nonsense, a realtor should tell it like it is. If you’ve followed the first 14 checklist questions and chosen someone you trust, now’s the time to listen. 19. What Do You Believe Will Sell This Home? This is the second most important question to ask a realtor. Ditto to question 18. When it’s a trusted relator, this should be easy advice to follow, even if it may be hard to hear—i.e. a remodel, removing all family photos, a new roof, painting over a beloved mural, etc. 20. How Can We Best Work Together to Sell This House? The agent-seller relationship is a partnership. Ask what you can do to help. 21. What Can I Do to Get This House Ready for Showings? Selling a home can sometimes be a full-time job for sellers, too, to keep a house spic and span for home showings. 22. Do I Need Professional Stagers for My Home? A realtor will come up with a plan for showings about how the house should look. That might include professional stagers—which a good agent will provide for free. 23. What Should I Already Be Packing Up? Preparing for a listing and then showing the home will almost always include the sellers removing personal property from the home, whether a professional stager is involved or not. Ask what the realtor believes should go—the clutter of children’s toys, the wall full of family photographs, the bed from a room that will be staged as an office—and get a head start on packing for the move. 24. What Are The Closing Costs? Be prepared for the upfront costs sellers may need when closing on a home offer. The total costs will depend on the buyer’s offer, but an agent should be able to estimate the money sellers need on hand. They can include attorney fees, title fees, broker commission, appraisal fees, and more. Q. Which term life products include free critical illness rider?

A. The following term life products include free critical illness rider in almost all states, except NY -

Prudential's term life product includes free chronic illness rider for NY. Below is a flyer from North American that compares its Builder IUL product against its competitors' IUL products. The flyer below shows you the mechanics of an IUL product's index account - how the insurance company could offer you performance guarantees associated with IUL. The flyer from North American below shows you how its IUL account performed between 2006 and 2017. In last blogpost, we showed you how Indexed Universal Life Insurance works. Below is an article that shows you how IUL's index account works. If you ever wondered how does indexed universal life insurance (IUL) works, below is an easy to understand flyer from North American. In next blogpost, we will show you how IUL's Index Account works.

Meet Carl. He's 65 and a former school teacher. He enjoyed his students. But he is ready to start enjoying retirement now. He's more interested in income certainty than growth. Find out how can he ensure that his money can last from the case study below. Q. What if I over-funded my 2018 Roth IRA?

A. You have several options - Option A. Recharacterization If you qualify for Traditional IRA, recharacterization is a good option, because you don’t lose earnings and the money still goes toward your retirement, and you will get a tax deduction for your contribution. Withdraw Excess Money If you don't qualify for Traditional IRA, you can withdraw the extra contribution and any earnings before tax deadline without penalty. The earnings will be reported as income. Apply Excess to Next Year's Roth IRA Doing this on a future tax return may not let you avoid the 6% tax this year, but at least you will stop paying once you apply the excess.

Q. What are the differences between a life insurance broker and life insurance agent?

A. When you’re purchasing life insurance, you’re obviously thinking about how your loved ones would fare if the worst were to happen to you. It is at this time that you must also consider the differences between an insurance broker and an agent. Insurance Agents vs. Insurance Brokers The main thing to understand is that there is a difference. Some life insurance specialists work only with one company. Such a specialist could be thought of as a “hostage” operator. These are people we commonly refer to as insurance agents. An insurance broker is different. This is someone who is able to work with any number of insurance firms. This person isn’t bound to any one company. They can go out and utilize any company that will allow them to do so. Do You Need to Work With an Insurance Agent or Insurance Broker? Are There Benefits Working With an Insurance Agent? The answer is yes, but only sometimes. Hostage operators can only offer you what the company they work with will provide. Therefore, you might not learn about everything that is available to you. If you’re looking for a specific type of insurance, for example, term insurance, you’ll want to look elsewhere. This is where a life insurance broker will shine. In these cases, an insurance broker, who is an independent specialist, will be ideal for you. That’s because he or she will be able to offer you several different options to choose from. Moreover, you’ll be able to select from a database of insurance companies to find the best arrangement for you. In this situation, an insurance broker will have the upper hand over an insurance agent, or hostage operator. Insurance agents, who work solely with a single company, won’t have the benefit of different companies to offer you. What’s more, very often they can only offer you insurance products which are more costly than the ones you would get from an insurance broker. The article below discusses gifting life insurance. "Family gifting strategies" shows the benefits and considerations one should know when considering using life insurance as a gift for loved ones. North American's ADDvantage term life insurance is now stronger than ever with the addition of critical and chronic illness accelerated death benefits at no added cost — that's added protection, no added premium! These accelerated death benefits can help your clients mitigate the risks and costs associated with major health events.

ADDvantage term is also strengthened with additional features including:

|

AuthorPFwise's goal is to help ordinary people make wise personal finance decisions. Archives

September 2022

Categories

All

|

RSS Feed

RSS Feed