A. Let's look at the upside and downside of this action.

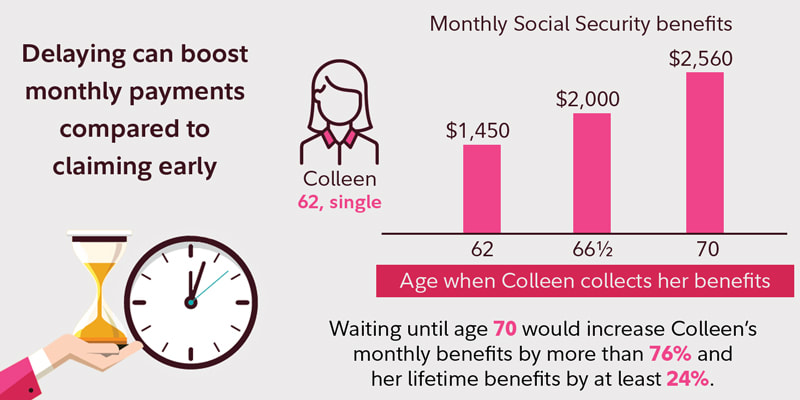

Money withdrawn form a retirement account is treated as taxable income, and you might find yourself in a higher tax bracket as a result. Worse, it could cause you to pay taxes on Social Security or lose deductions you otherwise would enjoy. This is why, in a perfect world, you’d want to carefully orchestrate the timing and amount of annual withdrawals, perhaps even starting before the IRS requires you to do so at age 70½.

The Downside

First, you’ll be making withdrawals sooner than needed, thus paying taxes on that money sooner than needed.

Second, less of your money will remain in the tax-deferred account, meaning less will enjoy further tax-deferred growth.

The Upside

On the plus side, you’ll invest whatever’s left of the withdrawal after you pay taxes on it — and those profits can enjoy capital gains tax rates, which theoretically are lower than the ordinary income tax rates paid on withdrawals from your tax-deferred account. And if you use low-turnover index funds, your taxable account should produce low annual distributions, enabling the bulk of the portfolio to, in effect, grow tax-deferred. (This, of course, does not apply to the interest and dividends produced in the portfolio.)

The Uncertainties

None of the above takes into consideration the impact of generated income on the rest of your tax return, such as the aforementioned implications on Social Security income and taxes, ability to deduct medical costs and other Schedule B items, and so on. Nor does this consider the impact of future tax-law changes.

RSS Feed

RSS Feed