About 75 percent of employers with 401(k) plans offer a matching program. A typical employer match is 50 percent of the employee contribution, up to 6 percent of your salary. So if you have a 401(k), your first retirement-saving priority should be to max out your employer match — it’s free money!

But the 401(k) isn’t the only game in town. If you want to save more than the amount your employer will match, don’t have access to a 401(k), or want to ensure a guaranteed lifetime income, here are three options to consider:

Traditional IRA

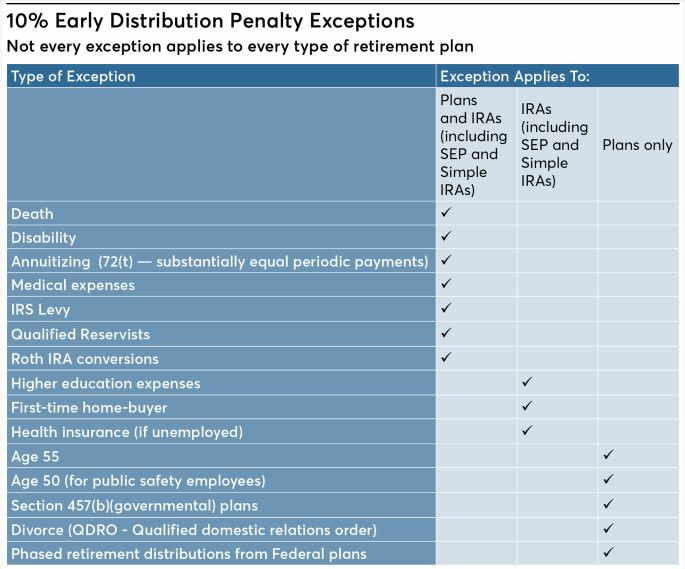

You can contribute up to $6,000 to an Individual Retirement Account in 2019 — $7,000 if you’re 50 or older. If you don’t have a 401(k) or similar retirement account at work, you can deduct your full IRA contribution from your taxes. Married couples can each have their own IRA and can each take advantage of the full combined contribution tax-deferred. As with a 401(k), you’ll pay taxes on contributions and earnings when you withdraw funds. Also like a 401(k), you’ll pay an additional 10 percent penalty if you withdraw funds before 59½. A traditional IRA is subject to required distributions after age 70½ and you can’t make additional contributions to your account once you reach that age.

Roth IRA

Roth IRAs have the same contribution limits as traditional IRAs. You can’t deduct Roth IRA contributions from your current taxes, but you can withdraw both contributions and investment earnings tax-free after age 59½ if the account is at least five years old. Unlike a traditional IRA or 401(k), there’s no penalty for withdrawing contributions before 59½, although there is a 10 percent penalty on early withdrawal of account earnings. Unlike a traditional IRA, you’re not required to withdraw funds by 70½ and you can even keep contributing to the account after that age. You can contribute to both a traditional IRA and a Roth IRA, but your total contribution can’t exceed the annual limits set by the IRS.

Annuity

One key thing 401(k)s and IRAs (excluding annuities) have in common is that when your money is gone, it’s gone. Annuities, on the other hand, provide insurance against the risk of outliving your money after you retire, and may also provide protection from loss due to market downturns.

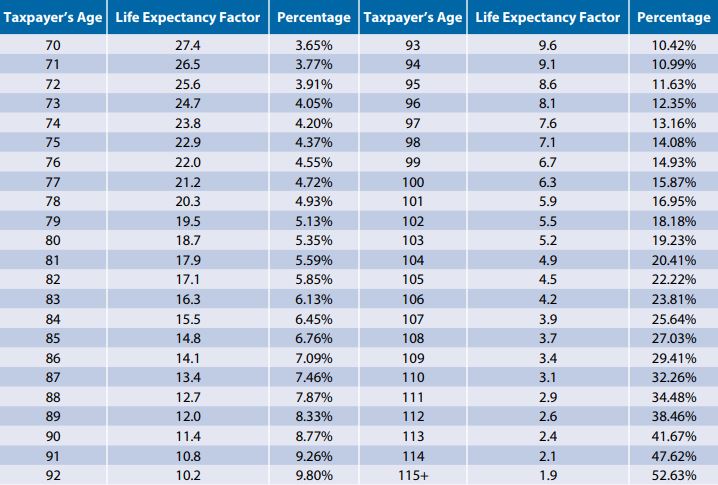

Life expectancy has been increasing, with the average 65-year-old expected to live to about age 84 for men, age 86 for women, and age 90 for at least one member of a married couple. And while most of us probably won’t live to be 100, about three percent of 65-year-old men and six percent of 65-year-old women can expect to see the century mark. Whether you live to be 80, 90 or even 100 and beyond, it’s important to consider an annuity that guarantees an income for life.

RSS Feed

RSS Feed