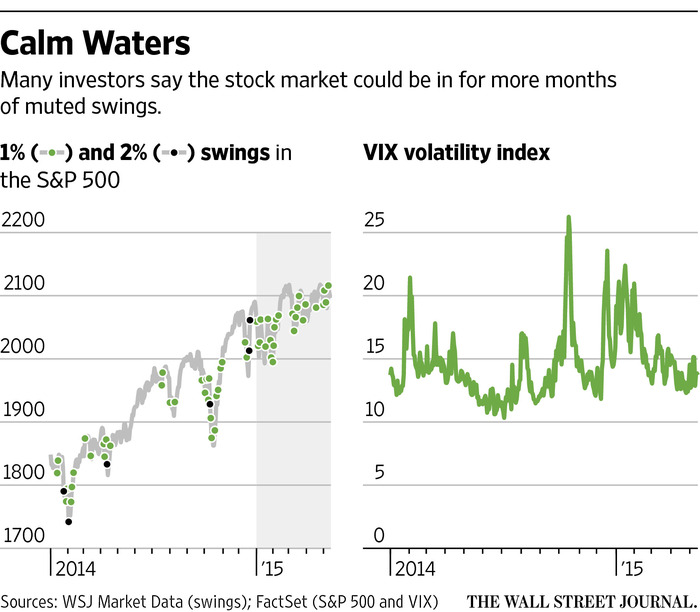

A. One popular measure of stock market volatility is VIX.

How to Measure Market Volatility

VIX is calculated in real time, it measures investors' sentiment by tracking how much they are paying for "out of the money" options, mostly puts rather than calls, because in the marketplace, puts activity far outweighs calls as investors' main concern is downside risk protection.

When investors' fears increase, they are willing to spend more on out of money puts, just like any type of insurance, when the purchaser feels the risk is imminent, he or she is willing to pay a high premium for insurance protection. The higher the VIX, the more fear investors have that the market will drop.

The VIX is normally around 20, but in panic times, it could shoot up to 80.

How to Deal with Market Volatility

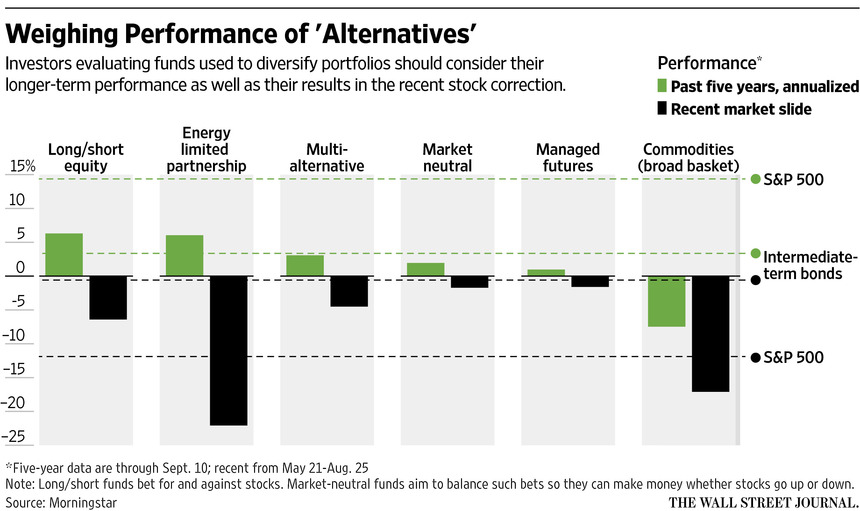

If you sense the market's fall is imminent, you could purchase "out of money" puts to protect the downside risk. Out of money means the premium tends to be not too high. If the market does fall significantly, you will profit from the puts. If the market doesn't fall much or not falling at all, your puts will expire worthless, but your core holdings will not suffer, which is the main purpose - spend little money to protect the core investments.

RSS Feed

RSS Feed