|

Fidelity's sector portfolio managers share some of their highest-conviction investing ideas for the coming year to uncover some of the best thematic opportunities within their sectors in 2020. Some themes, such as the arrival of 5G technology, will likely span across the equity market, while others are more specific to certain sectors or industries.

0 Comments

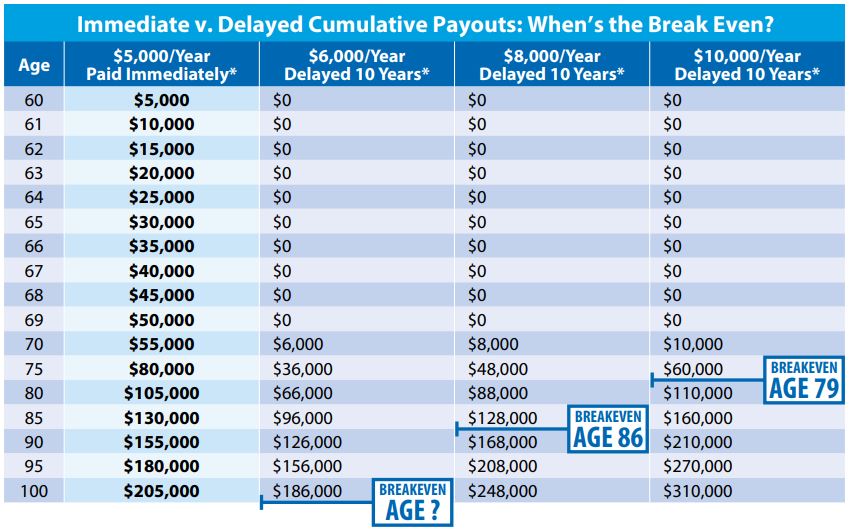

Planning retirement income? How do you size up payout delay versus starting right away? The following table compares a few different scenarios and shows you the breakeven years given different income streams -

Q. I am a solo ager with no spouse and no children, where could I get help to manage my finances when I couldn't?

A. There are 3 options a solo ager faces when protecting finances: 1. Use a trust You could set up a living trust and put all the assets into it. You could be your ow trustee, or name a relative or a financial institution as successor trustees to take over if necessary. Eventually, the institution would handle all your bills and investments, the advantages are professionalism, experience, and guidance offered by experts, but the con is it will not be cheap, as traditional trust companies only serve clients with several million dollars, even mainstream financial institutions such as Fidelity, Schwab and Vanguard would charge a few thousand dollars a year. 2. Use bill pay services You could find bill-paying service companies for day-to-day money management, then hiring accountants and attorneys to make bigger financial decisions. You can find such service companies through the American Association of Daily Money Managers (aadmm.com), or SilverBills who would review bills and authorize payments for a flat monthly fee starting at $99. 3. Do it yourself While you are still capable and independent, you can do all these by yourself, but you need to start thinking the time when you couldn't. Q. What's the best way to choose medical part D plan?

A. Those eligible for Medicare have 2 options: A stand-alone Medicare Part D prescription drug plan or an "all-in-one" approach with a Medicare Advantage plan. Here we will focus on Medicare Part D. There are two scenarios when you consider Medicare Part D: 1. If you currently take prescription drugs Not all Part D plans are created equal. Each plan varies in terms of cost, the drugs covered, special rules, and so on. Just because a friend or family member's Part D plan works for their needs doesn't mean it will work for yours. Instead, do some homework. Here are 5 simple steps to get started.

2. If you currently do not take any prescription drugs Even if you don't take prescription drugs currently, if you need them later and you try signing up for a Part D plan late, you could face a penalty of 1% for each month you went without coverage. Not having Part D coverage could be a costly—and long-term—mistake. You should consider enrolling in a Part D prescription drug plan as soon as you become eligible for Medicare (unless you have creditable drug coverage such as from an employer health plan), regardless of your current prescription drug needs. Do you want to live longer and healthier? Recent scientific studies revealed 3 easy ways -

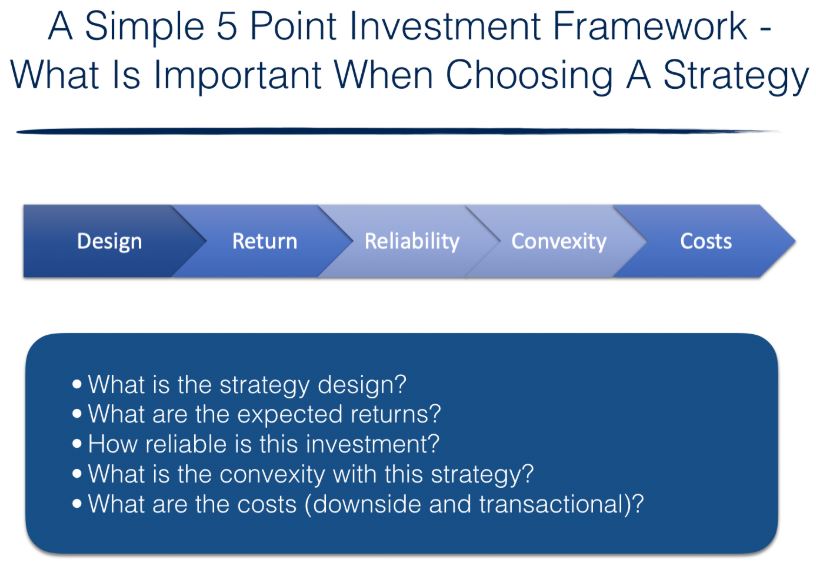

1. Spend 2+ hours each week outdoor In a recent study of nearly 20,000 people in England who had reported how long they spent in natural environments in the past week, plus their health and well-being, researchers found that spending just 2 or more hours outdoors was associated with consistently higher levels of health and well-being (even after controlling for the health benefits that might otherwise be a byproduct of the physical activity that happened to be outdoors). 2. Surround yourself with plants In a mega-study of more than 8 million people (!) across seven countries, a recent study conducted in collaboration with the World Health Organization and published in Lancet Planet Health (that itself was a meta-study of 9 separate longitudinal studies over long periods of time) found that “when you are exposed to greenery or greenness around your home, your probability to die… is less compared to those with less green-ness around their home”, and specifically that for every 10% increase in vegetation within 1,600 feet of the home, the probability of death drops by 4%. Notably, the green space could be grass, trees, or gardens, public or private, and held up in every country measured. 3. Be kind to other people Recent research from the book “The Five Side Effects Of Kindness” finds that being kind to another person, even just in a small way, appears not only to help others but to be good for our own health, slowing the body’s aging process by reducing free radicals and inflammation through the release of oxytocin. In addition, oxytocin triggers the release of nitric oxide, which dilates blood vessels and reduces blood pressure (protecting the heart). And other research finds a link between compassion and activity of the vagus nerve, which regulates heart rate and controls inflammation levels. In fact, one study found that even just meditating on compassionate thoughts towards yourself and others (even people you dislike!) stimulates the parasympathetic nervous system and elevates the levels of dopamine (the feel-good hormone), resulting in increased positive feelings, well-being, and social connections. Enjoy this article from UBS below ... Q. How to ensure an investment strategy is sound? A. You can use the following 5-point checklist to make sure the investment strategy is a sound one.

Q. What's the most economical way to protect my estate, especially it's not much?

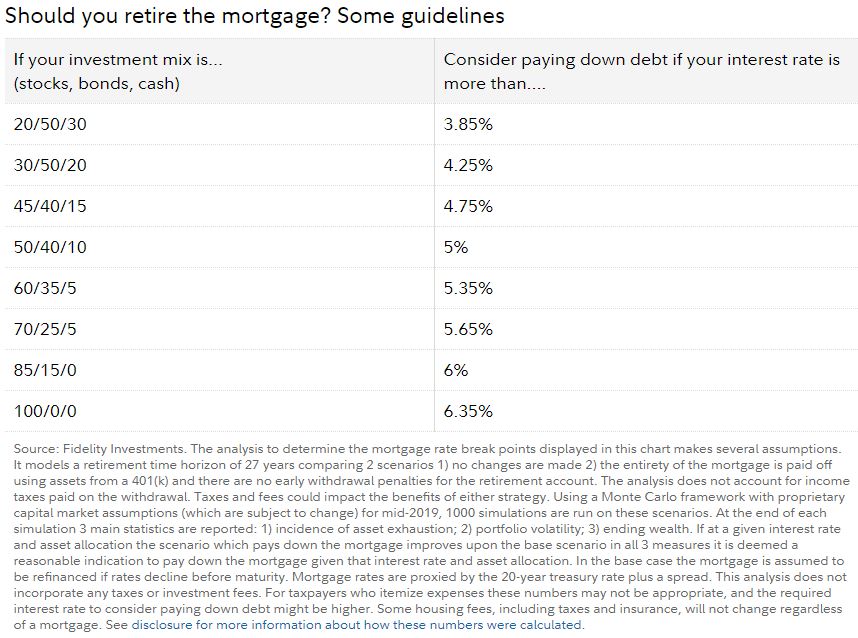

A. You likely have money, property and other items of value that you plan to leave to loved ones or charity. Here are 4 steps you can help yourself and your parents avoid becoming victims of inheritance theft: 1. Prepare an estate plan. Documenting your desires for the disposition of your assets is the first step in preventing people from claiming you made verbal promises to them. Hire an estate attorney that you’ve vetted personally or who is referred to you by a trusted source. 2. Choose a trusted friend or family member to serve as your executor and/or trustee. Don’t use an attorney, bank or trust company as executor or trustee because they typically charge exorbitant fees, often as a percentage of the estate’s value. And they can be difficult or even impossible to fire. And to help make sure the trustee follows your instructions, distribute copies of your will and trust documents to all of your heirs. If you feel uncomfortable letting others see your plans, require your executor or trustee to retain the services of an estate attorney (at your or your estate’s expense) to oversee matters. Instruct that the attorney be paid on an hourly basis rather than as a percent of the estate’s value. 3. Keep all your legal and financial documents in a safe place, This could be a safety deposit box or a fire-resistant home safe. Create digital backups. 4. If you make changes to your documents, inform all concerned. And that includes your independent, objective, fee-based financial advisor. Q. What factors should I consider if I should prepay mortgage or not? A. You need to consider your portfolio mix when you consider whether to prepay mortgage or not. Below is a guideline from Fidelity - Case studies:

Let's take a look at a hypothetical example. Say Joan is 10 years into a 30-year mortgage with an interest rate of 4%, an outstanding balance close to $275,000, and a monthly payment of about $1,300. She is approaching retirement and trying to decide if she should use her savings to pay off the mortgage before she stops working. Let's say Joan is a conservative investor—she holds about 20% of her portfolio in stocks, about 50% in bonds, and 30% in cash. If she prepays her mortgage, our estimate indicates she will end up improving her financial condition by reducing the risk of running out of money in retirement by about 10%, and improving her final balance by about 3% on average. But what if she was a more aggressive investor and held 70% of her portfolio in stocks and 25% in bonds and 5% in cash. According to our estimates, if Joan decides to prepay, she would still reduce her risk of running out of money. But in terms of wealth, the outcome would likely change: Instead of increasing her final balance, prepaying the mortgage would actually hurt her wealth. Because her investments would have grown more than savings from repayment, Joan would see her final balance decrease by about 10% on average. Q. What is affinity fraud and how to avoid becoming a victim of it?

A. Affinity fraud is a type of scam that preys upon members of close-knit groups, such as church or social club members, those who are part of ethnic communities or racial minorities, coworkers, and the elderly. Even members of the military have been targets. Many affinity frauds are Ponzi or pyramid schemes, in which money from new investors is paid to earlier ones to give the impression the investment is successful. To help avoid becoming an affinity fraud victim, follow these tips:

The financial planning magazine has a nice article that describes the top 10 IRS audit trends, it's full of data and charts, and is a good read if you have any concerns about being audited by IRS.

Below are the top 10 IRS audit trends -

Q. How does instant issue life insurance's underwriting work?

A. Behind the scenes, carriers use data and predictive analytics instead of full underwriting to assess risk and make an offer. They query databases that hold things like driving and prescription medication records, as well as previous insurance applications, all while the consumer’s online and waiting. Databases Used

If there’s a discrepancy between these records and your answers on the application, the carrier may not issue the policy then and there. Instead, the application is usually referred for further underwriting. Successful individual investors tend to be optimistic ones because, over the long term, the market rewards optimists far more frequently than pessimists.

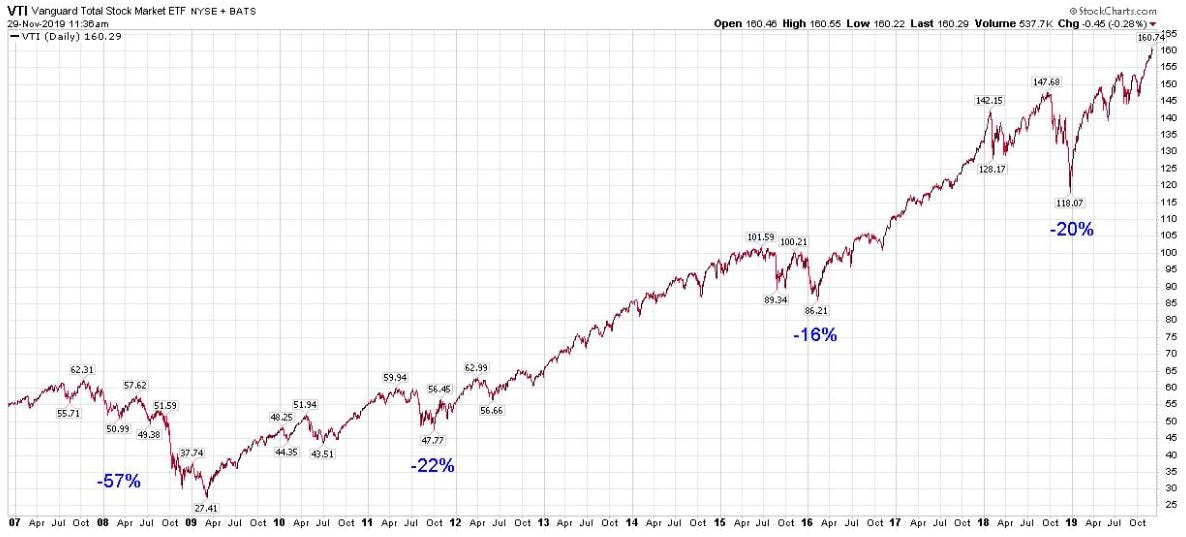

The flip side is that as time passes, our memories color the past corrections with a brighter, lighter brush. This makes it important to revisit history and revisit your exit strategies well before the next correction. Here are a few observations about market corrections in the past 12 years - Observations

Conclusion It is important to review all your positions and revisit the four corrections mentioned and shown in the chart below. Ask yourself what percentage pullback you could tolerate for each and every type of equity you own. A correction is inevitable. Are you emotionally prepared for it? Panic is not a profitable investment methodology. It's well known that life insurance's death benefit payment is generally tax free for the beneficiaries. However, do you know that in situations where a life insurance contract is transferred for "valuable consideration", the death benefit payment could be subject to income tax? See the Q&A and examples from John Hancock below for more details. Q. I have a term life product, what if my needs change in the future, what should I do at that time? A. The document from Prudential below shows some hypothetical scenarios that when your situation changes, you could use the simple term life product you currently have to convert it to serve your other needs later ... Q. Is there any trick I need to know when leasing a car?

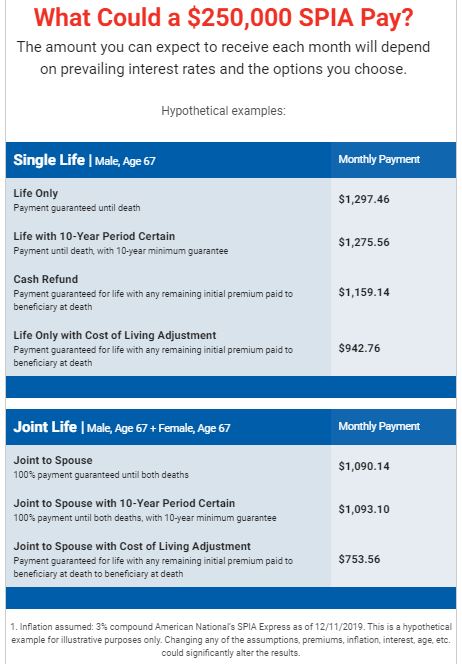

A. Yes, please keep these three money-saving tips in mind when leasing a car: 1. Make Sure You Have Gap Insurance This is perhaps the single most important — and most overlooked — element of leasing. Say your contract says the car’s residual value at the end of the lease will be $15,200, but the car’s actual value will be only $10,000. If you wreck the car three months before your lease expires, guess how much your insurance company will pay in settlement? The insurer will pay the dealer (who owns the car) the actual market value, which is $10,000. But your contract says the residual value is $15,200. That means you are responsible for the other $5,200. This “gap” between the lease contract’s stated residual value and the car’s actual value has caused many lessees to incur huge losses due to accidents. The solution: Make sure your lease contract includes “gap insurance” — even if you have to pay extra for it, for being without it is like driving without insurance. 2. Avoid the Cap Cost Reduction When someone buys a car, the more money he puts down, the less his monthly payments. Similarly, to lower your lease payments, you can make a cap cost reduction, which is a large, one-time payment made at the start of the lease. And as with a down payment, the more you pay in cap (short for capitalized) cost reductions, the lower your monthly payments. However, this is where the similarity ends. Remember that when leasing, you do not own the car. Thus, if you make a cap cost reduction, you are making a down payment on property that is not yours. Never do that — no matter how much the dealer wants you to, and no matter how much it reduces your monthly payments — for in the long run, you are throwing your money away. And the run might not be so long, either: Steve leased a $25,000 car and paid $3,000 in cap costs. Two months later, he totaled the car. Since he didn’t own the car, his insurer repaid the dealer $22,000; Steve lost his $3,000. Paying cap costs is a waste even if you don’t wreck the car. Why? Because the only reason dealers want you to pay it is so they can offer you a monthly payment that sounds really low. Would you visit a dealer who advertised a $20,000 car for just $199 a month? You bet! But would you get excited about having to pay $263 per month for the same car? Not likely. And that’s why dealers want you to pay a cap cost reduction. You see, in one recent ad, a car dealer offered a $20,000 car for $199 per month for 24 months with a cap cost reduction of $1,525. But paying $199 per month with $1,525 down is the same as paying $263 per month with no cap cost reduction. If $263 doesn’t sound so hot (and it’s not), then the other deal isn’t so hot, either. Instead of paying a cap cost reduction to lower your payments, ask the dealer to let you make additional security deposits. This will have the same effect as a cap cost reduction, except you’ll get the deposit back when you return the car. 3. Never Buy Optional Equipment in a Car You’re Not Buying When leasing, you must keep in mind that you don’t own the car. That means you must be careful when agreeing to options that the dealer offers you. Take Carmen for example. She worked out a fine deal on a car — $250 per month for 36 months, with no cap cost reduction. But then she decided to have the dealer install mats, fancier rims, a iPod adapter, and a navigation system. The cost of all these items came to $1,800, so the dealer added $50 to the monthly payment. This not only made sense to Carmen, since $50 per month for 36 months is $1,800, she thought it was a heck of a deal — because although she would be paying for the options over three years, the dealer did not add in any interest. It was a deal all right — but for the dealer, not Carmen. When the lease expired three years later, Carmen returned the car — and with it, the mats, rims, iPod adapter, and navigation system. Carmen paid the full cost of owning those items, but she only rented them. Dumb move, Carmen. What she should have done is incorporated the cost of the options into the overall price of the car, and then negotiated the lease price. That way, she’d be renting the options along with the rest of the car. Remember: When you lease, you are renting the car and everything in it. Don’t pay the costs of ownership when you lease. 4. Never Lease Beyond the Car's Warranty If you choose to lease, don’t lease for a term beyond the car’s warranty. If the car comes with a two-year bumper-to-bumper warranty, for example, get a two-year lease. By opting for a three-year lease, you could be stuck with huge repair bills in year three — on a car you don’t own! If you are interested in knowing how much your $250,000 could lead to lifetime payment, below is a table from American National showing you an hypothetical example -

Q. Is tax-loss harvesting really beneficial?

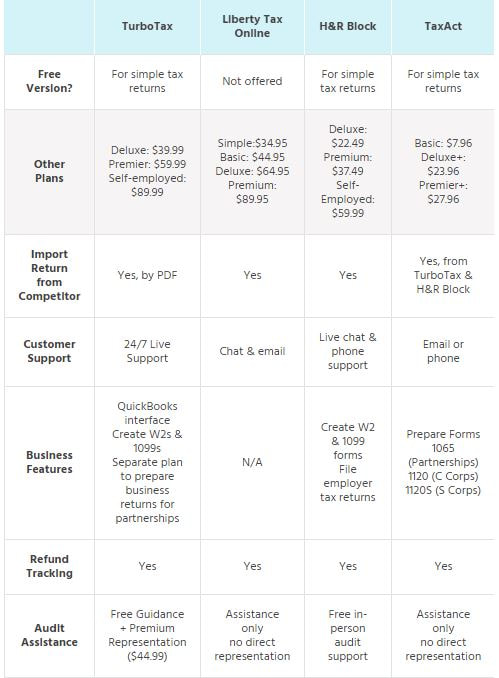

A. Based on this article, the answer is surprisingly that it maybe not! During year end, one of traditional tax planning strategies is to consider tax-loss harvesting to minimize tax exposure, as losses that are harvested can be immediately and fully offset against other capital gains recognized in the same year. The caveat, however, is that by harvesting a loss – selling at a lower-than-cost-basis price and buying back again after waiting out the wash sale period – also reduces the cost basis of the investment, effectively stepping the basis down to the re-purchased value, which increases capital gains exposure in the future by the same amount as the loss that was claimed today. Which means in practice, tax loss harvesting isn’t really a tax savings strategy, but merely a tax deferral strategy that reduces capital gains today in exchange for higher (offsetting) capital gains in the future. Because the value of tax loss harvesting is really only based on the tax deferral – and the ability to grow those tax-deferred dollars until the future – the value of tax loss harvesting is also contingent on the future growth rates themselves, with low-return environments further reducing the value of tax loss harvesting (to as much as 0.57%/year over a 10-year period at 10% returns but only 0.10%/yr at 4% returns). In addition, it’s notable that by deferring capital gains taxes to the future, there’s also a risk that tax rates will rise (especially given that capital gains are at all-time historical lows), which can actually turn tax loss harvesting from a positive to a negative. And of course, that’s before considering the costs, including transaction costs (which even without trading commissions, may still include bid/ask spreads), and the risk of tracking error when buying a not-substantially-identical security (where the substitute investment during the wash sale period underperforms, or ends out generating a short-term capital gain that must be recognized at higher tax rates to switch back). As a result, in the end it turns out that the value of tax loss harvesting is limited at best, and in many decades historically was actually a net negative (even with “just” a 0.1% transaction cost). Filing your taxes can be time-consuming and tedious. So it’s always good to get a little help. If you want to make this process as smooth as possible, I recommend using a tax service like TurboTax, TaxAct, H&R Block, Liberty Tax, or E-File.

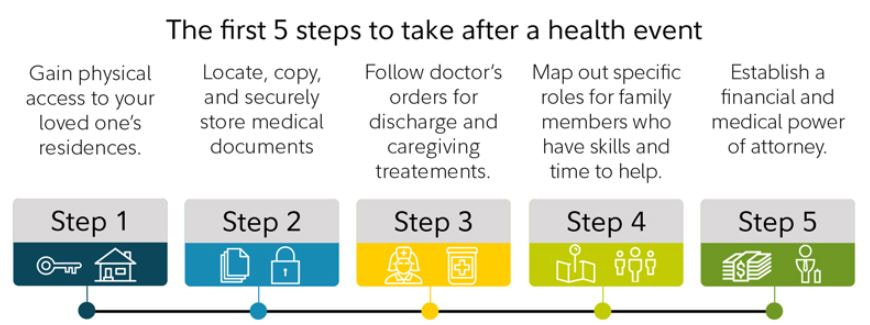

Here’s a table that shows a comparison between the tax services: Facing a family health crisis, here are first 5 steps to take:  Here are 5 key questions everyone should ask:

Take these eight steps now:

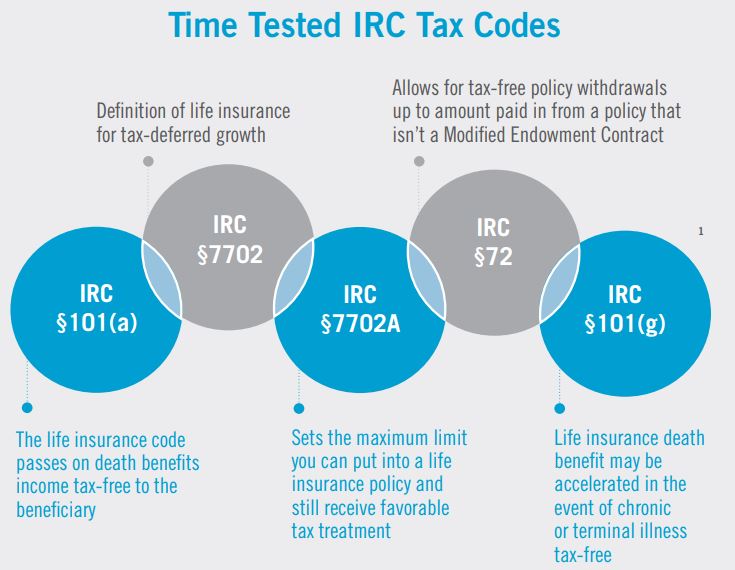

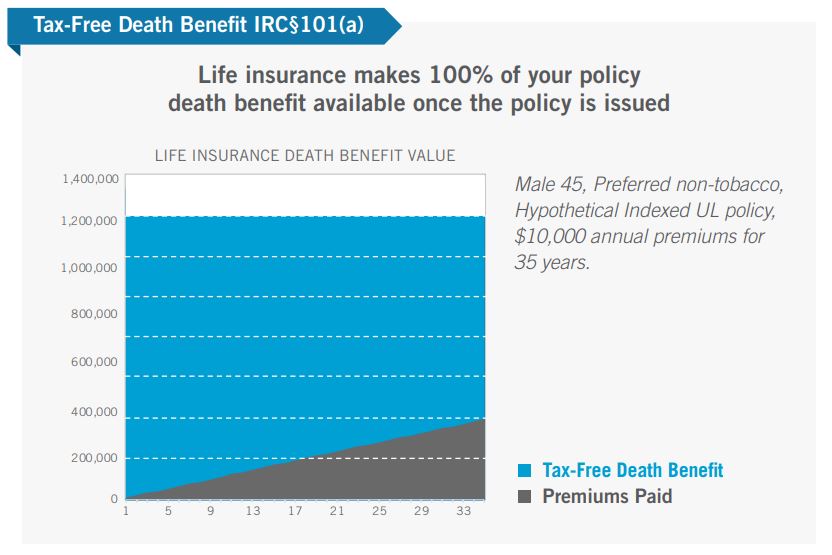

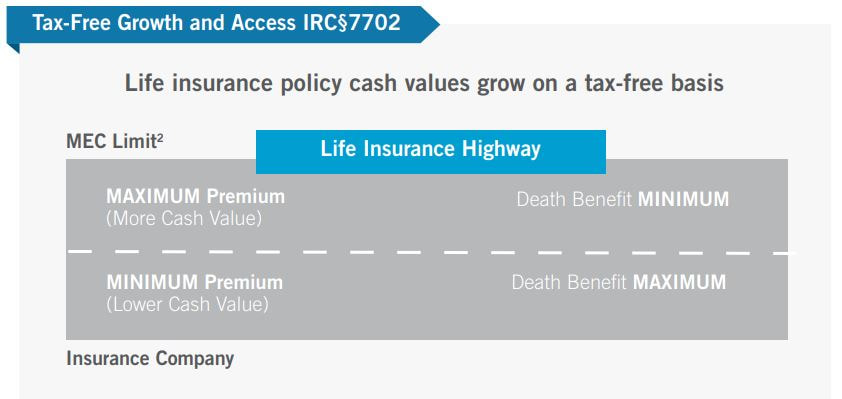

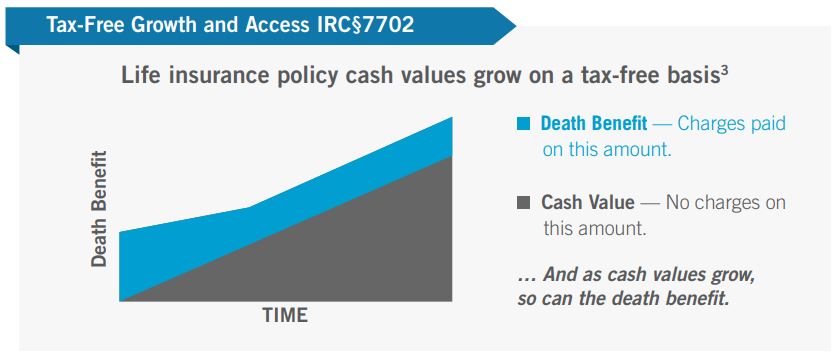

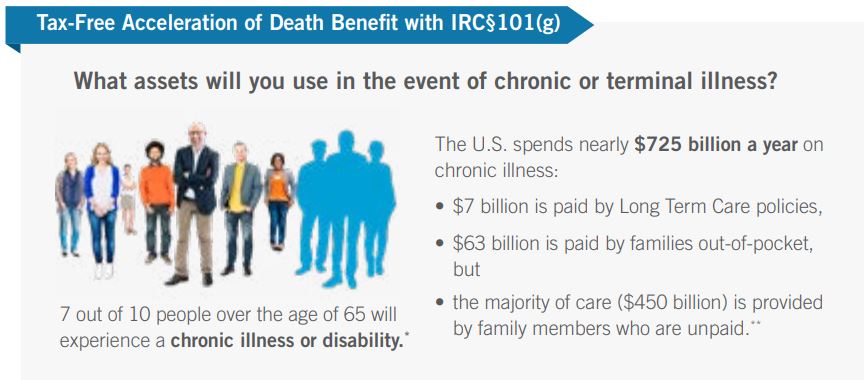

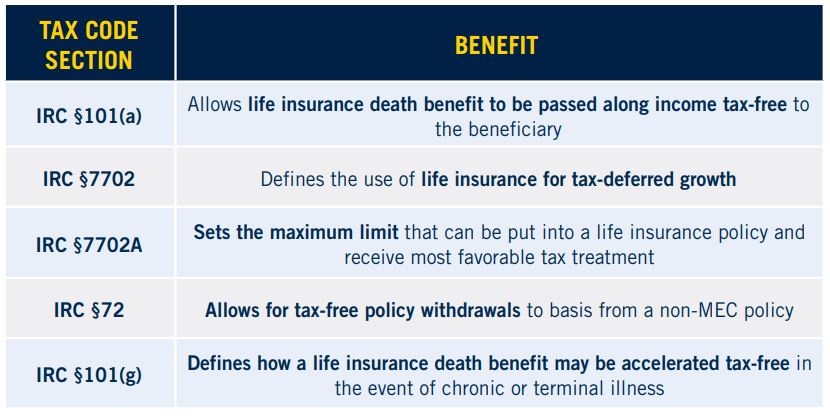

These 5 Internal Revenue Tax Code sections put the power of life insurance to work helping you reach your financial goals: Keep reading to see more detailed discussions of these 5 Internal Revenue Tax Codes and their applications in Life Insurance Products.

You need (or really want) to travel soon, and you need to book a flight. How can you find something like a deal or at least the lowest fare out there?

First, you can rely on the search engines to do the initial search. Google Flights has become a go-to, as it lets you search by destination, date, and alternate airports and easily alter search variables. (It includes flights from most, but not all, airlines.) After that, turn to a trio of similarly useful online tools, Skyscanner, JustFly, and Momondo. These websites focus on price first and are constantly updated. After you find a fare you like, click or tap over to that airline’s website. You may be surprised to discover that the fare is even lower than what these search engines report. If you are the type who likes to be on the lookout for a cheap fare, consider web portals like Airfarewatchdog and Scott’s Cheap Flights. Lastly, think about following an air carrier or two on social media – another avenue through which an airline can suddenly unveil a good deal. Q. What are the good ways to teach young kids lessons about money?

A. Teaching kids about money is one of the best educational foundations parents can give. And if you’re a money-savvy parent, you may have all the skills to put your children on the path to financial success. Here are 5 lessons smart parents could teach their kids about money -

|

AuthorPFwise's goal is to help ordinary people make wise personal finance decisions. Archives

September 2022

Categories

All

|

RSS Feed

RSS Feed