|

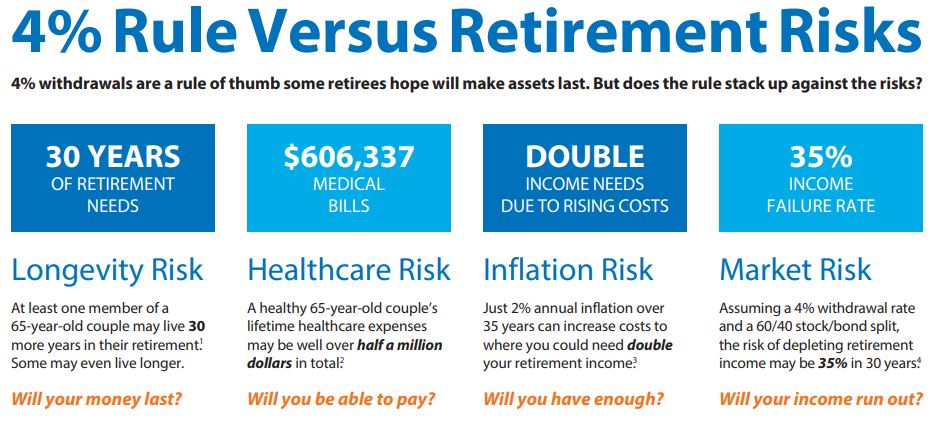

4% withdrawals are a rule of thumb some retirees hope will make assets last. But does the rule stack up against the risks? Annuity is a good hedge for these risks.

0 Comments

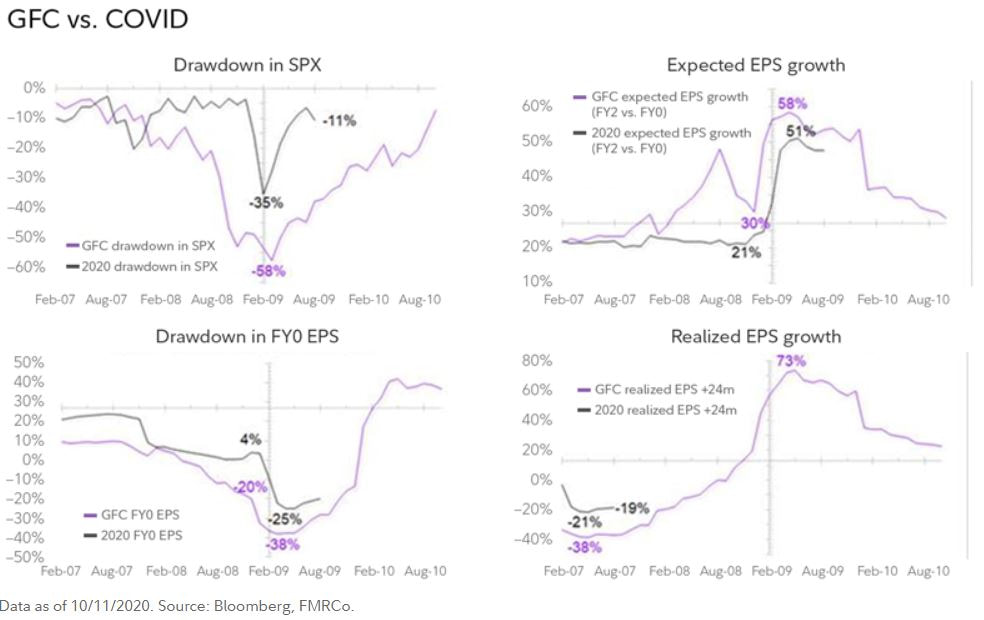

The Similarities Between 2008 Global Financial Crisis and 2020 COVID Impacts on Financial Markets10/30/2020 The 2008 global financial crisis (GFC) is a good analog for the 2020 market cycle caused by COVID, as it relates to the timing of the price bottom vs. the earnings bottom. Below is an analog of the 2 cycles, with the S&P 500 Index (SPX) drawdown in the upper left, the earnings drawdown in the lower left, the difference between expected fiscal year 2 (FY2) earnings and fiscal year zero (FY0) earnings in the upper right, and the subsequent realization of earnings over that 2-year time frame in the lower right. So far so good, which tells us that earnings are likely bottoming now. If earnings are bottoming now, the market can finally start to grow into its valuation and be less reliant on the fiscal/monetary impulse.

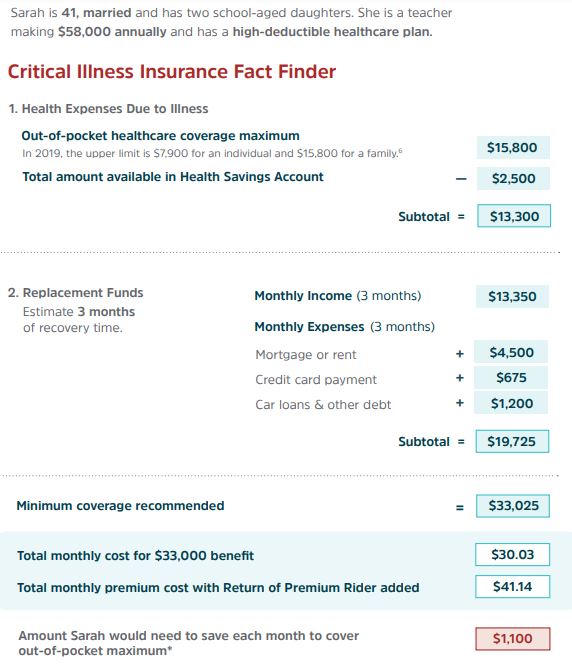

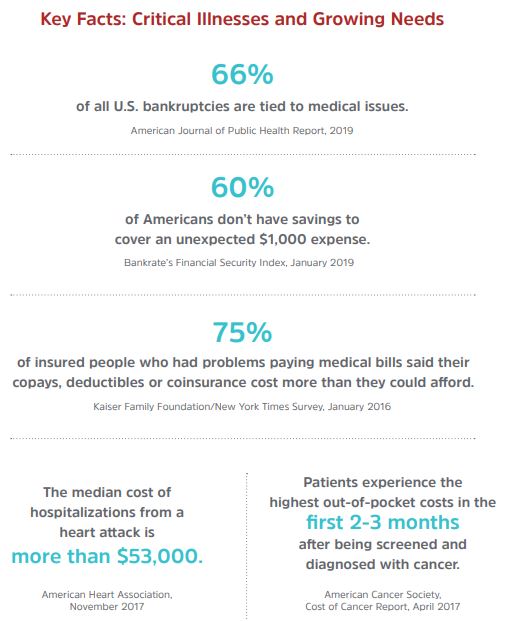

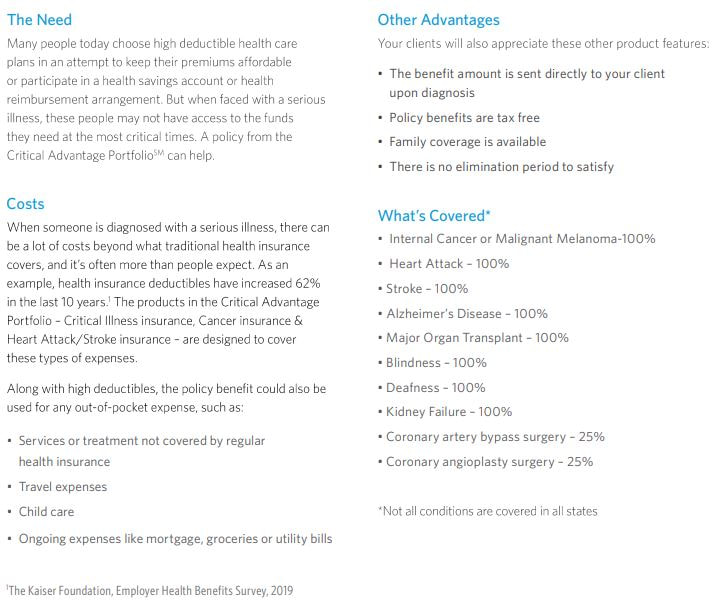

As of 08/31/2020, Select-a-Term policies issued in the past 5 years could be eligible to convert to a permanent policy with the AAS Rider. NonInvasive underwriting will be required to determine eligibility for the AAS Rider. The maximum AAS benefit is $3 Million, and partial conversions are allowed. This rider is not available for previously converted policies and is available in all states. In last blogpost, we discussed who needs critical illness insurance protection. Now we will show a case study below. She was happy to save about $100 a month in her health savings account (HSA), and her company contributed to her HSA each year as well. But a major illness would quickly wipe out her HSA balance and leave a real financial gap.

The numbers show how affordable it can be for Sarah and her family to close the gap if illness strikes. For $41.14 a month — less than the cost of one meal out with her husband and children — she can rest assured knowing she’ll have enough money to cover day-to-day expenses and any other unexpected costs. Sarah also knows because she added the Return of Premium Rider, she will get some of her premiums back if she never needs her policy. There are plenty of good reasons to buy a critical illness (CI) insurance. The rising cost of healthcare (and those painful high-deductible plans) are at the top of that list. But CI is also great for stay-at-home parents or part-time workers who don't log the 30 hours per week needed to qualify for disability income insurance. If you work part-time, stay at home with the kids, or just pay too much for health insurance, you could consider an affordable Critical Illness Insurance. In next blogpost, we will show a case study of how critical illness insurance helps someone. GuaranteeShield from American Equity

Many retirement portfolios continue to be impacted during these uncertain times. Here is a product from AIG that you can secure an income base that is guaranteed to double after 10 years when the rider has not been activated. And when you are ready for income, you can count on up to 5.6% withdrawals for life. A multi-asset income strategy that can invest across a wide variety of asset classes may be able to deliver more consistent returns and a better balance between risk and return than those with fewer options to choose from.

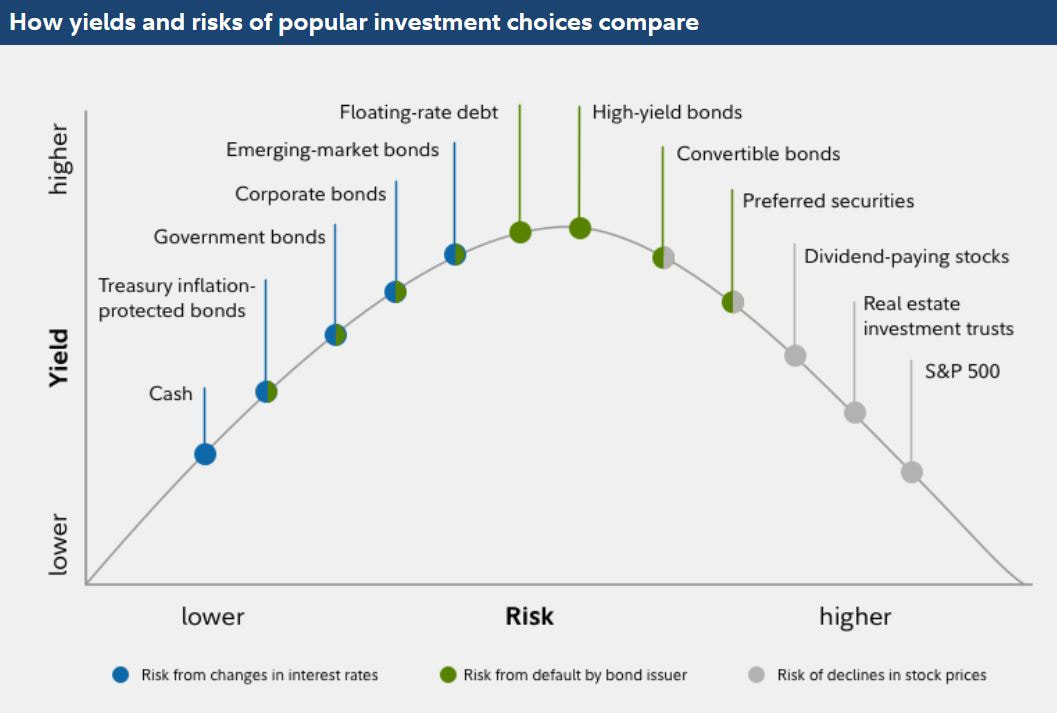

The chart below depicts long-term directional and ranking relationships among a number of asset classes on the dimensions of yield and risk compared to US common stocks as represented by the S&P 500 Index. The relationships and relative rankings among these asset classes may vary over time. Below is an article from Zacks that answers the question.

When you sell investment property, all of your profits are subject to either capital gains tax or depreciation recapture tax, which is a special type of capital gains tax. Your tax gets calculated on the difference between your cost basis and your selling price. Any debt that you owe, such as the balance on your mortgage, will not affect your capital gains liability. Your Cost Basis Your cost basis isn't just the purchase price of your investment property. The initial cost is what you actually paid at the closing, including your closing costs. For example, if you bought a small apartment building for $1 million and paid $1,500 in title fees, $5,000 in attorney's fees, $2,000 in miscellaneous fees and $8,000 in inspection fees, your actual cost would be $1.0165 million. To that cost, add the cost of any improvements you made to the property. Improvements are anything that changes your property's use, increases its value or extends its useful life. Taking the apartment building as an example, a $50,000 roof and $115,000 in kitchen and bathroom renovations would count as improvements and increase your cost basis to $1.1815 million. Depreciation and Basis While you own your investment property, the tax code lets you claim a small portion of its cost basis every year as a depreciation write-off. Depreciation is an accounting tool that simulates the decline in value that accompanies the gradual deterioration of buildings (although in recent years, almost all property has actually gained value over time). When you sell it for more than the depreciated value, the IRS will want you to return a portion of the money that you saved by claiming depreciation. To properly calculate your capital gains liability, you will need to total all of the depreciation that you were legally entitled to claim, whether or not you actually claimed it. Calculating Tax Liability You owe capital gains taxes on the difference between your adjusted cost basis and your net selling price. If you, for example, sell your apartment building for $1.95 million and pay $105,000 in commission and $8,700 in closing costs, your net selling price is $1.8363 million. Subtracting your $1.1815 million cost basis gives you a taxable capital gain of $654,800. In addition, if you sell for a profit, you will have to pay depreciation recapture taxes on all of your accumulated depreciation. If you claimed $320,000 in depreciation while you owned your building, you need to pay depreciation recapture tax on the all of the $320,000. If you sell for a loss, you will pay recapture tax on the difference between your net selling price and your depreciated basis. For example, if you sold the building for $925,000, you would have a capital loss, but since your depreciated basis would be $861,500 ($1.1815 million minus $320,000), you would pay recapture tax on the $63,500 difference. Federal Tax Rates Capital gains on assets that you hold for at least one year are considered long-term gains. For tax year 2019:

You may also be subject to a 3.8 percent Medicare surtax if your income exceeds $200,000 if you are single or $250,000 if you are married. These rates went into effect for the 2013 tax year and will not change without new laws being passed. It's always a good idea to verify these rates with the IRS or your accountant. Loans and Gains What you pay off on your loan isn't tax deductible. However, you can amortize many of the costs of getting your loan over its life. For example, if you pay $12,000 to take out a mortgage with a 10-year term, you can write off $1,200 per year. If you were to sell your property after only three years, you'd have $8,400 in remaining loan fees that you hadn't claimed. You would be able to add those remaining fees to your cost basis, reducing your gain when you sold your property. 1. Use above-the-line charitable deduction

Everyone is entitled to a charitable deduction this year. The Tax Cuts and Jobs Act doubled the standard deduction while repealing or limiting many itemized deductions, leaving millions fewer taxpayers claiming actual itemized deductions. Typically, there is no tax benefit for giving to charity unless you itemize deductions. However, the CARES Act created an above-the-line deduction of up to $300 for cash contributions from taxpayers who don’t itemize. To take advantage of this provision, taxpayers should make sure to donate before the end of the year. 2. Supercharge investment with opportunity zones Opportunity zones are one of the most powerful incentives ever offered by Congress for investing in specific geographic areas. In certain scenarios, not only can an investor potentially defer paying tax on gains invested in an opportunity zone until as late as 2026, but they only recognize 90 percent of the gain if they hold the investment for five years. Additionally, if they hold the investment for 10 years and satisfy the rules, they pay no tax on the appreciation of the opportunity zone investment itself. If they’re worried about capital gains rates going up under a new administration, this may provide an excellent tax-free investment. There are more than 8,000 opportunity zones throughout the United States, and many types of investment, development and business activities can qualify. 3. Make up a tax shortfall with increased withholding COVID-19 created cash-flow problems for many individuals. Taxpayers should make sure their withholding and estimated taxes align with what they actually expect to pay while they have time to fix a problem. If they find themselves in danger of being penalized for underpaying taxes, they can make up the shortfall through increased withholding on their salary or bonuses. A larger estimated tax payment at the end of the year can still expose them to penalties for underpayments in previous quarters, but withholding is considered to have been paid ratably throughout the year, so increasing it for year-end wages can save them in penalties. 1. Plan for health care costs

Solution: Consider long-term-care insurance Insurers base the cost largely on age, so the earlier you purchase a policy, the lower the annual premiums, though the longer you'll potentially be paying for them. It is also important to research the strength of the company you select, as well as investigate other potential options for funding LTC costs. 2. Expect to live longer Solution: Consider annuities To cover your income needs, particularly your essential expenses (such as food, housing, and insurance) that aren't covered by other guaranteed income like Social Security or a pension, you may want to use some of your retirement savings to purchase an income annuity. It will help you create a simple and efficient stream of income payments that are guaranteed for as long as you (or you and your spouse) live. 3. Be prepared for inflation Solution: Consider cost of living increases Social Security and certain pensions and annuities help keep up with inflation through annual cost-of-living adjustments or market-related performance. Choosing investments that have the potential to help keep pace with inflation, such as growth-oriented investments (e.g., stocks or stock mutual funds), Treasury inflation-protected securities (TIPS), real estate securities, and commodities, may also make sense to include as a part of an age-appropriate, diversified portfolio that also reflects your risk tolerance and financial circumstances. 4. Position investments for growth Solution: Consider diversification Build a diversified mix of stocks, bonds, and short-term investments, according to how comfortable you are with market volatility, your overall financial situation, and how long you are investing for. Doing so may provide you with the potential for the growth you need without taking on more risk than you are comfortable with. But remember: Diversification and asset allocation do not ensure a profit or guarantee against loss. 5. Don't withdraw too much from savings Solution: Consider a sustainable withdrawal plan Develop and maintain a retirement income plan or consider an annuity with guaranteed lifetime income as part of your diversified plan, so you won't run out of money, regardless of market moves. Our last ETF myth discussion was here. Now the final one below.

Several factors have contributed to the trend, including expense ratios varying inversely with fund assets, a shift toward no-load share classes for long-term mutual funds, economies of scale, investor preferences, and competition from ETFs. Most comparable ETFs continue to be less expensive than mutual funds. But it’s a mistake to assume that all ETFs are cheaper. For example, mutual fund Fidelity® 500 Index Fund (FXAIX) has a net expense ratio of 0.015%, and it has no transaction fee on Fidelity.com.2 That compares favorably with similar ETFs, such as the SPDR S&P 500 ETF (SPY) with an expense ratio of 0.09% and the iShares Core S&P 500 ETF with an expense ratio of 0.03%. It is worth noting that Fidelity offers zero expense ratio index mutual funds. Of course, expense ratios aren't the only thing to consider when evaluating ETF costs. Tracking error, which is a measure of how well the ETF tracks the performance of a benchmark, can affect the total return of an ETF. If you are looking to simply emulate the performance of a benchmark, like the S&P 500® Index, it may be prudent to seek out ETFs with low tracking error. Bid-ask spread is another factor that can affect your total cost. An ETF with a wider bid-ask spread—the difference in price between what a buyer is willing to pay and what a seller is willing to receive as payment—may be more costly, all else being equal. You can find an ETF’s bid-ask spread, along with its tracking error and other trading costs, on Fidelity.com on an ETF’s snapshot page. By comparison, mutual funds trade at the net asset value and the buyer/seller is not subjected to a bid-ask spread. The last ETF myth was discussed here.

Taxes are an important consideration for any investment held in a taxable account. In general, passive ETFs are considered tax-efficient on an absolute basis due to their unique structure, generally lower portfolio turnover, and how they are managed. One of the primary advantages of the ETF structure is that when an investor buys or sells shares of the ETF, the ETF administrator can match purchases and sales with other investors so that no actual security purchases inside the fund need to be made. As a result, this creation/redemption structure avoids triggering a taxable event. With that said, not all ETFs are equally tax-efficient. For example, ETF dividends are subject to taxes, and ETFs that pay nonqualified dividends may be less tax-efficient than those that pay qualified dividends. Annual distributions from an ETF to investors may be treated as qualified or nonqualified dividends. Qualified dividends are taxed at no more than 15%. However, just because the ETF reports that its distribution was a qualified dividend, that does not automatically make it qualified for the investor. The investor must have held the ETF for at least 61 days during the 121-day period beginning 60 days before the ex-dividend date. ETF investors, like mutual fund investors, are subject to the relevant tax rates on distributions that flow through to end investors, whether they take the form of dividends on stocks or coupon payments on bonds. It's also possible to invest tax-efficiently with ETFs by selecting those that minimize capital gains distributions and maximize exposure to qualified dividends, as well as holding tax-inefficient ETFs in tax-deferred or tax-exempt accounts. If minimizing taxes is a concern, consider consulting a qualified tax advisor. Find the next ETF myth here. You can find last ETF myth discussion here.

Most ETFs track an index, such as the S&P 500® Index. These types of investments are considered "passively managed." Any purchases or sales of securities by the fund are made to keep the portfolio in line with the index it attempts to track. "Smart beta" ETFs are a growing category of ETFs that are passively managed; however, they seek to either improve their return profile or change their risk profile, relative to a market benchmark. This is to say that smart beta ETFs are passively managed in that they attempt to replicate the exposures of a benchmark, but that the composition of the benchmark may not necessarily look like that of any market index, as it has been engineered to represent a targeted factor exposure. This is accomplished by tilting one or more factors of the corresponding benchmark, such as increasing or decreasing exposure to growth or value characteristics relative to a market index. There are some ETFs that, by design, do not strictly track an index. Instead, they are actively managed with the goal being to outperform a benchmark like the S&P 500. The fund manager for an actively managed ETF may choose to hold different securities, and/or in different weights versus those of the index that the ETF seeks to outperform. Keep reading the next ETF myth. If a stock is held in an ETF and that stock pays a dividend, then so does the ETF.

While some ETFs pay dividends as soon as they are received from each company that is held in the fund, most distribute dividends quarterly. Some ETFs hold the individual dividends in cash until the ETF’s payout date. Others reinvest the dividends back into the fund as they are received, and then distribute them as cash on the ETF’s payout date. ETFs may provide the option of forgoing receiving cash in exchange for the purchase of new shares with the dividends received. And certain brokers, including Fidelity, might allow you to reinvest dividends commission-free. You can find out if and how an ETF pays a dividend by examining its prospectus. Find the next ETF myth discussion here. The financial planning magazine has a great and easy to read article that properly titled "A skeptic takes a second look at Single Premium Immediate Annuities (SPIAs)".

The author went from being a skeptic of SPIA to identifying the right people for SPIAs, and analyzed the Pros and Cons of SPIA. Pros of Single Premium Immediate Annuities:

It's a great read for people who are withdrawing for their portfolios wanting some longevity insurance, as SPIAs can make sense as part of the solution. In the past, employees who were required to work remotely could deduct the cost of their home office. However, that is no longer the case. The new tax law eliminated a provision in the tax code that allowed workers to deduct unreimbursed business expenses, including the cost of a home office, as long as the expense exceeds 2% of their adjusted gross income.

In order to claim a home office tax deduction, you have to meet stringent conditions, see below -

In last blogpost, we discussed traditional annuities. Now we will discuss Income Annuities.

Income Annuities There are types of annuities that are expressly designed to provide a guaranteed income stream in retirement – income annuities. And although income annuities share some similarities with their traditional counterparts, they differ in important ways. Income annuities are designed for the sole purpose of providing a guaranteed stream of income, either immediately or in the future. An immediate income annuity typically is purchased with a single premium or “purchase payment” and requires that income payments begin within 12 months of the date your contract is issued. Income can be guaranteed for as long as you live or for a specific period of time. Because immediate income annuities guarantee a specific income amount, they offer very limited access to withdrawals, and only for some annuity options. Even if you choose an annuity option that allows withdrawals, it’s important to remember that withdrawing money from your contract can have a significant impact on the dollar value of future annuity payments. An immediate income annuity may be worth considering if you are nearing or already in retirement; want the security of guaranteed, predictable income; and need that income to start right away. If you think you might need that money down the road and you have limited additional liquid assets, an immediate income annuity is probably not the best choice for you. A deferred income annuity, on the other hand, is designed to provide guaranteed future income. A deferred income annuity generally permits multiple “purchase payments” over a period of time. On the annuity date you choose, all purchase payments are combined into a single, guaranteed income stream that will continue for as long as you live; some deferred income annuities offer period certain options as well. In this sense, a deferred income annuity can be used to generate a “pension-like” stream of future guaranteed income. A deferred income annuity differs from a traditional deferred annuity in important ways. In general, a deferred income annuity:

So which annuity should you consider? That depends on many factors. For retirement purposes, an annuity can work in conjunction with the savings in your 401(k) plans or IRAs (both of which can be affected by market ups and downs). And given the way life spans are stretching, there’s also a chance you may outlive your savings. An annuity can also work to supplement other sources of retirement income that are guaranteed, like a defined benefit pension plan or Social Security. With any annuity, it’s important to get the facts before making your decision. Retirement is your reward for decades of hard work—and part of that work is making sure you’ll have enough money for the kind of retirement you want. If you are looking for an additional source of predictable income now or in the future or a product that is designed to help you accumulate assets on a tax-deferred basis, annuities may be an option worth exploring. Retirement income can come from a number of financial sources; some guaranteed, some not. Annuities are an option for people who want to bulk up the guaranteed income portion of their retirement portfolio.

Generally, an annuity works like this: You purchase the annuity, either in a lump sum or a series of payments. In return, the annuity will make payments to you at a future date or series of dates. Annuities come in many different “flavors” – each of which is designed to help you achieve specific financial goals. They can work to build retirement savings, supplement other forms of retirement funding, or both. The different varieties of annuities can also be bewildering. Depending on individual circumstances, many people turn to a financial professional to help them navigate the choices. Traditional deferred annuities “Traditional” deferred annuities are the kinds of annuities with which most people are familiar. They are designed to help you accumulate assets on a tax-deferred basis as you save for long-term goals like retirement. Let’s look at two basic examples of traditional deferred annuities: “fixed” and “variable”. Deferred fixed annuities are “fixed” because they offer fixed interest rates. They are “deferred” because they require a waiting period before annuity payments can begin. During the deferral period, money in your contract is credited with a fixed rate of interest and grows at a steady pace. Because you don’t pay current income taxes on the earnings in your contract until you withdraw it, more of your money remains available to benefit from that steady growth. Fixed deferred annuities also offer annuity income options that can provide guaranteed income for life or a certain period of time (like 10 or 20 years). This type of annuity typically includes a withdrawal provision that allows you to access the money in your contract. It’s important to understand, however, that withdrawals may be subject to surrender charges, income tax, and even tax penalties. A fixed deferred annuity may be worth considering if you are looking for a conservative way to grow a portion of your assets and avoid market volatility. It may not be the best choice if you prefer greater growth potential (and don’t mind taking on the risk that goes with it) or if you need income that starts right away. Variable deferred annuities – Unlike fixed annuities, variable annuities are built to provide financial market exposure. Variable annuities generally offer a broad range of investment options – from more conservative fixed accounts to riskier growth options. Like a fixed deferred annuity, the money in a variable annuity also benefits from tax deferral. You don’t pay current taxes on earnings in your contract until you withdraw them – which means more of your money remains available to benefit from potential growth. A variable annuity also offers a variety of options when it comes to receiving income – including lifetime income options. Of course, greater growth potential involves more risk. A variable annuity can increase or decrease in value, depending on how financial markets perform. When considering a variable annuity, it’s essential to understand how the annuity works, including associated fees and expenses as well as the surrender charges, income tax and tax penalties that typically apply to deferred annuities. Just as important, you should have a clear sense of your financial goals and tolerance for risk. A financial professional can help you make an informed decision on whether a variable annuity is right for you. In next blogpost, we will discuss Income Annuities. By adding life insurance with chronic illness riders to your financial plans, you can be better prepared for life’s unexpected expenses. Gain the traditional values of a life insurance policy – death benefit for your loved ones – plus living benefits to help pay for LTC expenses while keeping your investments intact. Enjoy the flexibility. Unlike a long-term care policy, life insurance living benefits are not a “use it or lose it” feature. In the event of a qualifying condition, clients have the power to choose how the funds are used.

As of 08/31/2020, QoL Flex Term policies issued in the past 5 years could be eligible to convert to a permanent policy with the AAS Rider. NonInvasive underwriting will be required to determine eligibility for the AAS Rider. The maximum AAS benefit is $3 Million, and partial conversions are allowed. This rider is not available for previously converted policies and is available in all states. If you are interested in exploring more details, please contact us. Policies that are eligible are:

Permanent Products available:

Transition Rules:

COVID-19 has changed life insurance risk underwriting profoundly, specifically, in the following areas:

With interest rates making yet more new lows, does it still make sense to hold 40% of a portfolio in near-zero-yield bonds?

PIMCO economist Paul McCulley belives if the 60/40 portfolio keeps working from here, it means the system itself may be broken, as the 40-year run of the 60/40 portfolio has been driven heavily by a disinflationary environment that has occurred concomitant with a shift in the economy from labor to capital, driving up the value of income streams and leading to compounded returns since 1980 of 11.7% on stocks, 7.4% on bonds, and 10.4% on a 60/40 portfolio… in a way that can’t sustain and continue compounding in its current direction. If you want to look beyond the 60/40 portfolio, assume the 40 bonds' function is risk-buffering to stock volatility – there are arguably other ways to create ‘resilient’ (not-necessarily-bond-based) portfolios, from using a wider range of equity diversification itself (e.g., more sectors, more countries, more exposure to private equity and venture capital in addition to publicly traded stocks), to the growing number of ‘alternative’ investment options. And while historically many ‘alts’ were only offered in high-priced vehicles, the rise of alts in ETFs, along with a broader push towards alts in general, is beginning to bring down at least some of the costs. Life insurance might not be on your radar now, if you are younger. But if you are in your 40s, life insurance should be a particular consideration.

Why? First of all, life spans are increasing. According to a 2012 survey by the National Center for Health Statistics, average life expectancy for men and women in the United States has increased by more than five years since 1980. This means more people have two to three decades of a working career left when they hit their 40s. Also, most people's finances get more complicated as they enter middle age. By that time, many people have families that depend on them and a significant number of assets that may need protection in the future. So putting financial plans into action in your 40s or even your 50s is not too late, given the increase in average longevity. Beyond age and finances are individual circumstances. Let's say, on one hand, you earn more and you have kids. You pay a mortgage and you save for college through a 529 plan. Then you may want to explore the idea of a life insurance policy large enough to cover the potential expenses if you pass away. On the other hand, if your mortgage is nearly paid off and your children all have full-ride scholarships to college, your need for life insurance may be less critical. Or, perhaps you're single with no children. If you're financially stable and relatively debt free, you have less of a need for life insurance. On the other hand, you may want to look into an appropriate life insurance policy to cover your debts and funeral expenses if you are financially unstable and have sizable debt. That can get complicated as well. Basic varieties of coverage options range from whole life insurance, term life insurance, and universal life insurance . The task of determining if a life insurance policy is right for you can be challenging. Some people opt to consult a financial professional. In all scenarios, your decision about life insurance should reflect your current financial situation. To get a better idea of how life insurance fits into your finances, please feel free to contact us here. Most new retirees face the same conundrum - how best to spend down assets? There are many rules out there but none is ideal.

For example, one rule of thumb is to spend only portfolio interest and dividends. But this strategy could lead to retirees to put more assets into risky bank stocks. Another rule of thumb is to withdraw 4% of the initial balance and adjust the dollar amount annually by inflation rate. But this strategy doesn't respond to realized investment returns, for example, withdrawing fixed amount in a sinking market will soon run into trouble. A 2010 Vanguard Group paper points to a third strategy - a combination of an immediate inflation-adjusted annuity with an RMD approach to retirement asset withdraw yields stable cash flows that grew at a faster rate than those of other rules of thumb. What is RMD-based Withdrawal Strategy? It calculates the annual withdrawal as a percentage of the remaining portfolio (therefore it is responsive to investment returns). The withdrawal percentage increases with age, allowing retirees to use more of their portfolio as their life expectancy decreases. What is the drawback? This strategy may result in withdrawal rates too low, especially in early retirement time, causing retirees to leave behind money that they may have preferred to spend. |

AuthorPFwise's goal is to help ordinary people make wise personal finance decisions. Archives

September 2022

Categories

All

|

RSS Feed

RSS Feed