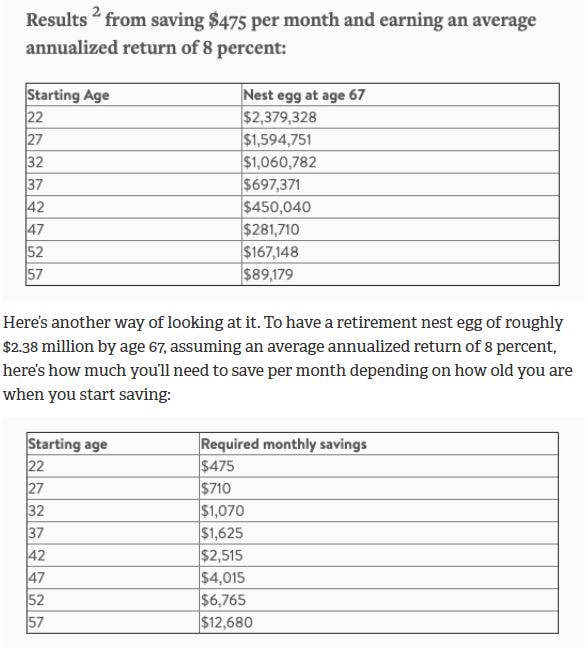

A. It's because you will be buying the best annuity in the world! Here is an example with numbers to illustrate:

Consider someone who is age 66 right now, if she delays taking social security until she is age 70, she will have to pull about $36,000 annually from her savings over the 4 years in order to replace the benefits that she would have gotten if she claimed.

In return, however, when she does claim at age 70, she will get a monthly benefit that is $1,040 higher than it would be had she claimed at age 66. To buy that $1,040 monthly payment with inflation protection as an annuity in the private market, it will cost her $252,000!

So in return for using $150,000 for 4 years, she would get a government annuity that is worth $252,000, that is a discount of 40%!

RSS Feed

RSS Feed