- The premium may be unaffordable for persons of limited financial resources

- Younger individuals are often not able to purchase the amount of death benefit needed and will often be underinsured if they choose whole life insurance as their only life insurance coverage

- Interest paid on policy loans is generally nondeductible

- If a policy loan is taken it reduces the death benefit

- Lifetime distribution of cash values are subject to income tax to the extent attributable to gain in the policy

- Surrender of the policy within the first 5-10 years may result in considerable loss, because surrender charges

- Erosion of purchasing power is present with whole life insurance because of fixed-dollar savings medium, and it is adversely affected by inflation

- Heavy front-end expenses accompany whole life policies

- The overall rate of return on the cash values inside the traditional whole life contract has not always been competitive in a before-tax comparison with alternative investments

- It is often impossible for a policyholder to determine the true rate of return in a whole life policy since the mortality and expenses deducted from the premium are not disclosed

|

In our last blog post, we discussed the advantages of whole life insurance, now the disadvantage of whole life:

0 Comments

Q. What are the advantages and disadvantages of whole life insurance?

A. Below is a list of the advantages of whole life insurance products -

Q. What are some of the permanent life insurance products' features and their tax implications?

A. Please see a summary below -

Q. I misplaced a savings bond, how to get a replacement?

A. You need to submit FS Form 1048, which asks for the bond's face value, issue date, and serial number. You will also need to explain the loss and when you discovered the loss. If you don't know the serial number, you may provide the exact issue date (month and year) in order for the Treasury Department to conduct a search. Get the form signed and certified by your bank, and mail it to the Treasury Department. Your replacement bond will be delivered to you electronically. Q. What is the best investment book one should read?

A. This is a simple question, yet with no definitive answer. In fact, MarketWatch did a survey of its readers and get a list of over 200 books! Below is its top 50: 1 to 10 “The Intelligent Investor” “A Random Walk Down Wall Street” “The Most Important Thing” “One Up On Wall Street” “The Little Book of Common Sense Investing” “The Four Pillars of Investing” “The Little Book that Beats the Market” “What Works on Wall Street” “Market Wizards” “Reminiscences of a Stock Operator” Here, for reference, are the next 40…. “The Richest Man in Babylon” “Berkshire Hathaway Letters to Shareholders” “If You Can” “The Only Investment Guide You’ll Ever Need” “Winning the Loser’s Game” “Dual Momentum Investing” “Rich Dad Poor Dad” “Trend Following” “A Wealth of Common Sense” “Margin of Safety” “The Elements of Investing” “The Millionaire Next Door” “Expected Returns” “Investing at Level 3” “Investor’s Manifesto” “Money” “Security Analysis” “Simple Wealth, Inevitable Wealth” “Stocks for the Long Run” “The Wealthy Barber” “Unconventional Success” “Fail-Safe Investing: Lifelong Financial Security in 30 Minutes” “Fooled by Randomness” “How To Make Money In Stocks” “The Alchemy of Finance” “The Intelligent Asset Allocator” “All About Asset Allocation” “Asset Allocation” “Common Sense on Mutual Funds” “Millennial Money: How Young Investors Can Build a Fortune” “The Investment Answer” “The Laws of Wealth: Psychology and the secret to investing success” “Thinking, Fast and Slow” “Unexpected Returns” “What I Learned Losing a Million Dollars” “You Can Be a Stock Market Genius” “Your Money and Your Brain” “Against the Gods: The Remarkable Story of Risk” “Common Stocks and Uncommon Profits” “DIY Financial Advisor: A Simple Solution to Build and Protect Your Wealth” “Extraordinary Popular Delusions and the Madness of Crowds” Q. Why do I want to consider Whole Life insurance?

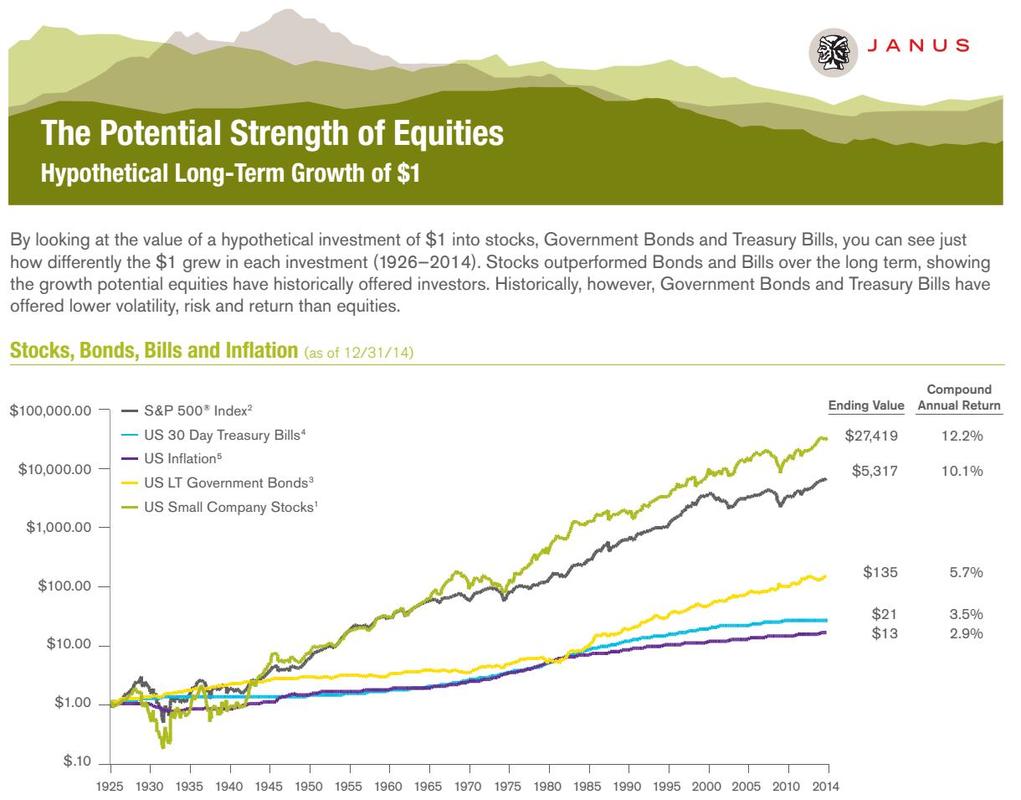

A. For several reasons: a. You want permanent coverage, with guarantees. Permanent policies provide coverage until the day you die. Term life offers a lower premium cost compared to whole, but the coverage is temporary. b. Whole life provides guaranteed cash value accumulation, death benefit amounts, and level premiums for life. Guarantees remove the guess work, and provide a level of security other policy types cannot match. c. Some whole life policies also include living benefits riders, so you can save the money to purchase long term care insurance which you might not need after paying many years of high premiums. Below is the famous Ibbotson Chart that shows the growth of $1 investment between 1926 and 2014. Given that stocks have had another couple of years of run since then, is the top near?

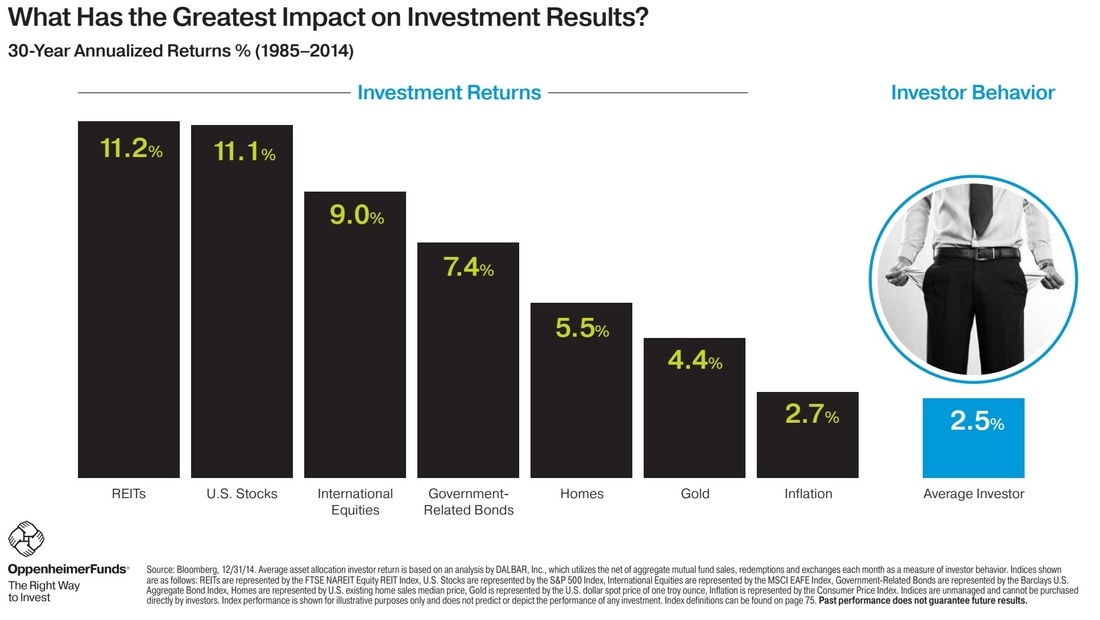

Q. What Has the Greatest Impact on Investment Results?

A. You are your biggest enemy when it comes to investment success! More money is lost due to fear and greed (how we respond) than all of the financial, economic and geopolitical events combined. It’s not the events themselves but our response to the events that can cause the greatest harm. As the chart below illustrates, the average investor couldn't even come close to beating the S&P 500 index and barely outpaces the rate inflation! Q. What to do with unneeded RMDs? A. Please see a video from Morningstar's Christine Benz about a few tax-efficient options for retirees who don't need their required minimum distributions. Q. What are the most commonly overlooked tax breaks for new parents?

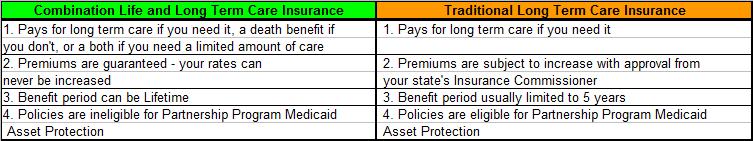

A. Kiplinger has an article that mentions 10 overlooked tax breaks for new parents, here are four of the most common ones - 1. Dependency Exemption You can claim your child as an dependent and deduct $4,050 income from tax in 2017. 2. Child Tax Credit A new baby entitles you to $1,000 child tax credit, until the child reaches age 17. 3. Head of Household Status If you are a single, having a child allows you to file as a head of household rather than using the single filing status, that will give you a bigger standard deduction and more advantageous tax brackets. 4. Adoption Credit This credit will reimburse you for up to $13,460 in expenses for a 2016 adoption. Q: What are the advantages of a Combination (Hybrid) Life and Long Term Care insurance policy versus a Traditional Long Term Care insurance policy, and vice versa?

A. The biggest problem with a Long Term Care (LTC) Insurance policy is that if you pass away and never use the policy, your premium payments are wasted. However, the same thing could be said to those premiums you pay for a homeowners insurance policy if you pass away and never use the policy – the insurance company keeps them and you are happy you never had a claim. However, for many consumers, simply having peace of mind over the life of a policy may not be good enough, people will feel better if one could get something back from the insurance company. That solution is a combination life and LTC policy. With a Combination Life and LTC Insurance policy, it will provide long term care benefits if you need long term care, a death benefit if you die without needing LTC, or both if you need a limited amount of LTC. The table below compares a combination life policy with a LTC policy. Q. Could some ETFs help reduce my investment risks?

A. Yes, some managed low-volatility ETFs - funds that hold defensive, dividend-paying stocks could help mitigate market risks to certain extent, for example iShares Edge MSCI Min Vol USA ETF (USMV) and PowerShares S&P 500 Low Volatility Portfolio (SPLV). However, while low volatility funds do reduce risks, they do not perform as well when compared with owning a diversified portfolio. For example, the above two funds both underperformed against S&P 500 Index between 2011 and 2017. The danger of using such low-vol funds is to try to use them to prevent short-term market declines, while such funds should be used more as part of a long term investment strategy, with the goal to generate a better risk-adjusted return. Q. Can I negotiate life insurance rates?

A. The answer is No, life insurance rates are non-negotiable. With this, shopping the best company with the best premium is the best option. This is easier if you are buying level term protection, which is the lowest premium all the time as opposed to other types of coverage and the type of life insurance. On the other hand, universal life insurance is harder to shop due to it's flexible premium feature. So, save your money and buy term life protection. Q. Can I buy life insurance for someone else?

A. Yes, you can buy term life insurance for someone else, as long as you could prove an "insurable interest" to the underwriter. In other words, would you suffer a financial burden if that person were to die? Usually life insurance is purchased on a family member, partner or key business associate. Please note you may never purchase life insurance on someone without their knowledge. The insured will have to sign the application and pass through underwriting in order to be insured. Case Study Sarah and Shane were in their early 50’s, and Shane had recently received a promotion. Shane had been increasing his group term at work but felt he also needed to provide permanent protection for his family in addition to group term. Shane was looking for the most cost efficient way to provide permanent protection for his family. If you like life insurance, especially term life insurance, with living benefits riders, please contact us. In our last blog post, we discussed the rationales behind the most tax efficient withdrawal strategy. Now we will discuss some potential complications.

1. Higher Tax Rate Later On If your tax rate will be higher later in retirement than in the first few years, for example, you will move from a low-tax state to a high-tax state. If so, you might want to consider strategies where you pay taxes on your retirement savings earlier in retirement in order to potentially lower taxable income later. One way to do that, depending on your situation, would be to shift more of savings to a Roth IRA by converting a portion of a traditional IRA. 2. More Investments in Taxable Accounts If you have a significant portion of investments in taxable accounts, you may be looking for ways to lower a tax bill on the earnings as you gradually draw down the principal to cover retirement living expenses. One consideration that might help is to invest the bond portion of taxable accounts in a diversified mix of municipal bonds, the earnings from which are generally exempt from federal income tax. 3. Pushed Into a Higher Tax Bracket If when you begin withdrawing money from your traditional IRA or 401(k), you find that the amount pushes you into a higher tax bracket. In this case, it might make sense to consider withdrawing from a tax-deferred account until taxable income nears the top of a tax bracket, and then tapping a Roth or other tax-exempt account for any additional income. 4. 70½ or Older If you are age 70½ or older, you might also consider making a qualified charitable distribution (QCD) to satisfy all, a portion of, or even an amount greater than an RMD - up to the IRS limits ($100,000 in 2017). Because the amount donated directly from an IRA to a qualified charity isn’t considered taxable income, this move can help avoid being pushed into a higher tax bracket. It can also be a very useful strategy for those whose high incomes result in phaseouts of itemized deductions. Be sure to consult a tax professional in such cases. 5. Other Complications Other factors that could play a significant role in a retirement tax strategy are whether a person intends to continue working, the income tax rate in the state and locality where they plan to retire, and how much of an inheritance they would like to leave for family members or to a charity. In our last blog post, we described the most tax efficient withdrawal strategy, now we will explain why it is the best strategy.

1. Start from taxable accounts first. Money in taxable accounts is the least tax efficient of the three types. That’s why it usually makes sense to draw down the money in those accounts first, allowing qualified retirement accounts to potentially continue generating tax-deferred or tax-exempt earnings. Investments may need to be sold when taking a withdrawal. Any growth, or appreciation, of the investment may be subject to capital gains tax. If you’ve held the investment for longer than a year, you’ll generally be taxed at long-term capital gains rates, which currently range from 0% to 20%, depending on your tax bracket (a 3.8% Medicare tax may also apply for high-income earners). Long-term capital gains rates are significantly lower than ordinary income tax rates, which in 2017 range from 10.0% to 39.6%. These are federal taxes; be aware that states may also impose taxes on your investments. If you have a loss, you can use it to reduce up to $3,000 of your taxable income, or to offset any realized capital gains. 2. Followed by tax-deferred accounts. You’ll have to pay ordinary income taxes when you withdraw pretax contributions and earnings from a tax-deferred retirement account, but at least these investments have had extra time to grow by taking withdrawals from a taxable account first. You may find yourself in a lower income tax bracket as you get older, so the total tax on your withdrawals could be less. On the other hand, if your withdrawals bump you into a higher tax bracket, you might want to consider taking withdrawals from tax-exempt accounts first. This can be complex, and it may be a good idea to consult a tax professional. And remember, the IRS generally requires you to begin taking RMDs the year you turn 70½. For employer-sponsored accounts, like a traditional 401(k), you may be eligible to delay taking RMDs if you’re still working at the company and do not own 5% or more of the company or business. You cannot, however, delay starting RMDs for retirement accounts for employers you no longer work for. 3. Save tax-exempt accounts for the last. Last in line for withdrawals is money in tax-exempt accounts. The longer these savings are untouched, the longer the potential for them to generate tax-free earnings. And withdrawals from these accounts generally won’t be subject to ordinary income tax. They’re totally tax free, as long as certain conditions are met. And leaving any Roth accounts untouched for as long as possible may have other significant benefits. For example, money for a large unexpected bill can be withdrawn from a Roth account to pay for a bill without triggering a tax liability (as long as certain conditions are met). Qualified Roth withdrawals are not factored into adjusted gross income (AGI) because they are not taxable income. This may help reduce taxes on Social Security and other income because they don't bump up taxable income. For Roth IRAs, it is important to note that RMDs are not required during the lifetime of the original owner, but for Roth 401(k)s and Roth 403(b)s, the original owners do have to take RMDs. That can be a good reason to consider rolling Roth 401(k)s and 403(b) accounts into Roth IRAs. Roth accounts can be effective estate-planning vehicles for those who wish to leave assets to their heirs. Any heirs who inherit them generally won’t owe federal income taxes on their distributions. On the other hand, Roth accounts are generally not an advantageous vehicle for charitable giving, so those involved in legacy planning may want to avoid the use of Roth accounts to the extent that this money is intended for charity. Be sure to consult an estate planner in either case. In our next blog post, we will discuss some complications when follow the strategy discussed here. In our last blog post, we discussed the characteristics of 3 different investment accounts. When it's take to take money out of these accounts, the goal is to manage withdrawals to minimize taxes, therefore maximizing the ability of remaining investments to grow tax efficiently.

The Most Effective Strategy The simplest, also the most effective withdrawal strategy is to use money from savings and retirement accounts in the order below, with one important caveat. For certain retirement accounts, if you are 70½ or older, required minimum distributions (RMDs) come first. For inherited qualified accounts like a traditional IRA, RMDs may come before age 70½, but the rules are complex, so be sure to check with a tax professional.

We will explain why this is the best strategy in next blog post. Q. I have taxable, tax-deferred, and tax-exempt accounts, what's the best strategy to maximize tax efficiency when taking money out of these account for my retirement life?

A. A typical retiree may have three types of investment account - taxable, tax-deferred, and tax-exempt. Each has an important, but different, role to play in helping manage tax exposure in retirement. We will review each of them in details below. Taxable Accounts Taxable accounts include your bank and brokerage accounts. Any earnings from these accounts, including interest, dividends, and realized capital gains, are generally taxed in the year they’re generated. In the case of capital gains, keep in mind that any increase in value of the accounts’ investments, such as mutual fund shares or an individual stock, isn’t a taxable event in itself. It’s only when an appreciated investment is sold that the gain is realized; i.e., it generates a taxable capital gain or loss. When you own a mutual fund, however, capital gains may be realized by the fund manager and distributed to you - often subjecting you to a tax liability - even if you haven’t sold your fund shares. Tax-deferred Accounts Tax-deferred accounts include traditional IRAs, 401(k)s, 403(b)s, or SEP IRAs. Most, or all, of contributions to these accounts were made "pretax" which means that ordinary income tax on those contributions are owed when withdrawals are made in retirement. Any earnings from these accounts are also typically taxed as ordinary income when they’re withdrawn. Tax-exempt Accounts Tax-exempt accounts include Roth IRAs, Roth 401(k)s, and Roth 403(b)s. Contributions to these accounts are typically made with after-tax money, which means the contributions - and any earnings - are not taxable provided certain conditions are met. It takes careful planning and a good strategy to maximize tax efficiency when you start taking money out of these accounts. We will discuss in the next blog post. Are you asking these tough questions?

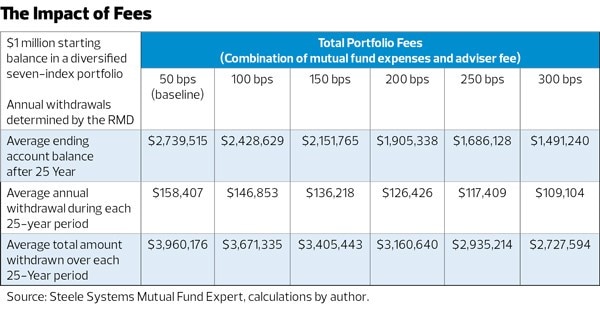

In our last blog post, we have assumed a retirement portfolio starting from $1 million and would support a retirement life between age 70 till age 95. The portfolio could be managed with two options: do it yourself style or managed by an advisor. What will the two performance look like? Based on data between 1970 and 1994, assume the DIY annual expense ratio to be 0.5%, and the advisor's fee plus fund fee to be 1.5% to 3%, the table below summarizes the performances under various fee assumptions, the results are stunning! Put in succinctly, with a lower fee, you would have more money left when you die and you would have spend more during your retirement years!

The above results are based on 1970 to 1994 these 25 years' results, between 1970 and 2016 there are 23 such 25-year periods, the conclusion remains the same - fee matters a lot! Q. How much a retirement portfolio could be impacted by high expenses?

A. We all know high expense hurts a portfolio's performance, especially when you compound that impact over time, but quantitatively how severe such impact could be? Please see a hypothetical example below. The Portfolio Assume you are age 70 and have accumulated a portfolio of $1 million assets. Furthermore, assume you could live to age 95, and between age 70 and 95, you will need to take out the required minimum distribution amount from your portfolio due to IRS requirement. You could have two options to manage your assets - a. Do It Yourself You could create an index-based portfolio by using the 7 indexes funds -

b. Hire an Advisor to Manage it Assume you pay an advisor to manage your portfolio. You will face two expenses:

How much these two options would get you through your retirement years? You will be surprised when you read our next blog post. Q. Can I get a mortgage in retirement?

A. There are several advantages of getting a mortgage even in your retirement, for example, maintain liquidity of your assets instead of putting lots of money in a house. However, for mortgage lenders, the way they evaluate a mortgage application is your ability to repay them. So if you are in retirement and your income from investments is not large enough, you will not be able to obtain a mortgage. Because of this reason, it's important to try to get a mortgage before your retirement. |

AuthorPFwise's goal is to help ordinary people make wise personal finance decisions. Archives

September 2022

Categories

All

|

RSS Feed

RSS Feed