|

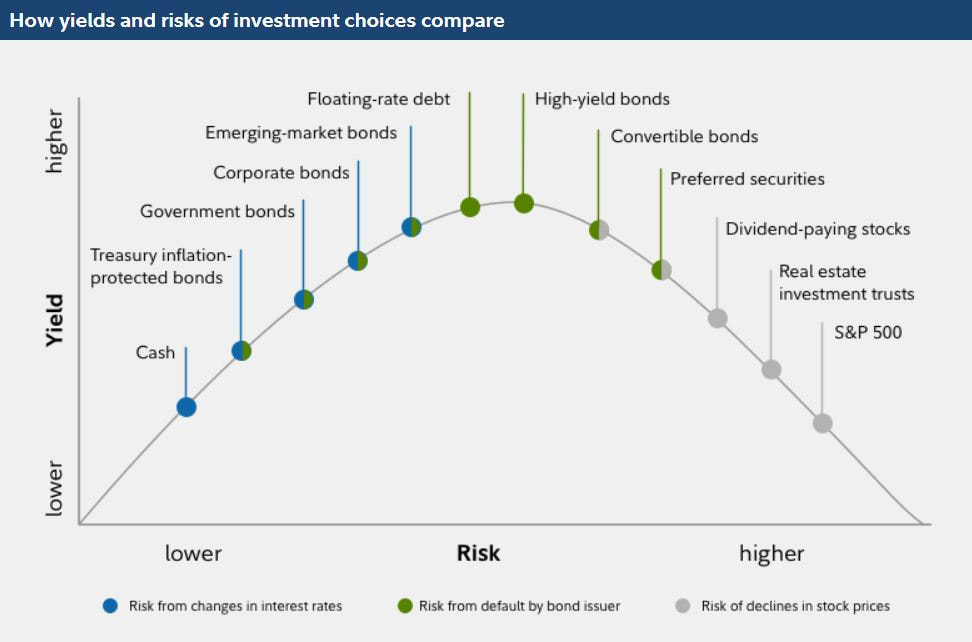

The forces that drive markets are always in motion. Because market conditions constantly change, the investments that deliver the highest returns today may not be the ones that do so next month or next year. That’s why multi-asset income strategies that can invest across a wide variety of asset classes may be able to deliver more consistent returns and a better balance between risk and return than strategies whose managers have fewer options to choose from.

0 Comments

Below are steps you could consider if you plan to clean your financial closet at the beginning of a new year:

Legacy planning takes on greater importance in unexpected times such as these. To plan ahead and put ambitions into action with protected strategies, you could explore the many purposeful, proven distribution planning options available with fixed annuities.

Non-Qualified Pre-death

Post-death

Qualified / IRA Pre-death

Post-death Spouse beneficiary or beneficiary not more than 10 years younger ■ Inherited IRA: (All fixed products less Indextra) ■ Lump Sum ■ Annuitization ■ 10-Year Deferral ■ Spousal continuation for spouses (all fixed products) All other designated beneficiaries ■ 10-Year Deferral - (SPIA 10-year certain or less) last payment due by 12-31 of 10th anniversary - For annuity claims: Holding account for up to 10 years with an annual renewal rate ■ Lump Sum At this time, there is no Bitcoin exchange-traded funds, but you have 3 other options to get Bitcoin:

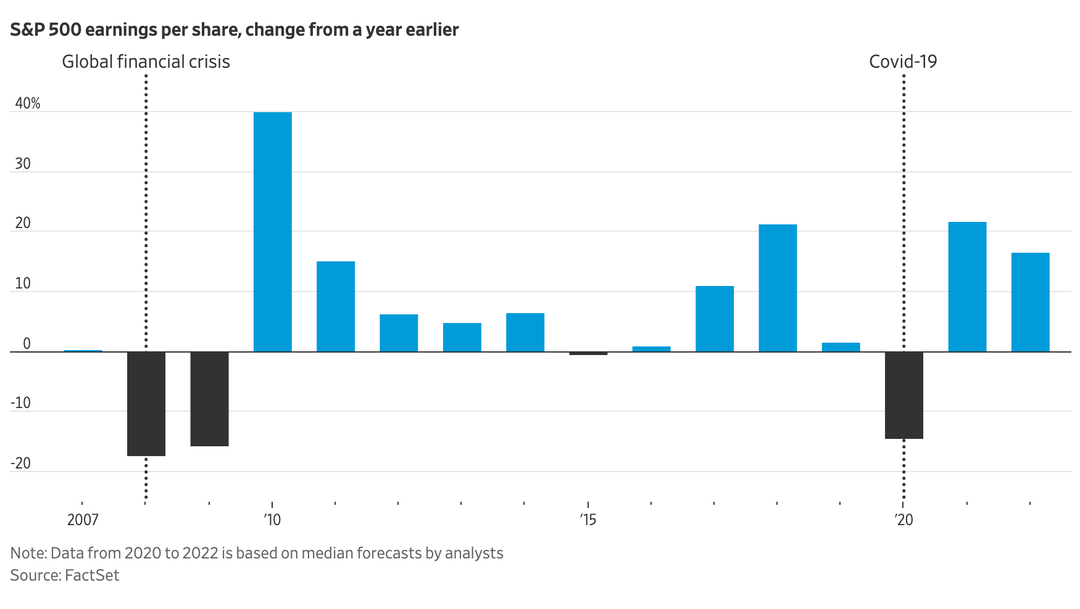

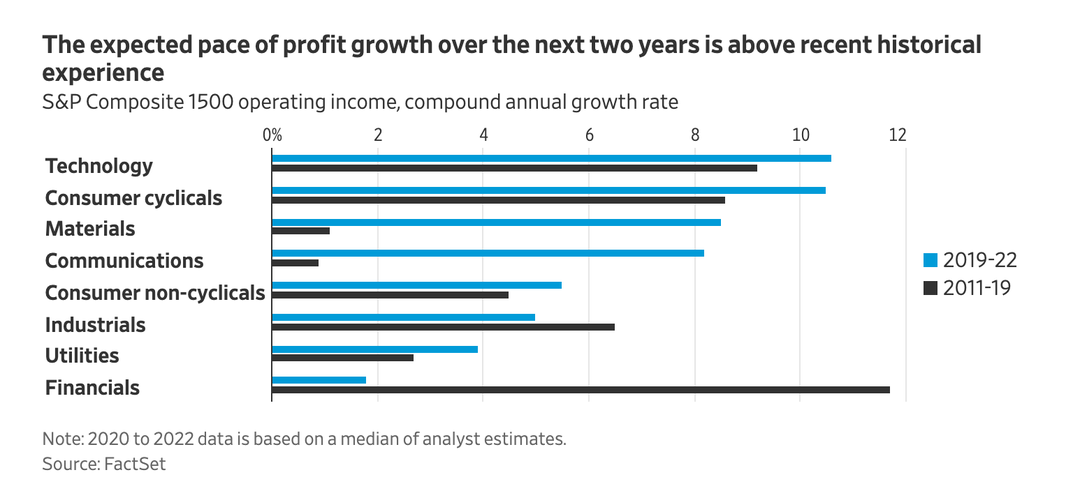

1. Buy from apps Apps such as Paypal, Square, and Robinhood could help. They are easy to use. You simply sign up for the app's service and start trading. There is usually be a fee, though, usually from 1.5%, for Paypal and Square, but Robinhood doesn't charges a fee, it makes money by routing customer trades through market makers and taking a cut of the spread between bid and ask prices. Once you bought the crypto currency, Paypal and Robinhood require you to keep your crypto on the platform and sell out in cash, and Sqaure allows you move your Bitcoin to an unaffiliated wallet which you can use to trade with other people. 2. Crypto focused platforms The largest is Coinbase, it offers dozens of cryptocurrencies and services like lending that are not available from the other apps. It charges a 0.5% spread on transactions, as well as a fee starting at 1.5%, depending on what source you use to buy in. 3. Through a brokerage account You can buy Grayscale Bitcoin Trust (GBTC) which is a security created by Grayscale Investments that consists entirely of Bitcoin and is structured as a private placement. GBTC is a trust, not an ETF, the difference is GBTC trades at a substantial premium to its net asset value, so as an investor, you have two potential risks: bitcoin's price drop, or the premium shrinks. Below is an article from Dec 4 2020 WSJ: Amid a wave of optimism in financial markets, investors can relax about the expected profit rebound in 2021. They might worry more about 2022. Wall Street is factoring in a 22% increase in S&P 500 earnings per share for next year. This seems reasonable, even cautious, following the expected 15% fall this year. This summer showed that consumption can return very quickly when restrictions are eased, and global trade and manufacturing already seem to be on a steady path to recovery. In 2010, after the global financial crash, profit growth was 40% as a result of a dismal 2009. But forecasts for 2022, the first “normal” year after the crisis, say more about what the market is thinking. Those expectations look less grounded. As of now, S&P 500 earnings per share are seen expanding another 17% in 2022. This is in line with what happened in 2011, when they rose 15%. Back then, however, profits were far less elevated because the downturn had lasted longer: Relative to their 2007 peak, they were up only 11% in 2011. Current expectations of 2022 earnings place them 21% above 2019 levels. Consumer-cyclical companies such as auto makers and hotels would be up 35% overall. Stocks look expensive compared with 2019 profits: 48% of companies in the broader S&P Composite 1500 index trade at higher valuations than at the end of last year. The proportion is broadly unchanged relative to 2021 earnings. Yet the figure falls to 29% when 2022 expectations are used for the calculation. In many S&P 1500 sectors, to make good on such forecasts, the compound annual growth rate in earnings from 2019 to 2022 would need to be above the recent historical norm—itself inflated by the impact of President Trump’s tax cuts in 2018. Maybe tech companies will gain an edge from the pandemic. It is harder to argue that other industries will emerge from this crisis permanently reinforced.

In short: Markets are baking in not just a “V-shaped” rebound next year but also a consumer-led boom in 2022. Such a scenario is possible. Pent-up savings will kick in after the economy reopens, especially if U.S. lawmakers manage to agree on a new round of fiscal aid. Still, the growing ranks of long-term unemployed, as well as potential trouble overseas—for example, among the weaker European economies—are reminders of the risk that the global economy will emerge scarred by Covid-19. Staying invested in stocks makes sense for now, given the potential for upgrades to 2021 forecasts. Longer term, caution is warranted when it comes to fully embracing cyclical sectors, particularly pandemic-battered “value” stocks like hotels and airlines, despite the enthusiastic New Year outlooks that asset managers are publishing at the moment. A rebound from pandemic troughs is almost a given. A 2022 economy that looks much better than 2019’s isn’t. To fully prepare for all your retirement years, one tactic is to consider dividing your assets into three buckets, each representing about 10 years of your potential 30-year retirement.

The Money Now Bucket This will cover the first 10 years of your retirement, when you’re most likely to lead an active lifestyle. You may want the assets held in this bucket to be accessible—more liquid — so you can take advantage of your newfound freedom to pursue the things you’ve always wanted to do, such as travelling, focusing on favorite pastimes, or new hobbies. Your asset allocation may follow a conservative approach, with a higher portion of your assets in cash or cash equivalents. The Money Later Bucket This will hold money you may spend during the second 10 years of retirement, when you begin to slow down and settle into routines closer to home. You may want the assets held in this bucket to provide a targeted return on investments. The income generated from these assets should strive to at least keep pace with inflation. Your asset allocation may follow a more balanced approach, with a focus on securities that may provide a fixed return and an opportunity for growth. The Money Much Later Bucket This will hold the money you may spend during the third 10 years of retirement, when you’ll most likely be focused on healthcare needs or providing care for a loved one. You may want these assets to be growth-oriented as you may not need to access them for 10 to 20 years depending on when you retired. Growth of assets over a longer-term period may be critical to be prepared for the often necessary, and ever-increasing, health care expenses associated with living a long life. Your asset allocation may follow a more moderate-to-aggressive investment approach that provides growth, but still gives you peace of mind. By taking the long view now, you may find yourself on stronger financial footing as you move through each stage of retirement. Q. How to exit a time share?

A. Dispose a time share, and most importantly, its associated obligations is not easy. Here are a few options to try: 1. Call the resort directly Most major resorts have a "deed-back" program, it is for you to return your property to the company for a fee of a few hundred dollars. You need to explain your situation in detail. To qualify, you usually can't be behind on your dues and you can't have a loan balance. 2. Stop paying If you still have a loan balance and stop paying, the lender will collect and could hurt your credit. If you already paid off the loan and stop paying fees, since it may cost less than foreclosing, the resort might just let you surrender and remarket your timeshare. 3. Resell it You can try to resell at eBay, Craigslist, or other specialty sites such as tug2.com and redweek.com 4. Talk to a company Never talk to a timeshare disposing company that charges you upfront fee. The Setting Every Community Up for Retirement Enhancement Act of 2019 (Secure Act) is bringing this theory to defined contribution plans such as 401(k)s. A new rule would require plan sponsors to provide workers with an annual disclosure showing what their monthly (and lifetime) income would be if they converted their plan savings to an annuity with a guaranteed stream of income. The law is designed not necessarily to push people into buying annuities but to illustrate how their funds will need to stretch over their lifetime.

People hear that they have to accumulate a lot of money for retirement. As time goes on and their 401(k) balances increase, they become overconfident that they have enough money to retire. But, they need to begin asking themselves: "What would it produce in income down the road?” TIAA provided an example of what someone around age 39 might see on his or her statement. Let’s say as of June 2019 the worker had $87,851 saved. Based on a monthly contribution of $420 that increases each year with inflation, and a number of other assumptions such as rate of return, at 65 the person is estimated to have a balance of $829,150 (or $382,585 in today’s dollars). The hypothetical annuity payment would be $4,586 (or $2,116 in today’s dollars). This assumes a single life annuity with a 10-year guarantee period and 4 percent interest rate. But what if your 401(k) account has just $200,000 when you retire? If such a person annuitizes $200,000 at 65 this might produce a hypothetical payment of $13,274 a year, or $1,106 per month based on a 6.6 percent payout rate (including interest rate and return of principal based on life expectancy). Although, the actual annuity payment will depend on current interest rates when annuitized. The 6.6 percent income rate means that for every $100,000 annuitized, the annualized income will be $6,600. The 4 percent interest rate is used in the calculation of the annuity factor to come up with the payment amount. With a lifetime immediate annuity, which is what would be used for the illustrations under the Secure Act, the payout rate is different from the rate of return. The actual realized return depends on how long a person lives, beyond the guarantee period. The Secure Act also dictates that there would be disclosure within the example to make sure workers understand that the calculations depend on numerous factors that can affect the estimates they are given. The Labor Department is required to issue rules instructing plan administrators on the assumptions that will be used to estimate a lifetime income stream. The illustrations would estimate retirement benefits that might be paid as a life annuity to a retirement account holder and a survivor annuity over the life of the participant’s surviving spouse, child or dependent. The plan administrators would assume the plan participant and a spouse were the same age, and a single-life annuity would also be shown. Done right, this new requirement could be a useful reality check. Rather than focusing just on your total balance, which could give you a false sense of financial security, this lifetime income illustration could bring clarity to how you view retirement savings. Keep in mind your money may have to last you several decades in retirement. This might shift people’s behavior and help them realize they need to save more for retirement. For retirees, it's reported that enrollees in Medical spent an average of about $6,000 on premiums and medical care in 2017. However, there are choices that can make Medicare costs lower and more predictable.

Here are 3 ways you can protect yourself from large out-of-pocket costs and even lower your ongoing monthly costs: 1. Medigap If you enroll in Medicare, then consider a supplemental policy, aka Medigap. You will have to pay a monthly premium, but Medigap plans pay for much of what Medicare doesn't, and you will be protected if you have a health emergency or get really sick and your out-of-pocket costs surge. 2. Medicare Advantage (MA) Consider a Medicare Advantage (MA) private insurance plan. You will trade some choices in doctors for usually lower costs. More importantly, MA plans set a limit on out-of-pocket costs (for 2021, Medicare says that limit cannot exceed $7,550). 3. State Programs There are savings programs that help pay for Medicare or out-of-pocket health costs. State Health Insurance Assistance Programs provide free counseling for Medicare beneficiaries. Go to shiptacenter.org to find contact info for your state's office, then make an appointment to discuss your situation and options. When you sell a rental property, you will owe federal and state capital gains and depreciation recapture taxes, according to this article in The Washington Post.

Property investors may also face the net investment income tax and will not qualify for capital gains exclusion, according to the article. Investors who want to boost their after-tax profit are advised to use a 1031 exchange, which will enable them to reinvest the sales proceeds to a like-kind property and defer capital gains taxes. ----------------------------------------------------- Q: I am selling a house in the District of Columbia that I bought 10 years ago, renovated and have rented out as an investment ever since. I paid $400,000 and can now sell for $800,000. I immediately renovated the kitchen and baths, which cost $100,000. At settlement, I plan on paying $48,000 in real estate commissions, $11,600 in D.C. transfer tax and an additional $10,400 in closing costs and seller credits to buyer. My pretax cash profit should be about $330,000. What are the tax implications, and what can I do to maximize my after-tax profits? — Savvy Seller A: Congratulations on successfully investing in a rental property. When you sell your rental property, you will incur federal and state long-term capital gains and depreciation recapture taxes. You may also incur the Net Investment Income Tax, which imposes an additional 3.8 percent tax on your net investment income above certain thresholds. Capital gain is the difference between your selling price and your adjusted tax basis. The Internal Revenue Service classifies capital gains as either short or long term. Gain on the property sales held for one year or less is considered short term and is taxed at your ordinary income tax rate. Gain on property sales held for more than one year is classified as a long-term capital gain and is taxed at rates ranging from 0 percent to 20 percent. Most homeowners will pay at the 15 percent rate. Although you state that your pretax cash profit is $330,000, your taxable long-term capital gain is only $230,000. Taxable capital gain is calculated by taking your sales price ($800,000), minus commissions and closing costs ($70,000), minus your adjusted tax basis ($500,000). Your adjusted tax basis is your original cost plus your capital improvements. “Assuming you are in the 15 percent capital gains tax bracket, your federal capital gains tax liability would be $34,500,” said Eric J. Wexler, a Rockville, Md., tax attorney and CPA. IRS regulations generally require that you depreciate residential rental property over 27.5 years (3.636 percent per year). Because land does not wear out, the IRS does not permit you to depreciate the purchase price attributable to the land. To calculate your depreciation deductions, we assume: your $400,000 purchase price was allocated equally between the land and the original improvements; and that the additional capital improvements were made before the home was placed into service as a rental property. As such, your property’s “depreciable base” is $300,000. Accordingly, you were able to take $10,908 annually for the 10 years it was rented, for $109,080 in total cumulative depreciation. “This non-cash tax deduction may have reduced your annual taxes,” Wexler said. “But now that you are selling, this non-cash tax deduction must be paid back, in part, as depreciation recapture tax. So, in addition to your $34,500 in capital gains tax, you will incur $27,270 in federal depreciation recapture tax, for $61,770 in total federal tax liability.” Your pretax cash profit minus your federal tax liability results in $268,230 in after-tax profits, which will be further reduced by state capital gains and depreciation recapture taxes. “Any taxable gain may be offset by any suspended losses that you were not able to use during the life of the property,” Wexler said. Because this is investment-only property, you are not eligible to use the $250,000 ($500,000 for a married couple) capital gains exclusion available when you sell your primary residence. IRS Pub. 544, available online at irs.gov, contains detailed instructions for calculating capital gains and depreciation recapture for residential rental property. Because your current plan to sell investment property results in significant tax liabilities with no real tax advantages, one way to dramatically increase your after-tax profit is to consider using a 1031 exchange. This IRS code section allows you to exchange your D.C. property and reinvest your cash in another like-kind replacement investment, such as other rental real estate or a Delaware Statutory Trust. A 1031 exchange requires you to identify your replacement property within 45 days and to close on your replacement property within 180 days of settling your D.C. property. A 1031 exchange allows you to defer liability for all federal capital gains and depreciation recapture taxes. You can sell your D.C. property and pay no federal income taxes on that gain so long as you use a qualified exchange intermediary to hold your funds and you reinvest your entire sales proceeds in a new investment property having a value equal to or greater than your D.C. property. If you have a Health Savings Account that couldn't meet the minimum amount and being charged a fee, below are three choices you could have with no minimum amount fee -

1) Review your goals : The end of the year is a great time to review the goals you made at the beginning of the year and set new ones for 2021. How did you do this year? Is there anything you’re proud of accomplishing? I like to start with bright spots because they can guide you toward success as you set new goals. But let’s be realistic, too; 2020 threw us a lot of curveballs. Was there anything you wish you could have done better? You can also learn from any potential stumbling blocks and figure out how to use them as stepping-stones next year. You may also want to take time now to review your net worth. That’s one way to gauge the progress you’ve made in your financial health this year.

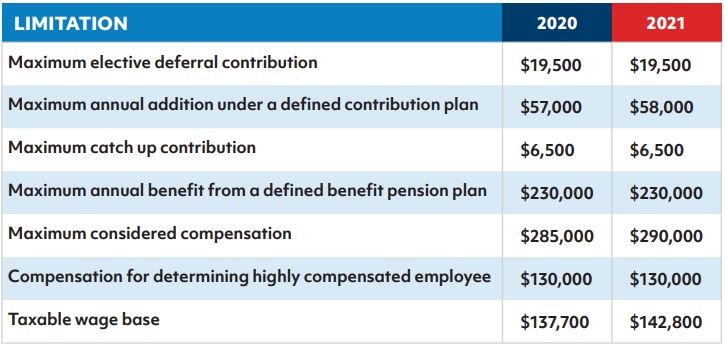

2) Update your budget : Did you save the money that you wanted to? Pay off the debt that you needed to? The end of the year gives you a solid end point to assess whether met the goals you set at the outset of 2020. What if you didn’t have a budget or financial goals? You’ve got a blank slate ahead. Why not create a budget that works? 3) Create a holiday bucket : Holidays can be budget breakers, so why not incorporate them into your spending goals right from the start? Christmas may look a lot different this year. But you can still create a separate bucket for holiday spending and when that money is gone, stop spending. You’ll thank yourself in January when you don’t have an unusually large credit card bill. 4) Use it or lose it: Some of your benefits—like vacation days or a medical or dependent care flexible spending account (FSA)—expire at the end of the year. Take stock of what you have left and use these benefits to your advantage. 5) Make any last charitable contributions : December 31st is the last day your charitable contributions can be deducted on your 2020 tax return. If giving to charity is a part of your spending plan, you can use these questions to help make the most of your charitable giving. 6) Pump up your 529: Just like charitable contributions, contributions to your 529 college savings plan must be made by December 31st to count for this tax year. Find out if your state is one of over 30 that allow you to deduct your contribution. You can find the specific deduction here. If your state is one of the four that allow an unlimited deduction, keep in mind the yearly gift-tax and super-funding rules. 7) Max out your 401k : While you have until April to make contributions to your traditional IRA, Roth IRA and HSA, you can only contribute to your 401k through December 31st . So, if you have extra cash and are looking to boost your savings, consider contributing your last couple of checks entirely to your 401k. Business owners can do the same with the employee portion of your Solo 401k contributions. 8) Find your tax return : You’ll be doing your taxes before you know it, so use this time to get prepared. Review last year’s return and make a mental list of records you’ll need to assemble. Year-end is also a good time to decide whether a Roth conversion makes sense for you. 9) Review your business structure: Evaluate your business structure and the QBI deduction to identify any changes you need to make to your business. You might want to set up a solo 401k, for instance, and if so, you’ll have to act before December 31 st (although you can make employer/profit sharing contributions up to the business tax filing deadline). 10) Defer income and incur expenses : If you’re a business owner, you may also want to look at ways to defer income into 2021 or pay for business expenses you anticipate for early next year. This is any easy way to reduce your tax liability for 2020. However, remember not to spend money on business expenses that you wouldn’t otherwise incur just for a tax deduction. Spending a $1 to save 24 cents still costs you 76 cents. 11) Will and trust review : The end of the year is a good time to take stock of changes in your life—like getting married or divorced, having children, starting a business or retiring. Your estate plan should reflect these changes. Get out your will, documentation for trusts you’ve established and powers of attorney and make sure they match your current situation. 12) Insurance documents: Insurance documents also need to cover your current situation. Take a look at your life and disability insurance policies to make sure they protect your current income and those dependent on it. Your renters or homeowners insurance should cover any additional big purchases you made during the year. And lastly, you should review your health insurance policy for any upcoming changes for 2020. For those of you enrolling in the Market Place, you have until December 15th to pick your plan. The Internal Revenue Service has issued the new benefit and contribution limits for qualified retirement plans for plan years beginning in 2021. Below are some of the key limitation amounts for the upcoming year.

The following article is from American National whose life insurance policies come with accelerated benefits riders. It could be applied to other insurance policies with similar accelerated riders.

=============== It is a golden rule that you always understand your product before you sell it. Would you sell it to your mother? Life Insurance with ABR’s? You bet I would. The key point to make in this continuation of ABR discussions is to understand when the time is right to consider accelerating a rider. As we know already, Accelerated Benefit Riders were and are designed to be available for assistance when the time is right. So, what is that time? Well that is a good question and the answer will depend on the individual and their situation. Let me try to answer this another way, if a policy holder files a claim and his or her life expectancy is long, a smaller and in some cases zero payment could be available. If their life expectancy is short due to their qualifying condition, a much larger payment could be available. Simply having a qualifying condition does not always mean you need to accelerate immediately or at all. Let me give you a couple of examples here from individuals I actually know and associate their stories to ABR’s. A 53-year-old male with a $100,000 of 10-year term which has been in effect for one year has what is considered a very mild heart attack. As an avid Crossfit athlete, he was found to have a 90% occlusion in one of his arteries. His condition was resolved with a coronary stint and improved with proper diet management and continuation of his exercise regimen. Negligible damage to his heart was done and his cardiologist indicated he has at minimum 30 years to live. A heart attack is a qualifying condition. Is this a good time to accelerate? No, because his life expectancy (30 years) or mortality has not changed. The present value of the future premiums is deducted from the present value of the death benefit. Take into account PV of nine years of 10-year Term premiums and 21 years of ART premiums being deducted from the PV of $100,000; this would result in an unpayable claim. A female age 45 with $500,000 IUL diagnosed with ALS (Lou Gehrig’s Disease) given a life expectancy of two years. She had very minor symptoms at time of diagnosis. Was it time to accelerate? You bet it would be a good idea to, at minimum, do a partial acceleration now. Use that partial and enjoy some time with her family while she is still functional. Further accelerate for expenses or other reasons when needed. Here again, life expectancy is very short resulting in a larger payment. She actually beat the odds and lived 3.5 years, but my point here is acceleration was appropriate and put to good use when really needed. Accelerated Benefit Riders from American National are a wonderful tool to provide peace of mind for future events should they occur. The important part is understanding how they are calculated and when is the best time to utilize them. As you have seen, simply having an event does not always mean immediate acceleration is needed. However, sometimes it does and that is the backbone of what these riders are for. Your protection when you really need it. Why a special needs child is special?

When a child is born with a special need, they will have a lifetime of care ahead of them. Typically, they will receive government aid, which will assist in paying for their future care and education. As such, they are limited in the amount of assets they can own or the income they can have and still qualify for aid. In addition, an expensive lifetime of need arises. This need is too expensive for parents to shoulder for the lifetime of the special needs child. Although most of the need will be paid for by the government, they will have other needs throughout their lifetime and potentially after the parents are deceased. There is a need to create a special needs trust to have sufficient funds available for future care, especially after parents are gone. The special needs trust will be set up to allocate money for the special needs child’s care without serving to disqualify the special needs child from government aid due to too much in assets or income. How does a family provide for a special needs child? Life insurance on mom, dad, and both sets of grandparents can help meet that need. With a life insurance policy, the death benefit can be allocated to the special needs trust to fund the child’s care for years to come after a grandparent or parent passes away. The biggest worry of a special needs child’s parents is what will happen to their child if they are not there to take care of the child. With life insurance as a funding vehicle for the special needs trust, the parents and grandparents can rest knowing they have the situation taken care of and the child will be cared for after they are gone. Which policy is the best? Typically, a Guaranteed Universal Life (GUL) policy is utilized. This policy often provides the most cost effective permanent policy that will serve the purpose of funding the special needs trust. Grandparents need permanent coverage in that they are older when purchasing the policy. Parents are also attracted to the GUL policy due to the low cost for permanent protection. Make sure the GUL policy also comes with Accelerated Benefit Riders in the event of a qualifying illness or accident that significantly reduces life expectancy. You can always use your HSA to pay for qualified medical expenses like vision and dental care, hearing aids and nursing services. Once you retire, there are additional ways you can use the money:

1. Help bridge to Medicare If you retired prior to age 65, you may still need health care coverage to help you bridge the gap to Medicare eligibility at 65. Generally, HSAs cannot be used to pay private health insurance premiums, but there are 2 exceptions: paying for health care coverage purchased through an employer-sponsored plan under COBRA, and paying premiums while receiving unemployment compensation. This is true at any age, but may be helpful if you lose your job or decide to stop working before turning 65. 2. Cover Medicare premiums You can use your HSA to pay certain Medicare expenses, including premiums for Part B and Part D prescription-drug coverage, but not supplemental (Medigap) policy premiums. For retirees over age 65 who have employer-sponsored health coverage, an HSA can be used to pay your share of those costs as well. 3. Long-term care expenses Your HSA can be used to cover part of the cost for a "tax-qualified" long-term care insurance policy. You can do this at any age, but the amount you can use increases as you get older. 4. Pay everyday expenses After age 65, there is no penalty if you use HSA money for anything other than health care. But you will have to pay income tax, similar to pre-tax withdrawals from your 401(k). In last blogpost, we discussed 2 types of bankruptcies. Now we will discuss your options.

Your options under Chapter 11 Assuming a company of the stock you own declares Chapter 11 bankruptcy, what can you do? First Option One option is to stand pat and maintain your ownership in the stock. In an optimal scenario, the company could negotiate a deal with its creditors under bankruptcy protection laws, reorganize and recover, and/or receive emergency funding from investors (or from the government, in rare instances, as was the case during the financial crisis for the banking and automobile industry). Stockholders may be asked by the court-appointed trustee to exchange current stock holdings for new shares in the reorganized company. The trustee may send back new shares that have less proportional ownership in the reorganized company. The trustee will also inform existing shareholders of their new rights, and if anything is expected to be received from the company. Typically, a company operating under bankruptcy laws will no longer qualify for listing on major exchanges like the Nasdaq or New York Stock Exchange. It is likely to be delisted from those major exchanges, and it may continue to trade on the OTC Bulletin Board (OTCBB) or Pink Sheets. OTCBB/Pink Sheets is a service that allows companies (typically those that are penny stocks or foreign companies who are not listed on a major exchange) to trade, and there are no reporting requirements for these companies. In this event, the stock symbol will be a 5-letter ticker symbol that ends in "Q." For example, General Motors declared bankruptcy on June 1, 2009, the old shares were delisted from the NYSE on June 2. The original shares that were listed under the symbol GM began trading on the OTCBB/Pink Sheets as Motors Liquidation Company GMGMQ (the current ticker symbol for the old shares is MTLQQ). A new entity was created on July 10, 2009—with the aid of the US government—to acquire the operational assets of the company. General Motors completed their IPO in 2010, and the new shares now trade under the original GM ticker symbol. Second Option In addition to maintaining ownership, another option is to attempt to sell the shares—likely at a significant loss relative to the initial investment. If you determine that the existing company is unlikely to emerge from bankruptcy (or even if it might, that the existing shares will be deemed worthless), this may be the best option. It is worth noting that one problem for this option is the difficulty finding a buyer at a desirable price or at all, given the significant risks associated with these investments. In last blogpost, we discussed how to find the warning signs of potential bankruptcy filing. Now we will discuss what are your options if it indeed occurred.

There are 2 main forms of commercial bankruptcy that are relevant to investors under the Bankruptcy Code: Chapter 7 and 11. What is Chapter 7? If a company files for Chapter 7, this means the company stops operations and a trustee is tasked with selling any assets the company owns in order to repay what it can to creditors and investors. In the event you own stock of a company that files Chapter 7 bankruptcy, it will likely become worthless and it is unlikely you will recover any of your investment (see sidebar). What is Chapter 11? Under Chapter 11 bankruptcy, there is slightly more hope that the company can survive and your stock will not become worthless. Chapter 11 allows a company to "reorganize" so that it might become profitable once again. Under Chapter 11, management runs the day-to-day business operations, but significant decisions are made by a bankruptcy court. Many of the companies that have declared bankruptcy during the pandemic have filed Chapter 11, in the hopes that economic activity might rebound if COVID-19 infections, hospitalizations, and mortalities abate. In next blogpost, we will discuss what are your options if a company files bankruptcy. One of the most devastating consequences of the COVID-19 pandemic—in addition to the human toll—has been the torrent of businesses, both big and small, forced into bankruptcy.

For an investor, there are two key questions to answer:

1. How to Find Warning Signs? Typically, a publicly traded company will exhibit several signs of distress well in advance of declaring bankruptcy. Significant and persistent declines in reported earnings and revenues, failure to raise needed investment capital, credit rating downgrades, and other company-specific events can indicate the company is experiencing severe problems. Of course, any of these occurrences would warrant a reevaluation of the company to determine if you still want to bear the risk and if it aligns with your investment strategy. If you own and have decided to hang onto the shares of a company that is exhibiting these signs, but you remain concerned about the possibility of bankruptcy, one tool that provides an easy-to-assess output is the Altman Z-score. This score estimates the probability of bankruptcy using multiple financial ratios to assess a company's liquidity, profitability, leverage, and activity. The higher a company's Z-score, the less likely it is to declare bankruptcy in the near future, and the lower a company's Z-score, the more likely it is to declare bankruptcy. You may be able to find this information in financial reporting databases. In next blogpost, we will discuss what options do you have if a company declared bankruptcy? The Verge highlights a number of different tools that facilitate budgeting and financial cash flow tracking, including:

What Are Durable General Power of Attorney and Durable Power of Attorney for Health Care?12/11/2020 Durable General Power of Attorney and Durable Power of Attorney for Health Care are two documents that you name an individual (called your “attorney in fact”) who you authorize to manage your financial affairs on your behalf. This person can sign contracts for you, pay your bills, make deposits to and withdrawals from your accounts, and file your tax return, among other services. You decide the powers your attorney in fact shall have.

It is important to note that POAs are valid only if you are unavailable, not if you are incapable. For example, if you are out of town on the day you must sign the papers to close on a real estate transaction, your attorney in fact can sign the papers for you. But your POA becomes invalid upon your incapacity. For example, if you are in a coma, your POA would be void, and your attorney in fact would no longer be able to act on your behalf. To solve this problem, your POA should be durable. This means the document survives your incapacity and allows your attorney in fact to continue representing you. The durable general power of attorney allows your attorney in fact to manage all areas you designated, including your financial affairs if you choose. The durable power of attorney for health care allows your attorney in fact to give instructions regarding your treatment to your health care providers (who are legally obligated to comply) – instructions that honor what you’ve stated in your advance medical directive. It’s rare for these two POAs to be combined into a single document. You might want different people to serve in these two roles. If you check any of the following boxes, you should talk to an estate attorney to see if you need a Trust or not:

In last blogpost, we discussed what is asset titling. Now we will show some of the details in asset titling.

Here is a brief description of how assets pass to heirs: Held Solely in Your Name Asset passes to your heirs via your will (see section below) and is subject to the probate process. Transfer on Death (for brokerage accounts) / Payable on Death (for bank accounts) You are sole owner of the asset, but upon death, the asset passes immediately to the named individuals registered on the Payable on Death account outside of probate. For example, “John Doe POD James Doe” is an account owned by John that passes to James upon John’s passing. Joint Tenancy With Rights of Survivorship (JTWROS) All owners have an equal share of the asset; when you die, your share passes to the surviving owners. This continues until there is only one survivor, at which point it becomes an asset held solely in that person’s name (see above). Tenants in Common All owners have an equal share of the asset; when you die, your share passes to your heirs as stipulated in your will (via probate). Tenants by the Entirety (TbyE) Available only to married couples in certain states. Both spouses (TbyE) are considered to own 100 percent of the asset, protecting the asset from creditors if only one of them is sued. At the first death, the asset passes to the surviving spouse, at which point it becomes an asset solely in that person’s name (see above). Community Property If you are married and live in Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington or Wisconsin, most assets acquired during your marriage are considered community property, unless you and your spouse strike a separate agreement. Assets obtained prior to the marriage might also be included; implications are complex and beyond the scope of this checklist. Legal advice is strongly recommended for residents of these states who are (or may become) married or divorced. Community Property With Rights of Survivorship (CPWROS) The surviving spouse inherits the deceased’s share of assets. The above cautions apply here as well. Limited Liability Company This is used to shield you from liability, and your share of the entity is usually dictated by the above options. Trusts Trusts allow you to manage, control and distribute your assets with greater specificity than you can with a will. Trusts also allow you to address tax, legal and liability problems. A trust is nothing more than a set of rules governing the management of assets. As the grantor (the person creating the trust), you get to make those rules. You’ll appoint someone to manage the trust (the trustee). You can be the trustee in some cases; regardless, you should also name a successor trustee, who will manage the trust if the trustee dies or becomes incapacitated. You’ll also designate beneficiaries of the trust. Some trusts are revocable (meaning you can change the rules as often as you wish, and you add or remove assets from the trust at any time), while others are irrevocable (meaning you can never change the rules or withdraw assets from the trust unless permitted by its rules). Revocable trusts are generally ignored by the IRS (meaning all tax aspects of the trust pass to you personally) while irrevocable trusts generally obtain their own tax ID number and file their own tax returns. (Be aware that such trusts are taxed at the highest tax bracket; whether the trust should pay taxes on its income or distribute that income to beneficiaries so they can pay the taxes instead – at their lower tax brackets – is a question for your financial advisor and tax advisor. The age(s) of the beneficiary(ies) and other aspects of their situation must be considered.) Revocable trusts also do not offer liability protection; irrevocable trusts do. The trust that’s right for you depends on the problem you’re trying to fix – and since your life might be complicated, you might need more than one trust. What is Asset Titling?

You get to select the asset’s legal owner whenever you buy or obtain an asset such as a house, car or financial account (held at a bank, brokerage firm, investment management or financial advisory firm, mutual fund or annuity company, or securities custodian). Will you own the property in your name, jointly with another person (such as a spouse or child), or will the asset be owned by a trust, LLC, or S or C corporation? Your decision has tax implications (important, but beyond the scope of this discussion) as well as crucial estate planning implications. There are significant considerations, such as liability exposure and other factors, but for our purposes here, your selection determines who will inherit a given asset following your death – and how that asset will pass to the selected heirs. Watch out for unintended consequences when choosing account registrations. For example, if you name only one child as TOD or JTWROS, you’ve disinherited all your other children. You could also create adverse tax and liability risks by converting “heirs” into “owners” of your assets. This is why estate attorneys often discourage their clients from using some of the ownership structures described above. In next blogpost, we will discuss how various assets pass to heirs under different conditions. Differences Between Short Term Disability Insurance and Long Term Disability Insurance - Part C12/7/2020 In last blogpost, we discussed what is long term disability insurance. Now we will discuss how to buy disability insurance.

Short-term disability is a pretty common employee benefit and can cover as much as 80% of your income for a few months. If you work in California, New York, New Jersey, Rhode Island or Hawaii, employers are required to offer short-term disability coverage. If you’re in another state, ask your human resources department for details. Some employers also include long-term disability insurance coverage as an employee benefit. You may also be able to purchase a group long-term disability policy through your company when you’re hired or during open enrollment if they offer supplemental benefits. Remember, if you get insurance through your employer, the coverage may end when your employment ends unless they have a portability option. Employers can decide to stop providing coverage at any time and or insurance companies can cancel policies. And keep in mind that you’ll probably have to pay taxes on employer-paid disability coverage. Buying your own policy allows you to customize it depending on your specific needs — which is why some people choose to buy their own coverage even if their employer offers one. Plus, if you own the policy, your benefits are tax-free. Individual coverage is a lot more comprehensive, because it’s not tied to your job. If you leave your job, it goes with you across the country. It’s kind of like a shadow — it follows you wherever you go. If you’re self-employed or want coverage beyond what your company offers, you can buy it directly from an insurance company representative or work with a broker for help. You might also be able to find group coverage through a professional association. Like life insurance, you’ll have to go through a medical underwriting process, which can feel pretty invasive. Medical underwriting involves answering health questions, giving a blood and urine specimen, providing access to your medical records and prescription history. You will also need to be underwritten financially since the carrier is replacing lost income. This involves the insurance company reviewing your tax returns, W-2s, pay stubs, and similar documents. As for how much it costs? Long-term disability insurance premiums vary depending on your income, age, occupation, and lots of other details, but most people spend 1% to 3% of their annual income. The younger you are when you sign up, the lower the premiums are likely to be. |

AuthorPFwise's goal is to help ordinary people make wise personal finance decisions. Archives

September 2022

Categories

All

|

RSS Feed

RSS Feed