People who have the option can contribute to a Roth 401(k) in order to accumulate assets in a Roth account. The proposed legislation does not limit these contributions, and the money can be rolled over to a Roth IRA when you leave your employer.

In many cases, a Solo 401(k) can offer a Roth option as well. This would work in the same fashion as a 401(k) offered via an employer as far as the employee contribution component.

Health Savings Account (HSA)

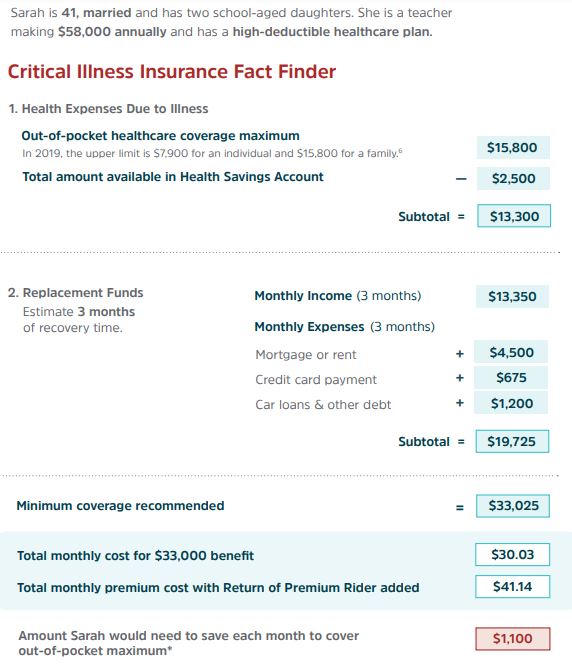

HSAs are a great vehicle for people who have access to a high-deductible health insurance plan. Health savings accounts allow for pretax contributions and withdrawals to cover eligible medical expenses are tax-free.

HSAs can act as another retirement account in that the money contributed to the HSA can be carried over from year to year if not used. This makes an HSA a great way to save for medical costs in retirement, essentially making it a tax-free retirement savings account. Many HSAs allow the money to be invested. If the money is not used for medical expenses in retirement, it can be withdrawn just like a traditional IRA with taxes due on the money.

Contribution limits for an HSA are:

- Individuals can contribute $3,600 for 2021 and $3,650 for 2022.

- Families can contribute $7,200 for 2021 and $7,300 for 2022.

- Those over age 55 can contribute an extra $1,000.

Life Insurance

A whole life insurance policy, along with some other types of cash value life insurance, is another way to build tax-free income in retirement. This is more complex than a backdoor Roth to be sure, but if this is a fit for you this can be an alternative.

Essentially, you would purchase the life insurance policy. Part of the premium funds the growth in cash value. They can withdraw the portion related to the premiums tax-free and take a policy loan against the rest of the cash value that will have accrued from dividends. The additional withdrawals will serve to reduce or eliminate the death benefit. Upon their death, the death benefit passes to your heirs tax-free.

There are a number of cautions and caveats to this approach, including ensuring you don't withdraw too much so as to create a modified endowment contract situation. Additionally, the cost of the premiums and your need for the death benefit should also be considered.

RSS Feed

RSS Feed