- regular LTC

- hybrid LTC; also has a death benefit (bigger LTC benefit, smaller death benefit)

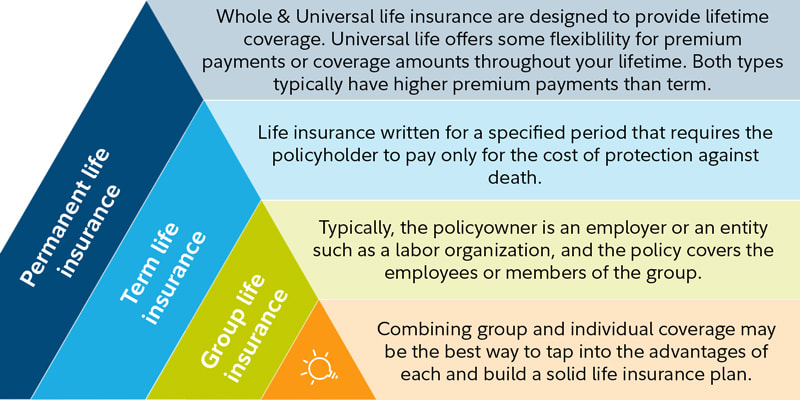

Insurance alternatives

- GUL/Whole Life policy with an accelerated death benefit or LTC rider (which I know most don't consider it true LTC coverage).

Annuity alternatives

- FIA + income rider; can double the payout for several years, which would help in case of a LTC event

- LTC annuity; 3-4x the principal to be used for LTC costs if needed

GUL + Reverse Mortgage alternative

- Reverse mortgage, line of credit; let it grow for years, compounding the interest rate. The money can then be used as needed if/when LTC is needed.

- GUL; to leave money to kids; if reverse mortgage money is used, there's less equity in the house to leave behind; so the GUL is to "protect" the inheritance of the children.

RSS Feed

RSS Feed