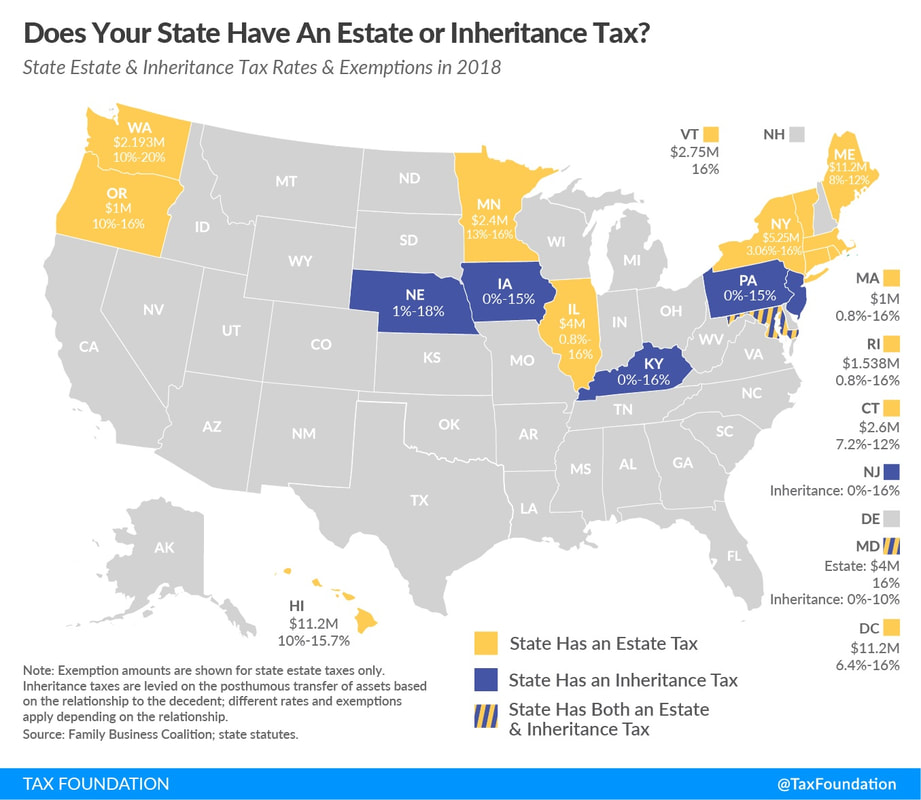

See the State Estate and Inheritance Tax Rates and Exemptions in 2018 map below:

|

Does your State have State Estate and Inheritance Taxes?

See the State Estate and Inheritance Tax Rates and Exemptions in 2018 map below:

0 Comments

Q. Are we overestimaing healthcare related costs in retirement?

A. Possibly. While most people probably have seen the annual Fidelity study that predicts individual retirees may need as much as $133,000 to $147,000 to cover health care costs in retirement, a recent EBRI study finds that after Medicare premiums, actual retirees are self-reporting the median spending on health care services is actually “just” $27,000, which averages out to barely more than $1,000/year or $100/month of out-of-pocket expenses over 25+ years of retirement, while total spending on all out-of-pocket medical expenses after Medicare premiums was under $2,000/year. In other words, beyond the ongoing cost of Medicare premiums themselves, the range of medical expenses in retirement may actually be much narrower, and much less uncertain, than is commonly suggested. Of course, there is still the challenge that medical expenses have, for decades, been inflating at a higher pace than the general level of inflation, and the cost of long-term care expenses in particular still remain a substantial wild card. Nonetheless, the EBRI survey shows that even those who die at age 95 or later and experience the most expensive (95th percentile) of costs, cumulative medical expenses are “just” $269,000 (effectively producing a range of medical expenses in retirement from $27,000 to $269,000). Which suggests in the end that the bulk of medical expenses may actually be more “plannable” and stable than commonly conveyed, and the real issue is how to plan for (or insure) long-term care expenses or the risk of a serious terminal illness that could rack up substantial medical bills in retirement. Q. What is the FIRE movement?

A. The acronym “FIRE” stands for “Financial Independence, Retire Early”, a movement born largely online with a focus on spending less, saving more, and harnessing the power of compounding to retire early. Her is an article from Quartz that analyzes its philosophy you might find interesting. The FIRE movement (as embodied by the massive nearly-400,000 participants in its active sub-reddit) arguably goes even further, embodying a broader life philosophy that combines personal finance with “a DIY work ethic, opportunistic side hustles, life hacking, and the tenets of anti-consumerism”. Are you on FIRE? Mark Miller from Morningtar tackles delayed filing, break-even points, and means testing of Social Security Benefits. North American launched its new indexed universal life insurance product, Builder Plus IUL — designed to help policyholders build a better future with stronger performance and marketability through competitive features including:

Q. How to evaluate the ROI from eliminate Private Mortgage Insurance (PMI)?

A. Saving up a “traditional” 20% down payment can be difficult for many individuals. As a result, many borrowers end up paying private mortgage insurance(PMI), in order to cover the lender’s risk that the proceeds from foreclosing on a property would not be sufficient to cover the outstanding liability of a mortgage. On the one hand, PMI is therefore valuable to borrowers as it creates opportunities for homeownership for those that don’t have enough cash saved up to put 20% down (it is effectively the “cost” of buying a home without a traditional down payment), but, at the same time, PMI can seem like an expensive drain on a borrower’s cash flow, making it enticing to pay down the debt to eliminate the need to pay PMI. How to determine the ROI in eliminating PMI? Here is a great article that discusses this topic. Q. How to plan for health care in retirement without going broke?

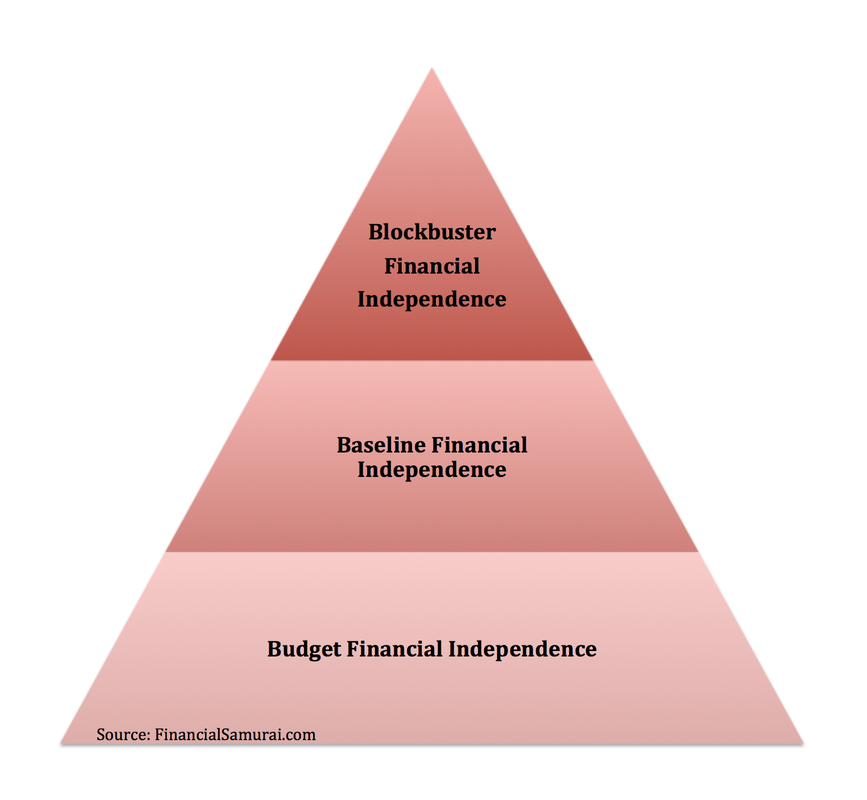

A. According to Fidelity’s latest estimate, a 65-year-old retiring couple will need an estimated $275,000 in today’s dollars to cover health care expenses in retirement (calculated as the present value of monthly Medicare premiums, copayments and deductibles, and prescription drug out-of-pocket expenses, but not nursing home or long-term care expenses). Notably, though, it’s not as though these retiree health expenses are actually due at a lump sum at the start of retirement; instead, the retirement is that they’re simply a series of $5,000 – $10,000/year expenses for retirees throughout the retirement years (albeit slightly lower in the early years, and higher in the later years as intermittent health events lead to a progressive series of higher-cost “one-off” health events). And in fact, the relative stability of health care expenses in retirement (at least until the later years) means it’s often easiest to simply earmark certain income retirements in retirement for those (recurring) health care expenses, such as one spouse’s ongoing Social Security payments. Pre-retirees might look to fund their future retiree health expenses by contributing to a Health Savings Account, and leveraging the HSA’s triple-tax-free benefits not for current medical expenses but retiree medical expenses. And for more affluent individuals, often the biggest challenge of health care expenses in retirement isn’t the actual cost, but simply the “sticker shock” of transitioning from a world where the employer often pays some, part, or even all of the health insurance expenses, while the retiree must handle the entire cost of Medicare premiums and co-pays, and Medigap supplement insurance, all by themselves. Of course, it’s also important to remember that one of the most straightforward ways to manage retiree health expenses is simply to try to live a healthier lifestyle in the first place, too! Check out the Marketwatch article for more details. 3 Tiers of Financial Independence, which tier you will belong to?

1) "Budget” financial independence You have enough and no longer need to work… but only if you make some necessary trade-offs to live a modest “budget” living of ~$40,000/year, which may entail moving to a lower cost of living area (even if you don’t necessarily want to), or delaying family/child decisions, or still feeling the need to engage in some side hustle to make ends meet; 2) “Baseline” financial independence You have enough to support a $100,000/year lifestyle that is consistent with the above median household income in the US; 3) “Blockbuster” financial independence Your sustainable income may be $200,000+/year or more, which makes financial independence viable regardless of where you live (even if it’s Manhattan or San Francisco!), or what kind of reasonably affluent lifestyle you live. Q. I have been deducting investment advisory fees in the past, but under the new tax law, from 2018, the itemized deduction for investment fees has been eliminated. How can I continue to get tax benefit for the fees I pay?

A. It's true that under the new tax law, commissions are still deductible, but if your financial advisor firm bills you wrap and AUM fees, they could no longer be tax deductible going forward. This leads to some best practice for paying fees out of your IRA accounts. For Traditional IRA Fees You should pay fees directly from your traditional IRA account, this effectively gains a deduction since investment fees are not paid from pretax fund. For Roth IRA Fees Roth IRAs are funded with after-tax dollars, so there is no tax benefit to pay investment fees out of your Roth IRA fund. It's best to pay a Roth IRA's expenses from outside Roth IRA account. #1 Decide how you are going to spend your time

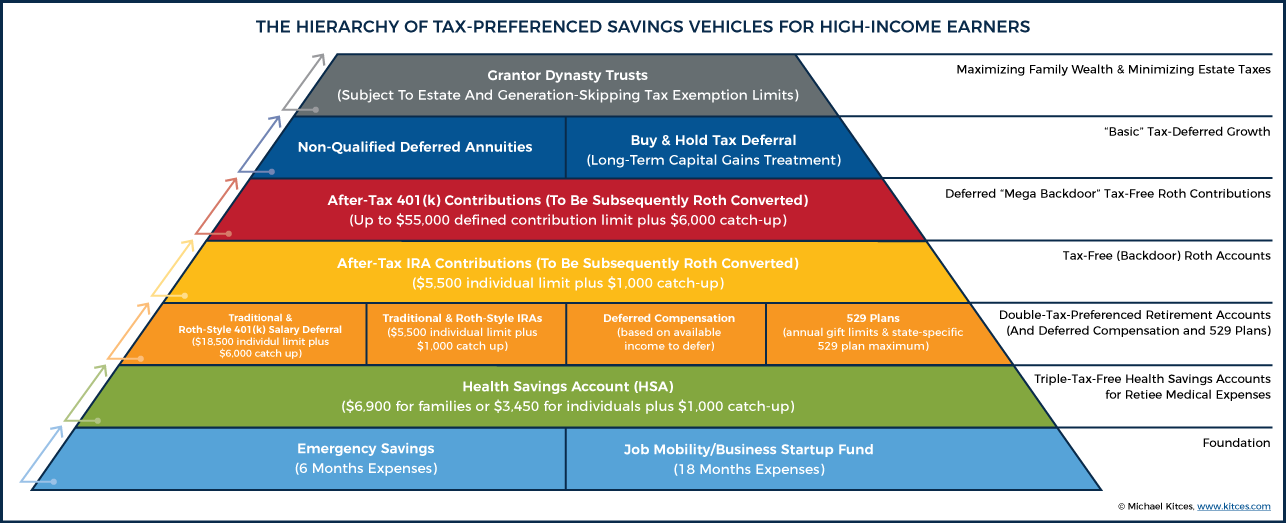

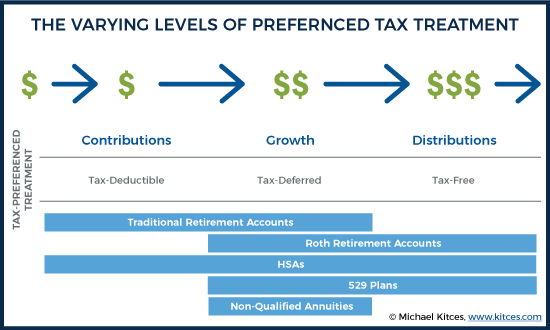

What are you going to do during the first six to 12 months in retirement, and what do you plan to do for the rest of your retired life? #2 Determine (realistically) how much money you will spend each month Remember to include periodic expenditures such as gifts, vacations, taxes, an occasional new car, and emergencies. #3 Anticipate the cost of healthcare You’ll have no employer to pay this for you — money for Medicare supplemental insurance (also known as “Medigap”) and private health insurance policies will come out of your pocket. #4 Consider buying a long-term care insurance policy Whether you should purchase a long-term care policy depends on your unique situation. When you shop for one, compare hybrid policies to traditional policies. #5 Refinance your mortgage Many people are shocked to discover that they either cannot borrow money after they retire, or they are forced to pay higher rates. #6 Boost your cash reserves Make sure your rainy-day fund is enough to cover at least six months’ worth of expenses. #7 Evaluate your sources of income You have already figured out what you’ll spend monthly. Now figure out where that money will come from. #8 Revise your investment strategy The way you’ve handled your investments over the past 30 years is not how you should handle them for the next 30. While preparing for retirement, you were focused on asset accumulation. When you’re in retirement, you need to focus on income and on keeping pace with the increasing cost of living. Assets must be flexible and liquid so you can meet needs you did not anticipate. New words will enter your vocabulary: rollovers and lump sums. #9 Review your estate plan Review your will and trust. Don’t have them? Get them. These documents can help protect you and your assets while you are alive and benefit your spouse and children when you pass on. #10 Ask yourself if you are excited about retirement Perhaps the most important thing of all. If you are not excited about retiring, then don’t. Many people quickly become bored after retiring. It’s OK — even exciting — to return to school or the workplace. Many do this, often in completely new fields. If you are interested in maximizing all the available tax-advantages out there, the following chart illustrates all the savings and investment vehicles you could take advantage of. For a more complete description, please read Michael Kitces' article.

Q. How many tax preferred accounts are out there in the U.S.?

A. There are 5 different types of tax preferred savings and investment vehicles, each with different restrictions. If money is not an issue, you should maximize your contributions to all of them -

Q. What are some of the expenses people didn't or under-budget for retirement time?

A. Here are 5 comon unexpected higher expenses for most retirees, see if you have considered all of them in your retirement budgeting - 1. Entertainment Expenses Many retirees are surprised to find out how much their actual entertainment expenses go up when they stopped working. 2. Healthcare Expenses Most people expect Medicare to cover all of the healthcare costs, it will not! 3. Home Related Expenses Even you downsize, you will find moving expenses or custom home improvement costs are a lot higher than you thought. 4. Family Support Expenses Many retirees still support their adult children financially. 5. Longevity Expenses Many retirees fail to budget for the scenario that they could live much longer than they thought, and it's very dangerous to run out of money when you are still alive! In our last blogpost, we discussed what is Chronic Hep B. Now we will discuss the underwriting of Chronic Hep B life insurance applications.

Underwriting for Chronic Hepatitis B The primary questions to be asked of a proposed insured that presents with this history are:

Underwriting decisions for chronic hepatitis B will be varied depending on the severity of the disease and how long a person has been infected. A Table 2-4 is typically what you’ll be looking at for a starting point, but Standard offers are possible with evidence of excellent control, normal liver function tests, negative biopsies, and good doctor's follow-ups. If you have concerns about your life insurance application, please contact us as we have a very experienced in-house underwriting team that could help you! Q. I have chronic hep b, will my life insurance application be declined?

A. First, let's discuss what is Chronic Hep B, then discuss what's likely offer an applicant with chronic hep B might get. About Chronic Hepatitis B Hepatitis B is an inflammation of the liver, due to an infection of the Hepatitis B virus (HBV). Although a common condition worldwide with more than half the population chronically infected, Hep B only has a 2% incidence of chronic infection in the United States. HBV is typically transmitted through birth, sex, or blood. Approximately one-half of the new infections are mild and unrecognizable occurrences. The other half are more significant that will show signs of jaundice and/or elevated liver function tests and, long-term, may develop into fibrosis, cirrhosis, or cancer…and occasionally death. Not to be confused with acute Hep B exposure — that typically isn't a real underwriting concern, once resolved — infections lasting longer than 6 months are considered chronic. To be considered for life insurance, a client must be recovered, in a carrier state, and/or only have a mild form of hepatitis. In our next blog post, we will discuss underwriting for help B applicants. Every year, analyst Mary Meeker presents a detailed report on internet usage, devices, behaviors, and more. Everyone should pay attention to these trends, here is a link to this report.

Q. I am still working at age 70 but can't delay required minimum distributions by consolidating my retirement accounts to my current employer's 401k account. How can I reduce tax on my RMDs?

A. Below are 2 options for older workers who don't need to tap savings to pay living expenses - 1. Give your RMD to charity Once you turn age 70.5, you can donate up to $100,000 from your IRA directly to charity every year. The donation wil count as your RMD and won't be included in your adjusted gross income. This could help you avoid a high-income surcharge on your Medicare premiums and lower taxes on your Social Security benefits. 2. Invest in a QLAC A qualified longevity annuity contract allows you to invest up to 25% of your IRA (up to a maximum $130,000) in a deferred income annuity that begins payouts years after you retire. The amount invested in QLAC isn't counted when calculating your RMD. Once you start taking income from the annuity, it will be taxed, along with your other RMD. But by that time, your tax rate should be lower because you won't be working anymore. Q. What are the top online freelancing websites?

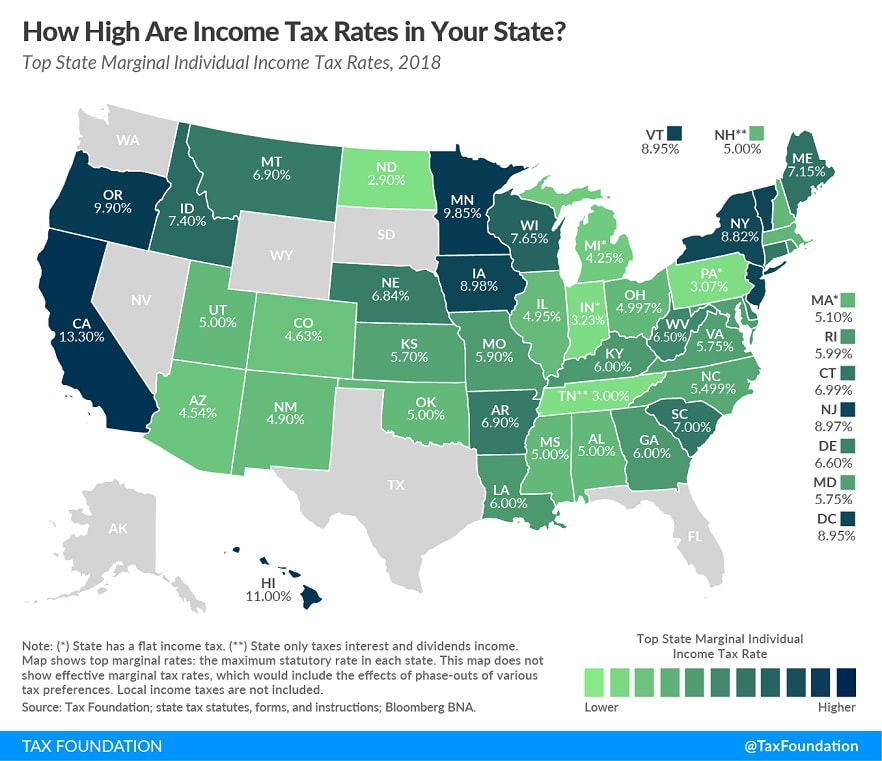

A. Here’s a list of the top online freelancing marketplaces, although there are many more focusing on specific skills like writing, design, or coding: Amazon Mechanical Turk is an interesting one. The site harnesses thousands of willing virtual workers to complete large, mundane tasks cheaply. Examples include transcribing audio, translating documents, tagging images, collecting URLs, etc. Tasks (called HITs) don’t take very long but only pay between a few pennies and a dollar. In other words: Less than minimum wage. TaskRabbit connects real-world workers with customers who need help with simple to-dos: Doing the grocery shopping, weeding a yard, assembling IKEA furniture, moving stuff, housecleaning, you name it. It’s available in about a dozen U.S. cities. To become a TaskRabbt you must be 21 and pass a background check. Once approved, you can bid on jobs just like other freelance sites. TaskRabbit competitors are popping up, too. Handybook focuses on cleaning and handyman services. GigWalk posts tasks related to local businesses, such as recruiting attendees for a concert or finding the prices of milk at a grocery store’s competitors. If you have a decent car and a clean driving record, you might consider becoming a driver for ridesharing services like Uber, or Lyft. Once approved, you can login to these apps and bid to give rides to customers. The app collects the money from the customer and pays you for each trip. But don’t be fooled, you might make less than you think as a rideshare driver. Which State has no income tax, which State has the highest income tax rate? This chart below shows it all - Note: (*) State has a flat income tax. (**) State only taxes interest and dividends income. Map shows top marginal rates: the maximum statutory rate in each state. This map does not show effective marginal tax rate, which would include the effects of phase-outs of various tax preferences. Local income taxes are not included. Source: State tax forms and instructions; Bloomberg BNA.

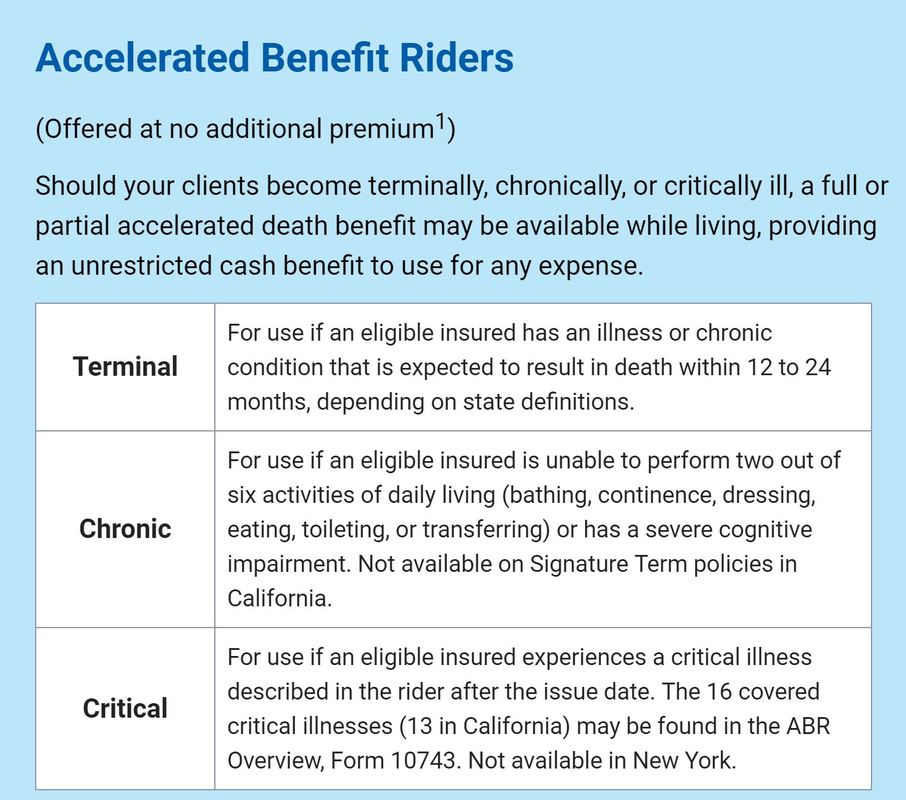

American National's Signature Term life product offers free living benefits riders. Its online quoting tool is very easy to use, you can click here to access the tool and play around with different scenarios and compare with other term products' rates.

American National's Signature Term life offers 3 free living benefits riders, and its rates are usually very competitive as well. 1 All riders may not be available in all states. The riders are offered at no additional premium. However, the accelerated payment will be less than the requested death benefit because it will be reduced by an actuarial discount and an administrative fee of up to $500. The amount of the reduction is primarily dependent on American National's determination of the insured's life expectancy at the time of election. Form Series ABR14-TM; ABR14-TM(NY); ABR14-CH; ABR14-CH(NY); ABR14-CT; ART12; ART12R(NY) (Forms may vary by state). Q. What kind of housing options are available for seniors, other than staying at their own homes?

A. There are 5 major housing options for retirees - 1. Aging at your current home You can stay at your current home and get help if needed. This minimizes any disruption from moving but may not be practical for every senior. 2. Home sharing If you have friends in similar situations, you can arrange with them sharing the same home. Visit National Shared Housing Resource Center for more information. 3. Continuing care retirement communities (CCRC) Such communities offer living arrangements that range from independent living to skilled nursing, with people moving from one setup to the next as their needs change. Visit National Investment Center for Senior Housing and Care for more information. 4. Naturally occurring retirement communities (NORC) People usually live in their own homes or apartments but pay an annual membership fee for access to transportation, social activities, or health care management services. Visit NORCBlueprint.org for more information. 5. Cohousing It works like a modern commune, members typically buy their own apartment or home and pay monthly membership dues to be part of the community and use a common area for meals, socializing and events. Visit Cohousing.org for more information. Q. How can I cut my living expense without moving to a cheaper place? I am in retirement now.

A. The only way is to sell your house to your children, assume they are willing and able to pay for the property's taxes, maintenance, repairs, and any remaining mortgage payments, and rent the house to you - with or without a rent. If you don't want to sell, you can give your house to your children via an irrevocable trust, then rent and live there. |

AuthorPFwise's goal is to help ordinary people make wise personal finance decisions. Archives

September 2022

Categories

All

|

RSS Feed

RSS Feed