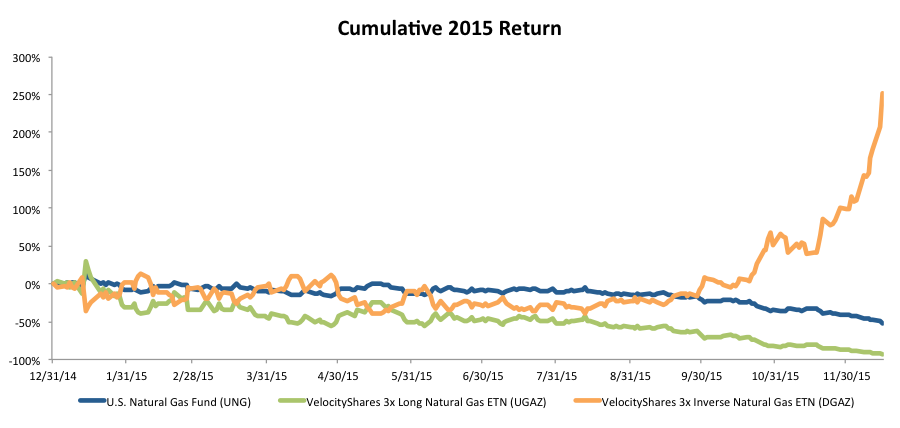

A. The chart below shows the year to date 3 natural gas funds' performances - the unleveraged ETF (UNG), the leveraged 3x Long (UGAZ) and Short (DGAZ).

In the end, UGAZ is down more than 90%, which the holders of UGAZ should feel lucky, because in theory it could down 3 times. For DGAZ holders, it's up 250%, less than 3 times as expected, but obviously it's a great performance if you were on the right side.

The above leveraged funds' performance proved what we discussed before - leveraged ETFs are toxic for long term investors - too much risk, just imagine you were thinking natural gas should be on an upside but it turned the other way. Your potential return is not worth the high volatility and risk.

RSS Feed

RSS Feed