|

Although term insurance is not always the most effective type of life insurance for all of a person's death benefit needs, it can be useful in many circumstances. Since term insurance is not just one product, but rather many variations on a general theme, different types of term insurance could be used for different people's needs.

Below we will discuss 10 advantages of a term life insurance policy. Advantage 1. Term insurance allows a person to acquire the greatest death benefit for the lowest premium outlay when the policy is first issued. However, this does not mean that term insurance is necessarily the least expensive form of insurance over the full duration of needed coverage. Because term premiums increase at each renewal, at the later ages the premium cost will far exceed the level premium that would have been charged for an ordinary whole life policy issued at the same age as the original term policy. Advantage 2. Term insurance is the best alternative for temporary life insurance needs. Usually term insurance is the best alternative if protection is needed for less than ten years. Conversely, some form of cash value life insurance will generally be the best alternative if protection must continue for fifteen or more years. If the duration of the needed protection is between ten and fifteen years, the best alternative depends upon the facts and circumstances of the case. As a general rule of thumb, term insurance will tend to be better than cash value insurance at issue ages below age 45, and worse at older issue ages if the length of the need for protection is between 10 and 15 years. We will discuss next sets of advantages in our next blog post. Q. I heard talks that health care costs will be very high in one's entire retirement life. How much should I prepare for the retirement health care costs?

A. Based on HealthView Service's 2016 Retirement Health Care Costs Data Report:

More than half of your social security benefits will go to health care costs:

Q. I heard the mortgage rate is near historical low again. What's the best way to refinance my mortgage?

A. Like any other purchases, the best way to refinance your mortgage is to shop around! You can start from Bankrate.com, on its front page, there is a section on the right for "Compare Rates", you can check the Refinance tab, then enter your zip code below, you will see a list of mortgage refinance offers in your area. Make sure you let the numbers talk, and don't be easily fooled to believe zero cost refinance is truly zero cost, as it could mean you are paying a higher interest rate, or roll the cost of refinance into your mortgage loan. Finally, note that the final offer will be dependent upon your credit score, so make sure take time to clean up and improve your credit score before you shop around, and this could take a few months to complete. Q. Is it true that delaying one's collection of social security benefits could always bring higher spousal benefits?

A. Not necessarily true! When one delays collecting social security benefits, the payout always increases. However, that doesn't necessarily mean the spousal benefits would increase as well. Here are two scenarios: Scenario A. A husband is eligible for a monthly benefit of $A at his full retirement age of 66, but waits till age 70 to claim social security benefits at amount $B (higher than $A). However, the delayed retirement credits (difference of $B-$A) are not used in calculating spousal benefits! So if the husband's wife claims social security at her full retirement age, her spousal benefit would be only half of $A, or half of the amount the husband would have received at age 66. Scenario B. The same husband starts collecting social security benefits at age 66 $A. As time passes, his benefits will gradually increase, due to annual cost of living adjustments and was recalculation. Let's assume at age 70, his monthly payout has increased to $C ($C will be a figure greater than $A but less than $B). Now, this husband's wife, if she first claims a spousal benefit at her full retirement age 66, would be eligible for a monthly sposal benefits of half of $C (higher than half of $A), or half of husband's current benefit. Q. How to interpret a stock price's gap up?

A. When a stock opens higher and stays there or even higher, it creates a gap in the stock's price chart. There are two types of stock price gap ups and they have different implications: Breakaway Gaps What is it In a breakaway gap, stock price breaks out a trading pattern and a new trend is starting. Implications It is a sign that a bullish trend is about to begin. Exhaustion Gaps What is it An exhaustion gap typically happens at the end of an up or down trend, it is caused by investors abandon previous bets (shorts) against the stock. Implications It is a sign that the run-up or the decline is ending, and a reversal is around the corner. Retirement Goals

Understand Annuities

Living Benefit Riders

Q. What are the U.S. estate and gift tax challenges faced by foreign nationals?

A. Foreign nationals may be subject to large U.S. Federal estate and gift taxes. Specifically, foreign nationals who do not permanently reside in the U.S. but who have assets in the U.S. cannot take advantage of some of the tax provisions available to U.S. citizens and resident aliens When a person with these circumstances and did not plan ahead, when they pass away they could owe a large estate tax bill. Furthermore, many people are confused about the definition of Non-resident Alien and Resident Alien, you can read one of our previous blog posts that discussed this topic. In our last blog post, we introduced a case study about a couple Jane and Joe and their retirement goals and challenges. Now we will describe the solution below:

The Solution Jane and Joe's financial advisor decided that the best course of action to better align them with their goals would be to offer them both permanent life insurance. This strategy gives them the potential to accumulate cash value as well as adding a long term care rider to the policy. Death Benefit The permanent life policy will provide individual protection in the event that one of them dies suddenly. The remaining spouse would be able to live out the rest of their retirement as they had planned. A permanent policy with a death benefit guarantee can help ensure that the coverage will remain in place until advanced ages or even to age 121, depending on the policy and the way they choose to pay their premiums. Long Term Care Rider If Jane and Joe choose to add a long term care rider they would be covered if either one of them became chronically, critically, or terminally ill. The rider will also give them the ability to accelerate their policy’s death benefit when they are alive so they can have money for whatever they need (i.e., building ramps to the home, adding a stair lift, etc.). This type of flexibility in the policy will give them added security. However, if they accelerate the death benefit while they are alive there will be less, if any, remaining death benefit available for their beneficiaries. Tax Benefits When Joe and Jane die, their estate will be passed on to their children. If their estate passes directly to their children, there is a possibility for a significant tax bill. All of the inheritance from their retirement accounts (the IRAs, 401(k)s, etc.) may be taxed at income tax rates as high as 39.6% since it would be impacted by their children’s other income and the way in which they withdraw the funds. That tax bill alone could cost them tens of thousands of dollars. With a life insurance policy, between the death benefit and any cash value it has accumulated, the children have a ready source of generally tax-free funds that they can use to pay off any taxes that are due and still have any remaining policy values for their own without any income tax obligation. The Conclusion Life insurance in retirement planning is a critical asset to ensuring you have a retirement free of financial burden. As we've seen with this case study there are many ways to incorporate life insurance into any retirement plan. Please contact us if you want to discuss any solution that fits your unique needs. When you plan for your future with your eyes toward retirement, a permanent life insurance can be a smart and simple solution to the challenges you may face.

A Case Study Joe is a 55 year old CPA and his wife Jane is a 51 year old Teacher. They have been married for 20 years and have 2 kids. The Current Situation

The Challenge

Jane & Joe's Retirement Goals

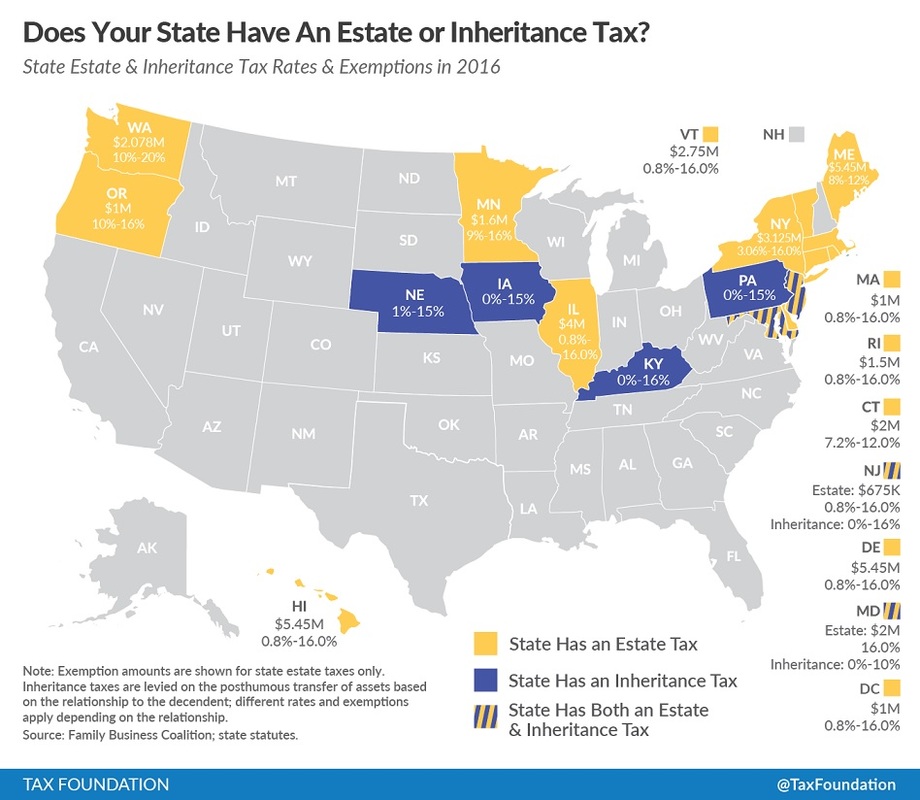

In our next blog post, we will discuss the solution. Q. Do you have a list of states with estate and inheritance taxes?

A. Check out the map below that shows states with estate and inheritance taxes and their rates - Q. It appears the recent market turmoil is actually a buying opportunity, what's the best way to take advantage of the market turmoil?

A. If you are the kind of investor that are always ready to snatch a bargain, the recent events like Brexit presents such an opportunity. One thing you could do is to sell a put of the stock you wanted to buy, now with the market turmoil, the stocks' volatilizes will increase which drives up the put's value. If the stock price drops, you could buy the stock at a lower price before the market turmoil. If the put wasn't executed by the buyer, you can keep the premium of the put. In our last blog post, we showed the 3 myths people usually have about successful investors. Now we will share 3 ways to evaluate a truly successful investor.

Annual Compound Growth Rate Over a Long Time It's best to check the return history of the investor - over a long period of time that includes at least two cycles of the stock market If the annual compound rate could beat the market considerably during such a long time period, then we have a truly successful investor! Stable Returns Over a Long Time The second metric to evaluate an investor is to see if the investor could keep stable returns over a long time. If an investor lost to the market consistently over many years, then had a huge successful year that led to a good annual compound growth rate, obviously the investor still couldn't be called a successful investor. Maximum Draw Down Over a Long Time The third metric to evaluate an investor is to observe the maximum draw down the investor experiences during the stock market cycle, especially during the worst time. Stock market often has the black swans, when it happens, it is a great time to test the investor's risk control ability, which is a must have for any successful investor. It's extremely hard to become a successful investor. For most ordinary investors, there is a practical way to be successful in the long term, we will discuss in the next blog post. It's very hard to be a successful investor. A truly successful investor is rare to find, but many people had wrong perception of a successful investor, as described below:

Accurate Predictions of Stock Market Moves Someone who made accurate predictions stock market's movements recently doesn't mean that person is a successful investor. You won't have a hard time to find stock predictors from the media, however, the truth is, while we could have a reasonable confidence about the long term stock market's movement, no one could consistently and accurately predict stock market's moves in the short term or medium term. High Short Term Returns Someone made great returns lately, or even over past several years doesn't mean that person is a successful investor. Just like in the casinos, there are always some winners, but a truly successful investor should be able to withstand the test of time. To judge someone who is a successful investor or not, you need to see if that person could survive and beat the market in several market cycles - not just when the market is up, but also when the market is down. High Risk High Returns Someone achieved great returns by taking great risks doesn't mean that person is a successful investor. For example, two investors achieved same return, but one took a leverage and one didn't, clearly we shouldn't just evaluate an investor's returns, more importantly, we need to evaluate risk-adjusted returns. In our next blog post, we would look at what are the measures we should use to evaluate a truly successful investor. Q. What are the most popular scams targeting seniors?

A. Based on National Council on Aging, here is a list of top 10 financial scams targeting seniors:

Q. I could qualify to invest in startups as an early stage investor. What are the factors I should consider?

A. Now if your income is over $100,000 and have a net worth over $100,000, you could invest in startups as an early stage investor. Millions of working class people might try their lucks in this new investment area. Below are 5 questions a recent Wall Street Journal article mentioned that everyone should ask before reaching to the pocket: 1. Could I afford to lose what I invested? The chance of the failure of a startup is very high, which means the chance of you losing your entire investment is very high. Can you afford losing it entirely? 2. How many investments have I looked into? Successful venture capitalists screen hundreds of deals before committing to a few startups, how many pitches have you gone through and feel comfortable the one before you is the one to go? 3. Did I do my homework? We have discussed before the due diligence required when invest in startups, and keep in mind, you are not evaluating a product, you are evaluating a business! 4. Was I overconfident? Are you overly confident on your investment decision making ability? Do you have a good track record that justifies so or not? 5. What is the exit path? Success early stage investments typically take at least a few years to exit with a profit. Can you sell your investment in any private exchange or stuck it for as long as it takes to cash out? Q. When I sell my primary residency, my gain will be above $500,000. What tax do I have to pay on the gain?

A. If you are married filing jointly, for your gain that exceeds the $500,000 maximum exclusion amount, it will be treated as long term capital gain and subject to the long term capital gain tax. In addition, the portion of your gain that is taxable is also treated as investment income for purpose of the 3.8% tax on net investment income. Q. Can I deduct loss as a long term capital loss from selling my primary residence?

A. The answer is No. Based on IRS ruling - married couples filing jointly could exclude up to $500,000 of the gain on the sale of their primary residence, if they have owned their home and used it as the main home for at least two of the past 5 years before the sale date. Any gain after the $500,000 amount will be subject to capital gain tax. Unfortunately, if you suffer a loss from selling your primary residency, you can NOT deduct the loss on the sale. Q. Is life insurance portable?

A. If you got your life insurance through your employer, when you leave the company, you lose the insurance. If you purchase a life insurance policy on your own (outside what your employer offers), it is always portable. You can move from one state to another state, or to another country, as long as you pay the premium, your policy will be in force. Q. What is no medical exam life insurance? Is it better or worse than normal life insurance?

A. The answer is, it depends. No Medical Exam Life Insurance (aka No Exam Life Insurance, Nonmed Life Insurance, Simplified Life Insurance, Guaranteed Life Insurance) is life insurance that does not require a paramed exam. Specifically, it does not require a blood sample, which many insurance applicants want to avoid. No Medical Exam Life Insurance is usually bad for very healthy people because of higher premium costs. However, it is good for people who have various health conditions, such as high blood pressure, high cholesterol, overweight, etc. For these people, if they apply for a medically underwritten policy, they could be table rated and have to pay a very high premium. Usually a No Exam policy would have a lower premium Also, for people with serious health conditions they would be declined normal life policies, No Medical Exam Life Insurance is the only option available to them. Please contact us if you have serious health conditions and have been declined life insurance elsewhere, we will find one No Med Exam policy for you. Q. Does low interest rate have anything to do with stock price?

A. The relationship between interest rate and stock price seems to be remote, but it's real, and complicated. When you evaluate a potential investment, you want to estimate its intrinsic value, which is based on future estimated cash flow divided by a discount rate. When interest rates are lower, there are two implications. First, lower interest rates imply distressed economic environment, a company's ability to generate superb cash flow will be impacted in such an environment. Second, lower interest rates imply lower discount rates, meaning an investor's expectation on return will be lower as well. Combine the above two implications, you will find it's hard to pinpoint the exact direction the lower interest rates on stock prices. However, we know one thing, if you forecast a company's ability to generate future cash flow based on its past (when interest rates were higher) records, you will greatly exaggerate its intrinsic value. Q. What can I do if my life insurance application was denied?

A. First, do not panic. Sometime simply by providing some additional medical records or getting a letter from your doctor could change the insurance underwriter's decision. Second, make sure you work with an experienced agent who represents many different life insurance companies, an experienced agent could you find out what're the issues that led to the denial of your application, and find an alternative company who might give you a pass in those areas. So far, we have not had any single client who was denied, we could always find the least cost solution for our clients. Please contact us if you have any concern for your health conditions and worried that might lead to denial. We will make you happy! Q. My mother is not a U.S. citizen, can I have her as the beneficiary of my life insurance policy?

A. Yes, your parents, even as non-U.S. citizens, can be your life insurance policy's beneficiaries, although typically as contingent beneficiaries. You just list their name in the beneficiary form, no further documents required at the time of application. Q. What are the tax advantages of annuity?

A. Annuity has the following 4 major tax advantages: 1. Tax-deferred growth The money you put in an annuity grows tax free as the interest compounds. This creates an attractive accumulation opportunity because your money will be able to grow on an annual basis without paying any income tax during the year. 2. Pay tax on profits only Unlike most other investments, you only pay tax on gains when you withdraw money out of annuity. This alleviates any worries about paying taxes on dividends, interest, or capital gains associated with most other financial products. 3. Reduce taxation of social security benefits Fixed and indexed annuities generate tax-deferred income, which has no impact on social security benefits, as long as the money stays in the annuity. This contrasts to many other "safe" products such as CDs, savings and money market accounts and municipal bonds that all contribute to provisional income, which often causes more of the owner's social security benefits to be taxed. 4. Flexible tax reporting and payment You can purchase an annuity, then wait till retirement to take distributions, in that time you're more likely to be in a lower tax bracket. You can essentially defer tax payments until it becomes more favorable for you to do so. No reporting is required as long as income isn't taken out of the annuity. In our last blog post, we discussed who are foreign nationals and what problems do they face. Now we will discuss how life insurance solves their problems.

Purchase life insurance in many foreign countries (e.g. China) can be very expensive and uncertain, U.S. life insurance has a strong appeal to foreign nationals. Specifically, here are some of the major benefits of having U.S. life insurance policies:

Can a foreign visitor with B1/B2 visa purchase life insurance in the U.S.? Are there any reputable life insurance companies cater these foreign nationals? The answers are Yes to both questions and you can find out the answer from one of our previous blog post. If you or someone you know who are foreign nationals and are interested in purchasing U.S. life insurance, please contact us, we have the expertise to help the out. |

AuthorPFwise's goal is to help ordinary people make wise personal finance decisions. Archives

September 2022

Categories

All

|

RSS Feed

RSS Feed