Below is a brochure from Securian to shows you how to use life insurance policy as a financial tool to plan your retirement.

|

As you prepare for retirement, you’re probably concerned about protecting the value of your assets, retiring comfortably and leaving a legacy for your family. Many people think preparing for retirement involves saving as much money as possible and investing it wisely by diversifying. However, in addition to diversifying investments, smart retirement savers also consider how taxes will affect their retirement dollars. Below is a brochure from Securian to shows you how to use life insurance policy as a financial tool to plan your retirement.

0 Comments

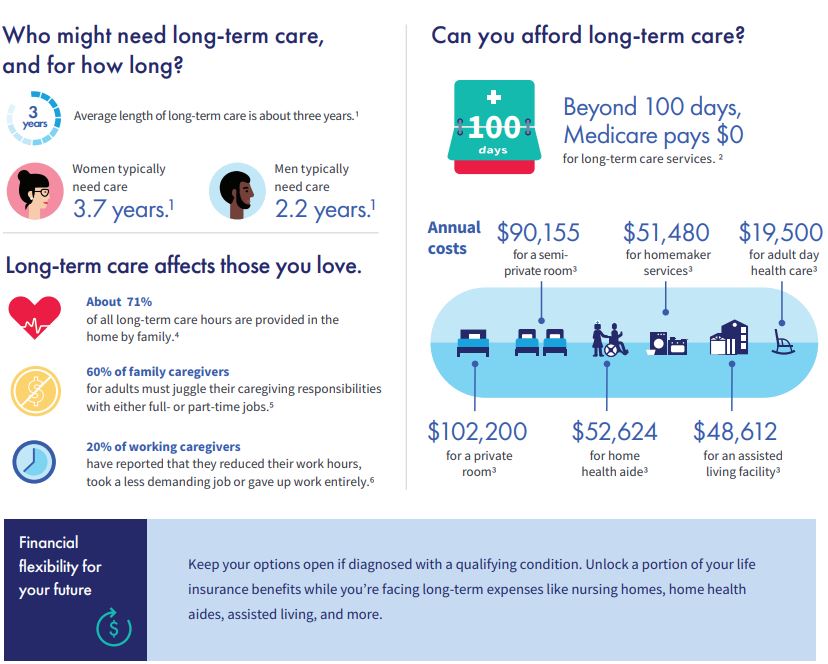

Did you know that beyond 100 days, Medicare pays $0 for long-term care services? Are you prepared?

You can use life insurance with Chronic illness riders to minimize unexpected financial strain due to a long-term illness. Q. I have cancer, can I still get life insurance?

A. Underwriting offers for cancer are very dependent on the amount of time passed since treatment, the location and type of cancer, and most importantly, the stage and grade. Many low-grade cancers can be offered Standard rates within a few months of treatment, while higher staged or graded tumors may take several years of postponement, followed by a period of years with a flat extra rating, before being considered at Standard rates. You need to be prepared to answer the following questions regarding the history of cancer -

Please contact us so we can help you find the best carrier given your situation. From the chart below, most consumers should face a medical reality checkup. If you are considering life insurance, you need to proactively consider using life insurance with flexible product features, such as Chronic illness riders.

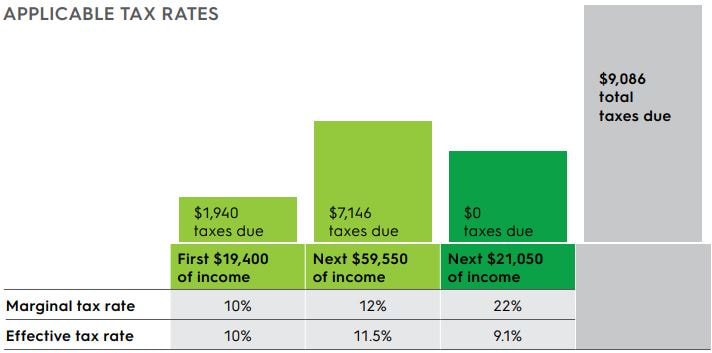

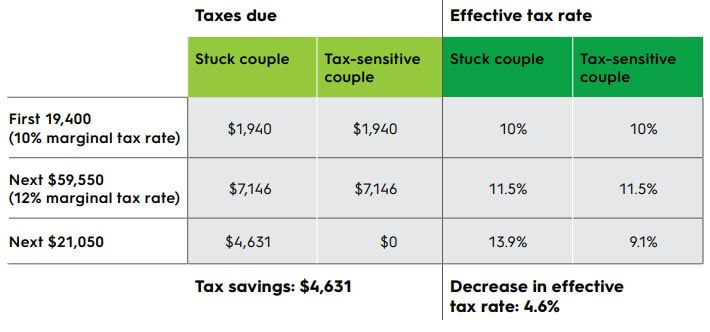

It’s not just how much your investments go up or down, it’s also when the ups and downs occur. The brochure below shows you the sequence of return risks and how to use permanent life insurance to prevent the sequence of return risks. As a business owner, your first concern is growing your business. You face tough financial questions. Securian has developed the Business Owner Life-stage Design (BOLD) process to help business owners like you. With BOLD, we can help address the unique and complex challenges you face. So you can stay focused on your business – and achieving the goals that matter most to you. The silver lining of the COVID-19 event is many life insurance carriers now offer accelerated and lab-free underwriting, which means you could get life insurance coverage faster and without medical exam! Attached below is a detailed description from Legal & General (aka Banner), other carriers' offers are similar, and some would even allow more than $1 million coverage amount! In last blogpost, we had a case study for a "stuck" couple. Now we will show you how a "smart" couple use life insurance to lower taxes. Case 2: "Smart" Couple Use Permanent Life Insurance to Lower Taxes The second married couple has the ability to design a tax-sensitive distribution strategy because they are using permanent life insurance to protect their family and their wealth. Just like the previous couple, their desired income is $100,000 and their required income is $78,950. However, they have the flexibility to take out $21,050 from any of the three financial toolboxes. This year, they decide they want to be as tax-efficient as possible and will take dollars from a tax-advantaged toolbox to fill their income gap. Net worth: Includes assets from all three financial tools: capital assets, retirement income and tax-advantaged Achieving desired income The taxpayers with a tax-sensitive distribution strategy desire to be as tax-efficient as possible. Taxes for tax-sensitive couple This couple will pay taxes in the first two tax brackets only. Their total taxes due will be $9,086, and their effective tax rate is 9.1 percent. Results

In this case, the second "smart" or tax-sensitive couple has a tax savings of $4,631 and a decrease in the effective tax rate of 4.6 percent compared to the other couple: In our last blogpost, we discussed withdrawals and tax. Now we will use 2 case studies to show how to use permanent life insurance to lower taxes. 1. One couple is stuck in their tax bracket 2. Another couple has a tax-sensitive distribution strategy Each couple puts away the same amount for retirement, but they allocate assets differently among the tools. Some contributions were made to qualified plans. Couple 1: Stuck in their tax bracket The first couple chooses to protect their family’s dreams, aspirations and accumulated wealth with term life insurance until it runs out. They focus solely on capital assets and retirement income assets to fund their retirement.

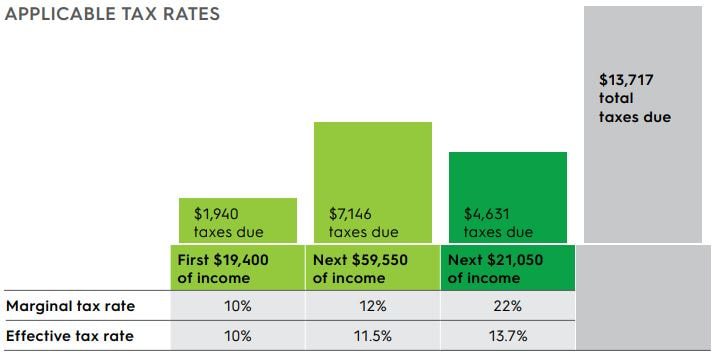

Achieving desired income The taxpayers stuck in their tax bracket decide to take dollars out of their retirement income toolbox to cover their income gap. Taxes for “stuck” married couple This couple will pay taxes on the first two tax brackets and some ($21,050) in the 22 percent brackets. Their total taxes due will be $13,717 and effective tax rate is 13.7 percent. In our next blogpost, we will show you how the second couple use life insurance to lower taxes. In last blogpost, we showed you the difference between policy surrender and policy loan. Now we will discuss how withdrawals are taxed.

How Are Withdrawals Taxed? In general, withdrawals from a policy’s cash value are not taxed until the owner’s entire investment in the contract has been withdrawn. There are four exceptions to this rule:

How are policy loans taxed? Policy loans taken from a life insurance policy are not taxable unless the policy is a modified endowment contract. If the insured dies while the loan is outstanding, the loan will be repaid out of the death benefit and no taxation should occur. Remember, there may be tax ramifications if the policy is surrendered, lapses or is exchanged while a loan is outstanding. What are the tax ramifications if the policy is surrendered? If the policy is surrendered, then the cash value will be taxable as ordinary income to the extent it exceeds the owner’s contributions to the contract. Any loss incurred is non-deductible and a personal expense. In addition, loan balances in excess of the owner’s contribution to the policy may also be taxed upon a full surrender. How is the internal cash value buildup taxed? Generally, any increase in the cash value of a life insurance policy is not subject to current income taxation as long as the policy meets the statutory definition of life insurance. However, if a policy does not meet the definition, any increase in the cash value will be taxed as ordinary income annually as received or accrued by the policyholder. In our next blogpost, we will use 2 case studies to illustrate how to use life insurance to lower tax. In last blogpost, we discussed 3 aspects of tax advantages of life insurance policies. Now we will discuss the withdrawals from permanent life policies.

Understanding how distributions are made and their tax treatment is important to knowing how and when you should take them. Partial surrenders vs. policy loans You can withdraw money from your policy’s cash surrender value by requesting a partial surrender — up to the amount of premiums you have paid — tax-free. This reduces the policy’s accumulation value and the policy’s death benefit. Because of the Internal Revenue Code (IRC) tax treatment of distributions from life insurance contracts — first in, first out — you can withdraw the cost basis first before you take out the gain. Once you have withdrawn the cost basis from a life insurance contract, any further withdrawals would cause taxation at ordinary income tax rates. In order to avoid taxation on the distributions over the cost basis, you can borrow money from the life insurance company using the gain in the policy as collateral. Since an obligation to repay the loan remains, a loan does not cause taxation to the policyholder. Policy loans and withdrawals may create an adverse tax result in the event of a lapse or policy surrender and will reduce both the surrender value and death benefit. In our next blogpost, we will show you how withdrawals are taxed. In last blogpost, we discussed 5 questions you should ask about your life insurance policy. Now we will show you the tax advantages of life insurance.

Tax Advantages of Life Insurance Permanent life insurance can be a key asset for many individuals due to its tax-advantaged treatment. No other financial tool becomes an instant asset upon the death of the insured. There are three key aspects of life insurance you should understand:

1. Premium Payments A life insurance policy is purchased with premium payments you makes to a life insurance company. The following are several key questions and answers related to premium payment. Are there contribution limits for life insurance policies? Unlike other tax-advantaged assets like Roth IRAs, there are no contribution limits based on your income. However, there is a limit set by the IRS determined in large part by the amount of death benefit being purchased. What are the benefits of a well-funded policy? A well-funded policy is funded close to the legal limits in order to achieve the most amount of premium growing tax-deferred. This reduces the risk the policy will lapse or will require additional premium payments, and potentially produces higher cash values. How do charges and fees impact accumulation value? While permanent life insurance does offer growth potential, you should understand several charges are assessed to your premiums before contributions reach the cash value portion of their policy:

2. Death Benefit Your’ premiums pay for a life insurance policy’s income tax-free death benefit – the primary purpose of this tool. If the insured dies, the death benefit can provide:

3. Cash Value While you see the value in a life insurance policy’s death benefit, you might not fully understand the cash value component of permanent policies. Understanding cash value accumulation is key to realizing the full value of life insurance as a financial tool. A well-funded policy that has good performance throughout the life of the contract can potentially:

In our next blogpost, we will discuss the distributions from permanent life insurance policies. In last blogpost, we introduced the concept of LIFT, now we will show you 5 questions you should ask about life insurance.

5 Questions to Ask To begin the LIFT research, you can explore the answers to these five common questions about choosing life insurance — and understand the tax advantages (see next blogpost):

In next blogpost, we will show you the tax advantages of life insurance. No tool can solve every problem. You should consider a variety of tools for your retirement strategy. One of these financial tools is permanent, cash value life insurance. Use life insurance is a key financial tool can:

Family Protection Tool Positioning life insurance as protection for family and accumulated assets can be part of every financial strategy. For people who may no longer contribute to qualified plans and other retirement vehicles due to income-based restrictions, additional dollars into a permanent life insurance policy can provide additional benefits, like:

In our next blogpost, we will discuss 5 life insurance questions you should ask. On March 27, 2020, the House of Representatives followed up on the Senate’s March 25 passage (by a 96 to 0 vote) of H.R.748, the CARES Act. The House passed the $2+ trillion bill by a voice vote. The bill’s goal is to rescue the economy and the millions of Americans struggling with the virtual nationwide shut-down of most commerce as a result of the coronavirus pandemic.

The law is stuffed with billions of dollars in loans, grants and direct payments to help individuals, people who have lost their jobs, small and medium sized businesses, big businesses especially hard hit by the coronavirus crisis, medical care providers, and states and localities battling the crisis. Below is a list of the CARES Act’s programs that may be of particular interest to NAIFA members and/or their clients.

Borrowers apply for these loans through participating banks. They will pay no fees on these loans. If, a year later, the borrower has not reduced payroll, or reduced workers’ compensation by more than 25 percent, the loans will be forgiven. And, the forgiven loan amounts will not be included in the borrower’s taxable income. Eligible payroll expenses include wages and salaries, the amount of employer-paid group health insurance allocable to the program’s coverage period, retirement benefit costs for the coverage period, and payroll taxes payable for the applicable period. The amount of the loan that will be forgiven excludes salary amounts above $100,000, paid leave expenses covered by the government through the coronavirus-related paid leave requirements enacted in the Families First Coronavirus Response Act, and mortgage principal and other loan principal amounts. Loan amounts that are not forgiven will be regular loans, with terms not to exceed 10 years and at interest rates that cannot exceed four percent. The program will be administered through the Small Business Administration (SBA), which will buy the forgiven loans from the banks that issue them (with the SBA paying all loan origination costs) when the banks certify, a year later, that the borrower has complied with the terms of loan forgiveness. The CARES Act requires that guidance on how the program will work must be issued within 30 days of the law’s enactment (so, by around April 27).

The CARES Act also sets up a loan program for businesses (usually big businesses) especially hard-hit by the coronavirus crisis—e.g., airlines, travel and cruise industries. It provides billions of dollars to states to help them battle COVID-19, and more billions in aid to hospitals, doctors and other medical care providers who desperately need more supplies like masks, ventilators, and personal protective equipment. It provides for more time for payments on student loans and federally-backed mortgages. In short, it is pumping more than $2 trillion into an economy that has virtually ground to a halt under shelter-in-place and social distancing orders that have shuttered or stalled millions of businesses. We discussed 6 major reliefs here, now the last 3 below.

7. Federal student loan payments, interest waived On March 13, the president announced that interest would be waived on federal student loans. Legislation codifying that order is retroactive to March 13. Learn more at Studentaid.govOpens in a new window. The CARES Act suspends payments on federal student loans for 6 months. The act waives any interest on the loans for 6 months as well. The missed months of payments will be recorded as if the borrower had made a payment for the purposes of loan forgiveness programs. The act makes emergency financial aid available to some students, up to the amount of the maximum Federal Pell Grant for the year. Federal work-study payments can be made to qualifying students who have been unable to complete their work under the program due to COVID-19. Students who are forced to withdraw from school due to the outbreak may have the portion of their loan covering that semester canceled. Requirements to return portions of grants or loan assistance will be waived for students who had to withdraw from school as well. A provision in the CARES Act provides an income tax exclusion for individuals who get student loan repayment assistance from their employer for a limited period of time. At the K–12 level, states may apply to waive certain federal education requirements for this school year. 8. More funding available for health care and expanded coverage Testing for COVID-19 must be covered by private health insurance without cost sharing. Any vaccines for COVID-19 must be covered as well without cost sharing. The CARES Act provides funding for health care providers and suppliers, including extra Medicare payments to hospitals to cover COVID-19 treatment and extra funding to community health centers. The act expands coverage of telehealth services under Medicare. It also allows high-deductible health plans with health savings accounts (HSAs) to cover telehealth services even if patients have not met their annual deductible. For health savings accounts, health flexible spending accounts, and health reimbursement arrangements, the act includes over-the-counter (OTC) medicines (without a prescription) and feminine products as qualifying medical expenses that can be reimbursed by these accounts. 9. Above-the-line deduction for charitable contributions The CARES Act allows for a $300 above-the-line deduction for cash charitable contributions made to 501(c)(3) organizations for taxpayers who take the standard deduction. The act also relaxes the limit on charitable contributions for itemizers—increasing the amount that can be deducted from 60% of adjusted gross income to 100% of gross income. These changes go into effect beginning in the 2020 tax year. Both of these provisions explicitly exclude enhanced deductions for contributions to 509(a)(3) charitable organizations (commonly known as sponsoring organizations) or donor advised funds. We shared the first 3 reliefs in last blogpost, now more below.

4. Paid sick and family leave available for more workers Paid leave is required for more employees by the Families First Coronavirus Response Act. These provisions apply to businesses of 500 employees or less. Businesses with 50 employees or less may be exempt from the paid leave provisions. Eligible employees must be allowed up to 2 weeks (or 80 hours) of paid sick time:

The CARES Act caps these payments at $200 or $511 per day or an aggregate payment of $2,000 or $5,110, depending on the reason for leave. Family leave was expanded under the Families First Coronavirus Response Act. Affected employees are entitled to up to 10 additional weeks of leave with job protection to recover from illness, at two-thirds their regular rate of pay, or to care for school-age children whose school has been closed. The CARES Act capped family leave payments at $200 per day and $10,000 in aggregate. For more information, visit DOL.govOpens in a new window. 5. Unemployment insurance has been expanded The Families First Coronavirus Response Act provides up to $1 billion in aid to the unemployment insurance system. The CARES Act also expands unemployment insurance. Under the provisions in the bill, more people will qualify for benefits and the amounts of weekly benefits will be increased. 6. Tax credits for the self-employed may be available The Families First Coronavirus Response Act includes help for people who are self-employed. It includes a tax credit for sick leave and family leave of up to $200 a day or 67% of average daily pay. It also allows for up to $500 a day for emergency paid sick leave for quarantine or testing for COVID-19, or 100% of average daily pay. Keep reading here for the last 3 major reliefs. 1. Deadlines have changed

The deadline for filing and payment of 2019 federal income taxes has been moved from April 15 to July 15, 2020, by the Internal Revenue Service (IRS). The IRS confirmed that July 15, 2020, will also be the deadline to make 2019 contributions to IRAs and health savings accounts (HSAs). Deadlines associated with contributions to workplace savings plans are not affected. 2. Direct payments to many Americans The CARES Act includes a provision to send most Americans direct payments of $1,200, or $2,400 for joint filers, plus $500 for each child. The amount of the payments will be reduced for those with higher incomes. For individuals filing taxes as singles, the reduced amount begins at an adjusted gross income (AGI) of $75,000 per year and is completely phased out at $99,000. For joint filers, the reduced amount begins at $150,000 and payment is eliminated at $198,000. Your AGI will be determined by your 2019 tax filing (or 2018, if 2019 is unavailable). 3. Some retirement account rules have been relaxed The CARES Act offers some help to those with retirement accounts. Required minimum distributions (RMDs) for 2020 are suspended for certain defined contribution plans and IRAs, including 401(k), 403(b), and governmental 457(b) plans as well as SEP IRAs, SIMPLE IRAs, and traditional IRAs. This includes the first RMD, which individuals may have delayed from 2019 until April 1, 2020. Certain beneficiaries taking distributions from inherited IRAs may also skip the 2020 distribution when calculating their 5-year distribution period. Affected, eligible participants in workplace retirement plans and IRA owners can take an aggregate distribution in 2020 of up to $100,000 from all retirement accounts without incurring the usual 10% early withdrawal penalty. The affected participant or IRA owner (including a spouse or dependent) would need to either be diagnosed with SARS-COV-2 or COVID-19 or experiencing adverse financial consequences as a result of an event, including but not limited to quarantine, furlough, lay-offs, reduced work hours, no available childcare, business closing or reduced business hours (self-employed), or other factors determined by the Secretary of the Treasury. In addition, the income tax on the distributions may be spread evenly over 3 years. Or, the distribution may be repaid to an eligible retirement plan within a 3-year period. Loan repayments for affected participants in workplace retirement plans may be delayed for one year. These changes will be in effect through 2020. Note that your plan may offer other withdrawal options. Keep reading here for other reliefs. Below are the highlights of the most recent tax changes found in the $2 trillion coronavirus relief bill:

If you are interested in more details of the above highlights, this Financial-Planning.com article is a good read. Roth IRA conversions

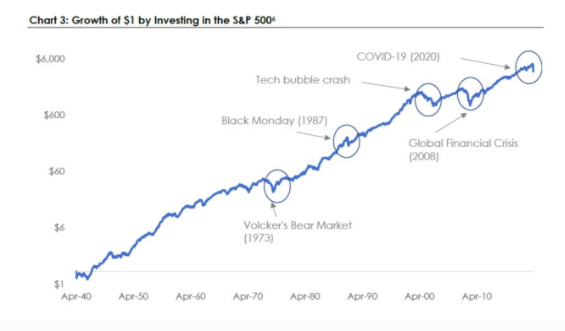

With traditional IRA balances slashed by the market downturn, the moment is opportune to cash out, take the tax hit and convert into a non-taxable Roth. Roth IRAs, which provide tax-free withdrawals in retirement, are favored by those who believe their current tax rate is lower than it will be down the road. And unlike conventional IRAs, Roths don’t require any withdrawals during the owner’s lifetime – an important consideration for those looking to leave wealth to their heirs. Estate planning Lowered stock values mean wealthy investors can maximize the amount of stock shares they give to heirs while avoiding federal gift taxes. To oversimplify, if your XYZ stock has fallen by half thanks to the market rout, you can now gift double the number of shares you could have just a few weeks ago. The lifetime gift tax exemption in 2020 stands at $11.58 million. Debt refinancing You can consider refinancing to take advantage of rock-bottom interest rates – not just for mortgages but for student loans and any other higher-rate debt. Tax-loss harvesting A strong, sustainable market rebound could mean huge realized gains from taxable accounts in the next few years – and those tax losses can be carried forward indefinitely to neutralize realized capital gains. Harvested losses can also be applied against gains beyond the financial markets. Squirreling away losses will present benefits for some of the entrepreneurs who have business exits on the horizon. Aggressive rebalancing Another piece of routine portfolio maintenance, rebalancing may now have amplified consequences. You can rebalance your portfolios during the recent pullback, and with volatility expected to continue, another rebalance is likely. The chart above demonstrates one of the most wonderful aspects of investing: markets recover.

Black Monday in October 1987 was an unprecedented event as the U.S. stock markets fell almost 22 percent in a single day. The tech bubble crash of 1999/2000 was a remarkable destruction of value, and amid the Global Financial Crisis of 2008, pundits and commentators were speculating as to whether we had seen the end of capitalism as we had known it. And yet, if we zoom out over the long term, equity markets are a remarkable provider of investment returns. This is the lens through which we should make our allocation decisions. During the darkest moments, we should remember why we made those decisions…and adhere to the plans created in those periods of less turmoil. I do not know how much damage will be tallied when this is over, but I do know that capitalism creates incentives for investment and, over the long term, has rewarded those who can tolerate the short-term volatility. In last blogpost, we discussed the difference for a spouse to be an annuity's joint owner or beneficiary. Now we will analyze the issue, also show you why a parent-child joint ownership of annuity also hurts you -

Joint Ownership Issues As stated before, required minimum distributions must begin at the death of any owner which means that when the first joint owner dies, the annuity must begin making distributions. The only exception is if the surviving spouse was named beneficiary, they could continue the annuity without current distributions. There is no real benefit to joint ownership as it does not extend the life of the annuity and it can be a detriment to continuing the annuity when the first owner dies. Many individuals believe that since they own their other property jointly, they should also own their annuity jointly. The better way to go would be to have each spouse name their spouse the beneficiary rather than making both spouses co-owners. Naming the spouse as beneficiary would allow a better tax outcome. Parent-Child Joint Ownership If a parent purchases a joint annuity with their child, the parent and child will own equal shares. A withdrawal requires two signatures and distributions are made out to both parent and child. If the parent paid the premium, they have just made a gift to their child of half the value of the annuity. If the parent wants to make a withdrawal, one half the distribution will be taxable to the child regardless of who receives the money. If the child is under age 59 ½ then the entire amount distributed is subject to a 10% penalty. If the parent owns the annuity jointly with a child or grandchild, making the child the co-owner makes no real difference in postponing distributions. If the child dies before the parent, the parent would be forced to begin liquidating the annuity even if they had supplied the money. The Bottom Line In most cases, using joint ownership only hurts the ability to sustain tax-deferred growth. Most owners think joint ownership will allow the annuity to continue until the second death and that they will obtain additional tax-deferred growth. In actuality, it is just the opposite. When the first owner dies it can trigger the required minimum distributions. Q. What is the joint ownership issue with an annuity?

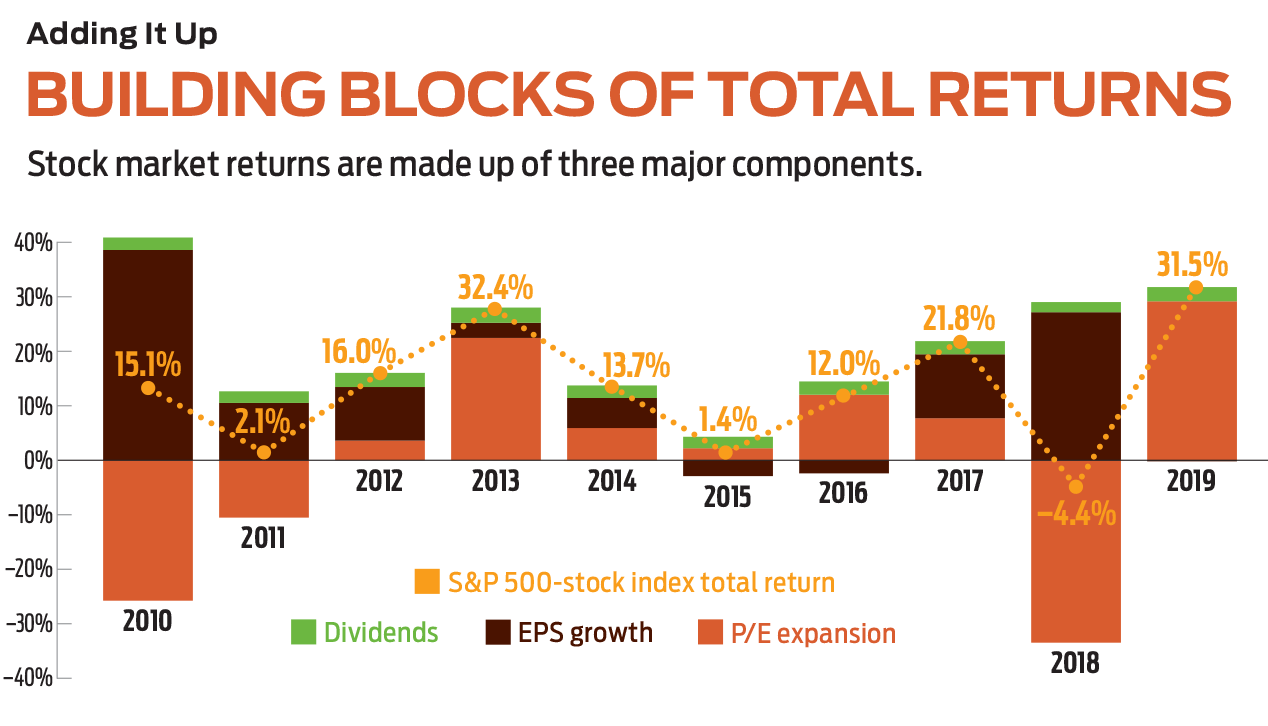

A. Annuities provide excellent investment vehicles and tax-deferred growth. If you take two investment accounts with the same assets and one is taxable and one is tax-deferred, the tax-deferred account will always do better because it is not paying taxes until the money is distributed from the vehicle. Annuities are treated similarly to IRAs and qualified plans. The additional advantage of a non-qualified deferred annuity is that unlike a qualified plan or an IRA, no required minimum distributions need to be made during the life of the owner. Once the owner dies, the annuity must begin making post-death distributions to the beneficiary. Under IRC Section 72(s), upon the death of any owner, the annuity must begin to make post-death distributions to the beneficiary. The Tax Reform Act of 1986 changed the joint ownership of annuity taxation rules to prevent using joint ownership to avoid taxation of the annuity over two lives. This makes annuities distributable whenever one of the owners dies. However, if the other spouse is named as beneficiary, the taxation would then be postponed. When a surviving spouse is named the beneficiary of the non-qualified annuity, they may continue the annuity in their name. This is very similar to a spousal IRA rollover allowing the surviving spouse to continue to receive tax-deferred growth. If one spouse is the owner but names their spouse as the beneficiary, then the spouse who is named beneficiary can continue the annuity and continue to receive tax-deferred growth in the annuity. In next blogpost, we will analyze why a joint parent-child ownership also hurts you.. Stock returns have 3 primary drivers, they can work in concert or at odds sometimes:

How to understand these 3 drivers? Earnings growth Assume if a stock costs $100 per share and has earnings per share of $10. If its earning grows by 5% to $10.50, the stock price should grow by a commensurate 5%, to $105, assume everything else remains the same, a 5% return. Valuation But stock prices reflect what investors expect in the future, which impacts valuations, commonly represented by a measure such as Price-Earnings Ratio (PE). If investors are bullish on a stock, they will bid up the price, thus expanding the stock's PE ratio. Say the $100 stock with $10 earnings has a PE ratio of 10, now confident investors bid the price up to PE ratio of 12, the stock now trades at $120, a 20% return. Dividend Dividends are what the company gives back to investors, it is the least volatile and don't ever detrack from the market's returns. As a result, reinvested dividends have an outsize impact on the market's return over time. The chart below shows how these 3 drivers impact stocks' returns over the past decade. What Is a Day Trade?

A day trade is what happens when you open and close a security position on the same day. What Is a Pattern Day Trader? You are a pattern day trader if you make four or more day trades in a rolling five business day period, and those trades make up more than 6% of your account activity within those five days. There are different types of day traders but the following two are the main ones:

What Happens If You are a Pattern Day Trader? It depends on your brokerage. For first-time offenders, the consequences might not be so bad, assuming your brokerage has a more forgiving policy. However, you will likely be flagged as a pattern day trader (in the violator sense) just so your broker can watch your activities for any consistent or repeat offenses. If you make four day trades in a rolling five days, some brokerages may subject you to a minimum equity call, meaning you have to deposit enough funds to have a minimum account value of $25,000 (even if you don’t intend to day trade on a regular basis). Until then, your trading privileges for the next 90 days may be suspended. You could be limited to closing out your positions only. And your margin buying power may be suspended, which would limit you to cash transactions. If you make an additional day trade while flagged, you could be restricted from opening new positions. This is a big hassle, especially if you had no real intention to day trade. If you violated the pattern day trading rules by accident, or if you were tempted to take some profits (or close out losses) within the same day—enough to get flagged in violation—the hassle just isn’t worth the momentary lapse in caution. But if you inadvertently end up flagged as a day trader and don’t intend to day trade going forward, you can contact your broker who may be able to give you some alternatives to avoid trading restrictions. Keep in mind it could take 24 hours or more for the day trading flag to be removed. If you do want to officially day trade and apply for a margin account, your buying power could be up to four times your actual account balance. You could inform your broker (saying “yes, I’m a day trader”) or day trade more than three times in five days and get flagged as a pattern day trader. This allows you to day trade as long as you hold a minimum account value of $25,000, and keep your balance above that minimum at all times. |

AuthorPFwise's goal is to help ordinary people make wise personal finance decisions. Archives

September 2022

Categories

All

|

RSS Feed

RSS Feed