How to Buy Life Insurance

There are a number of outlets for term life insurance where you can buy online and many people do. However, it may make sense to buy your policy from an experienced financial professional. Yes, those selling insurance usually get paid on commission. But the policies they offer are, in many cases, the same as the ones you will find online, so typically you won’t pay more for going through an agent.

And there can be some advantages. First, a financial professional can help you determine how much coverage you really need, and that may be the most important buying decision you make. Many people try to make an educated guess. And many companies offer online calculators to help gauge approximate needs.

But actual life circumstances and financial needs vary from individual to individual and can call for more refined and established methods of determining what type of insurance and how much coverage is needed. Financial professionals can help you make that determination.

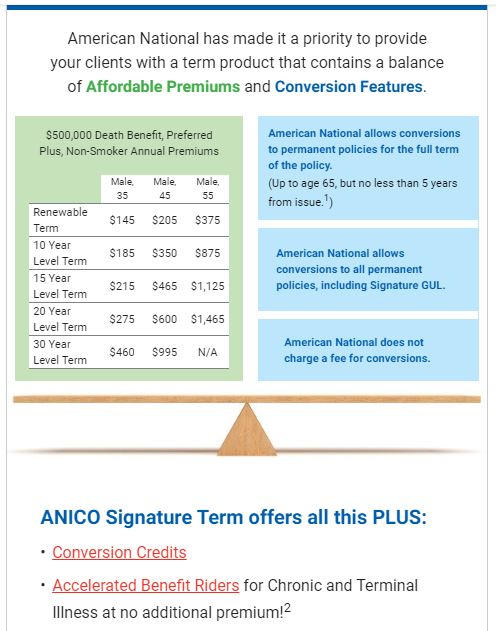

In addition, an experienced life insurance agent can also recommend a policy that is the best fit for you based on your age and financial goals. They also know the companies and policies they sell, and can answer all your questions. They can shop for the best rates and help you through the underwriting process.

Buying life insurance is an important financial decision. That’s why it is important to get the right amount and type of coverage to protect the financial security of the people that depend upon you every day.

RSS Feed

RSS Feed