Roth IRA conversion income is ordinary income and is taxed the same as wages, pensions and other IRA distributions and short-term capital gains.

Now let’s add a $50,000 Roth conversion. That will increase the tax on the LTCG from zero dollars to $7,028. The tax on the Roth conversion is only $2,684, but the total tax bill will be $9,712.

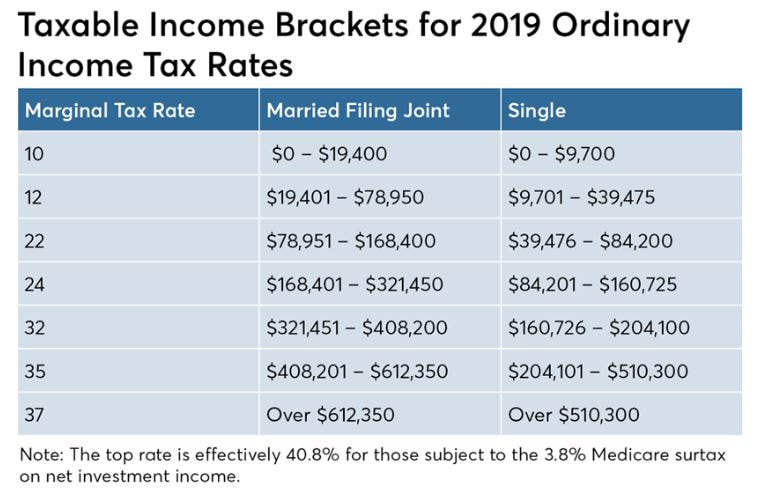

The $50,000 Roth conversion (or any other additional ordinary income) will get taxed first using the ordinary income tax brackets. The $50,000 Roth conversion (assuming this is the only other income) will be first reduced by the 2019 standard deduction of $24,400, leaving taxable ordinary income of $25,600, and that amount reduces the 0% capital gains bracket available for the $100,000 LTCG.

The $25,600 is taxed using the regular tax brackets, so that tax is $2,684. Here's the math if you'd like to follow along:

$19,400 at 10% = $1,940

$6,200 at 12% = $744

$25,600-----------$2,684

The $100,000 LTCG tax now goes from zero to $7,028. That’s a substantial — and often unexpected — increase.

The benefit of the zero to $78,750 LTCG bracket is reduced by $25,600, which was taxed at ordinary income tax rates, so only $53,150 is being taxed at 0% (the $78,750 less the $25,600 = $53,150). The remaining $46,850 of the $100,000 LTCG is now being pushed into the 15% LTCG bracket and the tax on that $46,850 x15% = $7,028.

$53,150 at 0% = $0

$46,850 at 15% = $7,028

$100,000--------- $7,028

Bottom line: In this simple example, the $50,000 Roth conversion was not only subject to its own ordinary income tax of $2,684, but also triggered a $7,028 tax on the LTCG that, without the Roth conversion, would have incurred zero tax.

Now let’s say we change the example by adding a Roth conversion of $120,000 to the LTCG of $100,000. The $120,000 Roth conversion eliminates the entire benefit of the 0% LTCG bracket, triggering a LTCG tax of $15,000 — all at 15%, and none at 0% on a LTCG that, without the Roth conversion, would have incurred zero tax. In addition, there will be a tax of $12,749 on the Roth conversion, for a total tax bill of $27,749.

RSS Feed

RSS Feed