A. The 5/24 rule refers to certain credit card issuing banks that bar you from opening certain new credit cards if you have already opened 5 other credit cards (from any bank) within the past 24 months. One of the banks who follow this rule is Chase Bank which has many good rewards-based credit cards. It's important to plan ahead your credit card applications.

|

Q. What is the so called 5/24 rule for credit card applications?

A. The 5/24 rule refers to certain credit card issuing banks that bar you from opening certain new credit cards if you have already opened 5 other credit cards (from any bank) within the past 24 months. One of the banks who follow this rule is Chase Bank which has many good rewards-based credit cards. It's important to plan ahead your credit card applications.

0 Comments

Q. My long-term care insurance provider stopped selling new policies. What will happen to my coverage?

A. Quite a few long-term care insurance providers were caught off-guard by the larger than expected claims and suffered due to the low interest rates, as a result, they no longer sell new long-term care policies. However, they would do two things - a. continue to serve existing policies and pay claims; b. sell their current businesses to other insurers who will pick up the policies and continue to serve them. In our last blog post, we discussed the 3 mental buckets in a retiree's head and the possible implications. Now we will discuss the most important implication - annuitization of assets.

Cash vs. Annuitization A prospective retiree's #1 concern is that she won't afford retirement or will outlive her available assets. In essence, this is the fear that the future income bucket won't be satisfied. The most straightforward solution is to buy a lifetime immediate annuity at retirement. Unlike the other types of annuities, an immediate annuity's expense is very low, but still many retirees do not take actions to address this biggest concern. Why? The reason is even she fears a shortfall in future income, she is not willing to give up the liquidity of current assets to secure it because having sufficient current assets is a required first foundation. In other words, it's not a fear of outliving money but a fear of outliving money available after having enough liquidity cash on hand to meet current expenses! Thus, it's not surprise that if a retiree chooses annuitization, she strongly prefers partial annuitization option to all or nothing strategy because this has less of an impact on the current assets bucket. Do you have such 3 mental buckets in your head? Q. If most retirees' concern is to outlive their money, why they do not purchase annuities?

A. This is a good question that has raised not just financial professionals but also behavior scientists' interests. Here is one possible explanation that ties to how human brains work: Based on one research, it's found that consumers typically account for their wealth in 3 buckets:

These mental buckets matter! For example, a household that feels poorer is likely to constrain its current income to get back on track - and focus blame for its shortfall on its latest expenditures. Meanwhile, a household wealthy in net worth terms may still feel poor and unhappy if it doesn't have a reasonable amount of cash on hand. What these mental buckets lead to? A prioritization of your behaviors and actions! When current income matters more than current assets, it's difficult to be satisfied with the status of the longer term buckets until the near term needs are satisfied. What's the implication? Annuitization is not viewed as a priority! We will discuss this in the next blog post. Q. What happens if an owner but not the insured of an insurance policy dies?

A. For the owner of the life insurance policy, if no contingent owner is named, the ownership of the life insurance policy would be transferred to the owner's estate. The policy would remain in force as long as the premiums are continued to be paid. Because of such scenario, it's important to name a contingent or successor owner when the owner is not the insured of the same life insurance policy. Q. Do annuities always favor insurance companies?

A. While insurance companies always take care of themselves, annuities don't always flavor them, even in this poor interest rate environment. The reason is simple - when purchase an annuity, you are also competing with other people on life expectancy, therefore if you outlive the other insurance companies' customers, you will have a better return. Example: if an 85 year old male has a life expectancy of 92 according to the Social Security Administration, but this person has a very healthy life style and could live to age 96, then those extra 4 years could yield a great return for this purchaser. Basically, when purchasing an annuity, one trades longevity risk (do I make it to 96?) for market risk (will stocks drop?). In our last blog post, we discussed 4 options you face when impacted by a ransomware. Now we will discuss 3 preventive measures you could take to prevent future ransom ware attacks.

Option 1. Back up your data regularly. Let's say that you back up your files every Sunday night. If you receive a ransomware threat on—worst-case scenario—a Sunday afternoon, you'll lose only a week's worth of data. If you would like to start backing up your files, you'll have to take the time to devise your own schedule and method. When establishing a backup plan, remember to keep these two things in mind:

Option 2. Be wary of phishing. Approximately 91 percent of cyber attacks start as phishing scams, according to Wired. When checking e-mail, remember to:

Option 3. Update your systems ASAP. Attackers know the vulnerabilities of yesterday's technology. The longer you avoid regular updates, the more time attackers have to exploit those vulnerabilities. Most of us haven't experienced ransomware, but as the number of attacks increases, so does the probability of becoming a victim. If the day comes when it does happen to you, will you have a plan for handling the situation? Q. Does it make sense to pay the ransomware fee or not?

A. Your computer was infected and you lost access to all your files unless you pay a ransom, should you pay or not? It's important to lay out all of the options you could pursue and the risks and benefits. Option 1. Search Online For A Solution You can searching online for a free tool that can decrypt your files. But the chances of success are extremely slim. Even if a solution to a previous type of ransomware is available, attackers learn from their mistakes and have likely used a more advanced form of the scheme on you. Option 2.Calling Law Enforcement Officers Unfortunately, there's very little that the FBI, for example, can do to resolve an individual ransomware incident. But reporting the crime can help put it on the authorities' radar, so they can work on a solution for future cases. Option 3. Pay the Ransom Depending on what those files contain, paying the ransom may be worth it to you. However, you need to be ready for one of the following two options"

Option 4. You Don't Pay Maybe you think the attacker is bluffing, but If you can't access your files, the attacker isn't bluffing. Or maybe you've decided that the price tag for your data is too high.

In our next blog post, we will discuss three relatively simple precautions you can take to prevent such a costly scenario in the future. Q. What do I need to do in order to make my children's life a lot easier when I die?

A. Here are 6 things you should do in order to deal with the legacy challenge -

The master list in 6 above should include information about the following accounts:

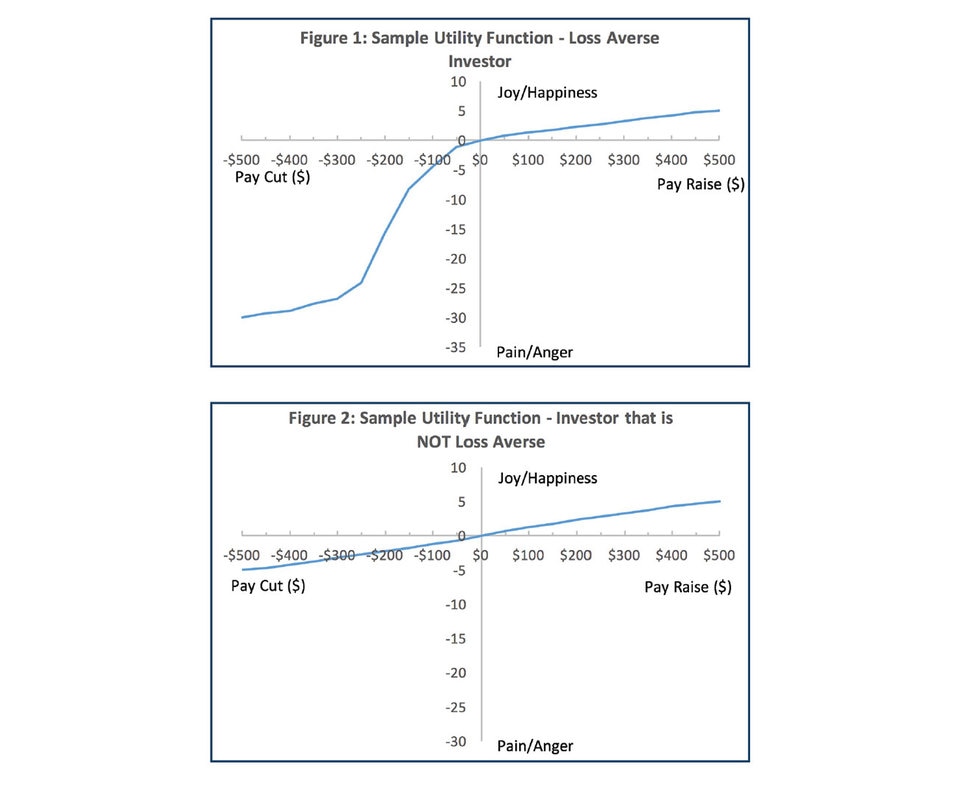

In our last blog post, we discussed the concept of risk aversion. Now we will turn our attention to loss aversion. The following picture illustrates well what does a loss-aversion investor looks like - As illustrated above, a loss-aversion investor feels extreme pain by selling an investment and incurring a loss. Because of this loss-aversion, this investor will hold on to a losing investment and cheat himself out so he could avoid the pain.

If you are such a loss-aversion irrational investor, what can you do? You should reframe the decision - imagine that instead of incurring a loss, you are avoiding a bigger loss. Also, by freeing up some cash, you could use it for a better investment. Finally, there will be tax benefits by incurring the loss. Q. What are the differences between risk aversion and loss aversion?

A. Risk-aversion refers to an investor who will not consider risky assets only if they provide compensation for risks via a risk premium. When faced with two investments with similar expected returns but different risks, a risk-averse investor will prefer the investment with the lower risk. In other words, a risk-averse investor is a rational investor. However, a loss-aversion investor is an irrational investor. Why? Please see our next blog post's analysis of loss aversion. Q. Should I consider umbrella insurance?

A. Yes, an umbrella insurance is typically only a few hundred dollars per $1 million coverage, it's so cheap and the seller earns so little that no one would actively try to sell it to you except your current insurance carrier. If you own rental properties, definitely get an umbrella insurance coverage, but even if you don't, there could be other uses of an umbrella insurance. For example, if you like hosting parties, imagine any of the following scenarios happens -

Because of such risks, it’s wise to add an umbrella insurance coverage in addition to your current homeowners insurance coverage so you are adequately protected in case someone decides to sue you. Q. What is the key difference between taking a loan to buy a home and taking a loan to buy a stock?

A. It's recommended to take a mortgage when buying a home, but for most investors, it's not a good idea to use a margin account to buy stocks/bonds/ETFs, for one key reason: When you take a mortgage, the bank doesn't care much about how your house's value changes. Even if the house value decreases dramatically, as long as you are still paying mortgage on time, you are okay, the bank won't take back your home. However, the same can't be said for when you use a margin account to buy stocks, bonds, or EFTs. Sure, you can use a margin account to buy stocks that are worth more than your cash value. However, if the stock's value drops, the brokerage house will force you to sell your investment, that's typically the worst time to sell. In short, it's only recommended for advanced investors who could handle the risk associated with a margin account to buy investments with margin. In our last blog post, we discussed the living benefits of life insurance products, now the sixth benefit people haven't thought of about life insurance.

Benefit 6. Legacy Planning Whether you are looking for a way to maintain your business after death, or to ensure your loved ones receive the care and assistance they need when you are gone, life insurance can play a big part in planning your legacy. As a tax-free source of money, you can use your life insurance value to pay for charitable contributions — allowing you to have a long-term impact on an important cause. Or, use it to pay off taxes, debts, and other expenses that might make the future difficult for your family members. Although many people think about providing an income for their heirs, or paying funeral expenses, as the fundamental purpose for a life insurance policy; they may forget about using that cash to fund new opportunities for their loved ones. Legacy planning with life insurance may mean that if anything happens to you, your children can still go to college without the burden of debt. Death benefits can pay for tuition, giving you peace of mind of knowing that you can still help loved ones accomplish their dreams. In our last blog post, we discussed the fourth benefit of life insurance people haven't thought of. Now the fifth benefit.

Benefit 5. Use of Living Benefits In addition to the tax-free access to your cash value, some insurance policies offer an added provision called a "rider," which can trigger some of the death benefit to be paid out while the insured is still living, under certain circumstances, such as a terminal illness, a critical illness, or a chronic illness, which might cost significantly for the treatment of the illness. The funds are available to use for any reason. However, not all insurance policies include such "living benefits riders", especially term life insurance policies. Please contact us if you are interested in such riders while only purchasing a Term life product. In our next blog post, we will discuss the sixth benefit of life insurance that people haven't thought of - legacy planning. In our last blog post, we discussed the third benefit of life insurance people haven't thought of. Now the fourth benefit.

Benefit 4. Replacing Essential Income As you moves through life, you will likely accumulate a range of expenses — from large debts like mortgages and loans, to smaller emergency payments, like medical bills. If you are struggling to pay for these expenses, you may be able to use withdrawals from your life insurance cash value as a source of additional income. Some financial planners recommend using life insurance to cover estate taxes so their other investments can continue to thrive, unimpeded by taxes, well beyond the death of the insured. Even if you are still working, your life insurance policy can offer a source of much-needed additional wealth in unexpected situations. For instance, as people today are living and working longer than previous generations, it's important to think about how people will take care of themselves if they suffer from a long-term illness. On the other hand, people may find that they suddenly need additional cash for child care, or the long-term care of a relative. In our next blog post, we will discuss the fifth benefit of life insurance people haven't thought of. In our last blog post, we discussed the second benefit of life insurance most people haven't thought of - protecting business with COLI. Now the third benefits -

Benefit 3. Accessing Personal Loans We often consider taxes to be an inescapable part of life. However, life insurance is one of the few products that can offer useful ways to sidestep certain taxes. Many life insurance policies offer owners a tax-free solution to their financial needs, upon the insured’s death. What's more, while you are living, it’s sometimes possible to take tax-free loans from the cash value of a policy. When you take out a life insurance policy, you can begin to accumulate "cash value." It is possible, in certain circumstances, to access this value using loans and withdrawals. Though you should expect to pay interest on these loans — just as you would with a loan from a traditional bank — you will not pay taxes on the money you receive. In certain policies, the interest rate on the withdrawal from the life insurance cash value is lower than a typical bank loan. However, your policy-provider may ask you to use the death benefit as collateral. This means that if you die before paying back the loan, your death benefit will fall by the amount outstanding. In our next blog post, we will discuss the fourth benefit of life insurance that most people haven't thought of. In our last blog post, we discussed the first benefit of life insurance that people haven't thought of, now the second one.

Benefit 2. Protecting Business With COLI For those who run a business, the life insurance "cash value" generated from one's long-term investments can sometimes pay the premiums on a corporate-owned life insurance policy, or COLI. For decades, commercial banks have been purchasing key-person life insurance on executive individuals — with benefits payable to the organization and/or the family of the employee, upon death. Now, corporations and non-profits can achieve the same benefits. COLI policies can give businesses the opportunity to fund benefit plan expenses, while increasing net income for the company overall. For instance, companies that have substantial costs to pay out for group life, medical, and other insurance plans can finance these costs with COLI. Many business owners look to enhance and protect their investments with COLI, because it can earn a competitive after-tax yield when compared to other investments, act as a hedge against benefit liabilities, match the long-term nature of benefit expenses, and more. COLI death benefits can even help the company recover the costs of the plan over the long-term. While these policies can perform in a similar way to individually-owned life insurance policies, corporate packages can offer several advantages that other policies simply cannot match while promoting growth and limiting risk. In our next blog post, we will discuss the third benefit of life insurance people haven't thought of. Q. Other than death benefit, what other benefits are life insurance products?

A. Life insurance is a fundamental part of a responsible and reliable financial planning strategy. However, many people assume they can only use life insurance for limited functions, such as paying off mortgages or funeral costs at the time of death. The truth is, life insurance can be highly versatile, customizable, and often perfect for creating a sanctuary against the unpredictability of the future. We will discuss 6 uses of life insurance products most people haven't thought of in this mini blog series. Benefits 1. Equalizing Inheritance In an ideal world, most of us would prefer to offer an equal inheritance to each of our heirs. Unfortunately, the nature of your assets may make this impossible. For instance, it can be challenging for more than one person to share an inherited home or business. Life insurance can provide a solution to this problem, by allowing you to give the monetary value of an asset — in cash — to one heir, while leaving the asset itself to another heir. In other words, rather than liquidating the asset and distributing the cash amongst each person in your family, life insurance can provide a cash value equal to that of the asset itself. A family business owner can therefore give a business to one of his or her children, while also giving the value of the business (in cash) to the children uninterested in running the company. An insurance policy that offers a cash alternative to certain assets can help you balance out complexities in financial planning — and give you a clearer view of how to organize the future. We will discuss benefit 2. Protecting Business with a COLI in next blog post. In our last blog post, we discussed 2017 income tax rates. Now capital gain tax rates.

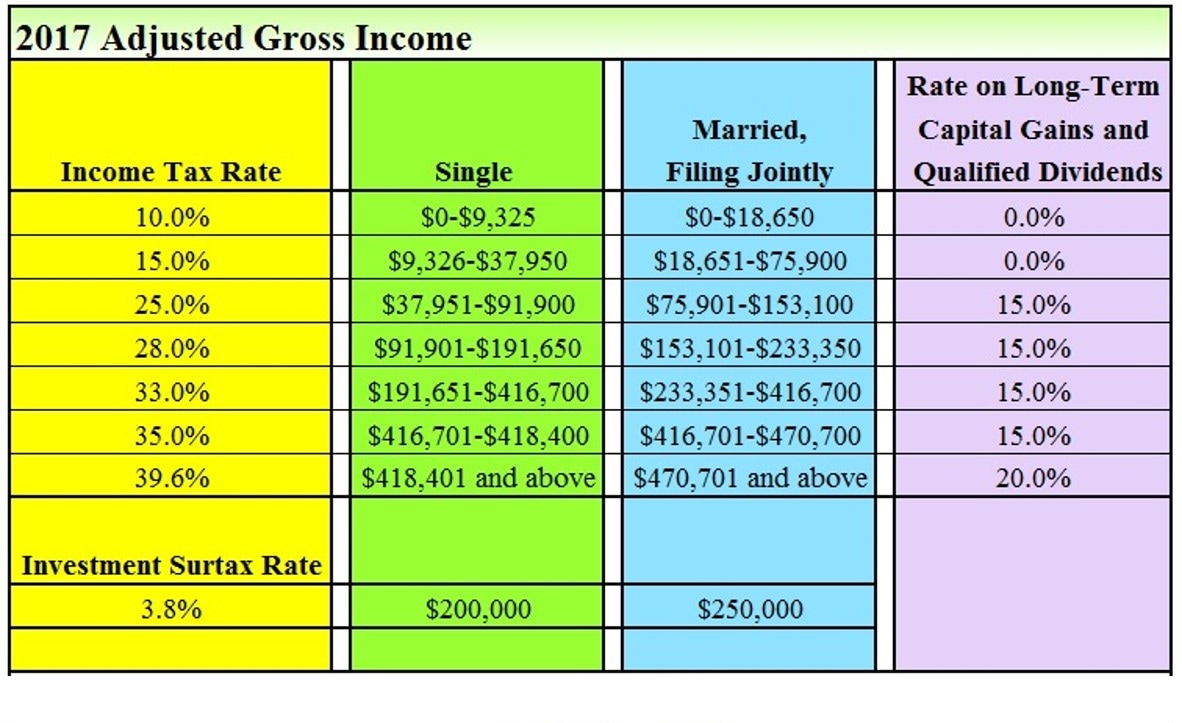

Capital Gains and Qualified Dividends Many taxpayers own stocks, bond, mutual funds, exchange traded funds and other investments. If you receive a qualified dividend or buy and sell an investment for a gain outside of a tax sheltered account, you may be subject to a qualified dividend tax or capital gains tax. Short term capital gains (365 days or less) are taxed at ordinary income tax rates. Long term capital gains (366 days or more) are taxed at the rates in the table above. For example, single filer earning $37,950 would have a 0% qualified dividend rate and a 0% long term care gains rate. Investment Surtax Single filers with taxable income of $200,000 or higher and those married filing jointly with taxable income of $250,000 or higher are further penalized with an investment surtax (net investment income tax). The investment surtax rate is 3.8% on income from investments, including, but not limited to: interest, dividends, short and long-term capital gains, rental income, royalty income and passive business income. Q: Our taxes are confusing. What are the income tax rates, capital gains rates and how do they differ in 2017?

A. Please refer to the table at the end of this mini blog series for a summary of the various tax rates for 2017. Income and Income Taxes For many taxpayers, their primary source of income is their wages. For others, it may be pension or social security income and/or retirement account withdrawals (RMDs or otherwise). Others may rely on savings account and bond interest. Most taxpayers can aggregate income from wages, pensions, social security and interest to determine their total income. Your total taxable income can be impacted by a number of factors, including, but not limited to: alimony payments, contributions to employer retirement plans and/or IRAs, contributions to HSAs, exemptions, dependents, deductions (standard or itemized) and credits. These adjustments to your income result in your adjusted gross income. Although the top marginal income tax rate of 39.6% is assessed on taxpayers with taxable income of $418,401 and higher for single filers and $470,701 and higher for married couples filing jointly, the actual tax rate paid is the effective income tax rate. The effective income tax rate is the blended rate you actually pay. Based on the table above, a single filer earning $91,900 would have a top marginal income tax rate of 25% and an effective income tax rate of approximately 20%. The first $9,325 of income would be taxed at 10%, the next $28,625 (from $9,326 to $37,950) would be taxed at 15% and the last $53,950 (from $37,951 to $91,000) would be taxed at 25%. Please read next blog post about 2017 capital gain tax rates. In our last blog post, we discussed the major flaws of the traditional asset distribution strategy for retirees. Now we will introduce a simple buy smart asset spending strategy -

A RMD-rule Based Asset Distribution Strategy This strategy calculates the annual distribution amount by dividing total asset balance by the life expectancy factor listed for the retiree's age, as shown in IRS Publication 590-B. This strategy addresses the major flaws associated with the two traditional asset spending strategies as we discussed in the last blog post. First, it does not use a fixed amount, rather it considers each year's portfolio balance, thus avoid making a bad year worse by taking out too much during that year. Second, its withdrawal percentage increases with age, allowing retirees to use more of their portfolio as their life expectancy decreases. This strategy is not perfect, though. It may result in withdrawal rates that are too low, particularly in early retirement years. While no simple rule is ideal, retirees may incorporate an RMD approach into a broader plan for covering expenses. A 2010 Vanguard Group paper found that combining an immediate inflation-adjusted annuity with an RMD approach produced stable cash flows that grew at a faster rate than those of other rules of thumb. Q. What's the best retirement asset withdrawal strategy?

A. There are traditional rules to retirement asset distribution - a. Use only portfolio's interests and dividends; b. Take 4% of the retirement asset at the beginning year, then adjust that amount annually with inflation. Unfortunately, each of these two traditional methods have serious flaws. a. Use Only Portfolio's Interests and Dividends The major flaw of this strategy is that the need for interests and dividends may influence asset allocation, which might need to overweight in certain risky asset classes, such as bank stocks. Also, by leaving the principal untouched may negatively impact the quality life of the retirees, although heirs will be very happy. b. Start With 4% Then Adjust With Inflation The major flow of this strategy is that the amount it takes out each year is a rather fixed amount, and fails to respond to actual realized investment returns each year. In a poor performing year, the portfolio could be seriously hurt by still taking a fixed amount. Is there a better retirement asset withdrawal strategy? The answer is yes, we will discuss in our next blog post. Q. I have appreciated stocks in both IRA and brokerage accounts, and I want to give some to my kids. Which account should I use?

A. You face two questions here - 1) should you sell the stocks and give your children cash, or give them the stocks and let them sell; 2) which account should you use. Assume you have owned those stocks for more than 1 year, and you are in a higher tax bracket than your children are, you are better off giving them stocks from your brokerage account, because - a) If your IRA is a traditional IRA account, you would owe tax on the market value of the stock at the time of the transfer. If your IRA is Roth IRA, while the distribution is tax-free, you will lose the tax-free growth shelter from Roth. b) By giving your children stocks rather than cash, they, not you, would owe the tax on the appreciation you have enjoyed. Since they are in lower tax brackets than you are, they will owe less in capital-gain tax than you would. For example, if they are in the 10%-15% tax bracket, they could pay 0% long term capital gain tax, even they don't wait a year to sell the stocks (because you have held the stocks for more than 1 year). Q. My financial adviser manages my IRA and changes a fee. If I pay this fee from IRA, will it trigger income tax as a withdrawal?

A. No. The fee is treated as an expense of the IRA rather than as a taxable distribution. However, it's best for you to pay the fee with money outside of IRA, so your money inside IRA could continue enjoy tax-free growth. You can then count the fee as a tax-deductible miscellaneous expense. With tax-deductible miscellaneous expenses (such as job-search related expenses, unreimbursed employee expenses, etc.), if they exceed 2% of your adjusted gross income, they become tax-deductible. |

AuthorPFwise's goal is to help ordinary people make wise personal finance decisions. Archives

September 2022

Categories

All

|

RSS Feed

RSS Feed