|

Forrester Consultant Ellen Carney recently played the role of a mystery shopper to see how easy – or hard – it was to buy life insurance online from seven carriers. The results she found may surprise you. Turns out, while the surveyed carriers get buyers started with a fast, easy online quote, their follow-up and customer service leave a lot to be desired.

Let’s take a look at what Carney experienced and the lessons we can learn from them as independent agents and brokers. These results are all published in the report titled “The Forrester Life Insurance Wave™: US Sales Websites, Q2 2018.” The Test In all seven tests, Ellen Carney tried to buy term life insurance with the following details: a 36-year-old married mother of two kids with a working husband. The carriers she tested were New York Life, John Hancock, Lincoln, Ladder, Northwestern Mutual, Prudential, and Mass Mutual. She created 11 categories to rate her experience with each carrier. At the end of the process, each carrier had an aggregate score represented as a point total scored in each category. The Results Of the seven carriers tested, Mass Mutual scored the highest with 66 points. Prudential and Northwestern Mutual round out the top three. New York Life scored only 33 points, the lowest of the group. You can see the seven carriers ranked here on InsuranceNewsNet. Getting a quote turned out to be the easy part. According to Carney, things often fell apart after that. Once she gave them the data needed for a quote, some of the carriers never followed up with her. Others had agent finders that were difficult to use. In some instances, the digital process was difficult to complete, with no help readily available. Other times, it wasn’t even clear what was happening with regard to approvals and underwriting. In short, the experience often left the consumer confused with no easy way to get help. As an independent life insurance agent, we will ensure you have a very smooth experience from beginning to the end, and you have no cost or obligation during the entire process! What if you had an early retirement but it ended up being bored?

This New York Times article discusses this problem and suggests two websites you could explore as a freelancer for consulting or other opportunities.

Q. I have colitis and Crohn's disease, can I still get life insurance and what class will I get?

A. The insurance company's underwriter is going to ask you a few questions, such as:

What Underwriting Class May I Receive? You can expect offers of Standard Plus or Standard on the milder cases, with good follow-up and limited colon involvement. Low to moderate table ratings should be expected for more moderate cases of chronic ulcerative colitis and Crohn’s disease. Severe cases with significant and frequent episodes of inflammation may lead to a postponement until further treatment. Underwriting any form of intestinal disorder can be positively impacted by good nutritional habits, use of vitamin supplements, regular exercise, and good weight control. A cover letter should address any positive lifestyle habits or additional information you’d like the underwriter to know. Please contact us if you need help with your life insurance needs. Q. My auto insurance premium increased a lot, however I haven't had any accident or received any tickets, is there anyway I could find out why?

A. There is one report you could check to find out why, because there could be an error in that report, it's call CLUE report. Just like your credit report that contains your credit details, the CLUE report contains your driving history. It is a database maintained by LexisNexis Risk Solutions, most auto insurance carriers provide claims data to it. Inside the report, there is a field called the Fault Indicator, it is where the insurer indicates who was at fault for a particular accident. The accuracy of that indicator is critical because auto insurers determine your premium based on it. You could request a copy of your CLUE report from your insurance carrier or directly from LexisNexis Risk Solutions, check all parts of it for accuracy, especially the Fault Indicator field. If you find an error, request a correction in writing. Write both to your insurer and to LexisNexis Consumer Center, P.O. Box 105108, Atlanta, GA 30348-5108. Q. What are the possible ways I could save on auto insurance premium?

A. Here are 10 tips to help you save on auto insurance bill. 1. Raise your deductible. Instead of forcing the insurer to pay claims in excess of $500, change your policy so that you pay the first $1,000. This will reduce your collision and comprehensive premiums significantly. By not filing small claims, you also avoid the risk of being charged higher premiums or even having your policy canceled. 2. Drop collision and comprehensive coverage on older cars. If your car is worth less than $1,000, the cost for collision coverage could be more than what you’d recover if the car were in a crash. Use a site like Kelley Blue Book to determine your car’s value. But make sure that you keep your auto liability coverage. 3. Ask about discounts. Many carriers reduce their prices if you buy coverage for two or more cars or if you buy homeowners coverage from them as well. You can also get discounts if your car has antilock brakes, air bags, automatic seat belts, alarms or antitheft devices, or if you complete a driver education course. Some discounts are also available if you are a member of certain professional, business or alumni associations, so ask your association and also check with your insurer. 4. Manage the cost of insuring teen drivers. It costs more to insure young drivers, but some insurers reduce their rates for good students, students who go to school more than 100 miles away from home and don’t take a car with them, or teenagers who have completed defensive driver classes. You may also save money by “re-garaging” a car if your child takes his or her car to school in a town where car insurance rates are lower. 5. Pay your bill once per year. Insurance companies let you pay in monthly or quarterly installments, but you’ll pay more than if you pay the entire bill once each year. 6. Don’t duplicate coverage. If your credit card or association membership offers towing and roadside assistance, don’t pay your insurance company to provide these benefits. 7. Drive less. The fewer miles you drive each year, the lower your premium. And if you don’t drive to work, your costs will be even less. Make sure that your insurer knows how many miles you drive and prices your policy accordingly. 8. Park in a garage. Cars stored in protected environments are less likely to be stolen or hit by other cars. Tell your insurer if you park in a garage and see if you can get a price break as a result. 9. Maintain good credit. Insurance companies believe that people who are responsible with their money are more likely to be responsible drivers. A good credit record can translate into lower premiums. 10. Don't let other people’s driving records affect your rate. Believe it or not, other drivers’ past behavior influences your insurance rate. That’s because insurers track the average insurance claim for every car make and model, and they use the data to help determine their rates. If drivers of a specific vehicle tend to have more accidents, incur more frequent or higher claims, or have their cars stolen more often, insurance companies will charge higher rates for everyone who drives the same type of car. So if you’re in the market for a new car and serious about keeping car insurance costs low, check out the Highway Loss Data Institute’s data. Or simply ask your insurer for a price quote before you decide which model to buy. In our last blogpost, we showed two couples who are considering long term care needs. Now we will compare their costs under 3 different options -

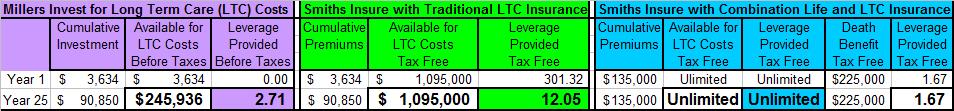

Option 1. Self-Insure (Invest) for Your Long Term Care Costs If the Millers each invest $1,817 ($3,634 combined) for one year and earn 7% (before taxes), they will immediately have a combined $3,634 available for LTC costs. If they invest a combined $90,850 ($3,634 X 25) over 25 years and earn 7% per year (before taxes), they will have a combined $245,936 available for LTC costs. Unfortunately, self-insuring (investing) provides a fraction of the leverage insurance provides. See the chart below. Option 2. Insure for Your Long Term Care Costs with Traditional Long Term Care Insurance The Smiths can purchase a Traditional Long Term Care Insurance policy with a $300 per day benefit and a five year benefit multiplier (minimum years of care). After the Smiths each pay $1,817 ($3,634 combined) for one year, they will have a combined $1,095,000 (tax free) available for LTC costs. If they pay a combined $90,850 ($3,634 X 25) over 25 years, they will have a combined tax free $1,095,000 available for long term care costs. Fortunately, insurance provides a multiple of the leverage self-insuring (investing) provides. See the chart below. Option 3. Insure for Your Long Term Care Costs with Combination Life and Long Term Care Insurance The Smiths can purchase a Combination Life and Long Term Care Insurance policy with a $300 per day or $9,000 per month benefit and a Lifetime of care. After the Smiths pay a combined $135,000 ($67,500 each), they will have a combined tax free Lifetime (Unlimited) amount available for LTC costs. They also gain a $225,000 tax free death benefit when the second person dies, assuming the policy’s LTC benefits are unused. Fortunately, insurance provides a multiple of the leverage self-insuring (investing) provides. See the chart below. Q. I am concerned about my long term care needs, but also concerned about the high long term care insurance costs. What should I do?

A. According to the U.S. Department of Health and Human Services, 7 in 10 people over the age of 65 will require long term care. This compares to a 1 in 340 chance of a major auto accident and a 1 in 1,200 chance of a total loss from a fire. About half the people reaching the age of 65 are expected to enter a nursing home at least once in their lifetime. The cost of long term care is expensive. The median cost of a private room in a nursing facility is $7,500 per month, an assisted living facility $3,600 per month and home care $3,800 per month. If you are 55-years-old expect to pay almost three times those amounts when you are likely to need care 25 years from now at the age of 80. Based on the average nursing home stay, total costs are expected to reach approximately $720,000 per person — easily wiping out a lifetime of savings for many families. So, what should you do? You have 3 ways to cover your long term care needs. 1. Self-insure 2. Purchase long term care insurance 3. Purchase long term care and life insurance combo Let's use numbers to illustrate - Two 55-year-old couples: the Millers choose to self-insure (invest) for their long term care costs, while the Smiths choose to insure. Unfortunately, each couple will likely need long term care for 5 years in a combination of locations; including a nursing home, an assisted living facility and their own home. The only saving grace is that their costs may only run at $300 per day or $9,000 per month per person. In our next blogpost, we will compare the three options' advantages and disadvantages. Q. I know wait to collect social security payment pays, but to what extent?

A. Assume you are a single worker born after 1960 with average annual salary of $60,000, at age 67, you can collect $2,000 a month. But what if you collects prior to or after age 67? The numbers below shows patience pays - Monthly Payouts Claiming Age $1,400 62 years old $1,500 63 $1,600 64 $1,733 65 $1,866 66 $2,000 67 $2,160 68 $2,320 69 $2,480 70 In our last blogpost, we discussed what questions to ask when interviewing a financial adviser. Now we will discuss how to do a background check on the financial adviser you will hire.

Step 2. The Background Check There are a few places you can visit to conduct background checks of a financial planner or investment adviser. Letsmakeaplan.org You can verify a planner's certification as a CFP at this site. You can also see any information on the planner's disciplinary history with the CFP Board and on bankruptcy filings in the past 10 years. Investor.gov You can search an investment adviser's name at this site and click on "Detailed Report" to see information on qualifications, employment history, disciplinary actions by regulators, criminal convictions and other details. Brokercheck.finra.org You can search an individual's or a firm's name to get such details as years of experience, licensing, exam passed and regulatory actions. Q. How do I vet a financial adviser?

A. Follow these two steps and you will find one who is reliable and experienced to work with. Step 1. Interview Several Advisers You need to talk to a few financial advisers before settling on one. Here are some of the questions you need to ask when interview a financial adviser -

In our next blogpost, we will discuss part 2 - conduct background checks. Q. The identity theft protection plans on the market are very expensive, is there an way I can do it myself in a low cost way?

A. Yes, you can piece together the features of the fee-charging ID Theft Protection program by yourself, free or with low cost - Step 1. Freeze or Lock Credit Report This prevents new lenders from viewing your reports, and it should block thieves from opening new credit accounts in your name. All the three major credit reporting agencies should allow you ot place or lift a freeze or lock free. Freeze has stronger legal protection. Step 2. Monitor Your Report Sign up Credit Karma which will show you your Equifax and TransUnion reports on a weekly basis and alert you to changes in those reports. If you are a Discover or Mastercard holders, you can sign up for free monitoring through them. Step 3. Set Up Alerts A credit freeze or lock won't stop a crook from fiddling with your existing credit card or financial accounts. So it is important to set up alerts to spot unusual activity in those accounts. Step 4. Get Free Help If you become a victim of ID fraud, you can browse recovery steps at the FTC's IdentityTheft.gov site and generate a tailored remediation plan and print sample dispute letters. Another resource is the Identity Theft Resource Center which posts guides to recovering from ID theft (including fixing problems that result from lost wallet and correcting misinformation on medical records), as well as links to state resources. Don't forget to ask your credit card issuers for help too. Q. I know I can't undo a conversion from traditional IRA to Roth IRA, what if I found my income too high after contributing to Roth IRA?

A. Even you cannot recharacterize a traditional IRA conversion to Roth, you can still recharacterize a Roth contribution and move the money to a traditional IRA. You can simply ask your IRA administrator to move your Roth contribution and any earnings on it (the Roth administrator will calculate it) into a traditional IRA before the deadline to file your tax return for the year of your contribution. Q. How do I determine if I am ready to buy a home?

A. Try to answer the following 10 questions to determine if you are ready to buy a home:

Foreign National Questionnaire For Non-US Citizen or Non-GreenCard Life Insurance Applicants5/17/2018 Q. I have H1b status, can I get life insurance in the U.S.?

A. For non-US Citizen or non-Green Card life insurance applicants, all insurance companies will treat your application on a case by case basis, depending on your answers to foreign national questionnaire below. It is possible to get Preferred or even better underwriting class offers -

Please contact us if you are in such a situation and are interested in applying life insurance in the U.S., we have helped many clients who are neither US citizen nor Greencard holders. In our last blog post, we discussed which assets and expenses you need to collect about your loved one, now we will discuss common issue 3.

Part C - Special Designations to Deal With Social Security and Veterans Benefits A POA is not enough for you to manage your loved one's social security payments and provide information to the Social Security Administration, instead, you need a "Representative Payee" designation To get it, you must complete Form SSA-11 and apply in person at your nearest SSA office. Similarly, to manage your loved one's veterans benefits, you must apply to be a "VA fiduciary". To do so, you need to submit a written request with your loved one's name and VA file number at your nearest regioinal VA office. You can download the guide "Managing Someone Else's Money: Help for Agents Under a Power of Attorney" from the Consumer Financial Protection Bureau's website. It includes tips on avoiding financial scams and hiring an accountant, attorneys and other professionals to help your loved one! In last blog, we discussed the 3 most important papers you need in order to take over your loved one's finances. Now we will discuss the second common issue -

Part B - Organized Your Loved One's Finances As an agent of your loved one, you need to find all the financial information you need which include -

You can look at your loved one's tax return to review the interest and capital gains reported to IRS to find out any financial accounts missing. Next, you need to gather all the expense information of your loved one, which include:

In our next blog post, we will discuss common issue Part C. Q. What steps I should take to prepare for taking over my parents' finances as they are getting old?

A. There are 3 common issues you will likely discover, we will discuss them one by one and offer suggestions for you to follow. Par A - Obtain Legacy Authority to Handle Their Finances 3 papers are typically needed: Durable Power of Attorney (POA) This is the most important document you will need in order to become your loved one's financial caregiver. It will declare you as the person's "agent" and provide the legal authority for you to sign tax returns, write checks, sell assets, etc. It might cost $150-$250 to have an attorney draft a POA, this will be money well spent as you could ask the attorney to draft specific specific, such as if your loved one wants to transfer assets to a spouse and/or children while he is alive, you may need a gifting provision which is not included in a standard POA. If multiple siblings are serving as agents, consider writing POA to specify that each of you can act independently. Also, keep in mind that rules goer POAs vary from state to state. Will Help your loved one create a will if he doesn't have one or update an existing one. If you help with a will, be careful that you don't open yourself up to accusations that illness or frailty made the incapacitated person susceptible to your "under influence" in shaping the will in your favor. Healthcare POA This will make you the person to make health care decisions for the loved one. To do so, you will need to set up a separate health care POA with your loved one's attorney and a living will, which directs doctors about end-of-life medical care. In next blogpost, we will discuss Part B of comments and solutions related taking over a loved one's finances. Where to donate -

Appliances, building materials, furniture, etc - CellPhones - Books - Shoes - If you want to save on travel related expenses, you need to try new and less known booking sites, here are a few of them:

Flight deals -

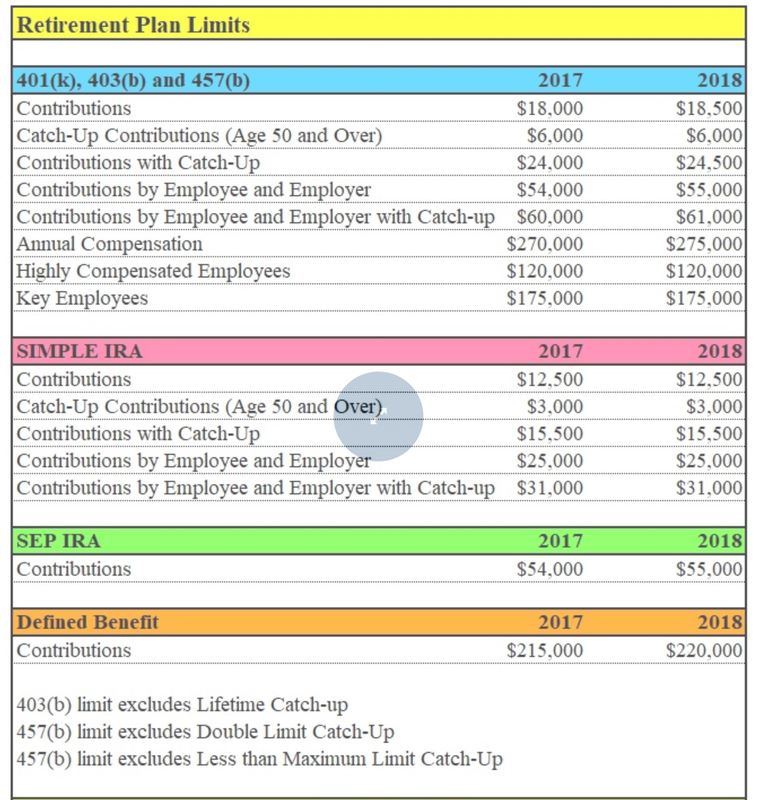

Hotel deals - Q. How the various retirement plans' contribution limits changed from 2017 to 2018?

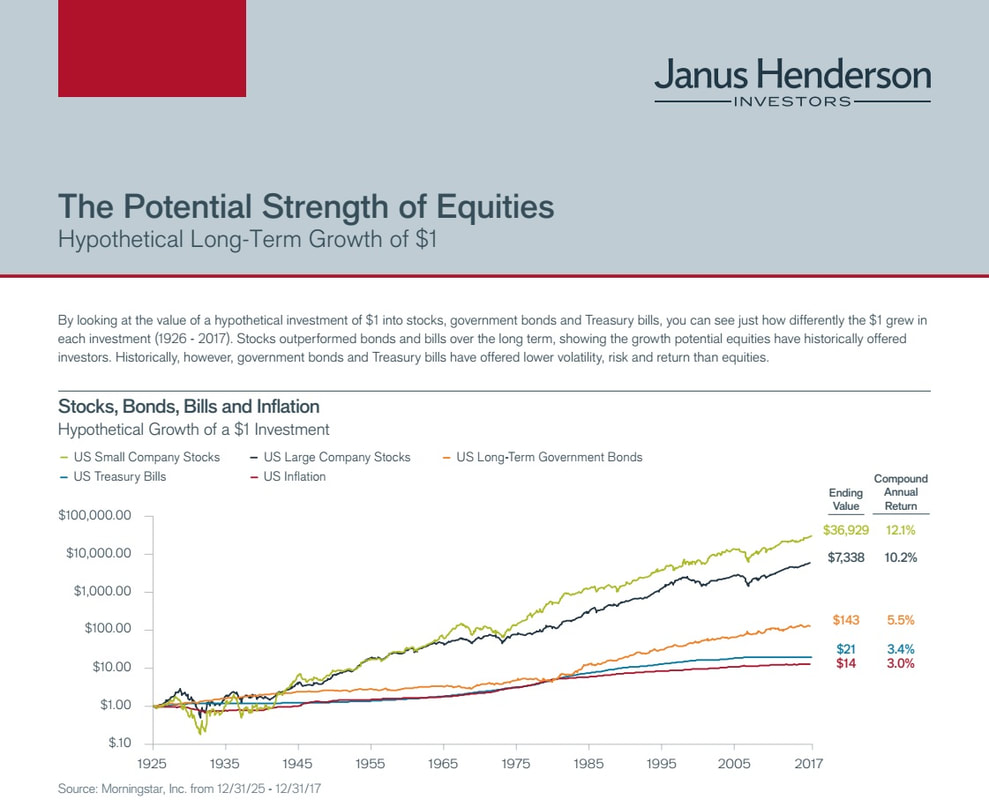

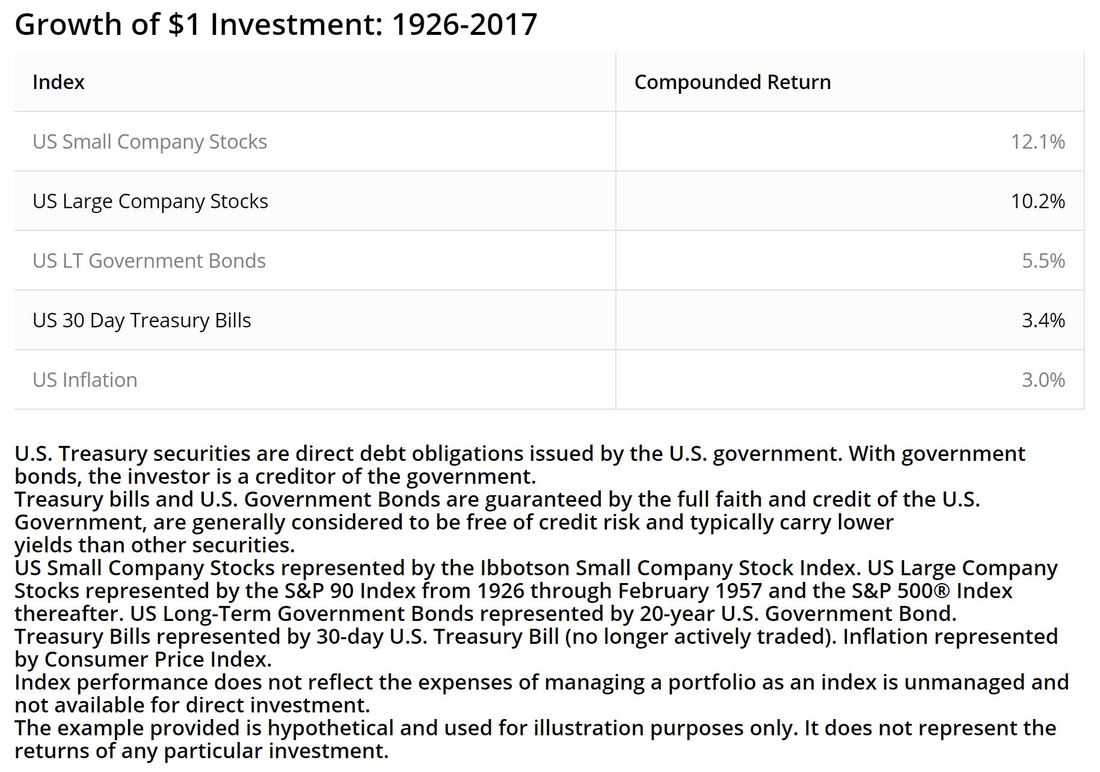

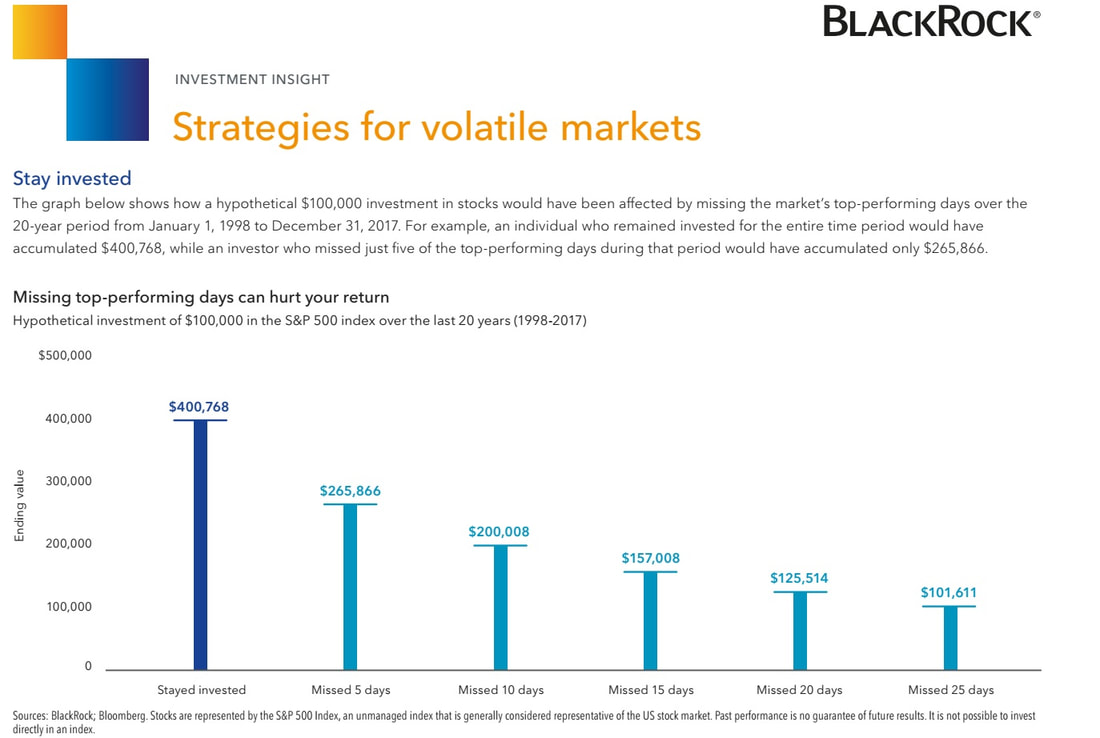

A. Please see table below that summarizes retirement plan limits - The graph below shows how a hypothetical $100,000 investment in stocks would have been affected by missing the market’s top-performing days over the 20-year period from January 1, 1998 to December 31, 2017.

For example, an individual who remained invested for the entire time period would have accumulated $400,768, while an investor who missed just five of the top-performing days during that period would have accumulated only $265,866. If you are worried about the higher volatility of US stocks, you could consider increasing exposure to European stocks!

The European recovery only began 4 years ago, and it started to accelerate in 2017. Europe offers cheaper stock valuations with a forward-PE ratio of 14 versus 17.5 for the S&P 500. Also, the inflation rate is just 1.3% and the European Central Bank has pledged to keep interest rates near zero. What to invest now? You could consider investing in Wisdom Tree Europe Hedged Equity Fund (HEDJ), it provides exposure to about 130 stocks of companies with strong cash flow and dividend yields in countries that use the euro. The fund also hedges its currency exposure which minimizes the effect of currency swings on share price. |

AuthorPFwise's goal is to help ordinary people make wise personal finance decisions. Archives

September 2022

Categories

All

|

RSS Feed

RSS Feed