|

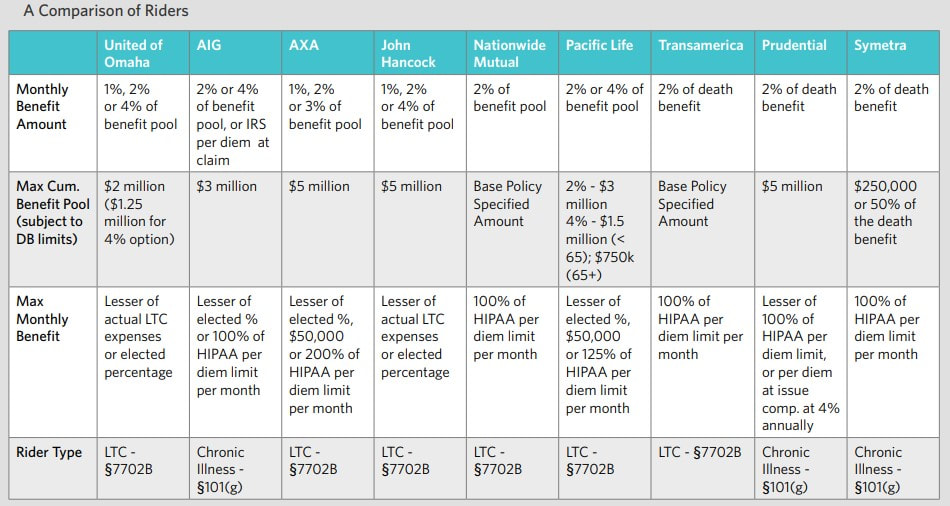

In last blogpost, we showed 2 case studies to compare indemnity and reimbursement. Now we will compare different insurance companies' LTC riders.

0 Comments

In last blogpost, we discussed the differences between indemnity and reimbursement.

Case study: maximum benefits limits Jackie purchases a life insurance policy with a Long Term Care Rider that has a $50,000 monthly benefit. Twenty-five years from now, she incurs covered expenses of $28,000 per month. • Under an indemnity policy with a 1x HIPAA limit, the most she could receive in LTC Rider benefits is $25,110 (even if she was paying for a max benefit of $50,000 per month). This means she would need to dip into her personal savings for the additional $2,890 per month • Under a reimbursement policy without a HIPAA limit, she could get reimbursed for her actual expenses of $28,000 (all income-tax free) By having more benefit available, Jackie gains flexibility and freedom. She can choose which facility she wants to go to (since she does not need to feel she is restricted to a facility that charges less than the HIPAA limit). She also doesn’t need to deplete her personal assets. One might argue that an indemnity rider is preferable to a reimbursement rider because if the client’s expenses are less than their maximum monthly limit, they can take more than their actual expenses. While this is true, keep in mind the reason your client is purchasing this LTC Rider. The goal isn’t to get “extra money.” It’s to cover LTC expenses so they don’t have to deplete their personal assets to pay for long-term care services. The more benefit the client takes in excess of their actual LTC expenses, the less time their LTC Rider benefits will last. Case study: duration of benefits Adam purchases a $1 million life insurance policy with a $1 million LTC Rider benefit pool, and a 2 percent monthly acceleration option. He can take up to $20,000 per month ($240,000 per year). If his actual expenses are $16,000 per month ($192,000 per year): • A reimbursement policy would last 62.5 months (5 yrs. 2 ½ months) • An indemnity policy where he is taking the full $20,000 would only last 50 months (4 yrs. 2 months) At first glance, an indemnity rider may seem like the obvious choice, that your client has access to greater benefits and that they won’t need to prove expenses. But once you’ve taken the time to delve into the product details and considered reallife situations, a reimbursement rider may prove to be more beneficial. In next blogpost, we will compare different insurance companies' LTD riders. In last blogpost, we discussed LTC rider's tax treatment.

Indemnity – Policyowner can take rider benefits up to the maximum monthly benefit limit regardless of the actual expenses incurred. Reimbursement – Policyowner is reimbursed based on actual expenses incurred by the insured, up to the maximum monthly benefit limit. Although this makes it seem like an indemnity rider might be the best choice, most indemnity riders have a “real maximum limit” of 1x the HIPAA limit. If we look ahead 25 years, the monthly HIPAA limit (at 3 percent inflation) would be $25,110. This would be the max benefit even if they purchased a $50,000 monthly benefit. The result: you may never get to take an amount up to the indemnity limit you purchased unless the IRS significantly changed the HIPAA limits or there is substantial inflation. Some indemnity carriers have a limit that is a multiple of the HIPAA limit, for example, 2x the HIPAA limit. However, keep in mind that the IRS only automatically allows benefits up to 1x the HIPAA limit to be received untaxed. If you wanted to take more than the HIPAA limit, you would have to ‘prove expenses’ to receive favorable tax treatment. So, even though you don’t have to submit receipts to the life insurance company, you will still have to keep track of your receipts to prove expenses to the IRS. With the reimbursement rider, you can take up to the full monthly benefit as long as they have qualifying expenses. There is no restriction based on HIPAA limits. You still will have to prove expenses to get reimbursed, but because there is no HIPAA limit, you may be able to take more benefit from the rider than from a company with a 1x HIPAA limit. And, because you have to submit receipts, your records will already be ‘in order’ to prove expenses to the IRS, if needed. In next blogpost, we will show a case study. While some insurance companies' LTC Rider follows what is known as a reimbursement rider model, other life insurance companies have LTC riders that use an indemnity model. Knowing the difference is important. The following information will help you get a better understanding of the two designs.

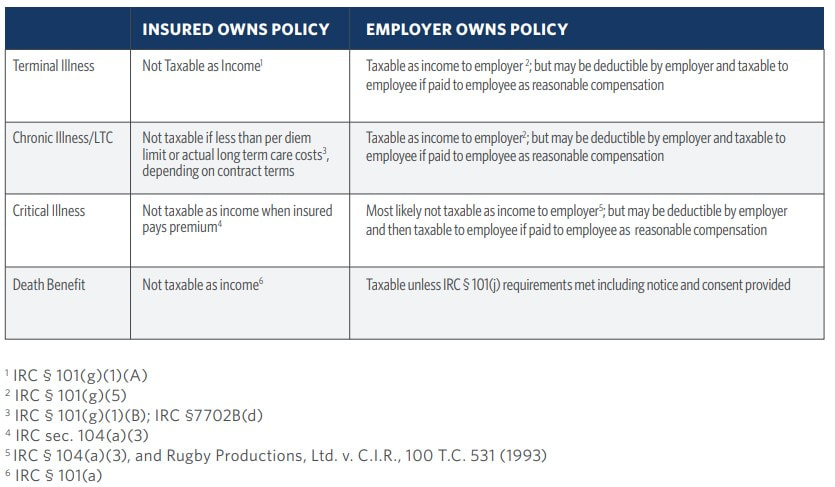

How LTC Rider Benefits are Taxed First, it’s beneficial to have an understanding of how LTC riders are taxed. LTC riders are designed to qualify for favorable federal income tax treatment under Section 7702B of the Internal Revenue Code, as amended. This favorable tax treatment extends up to the greater of the HIPAA limit, or actual long-term care expenses. The IRS HIPAA limit is currently $400 per day for 2021. That results in $12,000 per month (for a 30-day month). Chances are, the life insurance with LTC riders that you purchased won't be needed for 20-30 years from now. If we assume the 2021 limit increases for inflation at 3 percent, the daily HIPAA limit in 25 years would be $837, or $25,110 per month. In next blogpost, we will get to the differences between indemnity and reimbursement. Scenario 1. Nick purchases a life insurance policy with a long-term care rider

At age 50, Nick purchases a $1 million Life Protection AdvantageSM policy. He chooses to add the LTC Rider with the option to accelerate the entire $1 million for long-term care services at a monthly maximum rate of 2 percent of the maximum benefit per month. This allows him to be reimbursed for up to $20,000 in long-term care expenses per month. • When he needs long-term care services at age 75, he incurs qualifying expenses of $15,138.75 per month ($181,665 per year) for a semiprivate room in a nursing home. He resides there for four years before he passes. Over this four-year period, he is reimbursed for his four years of long-term care, which totals $726,660 • When he passes, his beneficiaries receive the remaining amount of $273,340 as a death benefit. He also still has his remaining $1 million in assets. When this $1,273,340 is divided among his three children, each will receive $424,446 Nick’s planned premium on his Life Protection Advantage policy was approximately $11,000 per year. Even considering premiums paid, this planning strategy still makes sense. Plus, if Nick had died prior to needing long-term care, his beneficiaries would have received the entire $1 million as a death benefit. Scenario 2. Nick doesn’t plan ahead for long-term care expenses At age 50, Nick chooses not to plan ahead for the possibility of a long-term care need. By not planning ahead, he ultimately makes the choice to self-insure. • When he goes into a nursing home at age 75, he starts taking $181,665 per year from his savings to pay for a semiprivate room. He resides there for four years before he passes. Over this four-year period, he spends $726,660 for long-term care services • His long-term care expenses reduce his $1 million in assets down to $273,340. Each of his three children receives an inheritance of $91,000 And, depending on the types of assets he had, he could end up paying unexpected capital gains tax, income tax and potential surrender charges generated from asset liquidation. Or, he could miss out on any returns the liquid assets were expected to generate. Summary By choosing the LTC Rider on his life insurance plan, Nick’s premium investment resulted in each of his three children ending up with significantly more inheritance than if Nick hadn’t planned for long-term care expenses. Help clients protect their assets and preserve their independence. Show them the value of an LTC Rider on their life insurance policy. Learn more about the LTC Rider at MutualofOmaha.com/ltc-rider. Are you looking for more growth potential to help offset inflation? Below is a brochure from AIG about how a fixed indexed annuity (FIA) could be a good solution for people to combat low rates and rising inflation. Below is a brochure from American National for its CENTURY PLUS ANNUITY for NY. This annuity product offers 4 major benefits:

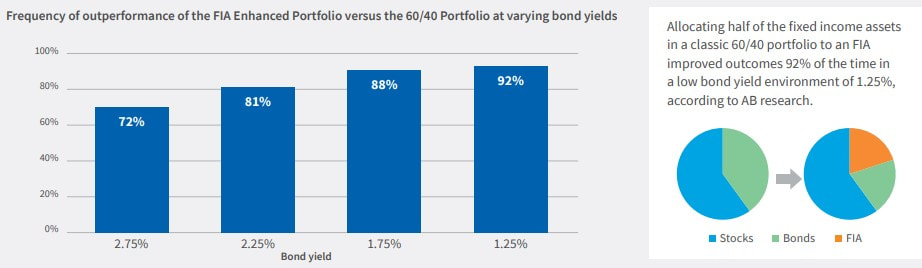

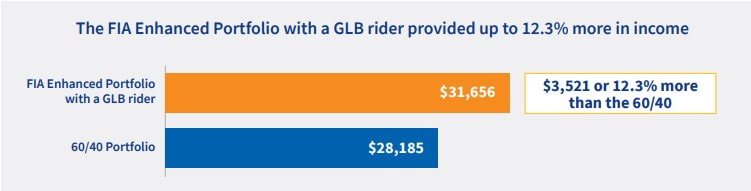

Are you using fixed income assets like CDs and bonds for yield, safety, or both? With 5-year CD rates at only 0.28% and bond yields at 1.95%1 , retirees relying on these assets to cover their expenses may not have enough income to meet their needs. Adding a fixed index annuity (FIA) can help protect against market downturns, while enhancing the performance potential of your clients’ portfolios, according to recent research by leading asset manager AllianceBernstein (AB). AB research showed that portfolio outcomes improved up to 92% of the time with a fixed index annuity Adding a lifetime income benefit improved outcomes 99% of the time AB also found that when it came to providing retirement income, adding an FIA with a guaranteed living benefit (GLB) rider enhanced results 99% of the time over a 60/40 portfolio. In the best-performing scenarios, the FIA Enhanced Portfolio with a GLB rider provided almost $3,500 more in annual retirement income, an increase of more than 12% over the 60/40 Portfolio. Whether you are getting started with the planning process, or need to review your existing plans, your legacy requires careful planning and the appropriate legal documents to ensure that your assets and belongings transfer to your loved ones as you wish.

A well-designed legacy plan can help you: ■ Arrange for the guardianship of your minor children ■ Preserve wealth and promote your values throughout generations ■ Protect assets from creditors, divorces and lawsuits ■ Minimize family discord ■ Provide for orderly family business succession ■ Promote a charitable cause ■ Provide for loved ones who have special needs while preserving eligibility for government assistance ■ Avoid probate and probate fees ■ Minimize or eliminate estate taxes at death Taxes and Transfer Costs Whether you do bare bones planning by drafting a will or fail to plan altogether, you have an estate that is subject to probate administration. Your estate must be administered through the probate court located in the county of your legal residence at the time of death. The overall cost of probate will vary according to state law and will generally hinge on the size of the estate—the more you own, the more you owe. In addition, generally the federal government imposes an estate tax on all property you pass to your loved ones upon your passing. Every asset you own at that time will be included in determining the value of your estate and any taxes due. Any amount that is above the applicable estate tax exemption in the year you pass away will be subject to federal estate taxes. In 2015, the estate tax exemption is $5.43 million. Some states impose their own separate estate tax. For example, in New Jersey, the estate tax exemption is $675,000. It is possible that an estate that is too small to generate federal estate taxes may nonetheless trigger state estate taxes. Some states impose an inheritance tax in addition to the state estate tax. Inheritance tax is imposed on the right to receive property by inheritance or legal succession. The tax imposed is based on the beneficiary’s relationship to you and the amount of property received from your estate CONTROL OVER THE RECOGNITION AND TAXATION OF IRREVOCABLE TRUST EARNINGS

Investing trust assets in an annuity can provide income tax efficiency within the trust and help meet the needs of trust beneficiaries. Taxable income retained by certain non-grantor trusts is subject to comparatively higher effective trust income tax rates and may be subject to an additional 3.8% net investment income tax. Although income may be distributed to trust beneficiaries to help reduce the impact of the trust tax rates, payment of income to the trust beneficiaries may not be desirable. Investment in an annuity by a trust meeting certain requirements may avoid this tax dilemma. Keep in mind that the manner in which the annuity is titled will have an impact on how the annuity contract operates. The titling options and rules are described throughout the remainder of this brochure. ANNUITIES AND TRUSTS: IRC SECTION 72(u) Annuities that are owned by trusts that act solely for the benefit of living individuals will receive tax deferral under IRC Section 72(u). With annuities that meet the requirements under IRC Section 72(u), the appreciation of the annuity remains tax-deferred until the trustee requests a distribution. Annuities owned by trusts that benefit nonnatural entities, businesses, or charities will not receive tax deferral. FLEXIBLE INVESTMENT OPTIONS WITH GROWTH POTENTIAL Changing trust objectives and economic conditions may cause the trust to change or modify its investment allocations. In many cases, the reallocation of trust assets may result in transaction costs and/or the realization of capital gains. DEATH BENEFITS WITH POTENTIAL TO ENHANCE THE VALUE OF ASSETS PASSING TO TRUST BENEFICIARIES An annuity with a guaranteed death benefit or enhanced death benefit offers the potential for long-term growth with downside protection, allowing the trustee to consider a more aggressive asset allocation for the benefit of the remainder beneficiaries. If the account performs poorly, an enhanced death benefit may provide an amount higher than the original account value at the death of the annuitant. GUARANTEED LIFETIME INCOME An annuity can satisfy a need for trust income through a guaranteed lifetime income stream for the income beneficiary of a trust. This can be beneficial for two reasons: 1. It allows the trustee to allocate a specific amount of trust assets to generate a lifetime stream of income. 2. It enables the trustee to invest more aggressively without fear of compromising income needed for the beneficiary’s life, thereby potentially growing the trust assets for the benefit of the remainder beneficiaries. The table below compares some of the differences in taxation based on ownership of the life insurance policy:

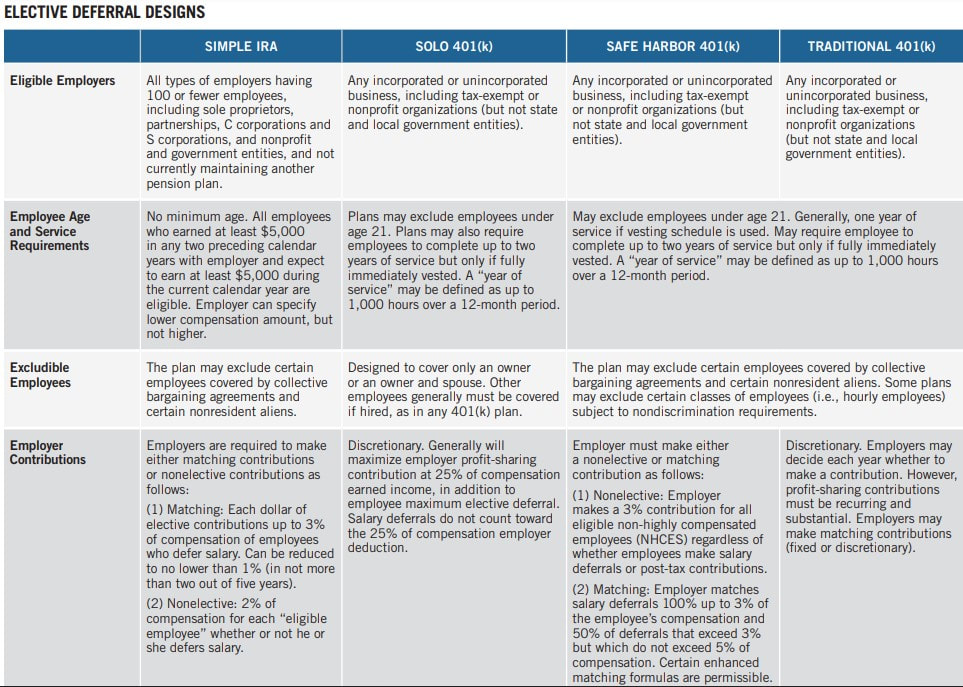

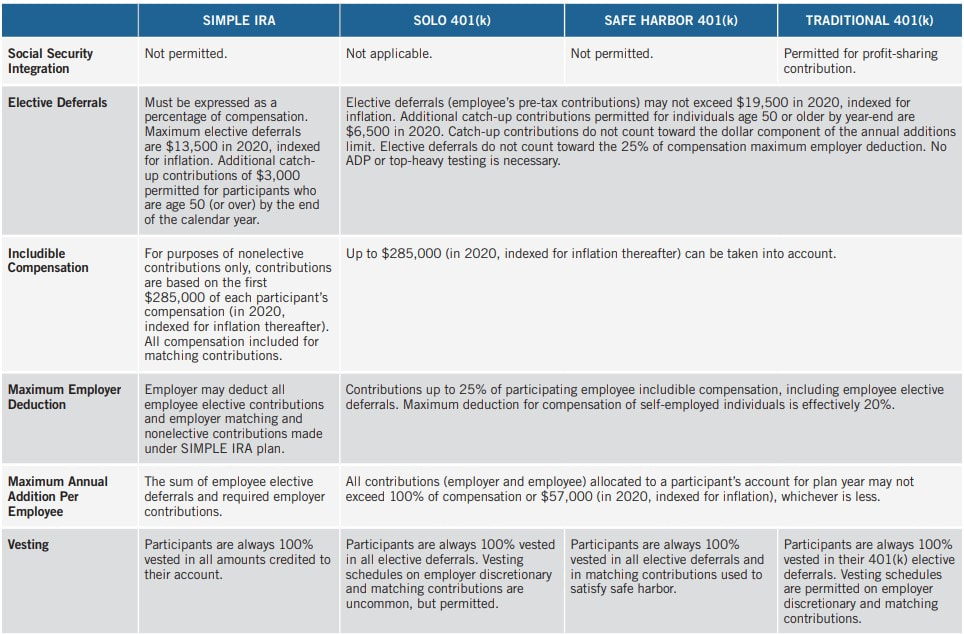

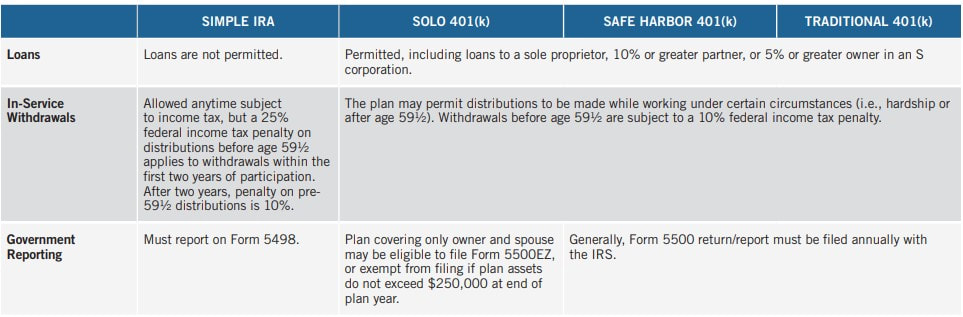

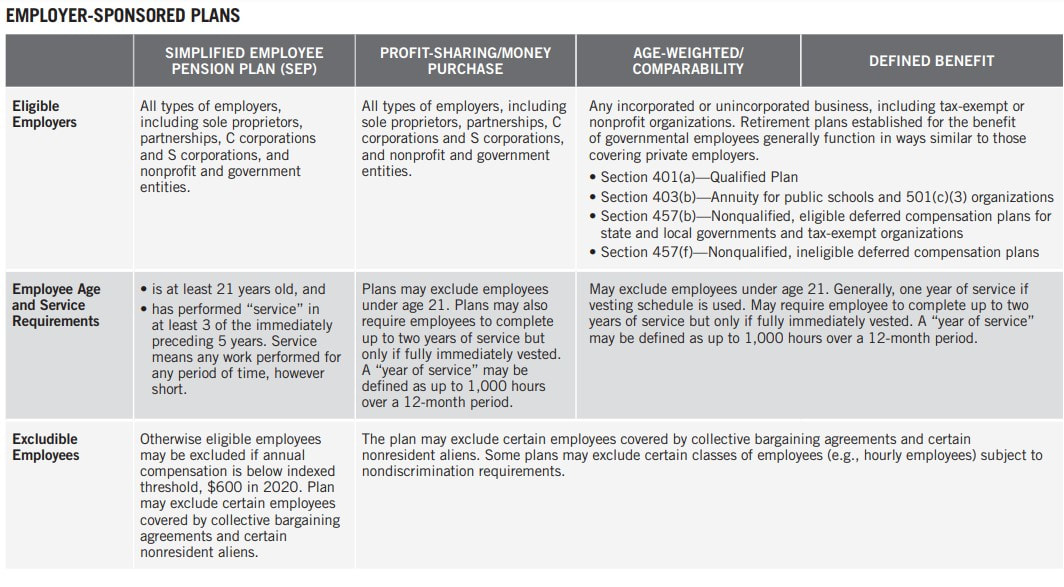

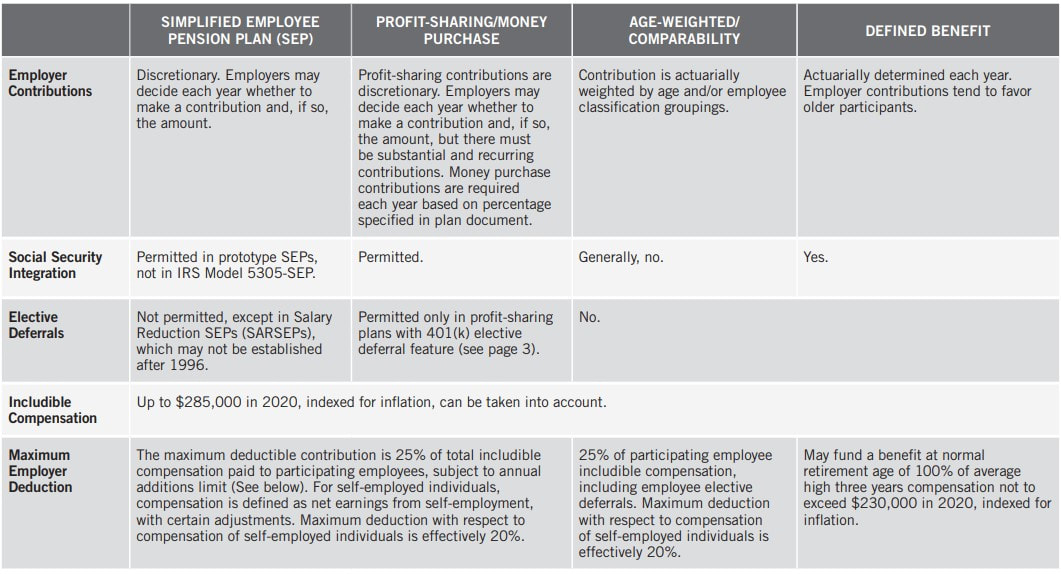

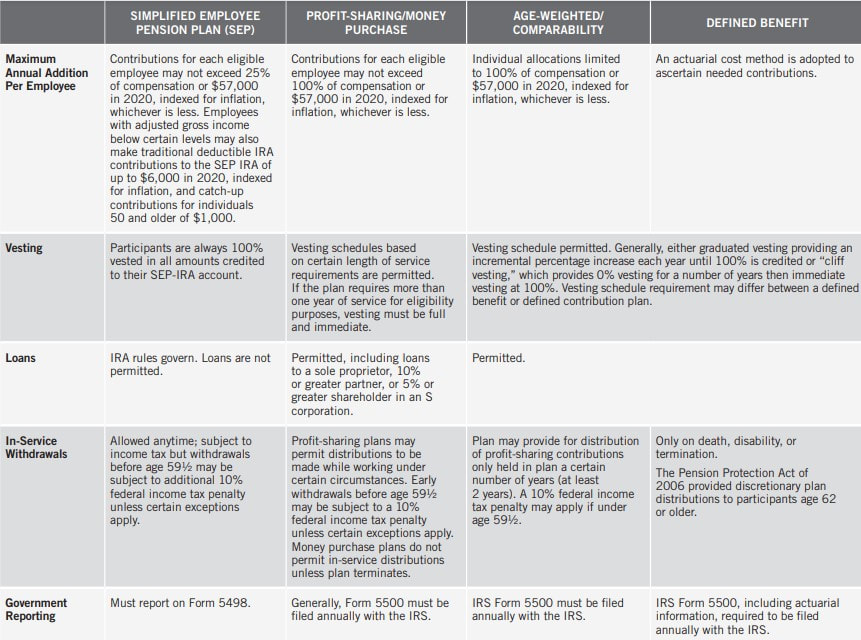

In last blogpost, we discussed employer-sponsored plans for business owners. Now we will discuss Elective Deferral Designs.

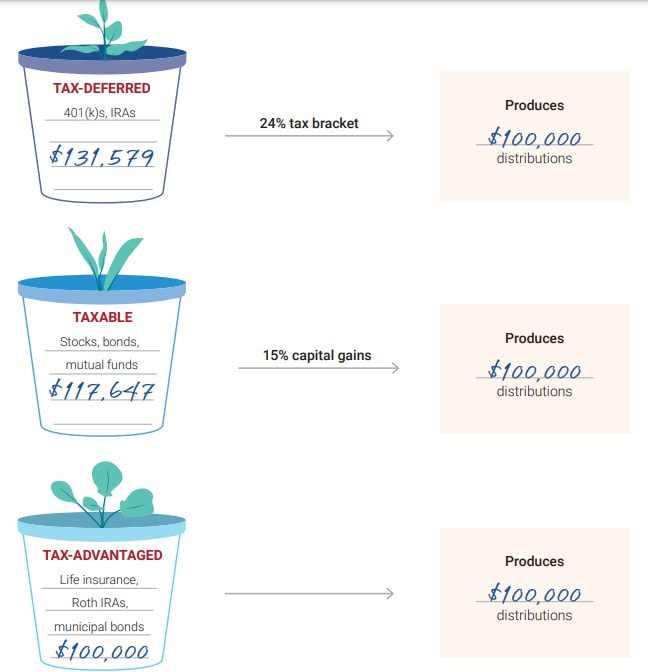

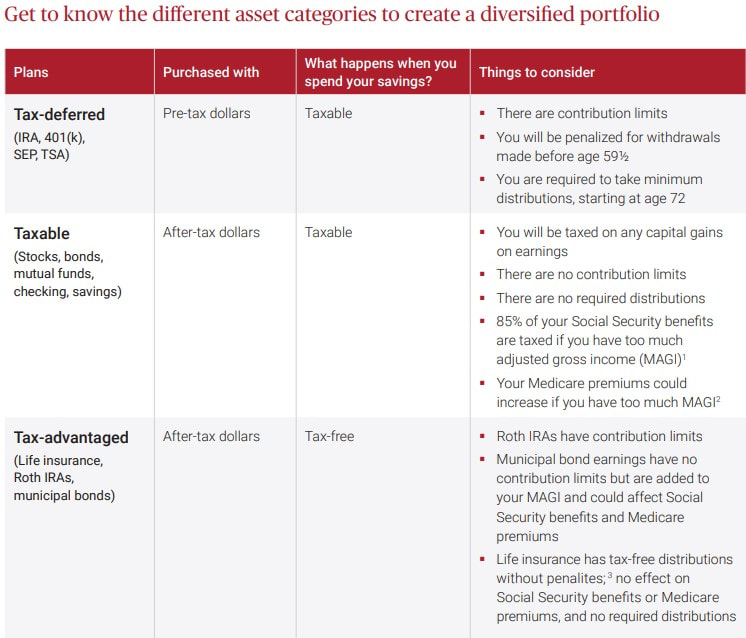

As you plant the seeds for retirement, now is the time to consider how taxes will affect you when you begin spending your savings.

The following illustration will help you understand how taxes affect your retirement plan and how to diversify assets, so you can keep more income and pay less in taxes when you begin distributions. As you understand how taxes impact the money you use to invest in the different options and how taxes impact your distributions, you will see that diversification is not only important for growth but distribution. In last blogpost, we discussed Conduit trust. Now we will discuss Accumulation trust.

With an accumulation trust, the trustee has broad discretionary authority to either pay out or accumulate retirement plan distributions during the lifetime of the primary beneficiary for possible distribution to another beneficiary, at a later date. However, after SECURE, even an accumulation trust isn’t the perfect solution. It has its tradeoffs. An accumulation trust may resolve someone's concerns about the beneficiary receiving too much too quickly, but at a prohibitively expensive income tax hit. SECURE requires that all retirement benefits be paid to the accumulation trust within 10 years, following the year of the death. To the extent the trustee accumulates retirement plan benefits in the trust, they will be taxed at the highest trust rates due to its compressed tax brackets. Yet, a strategy that combines an accumulation trust with the purchase of a life insurance policy may be the right solution to help offset the accelerated tax liability with an income-tax free death benefit at the death. Aimed at increasing access to tax-advantaged accounts and preventing older Americans from outliving their assets, the Setting Every Community Up for Retirement Enhancement Act (SECURE Act) is far-reaching retirement savings legislation that took effect in January. One significant provision eliminated stretch IRAs as an estate planning tool by requiring full distribution of an IRA to beneficiaries within 10 years, following the year of the employee or IRA owner’s death. Now is the time to identify new options to pass legacy to beneficiaries without also passing a big tax bill.

Conduit trust The new legislation may be most problematic for people with conduit trusts because the conduit trust will no longer operate the way originally expected it to work. Under a conduit trust, the trustee immediately pays all retirement plan distributions to the primary or lifetime trust beneficiary (“conduit” beneficiary). All retirement plan distributions paid to the trust are forced out to the conduit beneficiary and nothing accumulates in the trust. Historically, conduit trusts regulated and controlled the systematic and gradual payout of someone's sizeable retirement plan over the beneficiary’s lifetime. They were used to address the fears regarding the beneficiary’s potentially questionable financial judgment, discipline and restraint as well as concerns about creditors’ and other claimants’ (ex-spouses) attempts to access those assets, if otherwise, left outright the beneficiary. SECURE mandates the trustee accelerate distributions under the 10-year payout rule to the conduit beneficiary rather than make small incremental distributions over the beneficiary’s lifetime unless the beneficiary is an “eligible designated beneficiary” (EDB). An EDB is a surviving spouse, a disabled or chronically ill individual, minor child of client, or an individual who is not more than 10 years younger than the client. As a result, SECURE may expose a conduit beneficiary to an increased income tax burden and undermine the intent, purpose and utility of the trust if the designated beneficiary is not an EDB. At a minimum, people should have their conduit trusts reviewed and either modified to name an EDB, if appropriate for their circumstances, or potentially switch to an accumulation trust. In next blogpost, we will discuss Accumulation trust. Wealthy clients should invest more in private equity, a study says. Read the article from Financial-Planning.com if you are interested in this topic.

One of the major fears your clients face is outliving their income. A Palladium® Single Premium Immediate Annuity (SPIA) could help you shield you from this risk . SPIA allows a lump sum to be converted into a steady stream of guaranteed annuity payments, providing a guaranteed income for as long as it's needed. These 5 Internal Revenue Tax Code sections put the power of life insurance to work helping you reach your financial goals: United States

Many families use 529 plans as a way to save for future education costs due to its tax benefits, as funds in a 529 account grow tax-deferred, and that growth can subsequently be withdrawn tax-free if used for qualifying educational expenses. In addition, many states offer a tax deduction for 529 plan contributions, making these accounts even more attractive.

And while many families might not have the means to contribute more than the annual gift tax limits ($16,000 per individual, per recipient, in 2022), wealthier families have the option of ‘superfunding’ these accounts beyond this limit without using their gift tax exemption. The superfunding exception allows individuals to fund up to five years’ worth of 529 contributions to a given beneficiary in a single year, without triggering gift taxes when the contribution is made to the child’s 529 plan. For example, a parent could contribute $80,000 into a 529 for their child in 2022, and not have to use any of their gift tax exemption… as long as they do not make additional gifts to that child for five years. Given the additional years of potential compounding (with tax-free growth potential), superfunding a 529 could lead to a larger account balance by the time the student goes to college compared to making smaller annual contributions. At the same time, there are limits on how much someone might want to contribute to a 529 account. For example, because of the limited tax-free uses of funds in a 529, a parent or other contributor might not want to ‘overfund’ an account beyond what the account’s beneficiary is likely to need for college or graduate school expenses (especially if the parent has other financial priorities of their own!). On the other hand, the parent can choose to fund more and plan to change the beneficiary to a sibling or another individual who will have education expenses. And some families might even consider contributing so much into 529 accounts that it funds not only college for their children, but has enough left over to benefit further generations down the line. These ‘Dynasty 529’ plans have the potential benefit of perpetual tax-free growth, but come with several potential pitfalls to navigate (e.g., gift tax and Generation-Skipping Transfer Tax implications, as well as the possibility that a future beneficiary will use the funds for something other than education and pay the associated taxes and penalties). First introduced in the 1970s, index funds have grown in popularity over time thanks to their ability to provide broad-based diversification at (typically) very low costs, making their benefits available to investors of any level of wealth. And while mutual funds and Exchange-Traded Funds (ETFs) have been the dominant way for investors to get index exposure, thanks to improved technological capabilities and reduced trading costs, direct indexing – buying the individual component stocks within an index – has emerged as an alternative tool with a range of potential use cases.

Historically, direct indexing was developed as a means to unlock the tax losses of individual stocks in an index – even if the index itself was up – and was primarily used only by the most affluent investors (who had the highest tax rates and benefitted the most from the available loss harvesting). However, direct indexing can be used not only to harvest tax losses but also to harvest capital gains (particularly for those taxpayers in the 10% and 12% tax brackets). In addition, direct indexing can provide tax benefits to investors who are charitably inclined by allowing them to donate the underlying shares within an index that have the largest gains, thereby helping them to maximize their tax savings. For those whose primary goal is to benefit from a more personalized indexing strategy that still gains broad market exposure while specifically adjusting for personal preferences, using a personalized index can ensure the investor’s capital will support the exact industries or companies they wish to support (while also saving on the management fees otherwise charged by more packaged ESG/SRI mutual funds and ETFs). This article from Kitches.com discusses in great details of 4 types of direct indexing -

|

AuthorPFwise's goal is to help ordinary people make wise personal finance decisions. Archives

September 2022

Categories

All

|

RSS Feed

RSS Feed