Here are 5 questions to ask when you do an annual financial review.

1. Is my investment strategy on track?

You probably have several savings goals and accounts. Your annual financial review should revisit each of your priorities and your strategy for reaching them. If your situation has changed, make adjustments as necessary. At least once a year, check your target asset mix to ensure that it continues to meet your time frame, risk tolerance, needs, and preferences, and to perform any rebalancing that might be necessary in light of the past year's market performance.

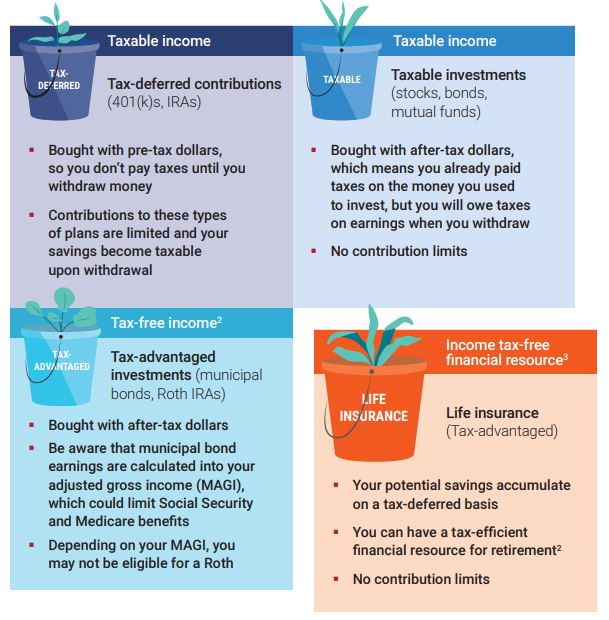

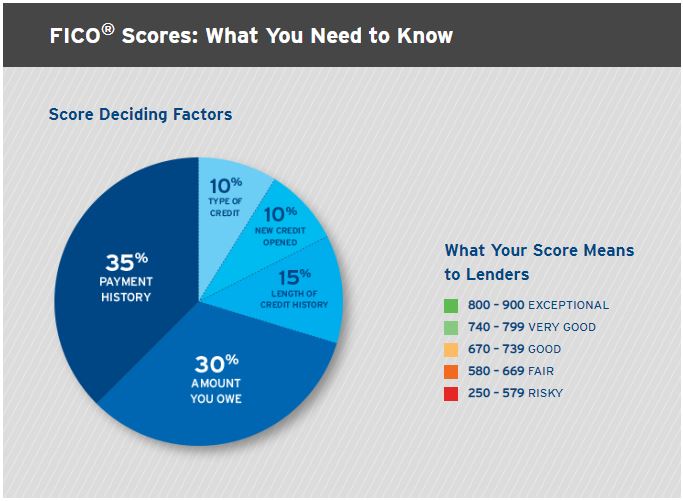

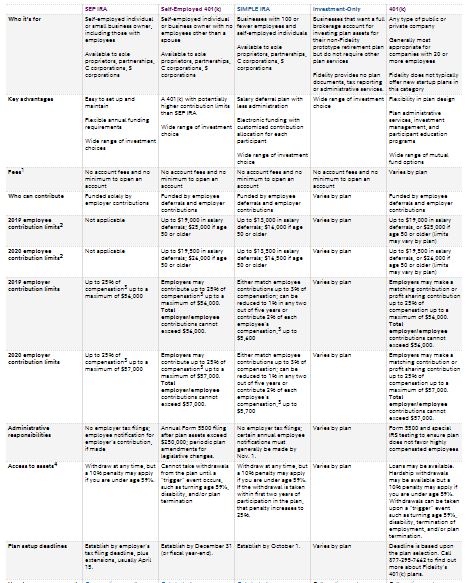

2. Am I saving tax-efficiently?

Beyond applying diversification strategies broadly to your overall portfolio, what approaches are you exploring to help defer, reduce, or more efficiently manage taxes on your investments? Basic rule of thumb: Consider putting certain investments which generate taxable income—for example taxable bonds and real estate investment trusts—in tax-deferred accounts like 401(k)s and IRAs. For those investments which are more "tax-efficient"—like stocks and ETFs held for more than a year—place them in taxable accounts.

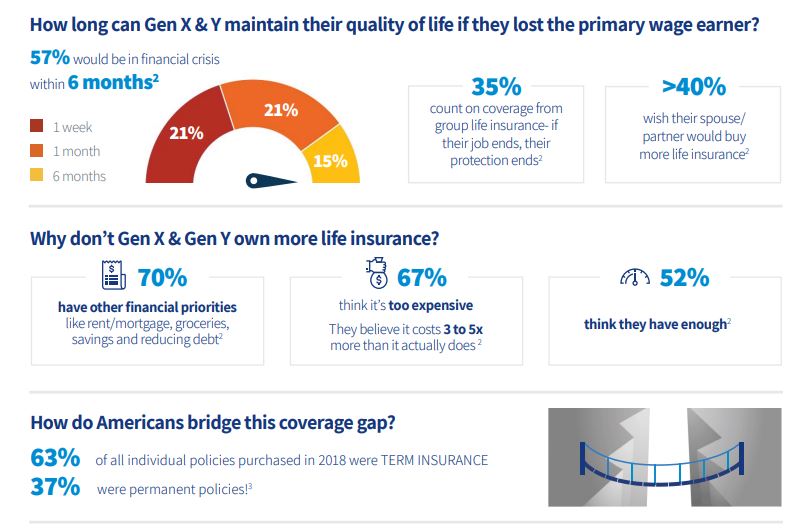

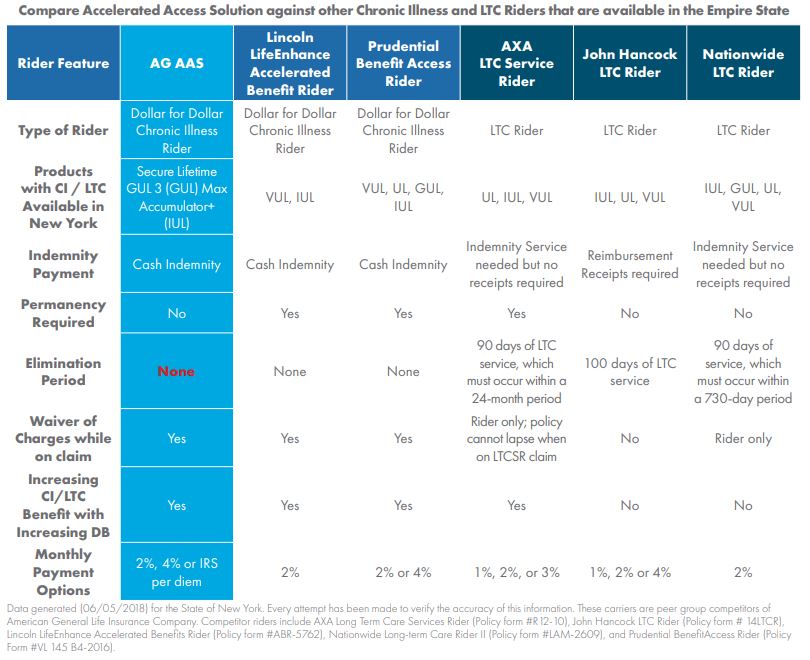

3. Am I protecting my income?

You've worked hard and want to protect your income. So it's wise to evaluate your family's total insurance needs annually to make sure you have the right amount and type of insurance to cover unforeseen circumstances that can derail a financial plan. Life insurance may be a good place to start. If your family is growing, you might want to increase the amount of your life insurance to protect your loved ones.

4. Am I preserving my assets?

Use your annual review to make sure you have an estate plan, and that it continues to reflect your family status and financial situation. Ensure that it helps make the best use of the latest estate and tax laws, and that key individuals know where to find relevant documents and information.

5. How does my financial plan affect my family?

It's not just your retirement or financial future that you are planning for, especially as you age. You are likely researching and cultivating strategies to provide financial assistance to a number of people that you care deeply for, including parents, children, or even grandchildren. Beyond college, a lot of parents are helping to launch their millennial children into the world of fully independent living. Meanwhile, many have aging parents who can no longer live on their own or manage their own financial and personal affairs. Will caring for others affect your financial goals, priorities, and outcomes?

RSS Feed

RSS Feed