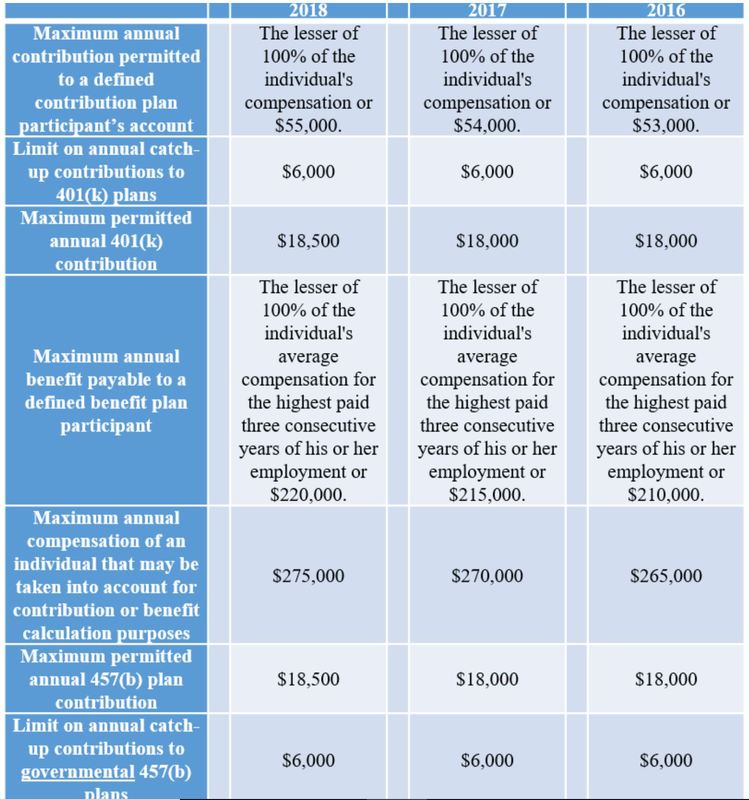

401(k), 403(b), most 457 Plans, and the Federal Thrift Savings Plan (TSP)

The annual contribution for employer-sponsored plans is increasing from $18,000 in 2017, to $18,500 in 2018. The catch-up provision for taxpayers 50 and older remains unchanged at $6,000. The total maximum contribution by older taxpayers effectively increases the $24,500.

Changes with IRA plans

The basic contribution of $5,500 is not changing, nor is the catch-up provision of $1,000 for taxpayers age 50 and older ($6,500 combined maximum). Contributions to a SIMPLE IRA also remain unchanged, at $12,500.

But there have been changes to the income limits for Roth IRA contributions, and for tax-deductible traditional IRA contributions, for those who are already covered by an employer-sponsored retirement plan.

For a traditional IRA, if you’re covered by an employer plan, the income limits are as follows:

- Single taxpayers—Contributions are fully deductible up to an income of $63,000. The contribution deduction is phased out between $63,000 and $73,000, after which no deduction is permitted. The old limits were between $62,000 and $72,000.

- Married couples filing jointly—Contributions are fully deductible up to an income of $101,000. The contribution deduction is phased out between $101,000 and $121,000, after which no deduction is permitted. The old limits were $99,000 and $119,000.

- Married couples filing separately—Contributions are only partially deductible with an income between $0 and $10,000. This is unchanged from 2017.

- If you’re not covered by an employer-sponsored plan, but you’re married to a spouse who is, your IRA contribution is fully deductible up to an income of $189,000. The deduction phases out between $189,000 and $199,000. The old limits were $186,000 and $196,000.

With a traditional IRA, you always have the option to make a nondeductible contribution if your income exceeds IRS limits.

Roth IRA income limits

Just as a reminder, if you exceed IRS income limits, you’re not permitted to make a contribution to a Roth IRA plan at all.

- For single taxpayers and heads of household, you can make a full contribution with an income up to $120,000. A partial contribution is permitted with an income between $120,000 and $135,000. The old limits were between $118,000 and $133,000.

- For married couples filing jointly, a Roth IRA contribution is fully permitted up to an income of $189,000. A partial contribution is permitted with an income between $189,000 and $199,000. The old limits were between $186,000 and $196,000.

- For married couples filing separately, a partial contribution is permitted with an income between $0 and $10,000. This is unchanged from 2017.

Retirement savings contribution credit

Referred to simply as the “Savers Credit”, it’s an opportunity for low to moderate income taxpayers the claimant tax a credit for making retirement contributions. The credit can be as much is $1,000 for single filers, and up to $2,000 for married filing jointly. There are income limits to qualify for the credit.

- The income limit is $63,000 for married couples filing jointly, which is up from $62,000 in 2017.

- For heads of household, the income limit is $47,250, up from $46,500 in 2017.

- For single filers and married taxpayers filing separately, the income limit is $31,500, up from $31,000 in 2017.

Changes in the maximum retirement contributions to all plans

The IRS imposes a maximum on the amount of contributions that you can make to all retirement plans. That includes the combination of IRAs and multiple employer-sponsored plans. The contribution limit is per individual, and not for a married couple filing jointly.

For 2017, the maximum contribution was $54,000. In 2018, it is increasing to $55,000.

Annual compensation maximum limits are increased from 270,000 in 2017, to $275,000 for 2018 (20% X $275,000 = the $55,000 maximum contributions to all plans).

The maximum contribution level for taxpayers age 50 and older increases from $60,000 in 2017, to $61,000 in 2018. This is comprised of the base maximum contribution amount of $55,000, plus the catch-up contribution of $6,000.

The dollar limitation concerning the definition of “key employees” in a top-heavy plan is unchanged at $175,000.

Standard deductions and personal exemptions

These have nothing to do with retirement plans, but we are including the changes since they apply to virtually all taxpayers—and they’re probably what you’ve heard most about when it comes to the new tax bill.

For 2018, the standard deduction for those who are married filing jointly has increased to $13,000. That’s a $300 jump from the $12,700 permitted in 2017. Single taxpayers and those who are married filing separately will see their standard deduction increase to $6,500, up $150 from $6,350 in 2017. The deduction for heads of household will be $9,550.

The personal exemption is increasing from $4,050 in 2017, to $4,150 in 2018. However, personal exemptions are phased out on higher incomes. For individuals, it begins to phase out with an income of $266,700, and is lost completely at $389,200. For married couples filing jointly, the phaseout begins at $320,000, and is gone with an income of $442,500.

That’s where we stand as we roll into 2018. But as has been the case in previous years, additional changes can’t be entirely ruled out.

Summary

The retirement plan changes for 2018 are mostly positive. But it’s important to know what income limits have changed and how much you can deduct on your taxes this year.

RSS Feed

RSS Feed