According to Arapakis’ research (using data from the Health and Retirement Study, the Medical Expenditure Panel Survey, and administrative Medicare and Medicaid data, a 65-year-old can expect to incur an average of $310,000 of health care costs during the remainder of their life. However, almost 80% of these costs are covered by insurance, leaving them to pay a mean total of $67,000 during their retirement (not including insurance premiums). Even an individual at the 90th percentile of medical expenses would ‘only’ have to pay a total of $138,000 out of pocket (out of a total of $642,000 of costs incurred) from age 65 until their death.

|

One of the key concerns among retirees is health care costs, including potential long-term care costs. Given the uncertain nature of these costs for a given individual, retirees will often save excessive amounts to cover these expenses, leaving behind dollars that they might have used for other spending needs. Amid this background, a recent analysis suggests that thanks to insurance coverage, retirees might face fewer out-of-pocket health care costs than they think.

According to Arapakis’ research (using data from the Health and Retirement Study, the Medical Expenditure Panel Survey, and administrative Medicare and Medicaid data, a 65-year-old can expect to incur an average of $310,000 of health care costs during the remainder of their life. However, almost 80% of these costs are covered by insurance, leaving them to pay a mean total of $67,000 during their retirement (not including insurance premiums). Even an individual at the 90th percentile of medical expenses would ‘only’ have to pay a total of $138,000 out of pocket (out of a total of $642,000 of costs incurred) from age 65 until their death.

0 Comments

What Is the Rule of 55?

The IRS rule of 55 recognizes that you might leave or lose your job before you reach age 59 1/2. If that happens, you might need to begin taking distributions from your 401(k). Unfortunately, there’s usually a 10% penalty—on top of the taxes you owe—when you withdraw money early. This is where the rule of 55 comes in. If you turn 55 during the calendar year that you lose or leave your job, you can actually begin taking distributions from your 401(k) without paying the early withdrawal penalty. You still have to pay taxes on your withdrawals, but you won’t have to pay the extra penalty. Not only does the rule of 55 work with a 401(k), but it also applies to 403(a) and 403(b) plans. If you have a qualified plan, you might be able to take advantage of this rule. You can verify the status of your plan by checking with the Summary Plan Description you received (or can access electronically) for your workplace retirement plan. 5 Things to Know About the Rule of 55 Before you start withdrawing money from your 401(k), though, it’s important to understand five things about the IRS rule of 55. 1. Public safety employees get an extra five years. Police officers, firefighters, EMTs, and air traffic controllers are considered public safety employees, and they get a little extra time to access their qualified retirement plans. For them, the rule applies in the calendar year in which they turn 50. Double-check to ensure that your plan meets the requirements, and consider consulting a professional before withdrawing money. 2. You can withdraw only from the plan specific to the employer. Before you start taking distributions from multiple retirement plans, it’s important to note that the 401(k) withdrawal rules for those age 55 and older apply only to your employer at the time you leave your job. So you can only take those penalty-free early 401(k) withdrawals from the plan you were contributing to at the time you left (or were fired from) your job. The money in other retirement plans must remain in place until you reach age 59 1/2 if you want to avoid the penalty. 3. You must leave your job the calendar year you turn 55 or later. The rule of 55 doesn’t apply if you left your job at, say, age 53. You can’t start taking distributions from your 401(k) and avoid the early withdrawal penalty once you reach 55. However, you can apply the IRS rule of 55 if you’re older and leave your job. If you get laid off or quit your job at age 57, you can start taking withdrawals from the 401(k) you were contributing to at the time you left employment 4. The balance must stay in the employer’s 401(k) while you’re taking early withdrawals. The rule of 55 doesn’t apply to individual retirement accounts (IRAs). If you leave your job for any reason and you want access to the 401(k) withdrawal rules for age 55, you need to leave your money in the employer’s plan—at least until you reach age 59 1/2. You can take withdrawals from the designated 401(k), but once you roll that money into an IRA, you can no longer avoid the penalty. And if you’ve been contributing to an IRA as well as your 401(k), you can’t take penalty-free distributions from your IRA without meeting certain requirements. 5. You can withdraw from your 401(k) even if you get another job. Finally, you can keep withdrawing from your 401(k), even if you get another job later. Let’s say you turn 55 and retire from your work. You decide you need to take penalty-free withdrawals under the rule of 55 and begin to take distributions from the employer’s plan. Later, at age 57, you decide you want to get a part-time job. You can still keep taking distributions from your old plan, as long as it was the 401(k) you were contributing to when you quit at age 55—and you haven’t rolled it over into another plan or IRA. ThinkAdvisor has a great article discussing the new contingent deferred annuity, here is the link and key parts of the article.

Longevity risk is one of the hot topics on the minds of advisors and clients considering expanding life expectancies. The poor performance of equities and bonds so far in 2022 compounds these concerns given the prospect of sequence of return risk for retirees. And while sources of guaranteed income, such as annuities, might be attractive to many clients, some balk at the loss of optionality that comes from taking funds out of their portfolio and putting them into the annuity. With this in mind, Aria Retirement Solution’s RetireOne introduced a fee-based Contingent Deferred Annuity (CDA) product (also known as a Stand-Alone Living Benefit or SALB) that allows clients to keep their funds invested in their current investment account (with eligible RIA custodians) while gaining the protection of guaranteed income if their account is depleted. With the CDA, the issuing insurance company guarantees a certain annual income for the purchaser, such as $40,000/year on a $1,000,000 investment account. This income initially comes from portfolio withdrawals from the account itself. If returns are favorable, the distributions simply sustain. However, if market returns are less favorable, and the portfolio is depleted to a specified level, at that point, the insurance company takes over the income payments. In return for this protection, the insurance takes an annual fee from the portfolio (varying from 1.1% to 2.3% per year in the case of the new Aria/Midland product, with fees driven in part by the amount of risk taken in the portfolio). Notably, the total cost of a CDA arrangement will also include the advisor’s own AUM fees for managing the portfolio, and any underlying fund fees. In a new whitepaper, retirement researcher Michael Finke compares the CDA to sharing a birthday cake at a party. If the slices are made too big (i.e., too much annual income is withdrawn from an investment portfolio), the cake (portfolio) could run out. On the other hand, if the slices are too small, there could be some left over (or in the case of a retiree, they spent less during their lifetimes than what their portfolio would have supported). The CDA ensures that the retiree will be able to have a certain annual income each year without having to make the annual ‘slices’ small enough to make sure the portfolio lasts throughout retirement (because the CDA guarantee backstops the arrangement if the ‘cake’ is running out). In the end, it is important for advisors to recognize their clients’ retirement income styles and choose a retirement income strategy accordingly. For those with full confidence in long-term market returns, underlying guarantees may not be necessary, and those who don’t want to take any market risk may not want to invest at all. However, for a segment in particular, the CDA structure is aiming to find a balance of serving clients who are willing to stay invested in markets, but are willing to give up some long-term upside (as a result of the annuity costs) in exchange for having some income floor in place in the event of an unfavorable sequence of market returns that is otherwise beyond their control. The brochure from Prudential below is a perfect piece about estate planning and taxes. It breaks down information into “Highlights” and “Examples” to ease understanding. Below is an article from AIG that shows how a fixed index annuity (FIA) can provide a unique combination of growth potential, asset protection and lifetime income that a traditional 60/40 stock and bond portfolio may not offer. Below is an article from the Barron's:

Moving to a state that has little or no income tax may not be a savings panacea. That’s what financial professionals are telling clients who are fed up with high income tax rates in their home state and weighing an out-of-state move. They’re counseling clients to take an in-depth look at the possible financial and lifestyle ramifications before packing their bags. Your money-saving move could end up being a costly one if you run afoul of state residency requirements. That’s because clients trying to escape a state with high income taxes could experience higher property taxes, sales tax, insurance rates, and other cost-of-living expenses that minimize or negate the financial benefit they’re seeking. “States with low or zero income tax are funding their government somehow,” says Rob Burnette, chief executive of Outlook Financial Center, an Ohio-based company that provides insurance services and asset protection solutions. Here are several factors financial professionals say clients need to consider. The overall tax picture. When helping clients make a relocation decision, financial advisors try to provide a full overview of how things could look in terms of income taxes, property taxes, sales taxes, and estate or inheritance taxes—major budgetary items people tend not to think about when making decisions on where to move. Property tax rates, in particular, tend to catch people unaware, says Morgan Stone, a certified financial planner and president of Stone Wealth Management in Austin, Texas. He has had several clients move to his town to escape high income tax states, such as California, only to be shocked by high property tax rates. In Austin, a person could pay $18,200 in property taxes for a $1 million home, compared with $6,400 for the same value home in San Francisco, according to Smartasset.com’s property tax calculator. Certified financial planner James Bogart recently ran an analysis to illustrate how much a relocating client who was buying an $800,000 home could expect in property taxes, effective income tax, sales tax, and estate or inheritance tax in six different areas of the country. The analysis also showed the estimated size of the client’s investment portfolio at age 90 based on these factors. The upshot: the state with zero income tax wasn’t the best move for the client’s portfolio. Rather, the client could amass roughly $1.4 million more by opting for the lowest property tax location instead. This type of analysis is important, he says, because it shows that income tax can’t be considered in a vacuum. Other taxes can still have a “material impact” on overall financial well-being, even if a client maintains the exact same lifestyle, says Bogart, who is president and chief executive of Bogart Wealth, which has offices in Virginia and Texas. Sources of income. While the common misconception is that if you move to a state with low or zero income tax, this rate will apply to all of your income, the analysis is more complicated if you earn income from multiple states, says Or Pikary, a certified public accountant and senior tax advisor with the Los Angeles office of Mazars, the global accounting and consultancy firm. Say, for instance, you have a business that sells to customers in multiple states. Even if you move to Florida, which has no state income tax, you’re still required to pay taxes to the other states to the extent the income is sourced from there, he says. Rental property owners, regardless of where they live, also generally need to pay income tax to the state where the property is located. As a result, “your perceived income tax savings may be less than you think,” Pikary says. Additionally, he suggests being cautious about state residency requirements if you’re moving to a lower tax state and maintaining ties to your old community. States have gotten more aggressive about doing residency audits—even more so since Covid began, he says. Your money-saving move could end up being a costly one if you run afoul of state residency requirements, he says. Cost of living differences. Burnette of Outlook Financial offers the example of a recently retired client who planned to move from Ohio to Florida. His calculations showed that by moving to Florida she would need to work part time to maintain her lifestyle. This was true despite the income tax savings she’d achieve by moving. Special deliberations for retirees. Some states, depending on your adjusted gross income, may not tax your income at all. So you may be in the same position—or worse—by moving to a zero income tax state once you factor in other taxes and a higher cost of living, Pikary says. “It has always puzzled me when someone retires from a high income tax state and moves to a no state income tax state, such as Texas, when they have no earned income and then make a large real estate. “In reality, it should be the reverse—live and work in Texas and enjoy no state income taxes, then retire and move to a high income tax state when you have no earned income. Buy a big house there, and pay half the property taxes you paid in Texas,” he says. Other considerations. Financial professionals say it’s important for clients to think through lifestyle implications and the potential associated costs. Those with school-age children should investigate the strength of the public school system and whether private school could be warranted and what the cost could be. Another consideration is whether your current state offers vouchers to attend private school and whether that’s a perk you’ll be giving up or gaining through a move, Pikary says. People should also scope out the medical system in the new location and whether they will have to pay more for car insurance or home insurance generally, or wrack up additional costs due to provisions such as flood protection they didn’t previously need, says Bogart. It’s also important for clients to determine whether they will still have access to activities they enjoy, such as skiing or sailing, and whether there may be extra costs involved. People also need to take into account their proximity to family and whether travel costs will increase. “Many decisions in life are part financial, but also part emotional,” says Bogart. “We need to properly assess as many implications as possible.” How do people manage their income and spending in retirement? How do they adjust their asset allocation as they transition into retirement? Certainly, there is survey data on the subject and much informed speculation. Yet the full picture—based on empirical evidence that shows how people actually behave—has remained elusive.

No longer. Drawing on an Employee Benefit Research Institute (EBRI) database of more than 23 million 401(k) and IRA accounts, and JPMorgan Chase data for around 62 million households, this article studied 31,000 people as they approached and entered retirement between 2013 and 2018. We discussed the first 2 reasons here, now the next 2 reasons.

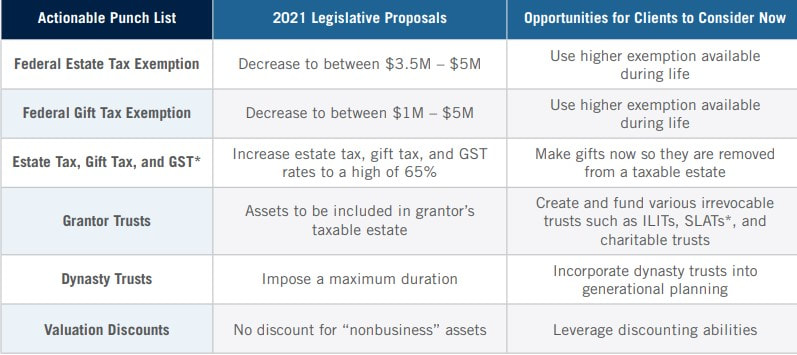

3. Lower tax rates Now is an opportune time to plan while the federal estate exemptions are still high and income tax brackets are lower. As planned today, the Tax Cuts and Jobs Act will “sunset” in 2026, changing: • The top marginal income tax rate reverts to 39.6% • The estate and gift tax exemption amount reverts to $5 million, indexed for inflation This could happen sooner than 2026, should legislation be passed. 4. Uncertain legislative environment The Build Back Better Act that was heavily debated in 2021 has not passed; the Tax Cuts and Jobs Act (TCJA) is sunsetting; and other proposed changes could be in the works. Past proposals give us insight into potential changes lawmakers could consider and propose again in another bill. What could happen in the future? What could be taken away? How can you prepare now? 1. Rising inflation

Given the current environment, it’s likely inflation is also on the mind of everyone. Inflation: In 2021, inflation was a staggering 7%— the highest the country has seen in 40 years! Inflation creates a “hidden tax” effect and the purchasing power will suffer. Purchasing power effect: With inflation at 3.5%, purchasing power will be reduced by 51% in 20 years (in other words, your dollar today will be worth 49 cents in 2042). Retirees, widows, and widowers will suffer most. Health care: Health care costs have been rising at a rate of nearly 5% for the past 40 years. Longevity: The longer one lives, the more damaging inflation will be. The death of a spouse may cause the surviving spouse to experience the “widow(er)’s penalty”— the likelihood that the surviving spouse will experience higher taxes, higher health care costs, and a reduction in purchasing power caused by inflation. 2. Historically low interest rates Changing interest rates affect estate planning. Some strategies are more effective in environments with higher interest rates, while others are more effective with lower interest rates. • Lower IRC Section 7520 and applicable federal rates provide opportunities for tax-efficient wealth transfer • For certain strategies to succeed, investments need higher returns than interest rates, and that’s easier with lower rates • Lending strategies can be more advantageous in a lower interest rate environment Coupled with high federal estate tax exemption amounts, people who use certain strategies in the lower interest rate environment have the ability to transfer wealth while incurring minimal or possibly no gift taxes. We will discuss the next 2 reasons in the next blogpost. We discussed the first 4 strategies here, now the last 2 strategies.

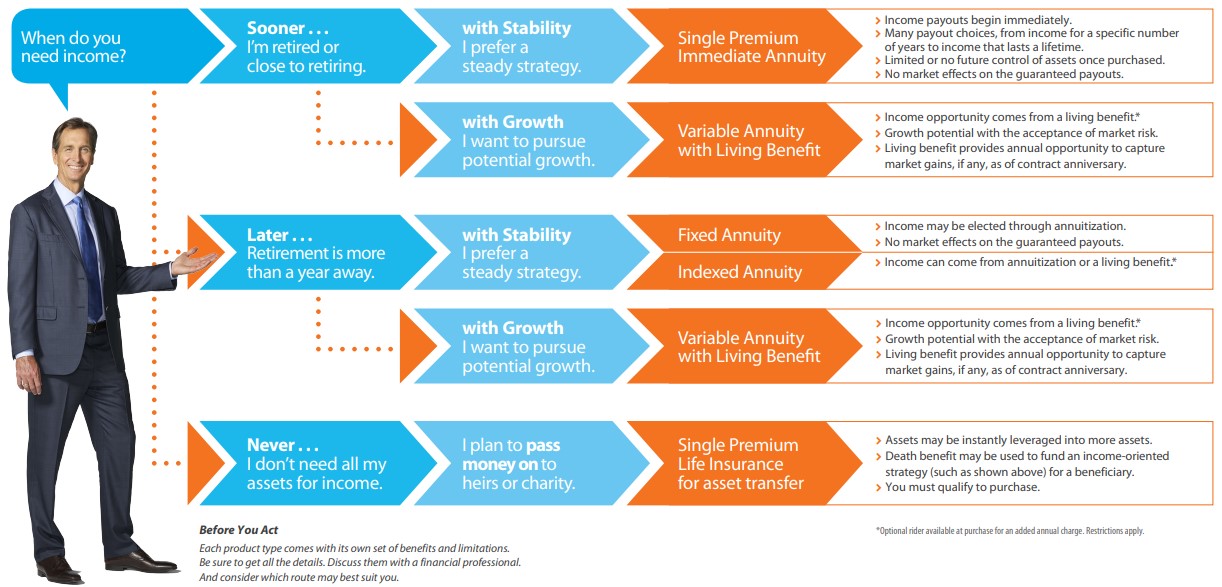

5. Dynamic income strategy With a dynamic strategy, retirees adjust their spending based on the performance of their portfolio and its resulting effect on a Monte Carlo simulation. For example, a retiree targeting an 85% chance of success in a Monte Carlo simulation might increase their income if this figure rises to 95% but decrease income if it falls below 75%. This ‘guardrails’ approach can also be improved by introducing risk-based measures as well. While retirees will appreciate the opportunity to increase their incomes, they will also have to be prepared for reduced incomes when their probability of success hits the lower guardrail. 6. Insurance strategy Finally, retirees can use an insuring strategy, in which they use their assets to purchase a guaranteed income stream, typically through an immediate fixed annuity. This has the advantage of guaranteeing a certain income for the life of the retiree (or both members of a couple) regardless of market conditions, and unlike the asset-liability management approach, it also covers the uncertainty of longevity (as annuity payments can be ‘for life’). However, purchasing such an annuity is an irrevocable commitment of capital, and includes costs associated with the product. We discussed the first two of six strategies here. Now the next two strategies.

3. A "bucket" strategy For retirees who are nervous about having to sell investments in a down market, a ‘bucket’ strategy can be useful. With this method, the retiree sets aside a cash-like ‘bucket’ of money to cover their expenses in the short term (perhaps two to three years) and allows the rest of their assets to be invested. In this way, the retiree will not have to sell invested assets to fund their lifestyle (until the short-term ‘bucket’ runs out) or be tempted to move their assets to cash in a downturn. However, a simple rebalancing has been shown to be a potentially superior strategy (in part by ensuring that liquidations come from asset classes that are up the most in value, similar to what bucket strategies are intended to accomplish). 4. Variable income strategy With a variable retirement income strategy, retirees plan to spend different amounts of income in the various stages of retirement. For example, research from David Blanchett demonstrated a ‘spending smile’, with inflation-adjusted spending among retirees declining throughout most of retirement, only increasing in their final years. Using a variable strategy could allow retirees to spend more in their early years, while saving for potential healthcare costs in their later years. However, some retirees might resist declines in real spending throughout the middle part of their retirement. We will discuss the last 2 strategies here. In last blogpost, we mentioned 6 strategies for retirement income planning, now we will discuss the first two.

1. Asset liability management A conservative way to ensure that a retiree’s expenses will be covered is asset-liability management, by which an individual invests money today to meet a future liability (their retirement expenses in future years) with a high degree of certainty. Under this method, a retiree could decide how much income they want in the future, and invest an amount of money that will achieve that goal using conservative investments (e.g., Treasury Inflation-protected securities, or TIPS). However, given the conservative investments (and low current yields), this method can require a significant initial outlay of funds, and, because individuals do not know their exact longevity, it would be impossible to know how many years of income would be required. 2. Static inflation adjusted withdrawal The second method is to take static inflation-adjusted withdrawals from a portfolio each year. For example, the 4% rule developed by Bill Bengen suggests that, based on historic market returns and certain assumptions, retirees can afford to take out 4% of their portfolio in the first year, and adjust that amount for inflation in subsequent years (and while the 4% rule was developed in the 1990s, it remains an effective strategy today). This method allows for a steady, inflation-adjusted stream of income for the retiree (although its inflexibility could leave a retiree with significant unspent assets at their death if investment returns are strong). In next blogpost, we will discuss the next 2 strategies for retirement income planning. With many seniors living into their 90s and beyond, the assets of retirees have to cover a longer period than they would have a few decades ago (making them susceptible to sequence of return risk, though this risk can have extraordinary upside potential as well!). With this in mind, there are 6 strategies to help protect against longevity risk.

We will introduce each of the above 6 strategies in the next blogposts. The key point is that there are a variety of ways to prevent individuals from running out of money in retirement, and the best method for a given individual is likely to depend on, among other factors, their risk tolerance and spending flexibility. In next blogpost, we will introduce the first 2 strategies. In last blogpost, we discussed why creating a trust. Now we will review different types of trusts.

Living (revocable) trust A living trust is a special type of trust. It's a legal entity that you create while you're alive to own property such as your house, a boat, or investments. Property that passes through a living trust is not subject to probate--it doesn't get treated like the property in your will. This means that the transfer of property through a living trust is not held up while the probate process is pending (sometimes up to two years or more). Instead, the trustee will transfer the assets to the beneficiaries according to your instructions. The transfer can be immediate, or if you want to delay the transfer, you can direct that the trustee hold the assets until some specific time, such as the marriage of the beneficiary or the attainment of a certain age. Living trusts are attractive because they are revocable. You maintain control--you can change the trust or even dissolve it for as long as you live. Living trusts are also private. Unlike a will, a living trust is not part of the public record. No one can review details of the trust documents unless you allow it. Living trusts can also be used to help you protect and manage your assets if you become incapacitated. If you can no longer handle your own affairs, your trustee (or a successor trustee) steps in and manages your property. Your trustee has a duty to administer the trust according to its terms, and must always act with your best interests in mind. In the absence of a trust, a court could appoint a guardian to manage your property. Despite these benefits, living trusts have some drawbacks. Assets in a living trust are not protected from creditors, and you are subject to income taxes on income earned by the trust. In addition, you cannot avoid estate taxes using a living trust. Irrevocable trusts Unlike a living trust, an irrevocable trust can't be changed or dissolved once it has been created. You generally can't remove assets, change beneficiaries, or rewrite any of the terms of the trust. Still, an irrevocable trust is a valuable estate planning tool. First, you transfer assets into the trust--assets you don't mind losing control over. You may have to pay gift taxes on the value of the property transferred at the time of transfer. Provided that you have given up control of the property, all of the property in the trust, plus all future appreciation on the property, is out of your taxable estate. That means your ultimate estate tax liability may be less, resulting in more passing to your beneficiaries. Property transferred to your beneficiaries through an irrevocable trust will also avoid probate. As a bonus, property in an irrevocable trust may be protected from your creditors. There are many different kinds of irrevocable trusts. Many have special provisions and are used for special purposes. Some irrevocable trusts hold life insurance policies or personal residences. You can even set up an irrevocable trust to generate income for you. Testamentary trusts Trusts can also be established by your will. These trusts don't come into existence until your will is probated. At that point, selected assets passing through your will can "pour over" into the trust. From that point on, these trusts work very much like other trusts. The terms of the trust document control how the assets within the trust are managed and distributed to your heirs. Since you have a say in how the trust terms are written, these types of trusts give you a certain amount of control over how the assets are used, even after your death. In last blogpost, we discussed what is a trust. Now we will discuss why create a trust.

Since trusts can be used for many purposes, they are popular estate planning tools. Trusts are often used to:

The type of trust used, and the mechanics of its creation, will differ depending on what you are trying to accomplish. In fact, you may need more than one type of trust to accomplish all of your goals. And since some of the following disadvantages may affect you, discuss the pros and cons of setting up any trust with your attorney and financial professional before you proceed:

The duties of the trustee The trustee of the trust is a fiduciary, someone who owes a special duty of loyalty to the beneficiaries. The trustee must act in the best interests of the beneficiaries at all times. For example, the trustee must preserve, protect, and invest the trust assets for the benefit of the beneficiaries. The trustee must also keep complete and accurate records, exercise reasonable care and skill when managing the trust, prudently invest the trust assets, and avoid mixing trust assets with any other assets, especially his or her own. A trustee lacking specialized knowledge can hire professionals such as attorneys, accountants, brokers, and bankers if it is wise to do so. However, the trustee can't merely delegate responsibilities to someone else. Although many of the trustee's duties are established by state law, others are defined by the trust document. If you are the trust grantor, you can help determine some of these duties when you set up the trust. In next blogpost, we will discuss the different types of a trust. Whether you're seeking to manage your own assets, control how your assets are distributed after your death, or plan for incapacity, trusts can help you accomplish your estate planning goals. Their power is in their versatility--many types of trusts exist, each designed for a specific purpose. Although trust law is complex and establishing a trust requires the services of an experienced attorney, mastering the basics isn't hard.

What is a trust? A trust is a legal entity that holds assets for the benefit of another. Basically, it's like a container that holds money or property for somebody else. You can put practically any kind of asset into a trust, including cash, stocks, bonds, insurance policies, real estate, and artwork. The assets you choose to put in a trust depend largely on your goals. For example, if you want the trust to generate income, you may want to put income-producing securities, such as bonds, in your trust. Or, if you want your trust to create a pool of cash that may be accessible to pay any estate taxes due at your death or to provide for your family, you might want to fund your trust with a life insurance policy. When you create and fund a trust, you are known as the grantor (or sometimes, the settlor or trustor). The grantor names people, known as beneficiaries, who will benefit from the trust. Beneficiaries are usually your family and loved ones but can be anyone, even a charity. Beneficiaries may receive income from the trust or may have access to the principal of the trust either during your lifetime or after you die. The trustee is responsible for administering the trust, managing the assets, and distributing income and/or principal according to the terms of the trust. Depending on the purpose of the trust, you can name yourself, another person, or an institution, such as a bank, to be the trustee. You can even name more than one trustee if you like. In next blogpost, we will discuss why creating a trust. We discussed the importance of a will in last blogpost. more benefits of a will are discussed below.

Wills can fund a living trust A living trust is a trust that you create during your lifetime. If you have a living trust, your will can transfer any assets that were not transferred to the trust while you were alive. This is known as a pourover will because the will "pours over" your estate to your living trust. Wills can help minimize taxes Your will gives you the chance to minimize taxes and other costs. For instance, if you draft a will that leaves your entire estate to your U.S. citizen spouse, none of your property will be taxable when you die (if your spouse survives you) because it is fully deductible under the unlimited marital deduction. However, if your estate is distributed according to intestacy rules, a portion of the property may be subject to estate taxes if it is distributed to heirs other than your U.S. citizen spouse. Assets disposed of through a will are subject to probate Probate is the court-supervised process of administering and proving a will. Probate can be expensive and time consuming, and probate records are available to the public. Several factors can affect the length of probate, including the size and complexity of the estate, challenges to the will or its provisions, creditor claims against the estate, state probate laws, the state court system, and tax issues. Owning property in more than one state can result in multiple probate proceedings. This is known as ancillary probate. Generally, real estate is probated in the state in which it is located, and personal property is probated in the state in which you are domiciled (i.e., reside) at the time of your death. Will provisions can be challenged in court Although it doesn't happen often, the validity of your will can be challenged, usually by an unhappy beneficiary or a disinherited heir. Some common claims include: • You lacked testamentary capacity when you signed the will • You were unduly influenced by another individual when you drew up the will • The will was forged or was otherwise improperly executed • The will was revoked In last blogpost, we discussed some benefits of a will, we will keep discussing below.

Wills allow you to nominate an executor A will allows you to designate a person as your executor to act as your legal representative after your death. An executor carries out many estate settlement tasks, including locating your will, collecting your assets, paying legitimate creditor claims, paying any taxes owed by your estate, and distributing any remaining assets to your beneficiaries. Like naming a guardian, the probate court has final approval but will usually approve whomever you nominate. Wills specify how to pay estate taxes and other expenses The way in which estate taxes and other expenses are divided among your heirs is generally determined by state law unless you direct otherwise in your will. To ensure that the specific bequests you make to your beneficiaries are not reduced by taxes and other expenses, you can provide in your will that these costs be paid from your residuary estate. Or, you can specify which assets should be used or sold to pay these costs. Wills can create a testamentary trust You can create a trust in your will, known as a testamentary trust, that comes into being when your will is probated. Your will sets out the terms of the trust, such as who the trustee is, who the beneficiaries are, how the trust is funded, how the distributions should be made, and when the trust terminates. This can be especially important if you have a spouse or minor children who are unable to manage assets or property themselves. We will discuss the other benefits of a will in next blogpost. If you care about what happens to your money, home, and other property after you die, you need to do some estate planning. There are many tools you can use to achieve your estate planning goals, but a will is probably the most vital. Even if you're young or your estate is modest, you should always have a legally valid and up-to-date will. This is especially important if you have minor children because, in many states, your will is the only legal way you can name a guardian for them. Although a will doesn't have to be drafted by an attorney to be valid, seeking an attorney's help can ensure that your will accomplishes what you intend.

Wills avoid intestacy Probably the greatest advantage of a will is that it allows you to avoid intestacy. That is, with a will you get to choose who will get your property, rather than leave it up to state law. State intestate succession laws, in effect, provide a will for you if you die without one. This "intestate's will" distributes your property, in general terms, to your closest blood relatives in proportions dictated by law. However, the state's distribution may not be what you would have wanted. Intestacy also has other disadvantages, which include the possibility that your estate will owe more taxes than it would if you had created a valid will. Wills distribute property according to your wishes Wills allow you to leave bequests (gifts) to anyone you want. You can leave your property to a surviving spouse, a child, other relatives, friends, a trust, a charity, or anyone you choose. There are some limits, however, on how you can distribute property using a will. For instance, your spouse may have certain rights with respect to your property, regardless of the provisions of your will. Gifts through your will take the form of specific bequests (e.g., an heirloom, jewelry, furniture, or cash), general bequests (e.g., a percentage of your property), or a residuary bequest of what's left after your other gifts. Wills allow you to nominate a guardian for your minor children In many states, a will is your only means of stating who you want to act as legal guardian for your minor children if you die. You can name a personal guardian, who takes personal custody of the children, and a property guardian, who manages the children's assets. This can be the same person or different people. The probate court has final approval, but courts will usually approve your choice of guardian unless there are compelling reasons not to. In next blogpost, we will keep discussing the importance of the will. In last blogpost, we explained the key features of chronical illness rider.

A Case Study Jeffrey purchased a $1 million life insurance policy at age 50. His policy includes the Chronic Illness Rider. Some years later, he is diagnosed with a chronic illness and is unable to perform two of six ADLs. His doctor estimates he has two years to live. Jeffrey has a maximum total acceleration limit of $800,000, and has requested a $100,000 acceleration benefit. In Jeffrey’s case, with a two-year life expectancy, his actuarial discount is 9 percent. This means, since he requested a $100,000 acceleration, he will receive $90,900. He can use this benefit to: pay medical bills, stop working and spend time with family, take a dream vacation with his loved ones, or even to pre-plan and pre-pay his funeral. Calculating Jeffrey's Benefits

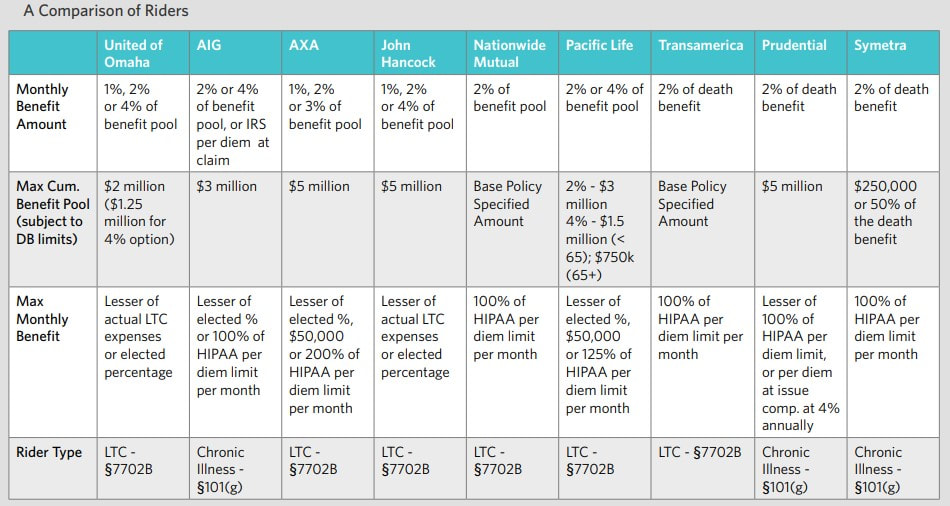

After taking his accelerated benefit, Jeffrey still has $900,000 in remaining death benefit and $700,000 in remaining accelerated death benefit option. In last blogpost, we showed 2 case studies to compare indemnity and reimbursement. Now we will compare different insurance companies' LTC riders.

In last blogpost, we discussed LTC rider's tax treatment.

Indemnity – Policyowner can take rider benefits up to the maximum monthly benefit limit regardless of the actual expenses incurred. Reimbursement – Policyowner is reimbursed based on actual expenses incurred by the insured, up to the maximum monthly benefit limit. Although this makes it seem like an indemnity rider might be the best choice, most indemnity riders have a “real maximum limit” of 1x the HIPAA limit. If we look ahead 25 years, the monthly HIPAA limit (at 3 percent inflation) would be $25,110. This would be the max benefit even if they purchased a $50,000 monthly benefit. The result: you may never get to take an amount up to the indemnity limit you purchased unless the IRS significantly changed the HIPAA limits or there is substantial inflation. Some indemnity carriers have a limit that is a multiple of the HIPAA limit, for example, 2x the HIPAA limit. However, keep in mind that the IRS only automatically allows benefits up to 1x the HIPAA limit to be received untaxed. If you wanted to take more than the HIPAA limit, you would have to ‘prove expenses’ to receive favorable tax treatment. So, even though you don’t have to submit receipts to the life insurance company, you will still have to keep track of your receipts to prove expenses to the IRS. With the reimbursement rider, you can take up to the full monthly benefit as long as they have qualifying expenses. There is no restriction based on HIPAA limits. You still will have to prove expenses to get reimbursed, but because there is no HIPAA limit, you may be able to take more benefit from the rider than from a company with a 1x HIPAA limit. And, because you have to submit receipts, your records will already be ‘in order’ to prove expenses to the IRS, if needed. In next blogpost, we will show a case study. While some insurance companies' LTC Rider follows what is known as a reimbursement rider model, other life insurance companies have LTC riders that use an indemnity model. Knowing the difference is important. The following information will help you get a better understanding of the two designs.

How LTC Rider Benefits are Taxed First, it’s beneficial to have an understanding of how LTC riders are taxed. LTC riders are designed to qualify for favorable federal income tax treatment under Section 7702B of the Internal Revenue Code, as amended. This favorable tax treatment extends up to the greater of the HIPAA limit, or actual long-term care expenses. The IRS HIPAA limit is currently $400 per day for 2021. That results in $12,000 per month (for a 30-day month). Chances are, the life insurance with LTC riders that you purchased won't be needed for 20-30 years from now. If we assume the 2021 limit increases for inflation at 3 percent, the daily HIPAA limit in 25 years would be $837, or $25,110 per month. In next blogpost, we will get to the differences between indemnity and reimbursement. Scenario 1. Nick purchases a life insurance policy with a long-term care rider

At age 50, Nick purchases a $1 million Life Protection AdvantageSM policy. He chooses to add the LTC Rider with the option to accelerate the entire $1 million for long-term care services at a monthly maximum rate of 2 percent of the maximum benefit per month. This allows him to be reimbursed for up to $20,000 in long-term care expenses per month. • When he needs long-term care services at age 75, he incurs qualifying expenses of $15,138.75 per month ($181,665 per year) for a semiprivate room in a nursing home. He resides there for four years before he passes. Over this four-year period, he is reimbursed for his four years of long-term care, which totals $726,660 • When he passes, his beneficiaries receive the remaining amount of $273,340 as a death benefit. He also still has his remaining $1 million in assets. When this $1,273,340 is divided among his three children, each will receive $424,446 Nick’s planned premium on his Life Protection Advantage policy was approximately $11,000 per year. Even considering premiums paid, this planning strategy still makes sense. Plus, if Nick had died prior to needing long-term care, his beneficiaries would have received the entire $1 million as a death benefit. Scenario 2. Nick doesn’t plan ahead for long-term care expenses At age 50, Nick chooses not to plan ahead for the possibility of a long-term care need. By not planning ahead, he ultimately makes the choice to self-insure. • When he goes into a nursing home at age 75, he starts taking $181,665 per year from his savings to pay for a semiprivate room. He resides there for four years before he passes. Over this four-year period, he spends $726,660 for long-term care services • His long-term care expenses reduce his $1 million in assets down to $273,340. Each of his three children receives an inheritance of $91,000 And, depending on the types of assets he had, he could end up paying unexpected capital gains tax, income tax and potential surrender charges generated from asset liquidation. Or, he could miss out on any returns the liquid assets were expected to generate. Summary By choosing the LTC Rider on his life insurance plan, Nick’s premium investment resulted in each of his three children ending up with significantly more inheritance than if Nick hadn’t planned for long-term care expenses. Help clients protect their assets and preserve their independence. Show them the value of an LTC Rider on their life insurance policy. Learn more about the LTC Rider at MutualofOmaha.com/ltc-rider. |

AuthorPFwise's goal is to help ordinary people make wise personal finance decisions. Archives

September 2022

Categories

All

|

RSS Feed

RSS Feed