|

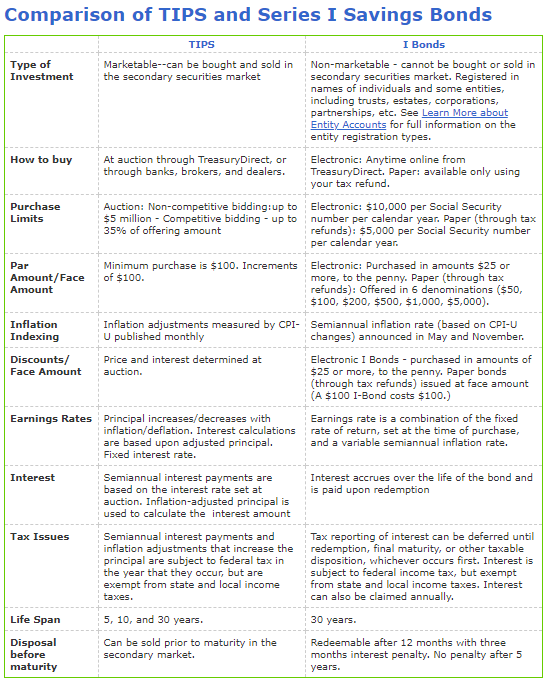

How advisors are using muni bonds in client portfolios amid a low-rate environment? This Financial-Planning.com article has a pretty good discussion of muni bonds' performance lately, what are factors you need to consider and how you could use it as part of your portfolio.

0 Comments

Spousal lifetime access trusts (SLATs) are surging in popularity, but they aren’t as simple as some advisors or clients may think, as this Financial-Planning.com article describes in details. Find out if SLAT is a good fit for your situation or not.

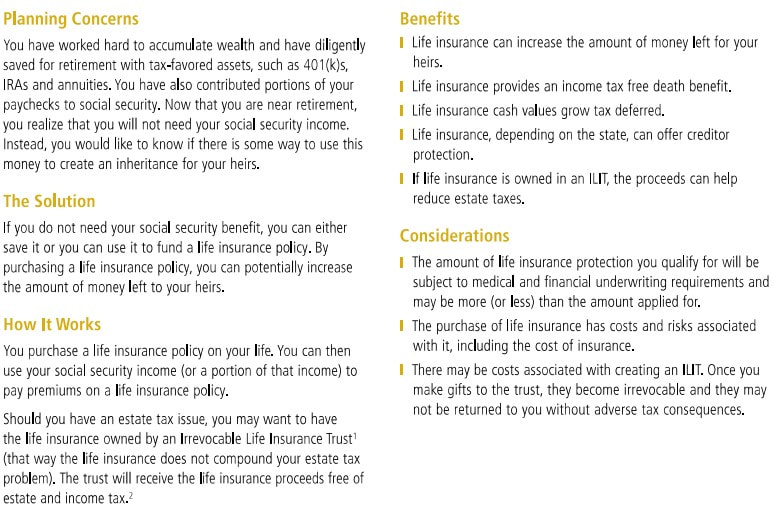

If you have a deferred annuity, below is a case study to maximize its value by using Life Insurance.

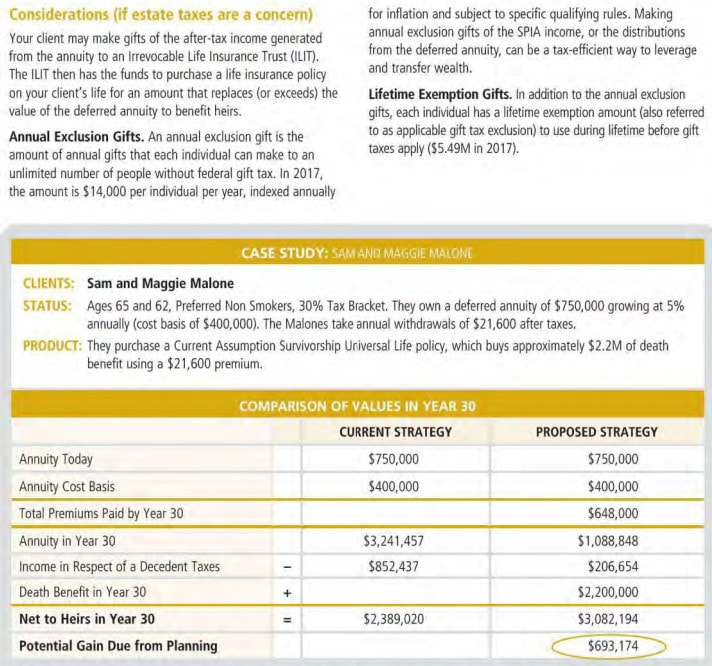

Why Make a Life Insurance Gift?

An insurance policy has the potential to create a substantial, cost-effective gift to charity through the policy's death bene t. The result is a gift that is much larger than the donor may otherwise have been able to make. Also, unlike a charitable bequest made in a will, a life insurance gift does not become a matter of public record and is made without the delays of probate. Premiums paid by the donor after a lifetime gift of a policy to charity are deductible for income tax purposes when the donor itemizes. When the charity is named as the policy beneficiary, the death proceeds paid to the charity are deductible for federal estate tax purposes. How Can a Donor Make a Gift of Life Insurance? A donor has three basic choices in making a charitable gift of life insurance:

What Are the Tax Considerations? A charitable gift of an existing life insurance policy can generate an income tax charitable deduction provided the donor assigns all rights. When considering a charitable gift of an existing policy, the donor has two choices:

Generally, when you make a charitable donation, you write a check that may be tax-deductible. However, there is another way you can give that allows your favorite charity to continue to receive your support, even after you’re gone.

John Smith wants to provide a significant gift to help a charity that he has volunteered much of his time to over the past several years. He has a life insurance policy that he has used to help fund the education of his two children. Now that both of them have their college degrees, John is considering three options in order to provide a gift to his charitable organization.

First, John can make the charity the beneficiary of part of his $500,000 life insurance policy. Since John would continue to be the owner of the policy, he would not receive an income tax deduction but his estate would receive an estate tax deduction for the portion that goes to charity. On the other hand, John can gift his life insurance policy to the charity and can claim an income tax deduction in the year that the policy is gifted. By transferring ownership of the policy to the charity, John has given up control and any benefits from the policy his children might receive, but the policy proceeds may be excluded from his estate. The three year rule applies, if John were to die within three years following the gift of the policy, the policy would be included in John’s estate. John can also allow the charity to purchase a new life insurance policy on his life. By allowing the charity to make the initial purchase of the policy, the policy proceeds will be excluded from his estate. In addition, John may receive an income tax deduction for cash gifts to the charity to make premium payments. With all the tax legislation oxygen taken up by BBB, many have forgotten about Secure 2.0, but it’s still waiting to see the light of day.

Keep an eye on this bill. Of all the the bills that could be enacted in 2022, this one has the best chance, having passed out of committee unanimously, with full bipartisan support. See if you may be affected by these proposals in 2022: ‘Rothification’ Secure 2.0 includes provisions allowing both SIMPLE and SEP Roth IRAs. In addition, plan catch-up contributions would be required to be made to Roth plan accounts, and plans could allow participants to have employer matching contributions made as Roth contributions. Other Proposed Changes

For people who already have Roth IRAs

You are set in terms of your spouse being able to inherit the account and use it as their own. For non-spousal beneficiaries, the main issue is the five-year rule. As with any type of IRA or retirement account, make sure your beneficiary designations are current and that they reflect your desires. For people with a Roth 401(k) It’s important that you roll this account over to a Roth IRA once you leave your employer to avoid RMDs. An additional consideration beyond the estate planning ramifications is the tax diversification a Roth IRA provides once you are retired. Your changing circumstances might merit using some or all of your Roth IRA to take tax-free distributions in retirement at some point, and you now have the flexibility to do this. For people who can make Roth Contributions Contributing to a Roth IRA each year can help build a Roth balance to pass on to beneficiaries. For those who have access to a Roth 401(k) account via an employer-sponsored plan or a solo 401(k) for the self-employed, contributing to a Roth 401(k) can offer a higher contribution limit with no income restrictions as with a Roth IRA. The amount in the Roth 401(k) can later be rolled over to a Roth IRA with no tax consequences, avoiding RMDs as well. Roth IRA Conversions A Roth IRA conversion is a strategy to consider for passing IRA assets to non-spousal beneficiaries either directly or as contingent beneficiaries upon the death of a surviving spouse. This is a viable way for people to prepay taxes for their beneficiaries. Beyond prepaying the taxes, the five-year rule can come into play if you did not previously have a Roth IRA. Whether or not a Roth IRA conversion makes sense as an estate planning tool depends on a number of variables, including: Your current tax situation. If you are in a high tax bracket, the amount due in taxes on the conversion may not be worth the ultimate tax benefits to the non-spousal beneficiaries. If you are in a relatively low tax bracket, this can be more beneficial. This situation might be the case if you have recently retired and is not yet taking Social Security benefit. You are relatively young. This might be someone in their 40s or 50s. This situation provides them with a potentially long time horizon for the converted amounts to appreciate in value and offset much of the impact of the taxes on the conversion. In looking at the taxes that would be incurred by you on the conversion, it is important to weigh this against the estimated tax savings in the future from not having to pay taxes on the RMDs for the amounts converted. Whether or not a Roth IRA conversion is both beneficial and desirable as an estate planning strategy can vary from year to year based on your tax situation and that of the overall family. Many Americans decide how to take their Social Security based on quite a bit of misinformation. They are told to take their benefit at age 62 because Social Security might not be there in the future. There are 140 million Baby Boomers and Generation Xers who would argue that they will not let politicians harm any of their benefits.

They are also not taught that the break-even age for Social Security is around 80 years old. So, if you take your benefit at age 62 or at age 70, if you live to the break-even age of around 80, you will receive the exact same amount of money. Here’s an example: If your Social Security benefit was $2,000 per month at age 62 you would receive $432,000 in benefits by age 80. If you defer until age 70, you would receive $3,600 per month. $3,600 per month until age 80, is $432,000 in benefits. That $1,600 per month difference comes into play if you live longer than age 80. Many Americans do. Men who make it to age 65 now have a life expectancy of age 86. Women who make it to age 65 have a life expectancy of age 89. If a married couple makes it to age 65 there is a 50 percent chance that one of them will live until age 95. So, if you break even at age 80 and you live past age 80, it will cost a lot of money if you didn’t defer until age 70. Live to age 85: Lose $96,000 Live to age 90: Lose $192,000 Live to age 95: Lose $288,000 Live to age 100: Lose $384,000 The above does not include cost of living increases, so the actual losses would be more if you live past age 80. Investors looking to gain exposure to Bitcoin and other cryptocurrencies currently have several options, including:

However, the lack of an ETF or similar vehicle that holds cryptocurrencies directly (and therefore better reflect the spot price of the cryptocurrency), has made it difficult for people to gain direct exposure to these assets. Yet while a U.S.-based crypto ETF (that actually holds the underlying cryptocurrencies themselves) remains in regulatory limbo, RIA Ritholtz Wealth Management has teamed up with index provider WisdomTree, crypto custodian Gemini, and crypto platform provider Onramp to offer access to a diversified cryptocurrency index through a separately managed account format that financial advisors will be able to use with their clients. The index offers direct exposure to a blend of 13 currencies, with a 36% weighting in Bitcoin, a 20% weighting in Ethereum, and 4% weightings in 11 other crypto assets. The index is currently available through Ritholtz advisors, but the creators hope to roll it out to other advisors in early 2022, and potentially directly to individual investors in the future. In terms of fees for the product, an Onramp executive said they should be ‘less than 2%’, which would put it below the expense ratio of the popular Grayscale Bitcoin Trust, but potentially above the sub-1% expense ratios for the Bitcoin Futures ETFs. Do your seek greater certainty in your retirement income strategies? Below is a case study that shows how an index oriented option can help offer income guarantees and increase income success rates. Joint ownership refers to two parties owning personal or real property together.

Joint ownership with right of survivorship—sometimes abbreviated JTWROS—can be beneficial because if one owner dies, the property transfers automatically to the surviving owner or owners, without the need for probate. JWTROS is most common with the family home, usually owned by two people who are married. At the death of the first spouse, the home transfers automatically to the survivor. Joint ownership is sometimes used by older people to plan to transfer assets to an adult child. For example, a parent might decide to jointly own his or her house, or investment account, with a child. Is this a sensible strategy? If a parent has joint ownership of an asset with one child and there are other siblings, the parent may desire that the proceeds of the house be evenly divided between siblings upon the parent’s death. However, joint ownership would generally override the legal obligation for the surviving joint owner to share the wealth. Joint ownership can also cause problems if a joint owner runs into financial trouble. For example, bankruptcy or a large financial obligation by the joint tenant child can cause a parent to lose some or all of the jointly owned asset. Depending on circumstances, naming a child joint owner on an asset may also have gift tax implications. Joint ownership can make sense where an older person has only one heir, few assets, no gift or estate tax issues, and a desire to avoid probate. In other cases, especially involving children as joint owners, it should be thoroughly evaluated prior to implementation. At death, the law provides a procedure by which personally owned assets are transferred from the deceased person to someone else. A person may give direction about the designated successor owner at death by means of a:

• Will • Beneficiary designation • Transfer-on-death (or pay-on-death) designation • Specific titling • Contract • Living trust With so many transfer options available, is a will or trust even necessary? For many people the answer is yes. For example, the death-time transfer of assets cannot always be adequately managed with titling, contract, or transfer-on-death designations. Wishes regarding guardianship of minor children cannot be expressed in title or beneficiary designations. It may also be impossible to achieve sophisticated death-tax planning or multi-generation distribution desires with title or beneficiary planning alone. In those cases, it makes sense for a person to have a testamentary document. What if there is no testamentary document? A person who dies without a will is said to be intestate. Those who die intestate have an estate plan imposed on them by the state in which they lived at the time of their death. Any personally owned asset subject to probate will be governed by the rules of intestate succession. Each state has its own variations on intestate succession. No matter which jurisdiction, the state- imposed rules are just as likely to make the wrong distribution decisions as the right ones. A state-imposed will—this one based on the Tennessee rules of intestate succession—might look like the one at this website: http://advancedunderwriting.com/masterblog/?p=97 There are many good reasons to give to charity, at the same time, with the tax incentives that the government offers for charitable donations, there are different ways to donate while achieving the maximum financially advantageous for the donor as well. Below are order of priorities proposed by an article from Oblivious Investor.

First, what is QCD: A qualified charitable distribution (QCD) is a distribution from a traditional IRA directly to a charitable organization (i.e., the check is made out directly to the organization rather than to you). Unlike most distributions from a traditional IRA, QCDs are not taxable as income. And they can be used to satisfy required minimum distributions (RMDs) for a given year. QCDs are limited to $100,000/year (per spouse, if you’re married). For somebody age 70.5 or older:

For somebody not yet age 70.5 (and therefore ineligible for QCDs):

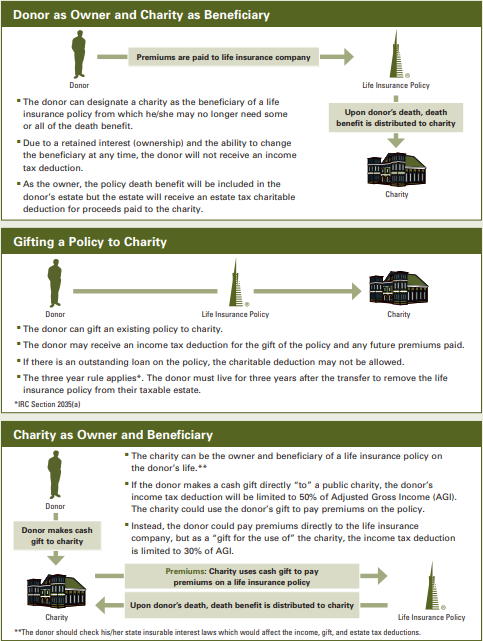

But as always, tax planning is case-by-case. A household could have circumstances such that the above would need to be rearranged in some way. We shared a little known secret here that Series I Bonds are currently offering 7.12% annual rate. The table below compares TIPS with Series I Bonds.

In our last blogpost, we shared an article from Morningstar suggested the 4% withdrawal rate rule may be dead due to low bond yields and high equity valuations which would lead to lower future portfolio returns than those experienced in the past. As a result, the paper concludes, a conservative “safe” withdrawal rate would be only 3.3%.

The financial advisor William Bengen who demonstrated the 4% rule in his October 1994 article in Journal of Financial Planning published a response to the Morningstar paper, he ironically notes that he has recently increased his estimate of a safe withdrawal rate to 4.7%. Looking into the data used for Morningstar’s projections, Bengen points out two key assumptions that drive the lower withdrawal rate: First, the study assumes that asset returns will be much lower than they have been in the past (projecting a 5.23% return for a 50/50 portfolio, versus historical returns from 1926 to 2020 of 9.55%); Second, that this low-return environment would persist for (at least) a 50-year time horizon. As a result, while the Morningstar paper generated a lot of headlines for going against the conventional wisdom of the 4% rule, it did so using potentially unrealistic assumptions (since historically, no period of below-average returns has lasted anywhere near that length of time). You can read Mr. Bengen's article here to get more details of his response. Three Morningstar researchers found that the 4% rule may “no longer be feasible.” Christine Benz, director of personal finance and retirement planning; Jeff Ptak, chief ratings officer; and John Rekenthaler, vice president and director of research, outline their reasoning in a recent paper, The State of Retirement Income: Safe Withdrawal Rates.

“Because of the confluence of low starting yields on bonds and equity valuations that are high relative to historical norms, retirees are unlikely to receive returns that match those in the past. Using forward-looking estimates for investment performance and inflation, Morningstar estimates that the standard rule of thumb should be lowered to 3.3% from 4%,” they state in the paper. Strategies that improve the ability for higher withdrawal rates include:

In next blogpost, we will share an article from the financial advisor who first proposed the original 4% about his view why the Morningstar paper's recommendation may be wrong. Fixed income investments are an important component in a portfolio because of their ability to cushion against equity market losses. However, when it comes to abundant returns, fixed income holdings have not had much luck during the low-interest-rate environment of the past few years. The increase in inflation has made the rarely used Federal Series I Savings Bond (or, more simply, the “I Bond”) significantly more attractive for investors.

I Bonds are offered via the Treasury Department and are backed by the U.S. government. They can be purchased through the TreasuryDirect website, and such purchases are limited to $10,000 annually per person. What makes I Bonds unique is their interest structure, which consists of a combined “Fixed Rate” and “Inflation Rate” that, together, make a “Composite Rate” – the actual rate of interest that an I Bond will earn over a six-month period. While the current Fixed Rate for newly purchased I Bonds is 0%, the Inflation Rate for I bonds purchased before May 1, 2022 is an annualized 7.12%, meaning the Composite Rate is also an annualized 7.12% (the highest rate of I Bonds since May 2000!) for the first six months that the I Bond is held (after which a new Composite Rate will be determined by any change to the Inflation rate). While I Bonds have a 30-year maturity, they can be redeemed after being held for at least 12 months. Investors who redeem I Bonds between 12 months and 5 years after issue will forfeit the last 3 months of interest, but I Bonds held for more than 5 years can be redeemed at their current value. The $10,000 annual limit on I Bond purchases restricts their benefit for those with larger portfolios, but there are several ways investors could increase the amount purchased at the current (very favorable) Composite Rate. For example, because the annual limit is a calendar-year limit, individuals could purchase $10,000 worth of I Bonds before January 1, 2022, and then an additional $10,000 between January 1 and April 30, 2022. Which means a couple could purchase a combined $40,000 worth of I Bonds and receive the annualized 7.12% Composite Rate for the first six months the bond is held. In addition, I Bonds can also be purchased for children or by trusts and estates, which could further increase the amount purchased. Finally, paper I Bonds can be purchased using a tax refund up to a $5,000-per-return limit, which is in addition to the $10,000 annual limit on I Bonds purchased through the TreasuryDirect website. Ultimately, the key point is that there is a limited amount of time for investors to purchase I Bonds at their very favorable Composite Rate of 7.12%, especially if they want to maximize the amount purchased for the 2021 and 2022 calendar years. In the current environment of low-interest rates and high inflation, I Bonds represent a potential opportunity for investors to increase the yield for a portion of their fixed income portfolio! Here is an article from Kitches.com that has more detailed discussion of this topic. Standard Deduction

For married couples filing jointly for tax year 2022, the deduction rises to $25,900, up $800 from the prior year. For single taxpayers and married individuals filing separately, the standard deduction rises to $12,950 for 2022, up $400, and for heads of households, the standard deduction will be $19,400 for tax year 2022, up $600. Gift Tax Exclusion The annual exclusion for gifts increases to $16,000 for calendar year 2022, up from $15,000 for calendar year 2021. Estate Tax Exclusion Estates of decedents who die during 2022 have a basic exclusion amount of $12,060,000, up from a total of $11,700,000 for estates of decedents who died in 2021. HSA Limitation For the taxable years beginning in 2022, the dollar limitation for employee salary reductions for contributions to health flexible spending arrangements increases to $2,850. Earned Income Credit The tax year 2022 maximum Earned Income Tax Credit amount is $6,935 for qualifying taxpayers who have three or more qualifying children, up from $6,728 for tax year 2021. AMT Exemption The AMT exemption amount for tax year 2022 is $75,900 and begins to phase out at $539,900 ($118,100 for married couples filing jointly for whom the exemption begins to phase out at $1,079,800). The 2021 exemption amount was $73,600 and began to phase out at $523,600 ($114,600 for married couples filing jointly for whom the exemption began to phase out at $1,047,200). Q. Is a taxpayer entitled to deduct business travel expenses?

A. Generally, a taxpayer is entitled to deduct travel expenses when those expenses are incurred while the taxpayer is “away from home” for business reasons. This is the case even though those travel expenses would otherwise be personal expenses (such as food or lodging). There are three basic requirements that must be met: The expense must be a reasonable and necessary traveling expense, it must be incurred while “away from home,” and it must be incurred “in the pursuit of business. The IRS requires that a taxpayer be away from the company’s principal place of business, rather than a residence, in order to deduct business travel expenses. The IRS has ruled that a taxpayer’s tax “home” — meaning principal place of business — is not limited to a specific building or worksite, but instead encompasses the entire city or general area in which the business is located. Q. Can a taxpayer deduct travel expenses for a trip that has both business and personal elements? A. If the primary purpose behind a taxpayer’s trip is personal, no travel expense deductions for expenses incurred in traveling to and from the destination will be permitted even if the taxpayer does engage in some business activities during the trip. However, if a trip has both business and personal elements, the taxpayer may deduct those expenses that are properly allocated to the business portion of the trip even if unable to deduct the expense of traveling to and from the destination because it is found that the trip was primarily undertaken for personal reasons. In last blogpost, we discussed 2 strategies to maximize social security benefits for married couples. Now we will continue to share the Earnings Test.

============== The Earnings Test Sometimes the lower-wage earner is younger and might still be working. In this case, consider the earnings test. The Social Security earnings test is a two-tier test. The first tier is between age 62 and the calendar year the client reaches full retirement age (FRA). The threshold is $18,000, and it moves every year. For every dollar that the client exceeds the earnings test threshold, they lose 50 cents of a Social Security benefit. Many people think, “If I’ve earned over $18,000 this year, I can’t claim Social Security benefits.” That’s not the case. It often still makes sense for the lower-wage earner in a married household to claim early, even if they’re a bit over that earnings test threshold, because they may lose only a few of their benefit checks throughout the year. For example, let’s say a client is working and earning $30,000 a year. The client is $12,000 over the earnings threshold. That means $12,000 divided by two is the penalty amount, or $6,000. Their Social Security benefit is $1,500. That means they would forfeit four checks during the year. They would collect eight checks instead of 12. When they reach FRA, their benefit will be adjusted to account for the months they did not receive a check. While they don’t get a lump sum for those checks, their future benefit is increased by the amount they would have received if they had not elected during those months. The earnings test is a cash flow penalty, not a tax. When your client reaches FRA during the calendar year, the second threshold is considerably higher than the first threshold. Let’s say your client reaches FRA in March. They could earn $40,000 in January and February ($20,000 each month) and still qualify to get their full benefits through the entire year because of how that threshold works in the calendar year they reach FRA. There are many nuances with the earnings test. It might only be three months or six months or nine months of extra checks, but several thousand dollars over a few months can add up. Below is an article from theadvisor.com about how financial advisors could use 2 strategies to help married couples maximize their social security benefits.

============ When considering Social Security claiming strategies, it’s critical to note some unique opportunities available to your married clients. With two different Social Security benefits available, it’s essential to calculate the optimal time to claim for each spouse. The clients’ claiming decision will affect these three areas:

Financial advisors should help married clients evaluate all Social Security claiming options, both in a vacuum and in the context of the overall financial plan. Here are a few critical considerations as you build these strategies. Both Delay If both spouses are in good health and have a family history of good health, consider delaying benefits until age 70. The couple will receive the most significant Social Security benefit possible. This will create, however, an income gap from when they stop working until those Social Security benefits begin. Roth conversions in that window can help avoid a situation later in retirement where minimum distributions are taxed at a higher marginal rate than could be achieved had the client completed Roth conversions or used IRA withdrawals for income in the early years of retirement. These techniques can create a lower lifetime tax bill. Split Strategy If you need to get some cash flow into the household sooner, consider a “split strategy.” The spouse in the household who earns less claims benefits as soon as possible, reducing the amount that needs to be drawn from other assets. More importantly, it allows the higher-wage earner’s benefit to grow as large as it can be at 70. The split strategy preserves the higher-wage earner’s benefit throughout their lifetime and the lifetime of the surviving spouse. When one spouse dies, the smaller benefit will go away. The more considerable benefit will continue. Many widows and widowers live for several years after the death of their spouse, and maximizing the second benefit can be excellent protection against poverty and stress in older age. The split strategy also provides a lot of tax flexibility. At worst, 85% of that smaller Social Security benefit will be taxable as ordinary income. Advisors can do Roth conversions or harvest from IRA money while delaying the higher-wage earner’s benefit. In next blogpost, we will continue with the Earnings Test discussed in the article. In our previous blogpost, we discussed life insurance underwriting for applicants with Hep C. Below is an article from Prudential about the facts and tips for people with Hep C. In last blogpost, we discussed HSA's tax advantages. Now we will discuss eligible retirement costs.

There are a host of medical and related costs that can be paid using funds from your HSA on a tax-free basis. A. Long Term Care Premium HSA dollars can be used to cover the cost of your long-term care insurance premiums. There are two caveats to be aware of. First, be sure your policy is a tax-qualified policy. Most LTC policies today are qualified, but you should verify this, nonetheless. Second, there are limits as to the amount that can be withdrawn from the HSA each year to cover these costs based on your age. B. Medicare Premiums Medicare premiums and deductibles, including Medicare Parts A, B, D and Medicare HMO premiums, can be covered by HSA funds on a tax-free basis, whether you pay them directly from your Social Security benefits or you write a check for the premiums. HSA funds cannot be used to pay Medigap premiums. C. Other Health Care Costs Medicare does not cover all types of health care expenses. Some examples of expenses not typically covered by Medicare Parts A and B that can be paid via HSA funds include:

|

AuthorPFwise's goal is to help ordinary people make wise personal finance decisions. Archives

September 2022

Categories

All

|

RSS Feed

RSS Feed