|

Below are 43 pages of resources that help insurance agents educate their clients about everything related education, I don't necessarily agree every content inside it, but hope you will enjoy all the resources in one single place!

0 Comments

The conclusion from previous two studies is that simple income annuities provide a better way for retirees to generate income when compared to bonds. If you want to read more study on this topic, here is another one available here. If, once you’ve had a chance to digest this information, you agree with the findings, here’s what you can do next:

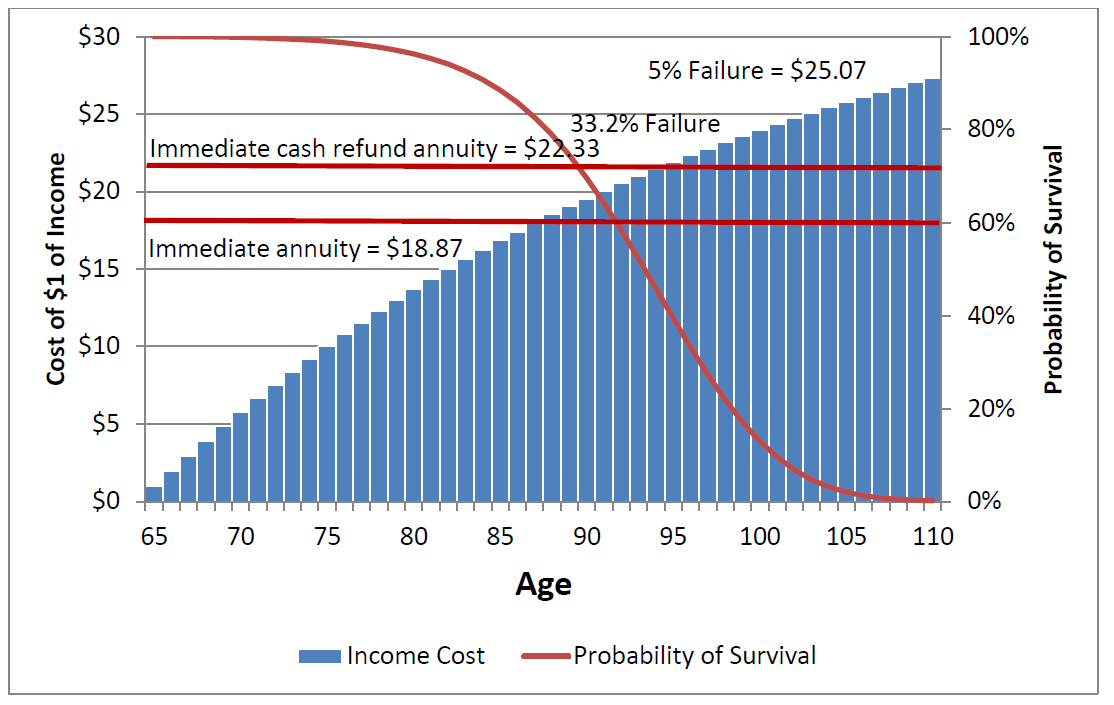

If you have any questions, please feel free to contact us. The last blogpost showed one advantage of annuity over bond. Now the second advantage - It Costs Less to Fund Retirement with Annuities Vs. Bond Ladders David Blanchett, Head of Retirement Research at Morningstar Investment Management, and Michael Finke, Dean at The American College, also studied annuities in their paper “Annuitized Income and Optimal Asset Allocation.” Using a slightly different lens than Professor Pfau, they compared setting money aside at retirement to either (a) fund a bond ladder or (b) buy an immediate income annuity. Creating enough income through a bond ladder to last long enough for 95% of couples’ lives costs $25.07 for every dollar of annual income needed. For example, if a 65-year-old couple wanted to spend $100,000 per year, it would require them to set aside 25.07x today, or $2,507,000. To create that same $100,000 per year by buying an immediate income annuity, it would cost only 18.87x, or $1,887,000, and the money would last for 100% of couples’ lives. (They also looked at a more expensive immediate income annuity that includes a refund at premature death, for which the cost was a little higher at 22.33x.) The annuity costing less than the bond ladder has two important implications:

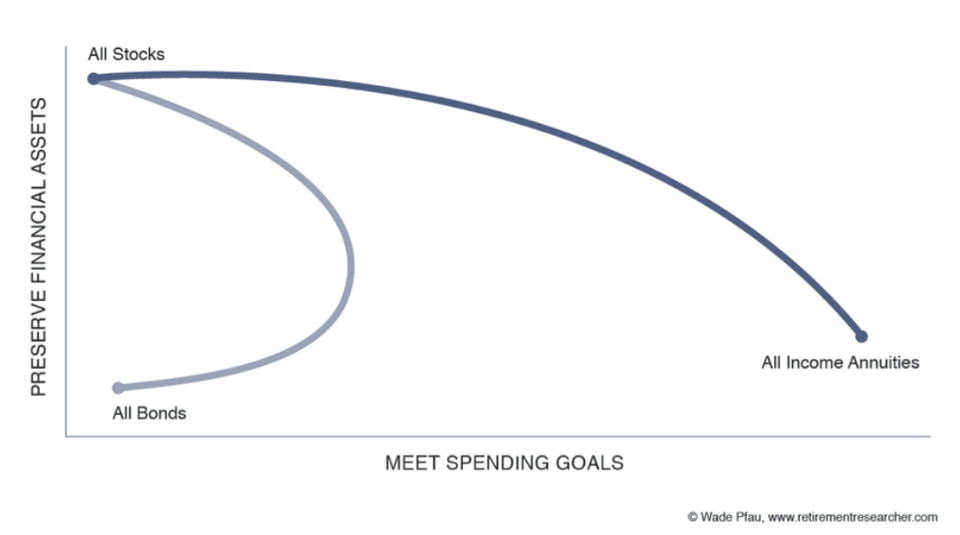

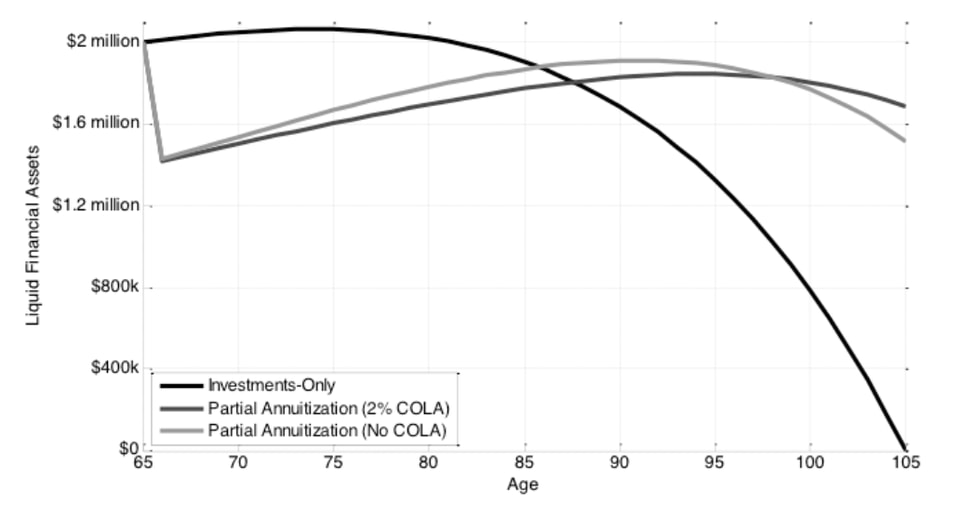

If you have digested the information and are convinced that annuities are better than bonds, there are a few actions you need to take. In last blogpost, the differences between bonds and annuities are explained. Now why bonds shouldn't be part of retirement portfolio - In “Why Bond Funds Don’t Belong in Retirement Portfolios,” Professor Wade Pfau presents a concept called the Retirement Income Efficient Frontier. He performs a Monte Carlo analysis to see how a number of different portfolios will perform in unknown financial market conditions against the two main goals in retirement: (a) not running out of money and (b) leaving a legacy. The portfolios he tests consist of stocks and/or bonds and/or annuities. His results show that the most efficient portfolios are those with stocks and income annuities, but without bonds. These are the portfolios that offer the smallest chance of running out of money and the greatest chance of leaving a legacy behind. As he explains, “Income annuities outperform bond funds as a retirement income tool because they offer mortality credits.” Annuities Provide More Income and Potentially More Legacy In the same paper, Professor Pfau also shows that liquid financial assets can be larger later in retirement if you have some of your portfolio in annuities. Shown below are 3 options for someone’s portfolio: (1) only invested in a mix of stocks and bonds, (2) bonds reduced in favor of an income annuity with a 2% annual inflation adjustment, and (3) bonds reduced in favor of an income annuity without an inflation adjustment. Initially, the liquid assets take a hit from annuity purchase. But they eventually catch up at around the same time the “mortality credits” kick in. That is, because the annuity provides more income than the bond, less needs to be withdrawn from the portfolio. And, because the annuity is purchased with money that would otherwise be in bonds, the remaining invested assets are weighted more heavily towards stocks.

In next blogpost, we will show that It Costs Less to Fund Retirement with Annuities Vs. Bond Ladders. In last blogpost, an investment rule of thumb was explained, now we will clarify definitions first …

Bonds are corporate or government debt instruments. When you buy a bond, you’re lending a fixed amount of money to a corporation or public entity. In exchange, and based on their credit risk and the duration of the loan, they pay you a semiannual coupon followed by your money back at maturity. The value you’ll get from a bond is much more predictable than that from a stock because it’s defined unless (a) you decide to sell early, (b) the company defaults, or (c) the company cancels the arrangement early. Bond funds — which you’re more likely invested in than actual bonds — are portfolios of bonds. Annuities, when purchased correctly, provide guaranteed income in retirement. You give money to an insurer upfront, and in exchange they promise you a steady amount of income each month starting at a predetermined date in retirement. It’s fixed for as long as you live and no matter what happens in the market. The amount of income you get each month depends on your age now, the age at which you start receiving income, your gender, and how much money you commit today. The difference between annuities and bonds are as follows:

Let’s take a look at some of their arguments next. Q. What's better to generate retirement income: bonds or annuities?

A. Many of us are familiar with and follow the "120 minus your age" investing framework. It says that you should subtract your age from 120 and invest that percentage in equities, putting the rest in fixed income. For example, a 50-year-old would be 70% (120-50) in equities and 30% (100%-70%) in fixed income. (Note that the rule used to be 100 instead of 120 but has since been revised due to increasing life spans.) The rule-of-thumb is based on a couple of key concepts:

So, as you age and get closer to retirement, you dial down your equity allocation as you move money to fixed income. The rule of thumb has its limitations, but in the absence of knowing more about someone, their risk tolerance, and their cash flows, it does a good job of guiding people towards the right investment mindset and outcomes. Most "Target Date" retirement funds work this way. But today, I want to challenge one aspect of the rule of thumb, and that is that we got the type of fixed income wrong. It should be annuities, not bonds. Keep reading the next blogpost in which we will clarify some definitions first. Overview

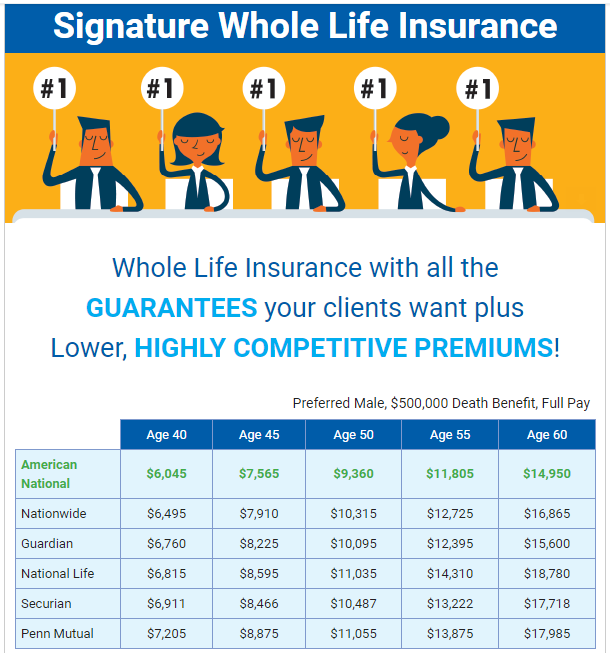

Signature Whole life insurance is designed to provide permanent coverage. The coverage and the financial benefits provided will be there when it is needed, no matter when that may be. Signature Whole Life provides a stable premium, a guaranteed death benefit, and cash values. It also provides the potential to receive policy dividends. GUARANTEED VALUES

DIVIDENDS: NON-GUARANTEED POTENTIAL Dividends depend on the financial results of American National and may be paid to policy holders at the end of each policy year. Although dividends are not guaranteed, American National has a history of paying dividends to whole life policy holders. Dividend options:

PAID UP ADDITIONS RIDER Allows the client to purchase paid-up participating whole life insurance. The paid up insurance can be paid as either a one-time purchase payment at the time of application or via scheduled payments for a specified duration of time. ADDITIONAL RIDERS

There may be an additional cost for the riders above, see Benefits and Rider Guide on the right for complete rider information. All riders are not available in all states. Q. How to put away maximum possible amount in my retirement account?

A. Below is a mega-backdoor Roth conversion strategy for you, if you note the following caveats:

Here are the steps to implement the strategy (with the help of an advisor): 1. Client maxes out annual contributions to all tax-qualified plans, including 401(k). Pro tip 1: Don’t forget the HSA! 2. Client makes a nondeductible, non-Roth contribution to 401(k), up to the permissible annual limit. Pro tip 2: Use of the 401(k) avoids the IRS aggregation rule. Pro tip 3: When possible, advise self-employed clients to design their 401(k) plans to permit non-Roth employee contributions. 3. Client rolls over the non-Roth contribution from the 401(k) into a Roth IRA account. Pro tip 4: Take care to avoid language that indicates the client’s intention to circumvent the limits on Roth contributions. Pro tip 5: It’s smart to allow some time to elapse before the rollover. Just remember that any accrued earnings before the rollover will be taxed upon withdrawal. When implemented properly, the mega-backdoor Roth strategy can help you set aside tens of thousands of extra dollars each year. These assets will accumulate tax-free and provide nontaxable income in retirement. For more detailed description, please see the article published in Financial Planning magazine. Financial planning expert Michael Kitces explains the changes to deducting mortgage interest and home equity loan interest for the 2018 tax year. The document from American National below has a pretty good description of everything you need to know about Single Premium Immediate Annuity and how to use it to generate lifetime income streams. In our last blogpost, we showed you the questions you need to answer in order to decide what type of trust you need. Now we will go through the different types of trusts below.

Bypass Trusts. Also called the credit shelter trust, marital trust, and family trust, this trust is designed to help a married couple avoid estate taxes. Each person may pass to heirs a certain amount of money at death with no estate tax. The bypass trust can increase this. Because tax laws vary year to year, contact your estate planning lawyer to make sure you have current information. Special Needs Trusts. This trust provides financial support to a person who is unable to manage his or her own financial affairs. To avoid the risk of interfering with the support that’s otherwise available from social services, the trustee may not want to use these assets for housing, clothing or food. Spendthrift Trusts. Instead of leaving an heir a bucket of money that he or she may quickly squander, you place that inheritance into this trust. The trust would then distribute the inheritance to the heir later, perhaps when the heir reaches a certain age, or in the form of an allowance, or for specific expenses, such as college or medical expenses. Life Insurance Trusts. For high net-worth individuals, owning their own life insurance is a big mistake — because the death benefit is subject to estate taxes. To solve this problem, have a life insurance trust own your policy. Instead of paying for the insurance yourself, you’d give that money to the trust, which would pay the premium for you. The trust would be the beneficiary, and your heirs would be the beneficiaries of the trust. An additional benefit of a life insurance trust: Instead of beneficiaries automatically getting the insurance proceeds immediately upon your death, you can instruct the trust to distribute the money to the heirs more slowly (see Spendthrift Trust above). Charitable Remainder Trusts. If you plan to donate assets to a charity after your death, you may find it beneficial, instead, to donate to a CRT now. By doing so, you get a tax deduction right now for your gift. You also can name yourself as the income beneficiary (giving yourself an annual income) and the charity gets what’s left after your death, tax free — just as you’ve intended. If you’re concerned that making the gift to the CRT denies your children their inheritance, you can buy a life insurance policy equal to the size of your gift, naming your children as beneficiaries of the insurance, using some of the trust’s income to pay the policy’s premiums (see Insurance Trust above). QTIP Trusts. Say you die leaving a spouse, minor children and assets. Further, say your spouse remarries, then dies. Result: Your spouse’s new spouse gets all your money, and your children are left with nothing. (We’ve seen this happen too many times.) To avoid this scenario, consider the Qualified Terminal Interest Property Trust. Instead of leaving your assets to your spouse when you die, you leave your assets to the QTIP trust. The trust gives income to your surviving spouse for his or her lifetime. But when your spouse dies, the assets remain in the trust for the benefit of your children. Because your spouse doesn’t directly own the assets, he or she can’t convey them to a new spouse and his or her own heirs. Living Trusts. This tool is designed to pass your assets to heirs without going through probate. Also, it can help insure that your assets will be used for your benefit and welfare if you become unable to manage your own affairs. Generation-Skipping Trusts. Such trusts, intended for truly wealthy estates, can preserve your assets for several generations while avoiding estate taxes. You can fund a GST with the same amount as the bypass trust for the benefit of your grandchildren and great grandchildren, and the assets will appreciate free of income and estate taxes. Such assets can also be protected from creditors. In our last blogpost, we discussed some of the basic concepts in a trust. Now we will show you a list of questions you need to answer in order to decide if a trust is right for you or not.

In our next blogpost, we will show you different types of trusts. Grantor

A trust is created by the grantor (that’s you). The grantor writes the rules governing how the trust is to operate, what it is to do, and how and when to do it. If the trust is revocable, you can change the rules at any time. If the trust is irrevocable, you can’t. (Each form has advantages and disadvantages, including tax implications.) Trustee When creating the trust, you appoint a trustee, who will have the job of managing the trust and its assets. (People often appoint themselves to serve as trustee.) The trustee must follow the trust’s rules, although, some trusts let the trustee use discretion in certain matters. Donor After you create the trust, it receives gifts from a donor (that’s also usually you, although you might permit your trust to receive gifts from others in addition to you or instead of you). The trustee collects the gifts and invests the money in accordance with the rules of the trust. As a result, the trust will find itself with three things: principal (the money it was given, also called the corpus), interest and dividends earned on the principal (called income), and profits (if any) from increases in value enjoyed by the principal (called capital gains). The rules you’ve written for the trust will determine who gets the income, capital gains and, ultimately, the principal. The recipient is called the beneficiary. Beneficiary Some trusts have lots of beneficiaries. They can be family members, friends, or charities — anyone you want, in any combination. Some trusts give the income to certain beneficiaries, while others get the capital gains and still others get the corpus — with the trust itself stating who is to get what and when (or under what conditions). It’s the trustee’s job to make sure all this happens in accordance with the provisions of the trust. Because different trusts do different things, it’s routine for people to have more than one. In fact, having four or five trusts is not uncommon. In some cases, trusts are even created by other trusts or in a will! Is a trust right for you? In our next blogpost we will show you the questions you need to answer in order to decide. Airfares

a. Know the differences between aggregators and third-party sites

b. Many sites belong to the same owner

c. Check out less well knowns

Lodging a. Online private rentals

b. Niche sites

c. Hotel reviews

d. Last minute deals

e. Book directly from hotels

Cruise a. CruiseCompete: it compares offers from multiple travel agents b. Websites specialize in cruising

c. Seasons with best deals

Package Tours Check out The United States Tour Operators Association: it is a good online resource THE CHALLENGE:

Convert retirement assets to cash flow that will last for the lives of married couple. THE SOLUTION: Joint and Survivor Immediate Annuity Case Study Background Lisa and Steve spent their careers accumulating assets for retirement. They had CDs, mutual funds, sizable 401(k)s, life insurance cash value, and annuities, mostly in qualified assets. As they approached retirement they became concerned about how to turn those assets into monthly cash flow. Other than their social security payments, they had no idea how to take money from their various assets to fund recurring monthly expenses. They were fearful to retire and lose the security of paychecks that provided income on a regular basis. Though they had a comfortable amount saved, they also were concerned about using too much of their savings too quickly and running out of money. Should they access their qualified money from their 401(k) plans or use their personal assets first? They just did not know how to proceed. Considerations They met with their longtime financial advisor and shared their concerns. He took out two sheets of paper and on the first sheet he listed and categorized all of their investment assets (qualified or non-qualified; liquid or non-liquid) and on the second he helped them list all their recurring monthly expenses. From the recurring expenses he subtracted any recurring income sources, such as social security. What was left were the recurring expenses not covered by cash flow. Once he determined how much unmet monthly income was needed, he then turned to the investment asset sheet and discussed which assets would work best to provide them the monthly income they needed. Their two largest assets were their 401(k) plans. Since a majority of their assets were in the 401(k) plans and their other non-qualified assets were a minority of their savings, he recommended they take a portion of the smaller 401(k) plan and fund a Joint and Survivor Immediate Annuity. This would allow them to cover their unmet cash flow needs while maintaining the liquidity of their non-qualified accessible assets. Solution Lisa and Steve liked the monthly income an immediate annuity would provide but wanted to make sure they would be prepared in case their expenses increased in the future. Their advisor explained that they could purchase an immediate annuity now and plan to purchase an additional annuity in later years if they needed it. Alternatively, they could choose to purchase an immediate annuity with an inflation factor built in to increase the monthly income each year to cover the increases in costs. The immediate annuity would provide income that would continue for both of their lives. By purchasing an immediate annuity to cover recurring expenses, they could leave other assets to grow while they live off the cash flow. If markets were good they could access their other assets to take a vacation, purchase a new car, or other financial outlay and be able to pull back and not touch these assets when in a down market when their asset values were declining. North American believes its Builder Plus IUL could help clients build an above average future - Visit North American's IUL page for more information, or contact us if you have any questions.

Q. What are the benefits of Guaranteed Universal Life?

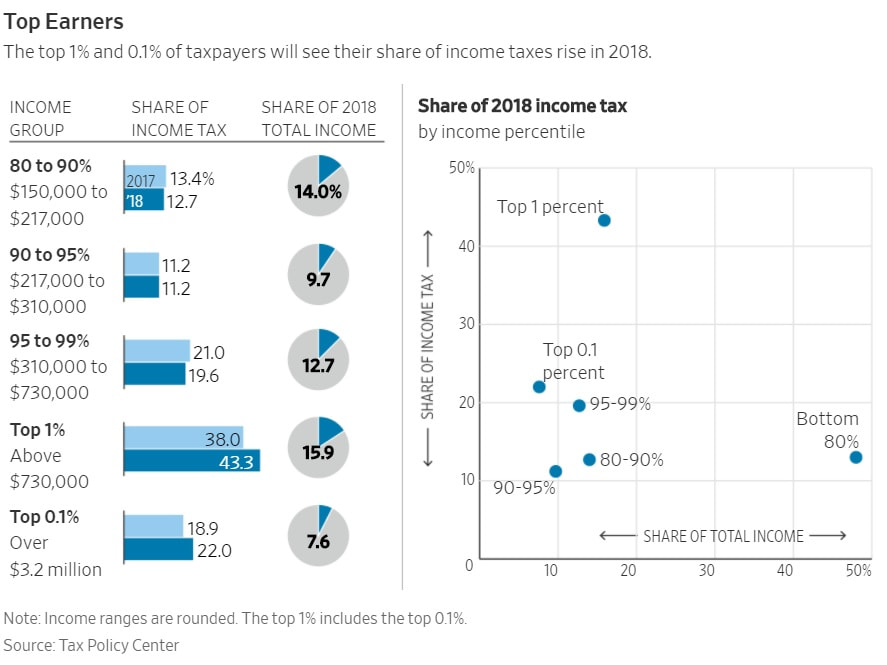

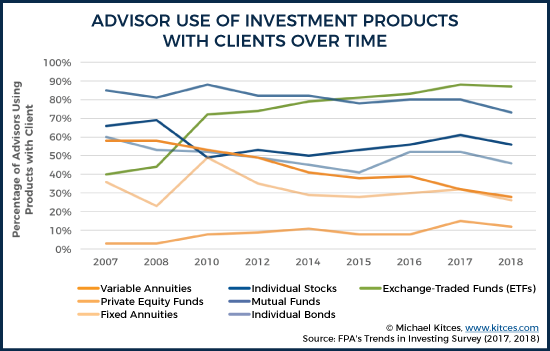

A. Here is an article from American National targeting life insurance agents but answers this question perfectly. When it comes to guaranteed universal life products, some agents may only think of the benefits as a guaranteed death benefit with level premiums. A common perception on these types of products might be that despite its death benefit security and simplicity, it is of little use when it comes to satisfying future financial endeavors such as college funding and other similar goals. American National’s Signature Guaranteed Universal Life can not only guarantee a death benefit but it may also be utilized in such a fashion to help satisfy future financial goals with its return of premium feature. The ability to access most, if not all, of the premiums paid into the policy in the 15th, 20th, and 25th year allows you to repurpose the policy while maintaining a guaranteed death benefit until you reach that point in the future in which you no longer need death benefit protection. The product is an excellent fit for those clients that are between 30 and 50 years of age who may have children at home with the urgency to save for college but also the necessity for life insurance in case the unfortunate happens. The return of premium feature will be accessible at that point in time when the kids head off to college and the need for life insurance will no longer needed. This serves and satisfies two critical needs; one the guaranteed death benefit, and two a college savings plan. College savings may not be the only concern for clients. Mortgage pay-offs or other future goals may be in the forefront such as remodeling your home or purchasing that sports car you’ve always wanted since high school. The Signature Guaranteed Universal Life product is an excellent fit for those customers who desire financial security with a guaranteed death benefit and most importantly level premiums with the ability to have 100% of them returned to the customer in the 20th or 25th year. The benefits do not stop with the two-pronged approach previously mentioned. The product also includes living benefit riders for chronic, critical, and terminal illnesses that may be partially -or- fully accelerated if there is a qualifying medical emergency. This means that the client is protected on all fronts from a financial standpoint. Savings are hard to come by with the rise in living expenses and other economic factors so why not ensure that your client can secure the benefits of a return of premium feature on their policy with the peace of mind knowing that the death benefit will not fluctuate and accelerated benefit riders accompany the policy? If you are interested in GUL, please contact us as we could help you shop around to find the best product for you! Q. Where do financial advisors allocate their clients' money?

A. The chart below tells the answer how financial advisors allocate their clients' money among different asset groups. Also, the latest 2018 Trends in Investing Survey from the Financial Planning Association shows that while a whopping 87% of financial advisors use ETFs, 73% of financial advisors are using mutual funds as well. From the broader historical data, the biggest shift for financial advisors hasn’t actually been from mutual funds to ETFs at all over the past decade, but from variable annuities into ETFs (and to a lesser extent, from individual stocks and bonds to ETFs as well), along with a rise of investing in private equity funds. In fact, mutual funds showed remarkably little decline in adoption rate over the past decade, at all, until just the past year! If you use Morningstar's Analyst Rating to help your investment decision making, you might be interested in this article that evaluated the performance of Morningstar Analyst Ratings.

Highlights of the findings - The good news is that the post-mortem reveals Analyst Ratings were generally predictive – most significantly amongst equity and asset allocation funds, where Gold (and sometimes Silver) rated funds generally did outperform. In the case of equities the “Negative” funds underperformed as well. However, there was relatively little persistent return differential between Bronze and Neutral funds, and the relative outperformance (or predicted underperformance) varied significantly by time horizon and asset class (and geographic region). In our last blogpost, we shared William Sharpe's famous article, now we will introduce a different view.

Pedersen's article is titled Sharpening the Arithmetic of Active Management, in which he points out that William Sharpe's entire premise is only true in a world where the market portfolio itself is stable and never changes – which isn’t a reality, as companies issue and repurchase shares and the index market portfolio itself is reconstituted over time… which means even “passive” investors must regularly trade in the aggregate just to maintain a “market portfolio”, and at least run the risk that they may “passively” trade at inferior prices to active managers. Of course, the caveat is that the impact of newly issued and repurchased shares, and the additions and subtractions from the index/market portfolio, can only create a positive active management opportunity if the changes are high-volume enough to allow an impact on the aggregate results. Yet Pedersen’s research suggests that this is in fact the case, given that IPOs in the primary market tend to sell at a discount relative to what they trade for in the secondary market when passive index funds would first get access to them (giving active managers an opportunity to better select the most winning IPOs before their market capitalization is clearly established by the market itself). Similarly, active managers can also trade in front of “known” index changes before they are implemented by passive funds, and because the “market portfolio” itself is still somewhat debated (market of US stocks? international stocks? also US bonds? international bonds? gold? commodities?), different active managers may fare better or worse by better selecting which “market portfolio” to own. Accordingly, Pedersen suggests that a better way to recognize the distinction is that active managers play an important economic role – to help allocate resources efficiently in the economy, particularly as new companies/shares are issued or repurchased, which is an economic benefit to society, while the economic role of passive investing is more about simply creating low-cost access to markets for the mass of investors in the first place. Which means passive investing isn’t “bad”, but active managers aren’t necessarily doomed (or only subtracting value from the economy) either. Q. Could actively managed funds provide superior returns than passively managed funds?

A. There are two sharply different answer to this question. Today we will introduce the famous article by Nobel Laureate William Sharpe's view. William Sharpe's famous article titled “The Arithmetic of Active Management”, it states that “before costs, the return on the average actively managed dollar will equal the return on the average passively managed dollar,” such that after costs are considered in the aggregate, active management always and must be a losing value proposition (even if there are certain groups of active managers that systematically outperform, as they would only do so by systematically beating other “bad” active managers who underperform by an equivalent amount). Feel free to read this article (not long) by yourself at CFApubs.org. In our next blogpost we will present the opposite view. You may have heard that working too much or too long will shorten your life. Retire early and relax — and let stress disappear.

Actually, the opposite is true, according to a study from Oregon State University. It found that people who work past age 65 actually add years to their life. The researchers found that healthy adults who retired one year past age 65 had an 11 percent lower risk of death from all causes, even when taking into account demographic, lifestyle and health issues. Adults who described themselves as unhealthy were also likely to live longer if they kept working, the findings showed, which indicates that factors beyond health may affect post-retirement mortality. In our last blog post, we discussed two major drawbacks of annuity-LTC combo products and how to treat them, now we will discuss the ideal people for such policies -

Situation One Someone who doesn't want to pay annual premium for a traditional long term care policy and want money in a safe, yet low-yielding investment. If the long term care benefits are not triggered, one can earn a low yield from the annuity. Situation Two Retirees who have significant cash value built up in life insurance policies in which the death benefits are not longer needed. Exchanging the cash value into a hybrid product to address the potential future long term care neede is a great way to get long term care insurance with no additional out of pocket expense. In the end, annuities with LTC riders could be perceived as "no, thanks" by some, but a "no-brainer" by others. If you are interested in such products, including life insurance products with LTC riders, please contact us as we represent all the major ones in the marketplace. In our last blogpost, we discussed the emerging trend of using annuity-LTC combo policy to replace stand-alone LTC policies. Now we will discuss two major drawbacks of such annuity-LTC combo polices -

a. Low Return Annuities tend to have low returns, sometimes as low as 1% or even 0%. b. High Costs Annuities already tend to have higher costs, with LTC rider, the costs will be even higher. Both drawbacks are real, however, here is the right perspective to look at them - An annuity-LTC combo essentially transfers 3 risks to the insurance companies - investment risk, interest rate risk, and longevity risk. If you could use a small portion of your portfolio to address all these risks, just like homeowners insurance or auto insurance, it makes sense to pay the fees and achieve two biggest objectives - a) Lifetime income, and b) some level of protection in the even of long term care. In our next blog post, we will discuss who are the ideal customers of annuity-LTC combo policies. |

AuthorPFwise's goal is to help ordinary people make wise personal finance decisions. Archives

September 2022

Categories

All

|

RSS Feed

RSS Feed