- Mortgage and loan

- Savings and investment

- Retirement

- Personal finance

- Insurance

- Business

|

This website has a nice collection of online personal finance calculators, it covers a wide range of topics, such as:

0 Comments

If you are looking for a fast way to find and chart economic and financial data from trusted sources, this company provides an easy way to do that, and it is free - Investormill.com.

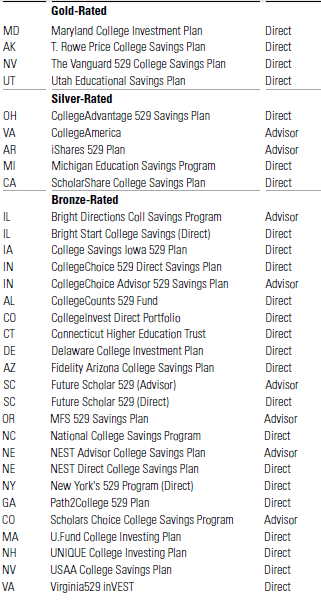

Best of all, you can also download data into Excel for future uses. Q. How do I determine if the return of premium rider is something good for me? A. Most of Term life insurance gives you a choice of "Return of Premium" rider. What it means is you pay higher than normal premium, at the end of the Term, if the insured is still alive, it will return ALL of your paid premium back to you. So it's like you are getting a free life insurance. Or, is it really so? Obviously not, the insurance company will go bankrupt if it does so. What this rider does is simply let you lend the extra premium to the insurance company to invest on your behalf. At the end of the day, the insurer returns your premiums back to you. If the return generated by the insurance company is better than what you can do by yourself, by all means go for the rider. Otherwise, think it again. You can use the following tool to evaluate the return you are actually getting by lending insurer this extra premium (note, this return is guaranteed return, so don't treat it the same as the un-guaranteed return you can get from the stock market). Q. How can I calculate my auto loan cost? A. The following loan cost tool can help you determine how much is the loan cost for the entire term of your loan. It can be used to calculate not just auto loan but also any loan, such as mortgage, interest costs. Just plug in the loan amount, annual loan rate, number of months of the loan. In our last blog we mentioned that Nevada has the best 529 plans, but remember, even Nevada offers 5 different 529 plans and not all of them are the best plans. The chart below shows which state's specific program is the best.

Q. I have saved 401K in all my working career, by my retirement age of 65, I estimate to have $1.5 million. How long will my retirement fund last? A. How long will your lifetime savings last depends on a few factors:

You can use the following tool to do a quick estimate about how long your retirement fund or 401K money will deplete. Q. How to quantify a fund's expense's impact on my investment? A. We all know that expense drags your investment's returns. The main cost of owning a mutual fund is measured by the expense ratio, the costs include the cost of managing the portfolio, legal, accounting and admin expenses, and sometimes marketing expense too. Average fund expense ratio in the U.S. fund industry is about 1.20%, it may sound like a small percentage number, but it will add up over time. You can use the following Fund Expense Impact calculator to easily figure out such expense's impact on your return. Just enter your initial investment amount, the fund's average annual return, the fund's average annual expense ratio, and your investment years, you will see how much total fund expense you will incur and how much of your profit will be eaten by it! Q. How much I need to save each year in order to reach my target retirement saving amount? A. The following retirement Annual Savings calculator can help you figure out how much annual saving is required in order to reach your desired retirement savings amount at your desired retirement age. The key input needed are:

Q. I am saving diligently each year, I also have a target retirement age and amount. How to know the kind of annual return I need to achieve in order to reach my retirement target? A. You can use the following tool to calculate the minimum annual investment return you need to achieve in order to achieve your target retirement savings amount at the desired retirement age and annual saving amount. Just fill up the yellow area and the tool will give you the minimum annual investment required. This number can guide your investment portfolio creation and risk taking. For example, if the required minimum annual return is low, you can go it safe, knowing that you will be on your way to achieve your target easily; otherwise, you have to take more risks, save more each year, or postpone your retirement time. Q. I have been saving diligently each year, I also know my target retirement savings amount. Is there an easy way to estimate when I could reach my retirement target? A. Yes, you can use the following retirement age calculator to estimate when you will be ready to retire. This tool will tell you the age you will achieve your target retirement savings amount, given your current age, your current savings amount, your planned annual saving amount, and your estimated annual investment return. Q. How do I calculate my investment performance, if I have been investing different amounts at different times? A. You can use the following investment return calculator to calculate the average annual return. All you have to do is to enter the dates you made the investments (in MM/DD/YYYY format) and the corresponding amounts, and the end date you want to evaluate the performance and the account value on that date. Note: this investment return calculator only applies to s If you want to manage your family's finance well, the first thing you need to do is to measure your money - how much you bring in each month and how much you spend and save each month. You can download the following free Family Monthly Budget and Actual Worksheet and start tracking your family's money flows today! Q. Is there an easy way I can estimate how many years my insurance benefits will last for my beneficiaries? A. Yes, you can use the following tool to estimate the numbers of years your insurance's Death Benefits as well as your savings at the time of death will deplete for your loved ones. The key factors are:

Q. I am considering buy Whole Life insurance, how do I evaluate its return? A. Because of the fixed premium feature of any Whole Life product, its return's calculation is quite easy. However, before we introduce the tool below, it's worth pointing out a benefit of Whole Life that is little understood by most people - the policy owner's ability to use the cash value as a collateral to borrow against it for other investment uses. For example, if you have $100,000 cash value in a whole life product, now have an real estate flipping opportunity that requires $100,000 cash. You can use the $100K CV as a collateral and borrow up to $100K from the insurance company. Your $100K cash value still earns the return inside the Whole life, and you also have the extra $100K cash for your investment. You do have to pay loan interest rate to the insurer, but if your other investment's return is superior, you will be able to pursue that investment while still letting your Whole life policy's cash value keep growing. Now, back to evaluating a Whole life product's average annual return - You just need to enter the starting age of the policy, the annual premium amount and the # of years the premium paid (or to be paid), then select any year in the future and the corresponding Whole Life's cash surrender value and death benefit value in the illustration, you will be able to see the average annual returns. If you are not using credit cards with money back rewards, you are leaving money on the table. But how much could such credit card-based rewards pile up each year? You can use our online credit card rewards calculator to get an idea! Which is better - an IV league college or a good public university with a good amount of scholarship? If College education is an investment in your child, you may wonder, what's this college investment's worth? This online College's Worth calculator can help you compare different college options, at least financially, and help you make a wise decision for your child's college decisions. It is not always easy to compare two different auto financing options - For example - Option 1 gives you $30,000 auto loan with 0% interest rate for 3 years Option 2 gives you $30,000 auto loan with 0.9% interest rate for 5 years Which option is better? Is zero percent auto loan always the best option? The key could hinge on your cost of money (the annual discount rate in the calculator below). Run our auto loan financing calculator below to compare by yourself. Q. Is Guaranteed Universal Life (GUL) a good deal? A. Like any insurance products, GUL fits for certain families, and for those families that GUL does fit, GUL might even sounds like a deal that is too good to be true! Here is why - With GUL, the death benefit is guaranteed. An insured can choose 10-pay (or even 5-pay or 7-pay if you can afford) to complete the premium payments in maximum 10 years and never worried about the lapse of the insurance coverage. Your beneficiaries are guaranteed to receive the death benefit. For some companies' GUL, there is even a LTC rider that the insured can access the benefit money while still alive. You can use the online GUL annual return calculator below to check out the kind of guaranteed annual return GUL offers. If you need to know how much premium for your situation and which insurer offers the best GUL, please contact us. Generally, as you will find out by running the GUL return calculator, its guaranteed return is very impressive (remember, it's guaranteed return, with no risk). Also, the earlier the insured dies, the higher the return will be. So one way or the other, an insured is a winner (either higher return or longer life). There are several insurance companies offer GUL products with premiums differ widely. As an independent insurance agent, we can help our clients shop around and find the best deal. Contact us if you are interested in GUL.  Q. I have a huge winner in a stock this year, when should I sell it? A. Knowing when to sell a winning stock is probably the toughest decision an investor needs to make. If you sell too early, you might miss more gains; but if you hold it more, the price might start dropping. In addition, there is a complication of paying ordinary income tax on the short-term capital gain versus paying the lower long-term capital gain tax rate if you hold the winning stock for more than a year. Below we will introduce a break-even sales price tool to help you figure out a price point that there will be no difference between if you sell the winning stock (so you have to pay the higher short term income tax rate) and if you hold it till one year (therefore paying a lower long term capital gain tax rate). We will call this break-even sales price point. The math formula is: Break-even Sales Price = (After-tax proceeds from the sale at your ordinary income tax rate - long-term capital gain tax rate * cost basis) / (1-long-term capital gain tax rate)  Q. How do I evaluate different auto financing deals and determine which option is better? A. It could be tricky to compare two auto financing offers. For example: Option 1: $30,000 auto loan with 0% interest rate for 3 years Option 2: $30,000 auto loan with 0.9% interest rate for 5 years Which option is better? The answer is - it depends on your cost of money. For the above example, you can look at it the following way: With option 1, you have $10,000 cash outflow each year during the next three years. With option 2, you have $6,138 cash outflow each year during the next five years. Don't simply add the cash outflows in each option and compare which number is great, and conclude the bigger the number, the more expensive the option is. This's the wrong approach! You need to consider your cost of money, say it's 5%. This means, if your money is not used to pay back the auto loan, you can invest and get 5% annual return. Now you may realize the $10,000 cash outflow in option 1 may not look like a good deal, since it occupies more money during each of the next three years, and you could otherwise use the extra money to invest and get 5% return! However, option 1 has an advantage in the years 4 and 5 because it stops paying back the loan. So, net net, which option is better? You can use our free online Auto Loan Financing Option comparison calculator to check the answer and play around with your own scenarios.  Q. My home state offers tax incentive to invest in the state's 529 plan, but its expense ratio is quite high. Should I invest in my home state 529 plan? A. There is a simple rule of thumb to determine if you should invest in your home state 529 plan or not - E < T/N + 0.17% ? E - your home state 529 expense ratio T - the percentage of your contribution you will get back in state tax benefits N - the number of years you will need the 529 money 0.17% - is the cheap New York State 529 plan's expense ratio If your E is less than T/N+0.17%, invest in your home state 529 plan. Otherwise, go with NY State 529 plan. Example If you put $5,000 into your home state 529 plan, you will get 5% state income tax deduction, which is $250. Your child will be in college 10 years from now. T/N = 0.5%. If your home state 529 plan's expense ratio is less than 0.67%, invest in your home state 529 plan this year. Repeat the above calculation each year. |

AuthorPFwise's goal is to help ordinary people make wise personal finance decisions. Archives

September 2022

Categories

All

|

RSS Feed

RSS Feed