From your personal experience, you probably feel the same way - in a bull market, you are more risk tolerant, while in a bear market, you are intolerant of risks.

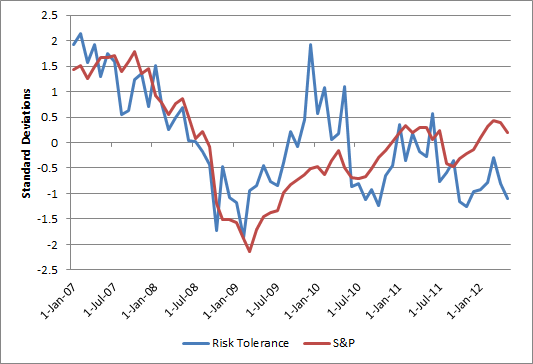

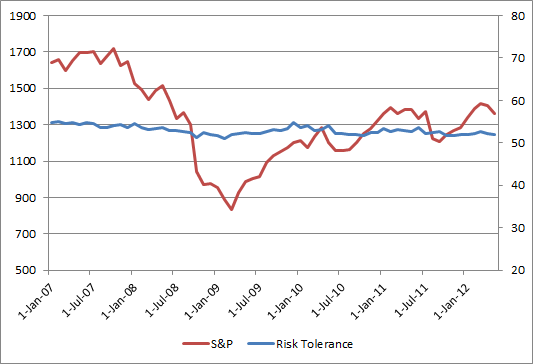

However, a recent study indicates, investors' risk tolerance level actually is quite stable, what changes is the perception of risk. See chart below:

Don't over-read any measurement of your risk tolerance, in other words, no need to change your portfolios due to risk tolerance score "wobble" in the midst of volatile markets. Of course, that doesn't mean taking a hands-off approach in the midst of market volatility - to the upside or the downside - but it does reinforce the conclusion that in the end, risk tolerance may be something that's stable enough to measure once as an anchor, but managing risk perceptions (or more importantly, mis-perception) is something need to continue to do.

RSS Feed

RSS Feed