A. A right options strategy could provide an effective and low cost way to insure your stock market gain.

Options are typically described as risky investment. But the right option strategy could actually minimize your risk.

Strategy 1. Buy Put Options

For example, you want to hedge against your large cap stocks gain, you can purchase put options on the SPY which is an ETF that tracks the S&P 500's performance.

On July 15, 2013, SPY was traded at $168. If you want to limit your downside to 10% in the next 6 months, you can purchase a put that lets you sell 100 SPY shares for $142 per share during anytime in the next 6 months for $280. You are protected if it drops below $142.

The cost of this put option - $280 is just 1.7% of the amount you insured against the drop ($280/$16800).

Strategy 2. Buy Put and Sell Call

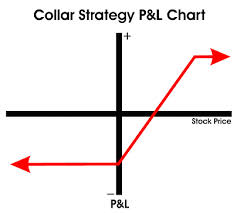

If you are OK to give up some upside, you can insure your gain cost-free, or even with a little gain. To do this, you will buy a put option and sell a call option at the same time, a strategy called a Collar.

For example, in addition to purchasing the put option mentioned in strategy 1, you sell a call option at the same time (which will limit your upside if the market keeps going up, but you are OK with it because your view is the market might be losing some steams in the near future). You can sell a SPY Jan 2014 $175 call for $3.30. You will gain $330 per 100 SPY shares. Your will net $50 gain in this Collar strategy.

If the SPY traded above $175 anytime before the expiration date in Jan 2014, you would be obligated to sell the shares at $175, a gain of 4%.

RSS Feed

RSS Feed