A. Rebalaning a portfolio is one of the justifications of money managers use to charge the portfolio management fee. It typically applies to asset classes rather than individual stocks. For example, you keep certain balance between growth and value stocks, or stocks versus bonds. In theory, rebalancing forces you to "sell high and buy low" which is good for every investor, because behavior finance has found investors tend to do the opposite - chase the highs and sell the lows.

However, there are two arguments against rebalancing and it appears to be valid.

Argument 1. Not Good for Two Assets with Different Returns

Here is the first argument, using two asset classes as the example -

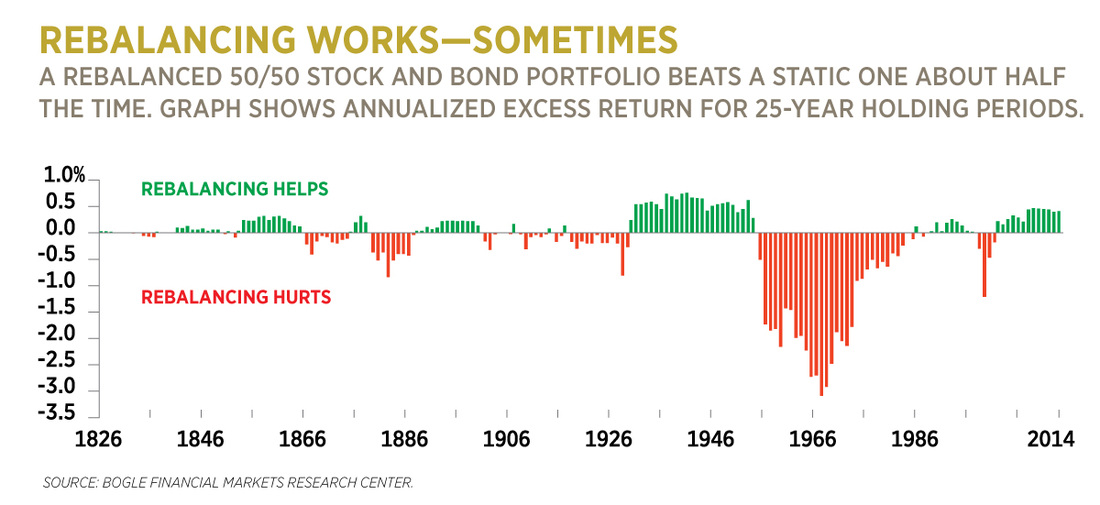

Rebalancing works well for the two asset classes, if both classes have the same long term average returns. However, if one asset class, for example, stocks, tends to have much higher average return than the other asset class, for example, bonds, then rebalancing frequently will drag down the average return of the overall portfolio.

Argument 2. Not Good for a Prolonged Bear Market

The second argument against rebalancing is that in a prolonged bear market, rebalancing means average down and getting terrible results.

The chart below illustrates the effect of rebalancing, it certainly made things worse in a bear market.

If you want to know more, there is an article with in depth discussion of rebalancing.

RSS Feed

RSS Feed